Community Financial Services Group Llc decreased its stake in Microsoft Corp (MSFT) by 2.24% based on its latest 2018Q3 regulatory filing with the SEC. Community Financial Services Group Llc sold 2,835 shares as the company’s stock declined 1.64% with the market. The institutional investor held 123,675 shares of the prepackaged software company at the end of 2018Q3, valued at $14.15 million, down from 126,510 at the end of the previous reported quarter. Community Financial Services Group Llc who had been investing in Microsoft Corp for a number of months, seems to be less bullish one the $789.09 billion market cap company. The stock decreased 1.58% or $1.65 during the last trading session, reaching $102.78. About 35.54M shares traded. Microsoft Corporation (NASDAQ:MSFT) has risen 30.43% since February 2, 2018 and is uptrending. It has outperformed by 30.43% the S&P500. Some Historical MSFT News: 19/04/2018 – Ecolab Launches Cleanroom Portfolio in North America; 16/05/2018 – Techmeme: Sources: Microsoft is planning a line of lower-cost 10-inch Surface tablets priced at about $400 with USB-C; 07/03/2018 – BluChip Solutions, an ITPS Company, Partners with 2 of the Largest Universities in the Country to Launch Microsoft Office 365 P; 10/04/2018 – PROS Announces Participation in Hannover Messe; 26/03/2018 – Microsoft On Track For Best Day Since Oct. 2015 — MarketWatch; 17/04/2018 – MatrixCare Continues to be a Leader for LTPAC Industry in Interoperability; 06/03/2018 – Social media firms are like irresponsible landlords -UK counter-terrorism police head; 18/04/2018 – SmartBear Empowers Developers to Create Quality Software at an Increased Speed; 16/05/2018 – Momentous Entertainment Group Provides Filings Update; 26/03/2018 – Morgan Stanley expects Microsoft’s dominant share of the projected $250 billion public cloud market will grow

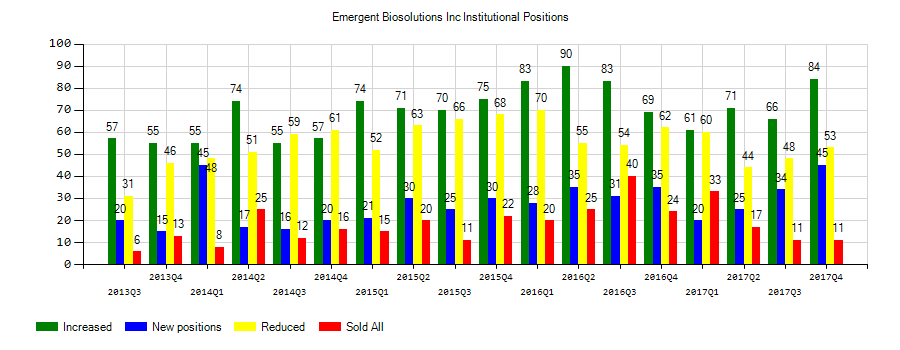

Hillcrest Asset Management Llc increased its stake in Emergent Biosolutions Inc (EBS) by 17.51% based on its latest 2018Q3 regulatory filing with the SEC. Hillcrest Asset Management Llc bought 20,204 shares as the company’s stock rose 13.50% while stock markets declined. The institutional investor held 135,606 shares of the health care company at the end of 2018Q3, valued at $8.93 million, up from 115,402 at the end of the previous reported quarter. Hillcrest Asset Management Llc who had been investing in Emergent Biosolutions Inc for a number of months, seems to be bullish on the $3.19 billion market cap company. The stock increased 0.43% or $0.27 during the last trading session, reaching $62.66. About 369,507 shares traded. Emergent BioSolutions Inc. (NYSE:EBS) has risen 57.94% since February 2, 2018 and is uptrending. It has outperformed by 57.94% the S&P500. Some Historical EBS News: 12/04/2018 – EMERGENT BIOSOLUTIONS COMPLETES MRP FOR BIOTHRAX IN EUROPE; 24/05/2018 – Global group taps U.S. biotechs to speed work on Nipah vaccine; 05/03/2018 – Gilead Sciences: No Patients in Biktarvy Treatment Arm Demonstrated Treatment-Emergent Resistance Through 48 Weeks; 24/05/2018 – CEPI – EMERGENT HAS EXCLUSIVE OPTION TO LICENSE & TO ASSUME CONTROL OF DEVELOPMENT ACTIVITIES FOR NIPAH VIRUS VACCINE FROM PROFECTUS; 12/04/2018 – Emergent BioSolutions Announces Successful Completion of Mutual Recognition Procedure for Market Authorization of BioThrax in European Countries; 03/05/2018 – EMERGENT BIOSOLUTIONS INC EBS.N FY2018 SHR VIEW $2.38, REV VIEW $731.4 MLN — THOMSON REUTERS l/B/E/S; 09/05/2018 – SCALES CORPORATION LTD – SELLS BUSINESSES POLARCOLD STORES AND WHAKATU COLDSTORES LTD TO EMERGENT COLD; 31/05/2018 – SPROTT INVESTS IN EMERGENT BEFORE GOLD BLOCKCHAIN PLATFORM; 31/05/2018 – Sprott Inc. Invests In Emergent Technology Holdings; 26/03/2018 – Emergent BioSolutions Announces Executive Management Changes That Enhance Execution of Company’s Growth Strategy

