Equitec Specialists Llc decreased its stake in Amazon Com Inc (AMZN) by 81.31% based on its latest 2018Q3 regulatory filing with the SEC. Equitec Specialists Llc sold 8,700 shares as the company’s stock declined 15.37% with the market. The institutional investor held 2,000 shares of the consumer services company at the end of 2018Q3, valued at $4.01M, down from 10,700 at the end of the previous reported quarter. Equitec Specialists Llc who had been investing in Amazon Com Inc for a number of months, seems to be less bullish one the $795.18B market cap company. The stock decreased 5.38% or $92.5 during the last trading session, reaching $1626.23. About 11.51 million shares traded or 65.34% up from the average. Amazon.com, Inc. (NASDAQ:AMZN) has risen 41.49% since February 2, 2018 and is uptrending. It has outperformed by 41.49% the S&P500. Some Historical AMZN News: 19/03/2018 – Amazon is even addressing the amateur gaming community with the launch of Amazon GameOn; 14/05/2018 – Uber Taps Amazon Division Head to Manage Northern, Eastern Europe; 09/05/2018 – Amazon to let customers install tires at Sears stores; 20/03/2018 – Amazon Is Said to Squeeze Suppliers to Curb Losses in Price Wars; 25/04/2018 – Amazon targets kids with a version of Alexa that rewards politeness and a candy-colored Echo; 02/05/2018 – The Amazon effect could potentially leave all Americans neighborless; 16/05/2018 – Amazon Serves Up New Benefit for Prime Members at Whole Foods Market; 17/04/2018 – Amazon and Google have not yet agreed to the Cybersecurity Tech Accord; 29/03/2018 – Donald Trump Slams Amazon.com–3rd Update; 16/04/2018 – Roger Cheng: Scoop: Cut-rate live TV streaming service Philo will work on Apple TV, Amazon Fire TV this summer, and let users

Woodstock Corp increased its stake in Air Prods & Chems Inc (APD) by 9.44% based on its latest 2018Q3 regulatory filing with the SEC. Woodstock Corp bought 3,064 shares as the company’s stock declined 5.41% with the market. The institutional investor held 35,518 shares of the basic industries company at the end of 2018Q3, valued at $5.93 million, up from 32,454 at the end of the previous reported quarter. Woodstock Corp who had been investing in Air Prods & Chems Inc for a number of months, seems to be bullish on the $36.44 billion market cap company. The stock increased 0.91% or $1.5 during the last trading session, reaching $165.89. About 1.10M shares traded. Air Products and Chemicals, Inc. (NYSE:APD) has declined 2.42% since February 2, 2018 and is downtrending. It has underperformed by 2.42% the S&P500. Some Historical APD News: 02/05/2018 – Air Products Will Host MidAtlantic Rubber and Plastics Group’s Spring Technical Meeting; 26/04/2018 – Air Products & Chemicals Ups FY 2018 Guidance After 37% 2Q Profit Rise; 26/04/2018 – AIR PRODUCTS AND CHEMICALS INC APD.N FY2018 SHR VIEW $7.40 — THOMSON REUTERS l/B/E/S; 26/04/2018 – AIR PRODUCTS APD.N SEES FY 2018 ADJUSTED SHR $7.25 TO $7.40; 02/04/2018 – Air Products’ Texas Plant Onstream Adds Hydrogen Supply to Gulf Coast Pipeline Network; 30/04/2018 – Air Products to Highlight Industrial Gas Solutions for Optimizing Steelmaking Operations at AISTech 2018; 24/04/2018 – AIRBUS CEO: NEXT FIGHTER PLATFORM WILL BE RANGE OF AIR-PRODUCTS; 26/04/2018 – AIR PRODUCTS EARNINGS CONFERENCE CALL BEGINS; 26/04/2018 – AIR PRODUCTS SAYS LU’AN TO ADD 25C TO FY 2019 EPS; 26/04/2018 – Air Products & Chemicals 2Q EPS $1.89