Among 7 analysts covering Emergent Biosolutions (NYSE:EBS), 5 have Buy rating, 0 Sell and 2 Hold. Therefore 71% are positive. Emergent Biosolutions had 16 analyst reports since August 10, 2015 according to SRatingsIntel. Singular Research initiated it with “Buy” rating and $44 target in Monday, March 28 report. Chardan Capital Markets initiated Emergent BioSolutions Inc. (NYSE:EBS) rating on Friday, April 15. Chardan Capital Markets has “Buy” rating and $47 target. The rating was initiated by Wells Fargo with “Outperform” on Friday, February 19. The firm has “Buy” rating by Cantor Fitzgerald given on Monday, June 11. Wells Fargo maintained it with “Market Perform” rating and $65 target in Thursday, August 30 report. Wells Fargo downgraded the stock to “Hold” rating in Tuesday, April 24 report. Cantor Fitzgerald maintained the shares of EBS in report on Friday, November 2 with “Overweight” rating. The stock has “Buy” rating by Chardan Capital Markets on Tuesday, September 4. Singular Research maintained it with “Buy” rating and $40 target in Tuesday, June 28 report. Goldman Sachs upgraded Emergent BioSolutions Inc. (NYSE:EBS) on Friday, November 2 to “Buy” rating.

Since August 3, 2018, it had 0 insider purchases, and 13 selling transactions for $19.93 million activity. Another trade for 17,717 shares valued at $1.23M was made by Bailey Sue on Tuesday, November 27. $3.20M worth of Emergent BioSolutions Inc. (NYSE:EBS) was sold by El-Hibri Fuad on Monday, November 26. JOULWAN GEORGE A sold 4,058 shares worth $277,784. On Wednesday, November 7 Richard Ronald sold $552,510 worth of Emergent BioSolutions Inc. (NYSE:EBS) or 7,893 shares. 90,776 shares were sold by Abdun-Nabi Daniel, worth $5.46 million. Havey Adam also sold $525,535 worth of Emergent BioSolutions Inc. (NYSE:EBS) shares.

More notable recent Emergent BioSolutions Inc. (NYSE:EBS) news were published by: Globenewswire.com which released: “Emergent BioSolutions Joins Effort to Combat National Public Health Threat From Opioid Overdose Through Acquisition of Adapt Pharma and Its Flagship Product NARCAN® (naloxone HCl) Nasal Spray – GlobeNewswire” on August 28, 2018, also Globenewswire.com with their article: “Emergent BioSolutions Receives Health Canada Approval of BioThrax® (Anthrax Vaccine Adsorbed) – GlobeNewswire” published on December 17, 2018, Globenewswire.com published: “Emergent BioSolutions to Release Third Quarter 2018 Financial Results and Conduct a Conference Call on November 1, 2018 – GlobeNewswire” on October 11, 2018. More interesting news about Emergent BioSolutions Inc. (NYSE:EBS) were released by: Globenewswire.com and their article: “Emergent BioSolutions Reports Fourth Quarter and Twelve Months 2017 Financial Results – GlobeNewswire” published on February 22, 2018 as well as Globenewswire.com‘s news article titled: “Emergent BioSolutions Completes Acquisition of Specialty Vaccines Company PaxVax – GlobeNewswire” with publication date: October 04, 2018.

Investors sentiment increased to 1.12 in 2018 Q3. Its up 0.12, from 1 in 2018Q2. It is positive, as 15 investors sold EBS shares while 84 reduced holdings. 42 funds opened positions while 69 raised stakes. 38.83 million shares or 1.86% more from 38.12 million shares in 2018Q2 were reported. California State Teachers Retirement invested in 68,061 shares. Ubs Asset Americas Inc accumulated 46,547 shares. Texas Permanent School Fund reported 0.03% stake. Employees Retirement Association Of Colorado holds 7,126 shares or 0% of its portfolio. Thrivent For Lutherans holds 0.01% or 30,000 shares. State Of Alaska Department Of Revenue has 0.02% invested in Emergent BioSolutions Inc. (NYSE:EBS) for 14,252 shares. Parametric Associates Lc, a Washington-based fund reported 266,670 shares. Mutual Of America Management Ltd reported 0.14% of its portfolio in Emergent BioSolutions Inc. (NYSE:EBS). Moreover, Greenwood Cap Assoc Limited Co has 0.08% invested in Emergent BioSolutions Inc. (NYSE:EBS). Zacks Mgmt reported 20,984 shares. Wellington Llp has 26,262 shares. Dubuque Bancorporation And holds 0% of its portfolio in Emergent BioSolutions Inc. (NYSE:EBS) for 407 shares. Wolverine Asset Mgmt Ltd holds 0% or 1,498 shares. Zurcher Kantonalbank (Zurich Cantonalbank) has invested 0% of its portfolio in Emergent BioSolutions Inc. (NYSE:EBS). The New Jersey-based Prudential Incorporated has invested 0.03% in Emergent BioSolutions Inc. (NYSE:EBS).

More notable recent Microsoft Corporation (NASDAQ:MSFT) news were published by: Nasdaq.com which released: “Technology Sector Update for 01/10/2019: ERIC, TWTR, TSM, MSFT, AAPL, IBM, CSCO, GOOG – Nasdaq” on January 10, 2019, also Nasdaq.com with their article: “Noteworthy ETF Outflows: IWV, MSFT, AAPL, V – Nasdaq” published on January 28, 2019, Nasdaq.com published: “Technology Sector Update for 01/23/2019: IBM, TEL, TDY, MSFT, AAPL, GOOG, CSCO – Nasdaq” on January 23, 2019. More interesting news about Microsoft Corporation (NASDAQ:MSFT) were released by: Nasdaq.com and their article: “IWV, MSFT, AAPL, JNJ: Large Inflows Detected at ETF – Nasdaq” published on January 18, 2019 as well as Nasdaq.com‘s news article titled: “Technology Sector Update for 01/18/2019: CASA, BABA, TEAM, BIDU, MSFT, AAPL, IBM, CSCO, GOOG – Nasdaq” with publication date: January 18, 2019.

Community Financial Services Group Llc, which manages about $293.11M US Long portfolio, upped its stake in Spdr S&P 500 (SPY) by 8,270 shares to 51,028 shares, valued at $14.84 million in 2018Q3, according to the filing.

Since August 31, 2018, it had 0 insider purchases, and 10 selling transactions for $54.07 million activity. Another trade for 203,418 shares valued at $21.70 million was sold by Nadella Satya. 2,000 shares valued at $214,363 were sold by BROD FRANK H on Monday, November 5. Hogan Kathleen T sold 40,000 shares worth $4.45 million. Hood Amy sold 118,000 shares worth $13.09 million.

Investors sentiment decreased to 0.81 in Q3 2018. Its down 0.03, from 0.84 in 2018Q2. It dived, as 33 investors sold MSFT shares while 981 reduced holdings. 145 funds opened positions while 681 raised stakes. 5.28 billion shares or 0.60% less from 5.31 billion shares in 2018Q2 were reported. Athena Capital Advsrs Limited Liability Company reported 107,978 shares. Brown Advisory Incorporated invested in 1.58% or 4.85 million shares. Shelton Capital Mngmt has 581,439 shares for 3.79% of their portfolio. Friess Assoc Ltd Liability Company has 3.3% invested in Microsoft Corporation (NASDAQ:MSFT). Scotia reported 948,858 shares. Kempen Capital Management Nv reported 0.34% in Microsoft Corporation (NASDAQ:MSFT). Barrow Hanley Mewhinney And Strauss Ltd Liability Co reported 9.85M shares. Marshall Wace Limited Liability Partnership reported 454,690 shares. North Star Asset owns 144,544 shares or 1.33% of their US portfolio. Eagle Capital Ltd Liability Company reported 8.56% in Microsoft Corporation (NASDAQ:MSFT). Barometer Capital Mgmt holds 2.52% or 282,958 shares in its portfolio. Weatherstone Management has invested 0.33% of its portfolio in Microsoft Corporation (NASDAQ:MSFT). Cypress Cap Grp Inc has invested 1.91% in Microsoft Corporation (NASDAQ:MSFT). Rockland Tru Company reported 45,116 shares. Arcadia Inv Management Corporation Mi invested 0.29% in Microsoft Corporation (NASDAQ:MSFT).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.