Investors sentiment decreased to 1.06 in Q3 2018. Its down 0.29, from 1.35 in 2018Q2. It dived, as 38 investors sold APD shares while 279 reduced holdings. 90 funds opened positions while 245 raised stakes. 182.35 million shares or 0.57% less from 183.38 million shares in 2018Q2 were reported. Dynamic Advisor Solutions Llc holds 0.07% of its portfolio in Air Products and Chemicals, Inc. (NYSE:APD) for 2,091 shares. Moreno Evelyn V holds 1.61% or 34,525 shares in its portfolio. Veritable Lp stated it has 12,273 shares or 0.04% of all its holdings. Sensato Invsts Limited Liability Company owns 4,300 shares for 0.12% of their portfolio. 12,585 are held by Long Road Invest Counsel Ltd. Peoples Fincl Serv stated it has 0.85% of its portfolio in Air Products and Chemicals, Inc. (NYSE:APD). Thrivent Fincl For Lutherans accumulated 9,412 shares. Moreover, Fenimore Asset Mgmt has 2.17% invested in Air Products and Chemicals, Inc. (NYSE:APD) for 370,148 shares. 1,200 are held by Bedell Frazier Invest Counseling. Robeco Institutional Asset Bv reported 463,373 shares or 0.33% of all its holdings. Svcs Automobile Association invested 0.11% in Air Products and Chemicals, Inc. (NYSE:APD). 3,590 were accumulated by Ibm Retirement Fund. Ironwood Inv Mgmt Limited Liability Corporation, a Massachusetts-based fund reported 2,941 shares. Capital Fund Management Sa has 76,036 shares for 0.07% of their portfolio. The Hawaii-based First Hawaiian Fincl Bank has invested 0.02% in Air Products and Chemicals, Inc. (NYSE:APD).

Among 22 analysts covering Air Products & Chemicals (NYSE:APD), 18 have Buy rating, 0 Sell and 4 Hold. Therefore 82% are positive. Air Products & Chemicals had 70 analyst reports since August 4, 2015 according to SRatingsIntel. The company was maintained on Thursday, September 28 by Jefferies. The rating was upgraded by JP Morgan to “Outperform” on Friday, February 9. Citigroup downgraded the shares of APD in report on Tuesday, January 5 to “Neutral” rating. The rating was downgraded by JP Morgan to “Neutral” on Monday, January 29. KeyBanc Capital Markets maintained Air Products and Chemicals, Inc. (NYSE:APD) on Tuesday, January 30 with “Overweight” rating. The company was upgraded on Monday, November 21 by Argus Research. As per Thursday, September 17, the company rating was maintained by Deutsche Bank. The company was initiated on Tuesday, March 27 by BMO Capital Markets. The rating was maintained by SunTrust on Friday, January 26 with “Buy”. The stock of Air Products and Chemicals, Inc. (NYSE:APD) earned “Buy” rating by Monness Crespi & Hardt on Wednesday, December 21.

Woodstock Corp, which manages about $699.55 million and $591.67M US Long portfolio, decreased its stake in Intuitive Surgical Inc (NASDAQ:ISRG) by 2,066 shares to 40,706 shares, valued at $23.37 million in 2018Q3, according to the filing. It also reduced its holding in Intl Business Machines (NYSE:IBM) by 7,547 shares in the quarter, leaving it with 22,458 shares, and cut its stake in Idexx Laboratories Inc (NASDAQ:IDXX).

Since November 12, 2018, it had 1 insider buy, and 0 insider sales for $3.20 million activity.

More notable recent Air Products and Chemicals, Inc. (NYSE:APD) news were published by: Seekingalpha.com which released: “Air Products to build second California liquid hydrogen production plant – Seeking Alpha” on January 07, 2019, also Globenewswire.com with their article: “Analysis: Positioning to Benefit within AMETEK, Taylor Morrison Home, MBIA, Air Products and Chemicals, CBIZ, and Aqua Metals — Research Highlights Growth, Revenue, and Consolidated Results – GlobeNewswire” published on January 31, 2019, Seekingalpha.com published: “Sell Kraft-Heinz At $64-65 – Cramer’s Lightning Round (6/21/18) – Seeking Alpha” on June 22, 2018. More interesting news about Air Products and Chemicals, Inc. (NYSE:APD) were released by: Seekingalpha.com and their article: “Expected Dividend Increases In February 2019 – Seeking Alpha” published on January 30, 2019 as well as Seekingalpha.com‘s news article titled: “Air Products And Chemicals: Jilted Again – Seeking Alpha” with publication date: April 01, 2017.

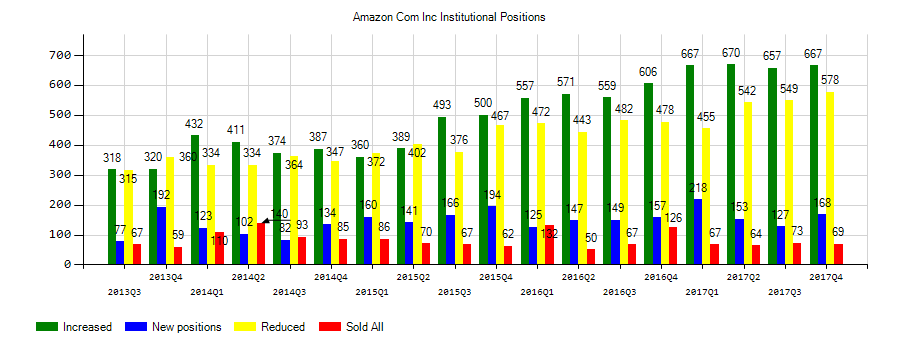

Investors sentiment decreased to 1.18 in 2018 Q3. Its down 0.16, from 1.34 in 2018Q2. It dropped, as 55 investors sold AMZN shares while 636 reduced holdings. 157 funds opened positions while 655 raised stakes. 260.67 million shares or 2.89% less from 268.42 million shares in 2018Q2 were reported. Omega Advsr Inc accumulated 10,100 shares. Van Eck Assoc holds 37,585 shares or 0.37% of its portfolio. Cohen Steers invested in 8,739 shares or 0.05% of the stock. Lloyds Bk Group Public Limited Company accumulated 70 shares or 1.71% of the stock. Ws Mngmt Lllp accumulated 0.45% or 6,823 shares. Etrade Mngmt Limited Liability accumulated 8,539 shares or 0.49% of the stock. Grimes And invested in 0.22% or 1,372 shares. Lehman Fincl Res invested in 428 shares or 0.4% of the stock. Letko Brosseau Associate stated it has 0.01% in Amazon.com, Inc. (NASDAQ:AMZN). Moreover, Roundview Ltd Com has 1.47% invested in Amazon.com, Inc. (NASDAQ:AMZN) for 2,982 shares. Hartwell J M LP invested in 20,005 shares. Headinvest Ltd Co has invested 0.14% in Amazon.com, Inc. (NASDAQ:AMZN). Birch Hill Inv Advisors Limited Liability Com stated it has 33,111 shares. Regent Inv Limited Com has 2.98% invested in Amazon.com, Inc. (NASDAQ:AMZN) for 4,748 shares. First Manhattan has invested 0.06% in Amazon.com, Inc. (NASDAQ:AMZN).

Since August 15, 2018, it had 0 insider purchases, and 22 selling transactions for $92.11 million activity. Zapolsky David had sold 1,927 shares worth $3.66M. On Monday, October 29 BEZOS JEFFREY P sold $27.69 million worth of Amazon.com, Inc. (NASDAQ:AMZN) or 16,964 shares. On Thursday, November 15 Huttenlocher Daniel P sold $285,960 worth of Amazon.com, Inc. (NASDAQ:AMZN) or 181 shares. Jassy Andrew R sold $3.28M worth of stock. 2,030 shares valued at $3.21 million were sold by Olsavsky Brian T on Thursday, November 15. The insider STONESIFER PATRICIA Q sold $2.31 million.

Analysts await Amazon.com, Inc. (NASDAQ:AMZN) to report earnings on February, 7. They expect $5.48 EPS, up 153.70% or $3.32 from last year’s $2.16 per share. AMZN’s profit will be $2.68 billion for 74.19 P/E if the $5.48 EPS becomes a reality. After $5.75 actual EPS reported by Amazon.com, Inc. for the previous quarter, Wall Street now forecasts -4.70% negative EPS growth.

Equitec Specialists Llc, which manages about $452.73M US Long portfolio, upped its stake in Micron Technology Inc (Prn) by 342,000 shares to 2.30 million shares, valued at $9.48 million in 2018Q3, according to the filing. It also increased its holding in Virtus Invt Partners Inc by 8,200 shares in the quarter, for a total of 29,444 shares, and has risen its stake in Ciena Corp (Put) (NYSE:CIEN).

Among 57 analysts covering Amazon.com (NASDAQ:AMZN), 54 have Buy rating, 0 Sell and 3 Hold. Therefore 95% are positive. Amazon.com had 334 analyst reports since July 21, 2015 according to SRatingsIntel. Axiom Capital maintained the shares of AMZN in report on Monday, December 28 with “Buy” rating. The firm has “Buy” rating by Macquarie Research given on Tuesday, February 13. The rating was maintained by Robert W. Baird with “Buy” on Tuesday, August 15. The stock of Amazon.com, Inc. (NASDAQ:AMZN) has “Hold” rating given on Thursday, April 5 by Stifel Nicolaus. On Thursday, August 27 the stock rating was upgraded by Raymond James to “Outperform”. The stock of Amazon.com, Inc. (NASDAQ:AMZN) has “Buy” rating given on Wednesday, June 27 by Loop Capital Markets. The firm earned “Buy” rating on Monday, October 23 by Canaccord Genuity. The firm earned “Buy” rating on Thursday, December 7 by Cowen & Co. As per Friday, February 3, the company rating was maintained by Mizuho. The firm earned “Outperform” rating on Friday, August 28 by Cowen & Co.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.