Pictet Asset Management Ltd decreased Intuitive Surgical Inc (ISRG) stake by 0.86% reported in 2018Q3 SEC filing. Pictet Asset Management Ltd sold 4,200 shares as Intuitive Surgical Inc (ISRG)’s stock declined 8.08%. The Pictet Asset Management Ltd holds 485,703 shares with $278.79 million value, down from 489,903 last quarter. Intuitive Surgical Inc now has $59.92 billion valuation. The stock increased 0.19% or $1.01 during the last trading session, reaching $524.65. About 711,681 shares traded. Intuitive Surgical, Inc. (NASDAQ:ISRG) has risen 29.79% since February 1, 2018 and is uptrending. It has outperformed by 29.79% the S&P500. Some Historical ISRG News: 23/03/2018 The research center previously created Apple’s Siri and the core technology used by Intuitive Surgical in their da Vinci systems; 17/04/2018 – INTUITIVE SURGICAL 1Q ADJ EPS $2.44; 18/04/2018 – Intuitive Surgical Volume Jumps More Than Eight Times Average; 14/05/2018 – Intuitive Surgical at Bank of America Conference Tomorrow; 03/05/2018 – New Study Shows Robotic-Assisted Surgery Benefits for lnguinal Hernia Repair; 21/04/2018 – DJ Intuitive Surgical Inc, Inst Holders, 1Q 2018 (ISRG); 17/04/2018 – Intuitive Surgical’s quarterly profit jumps 59 percent; 23/04/2018 – Labaton Sucharow LLP Announces Notice of Pendency of Class Action in the In re Intuitive Surgical Securities Litigation; 16/04/2018 – Intuitive Surgical Inc expected to post earnings of $2.07 a share – Earnings Preview; 17/04/2018 – Intuitive Surgical 1Q Rev $848M

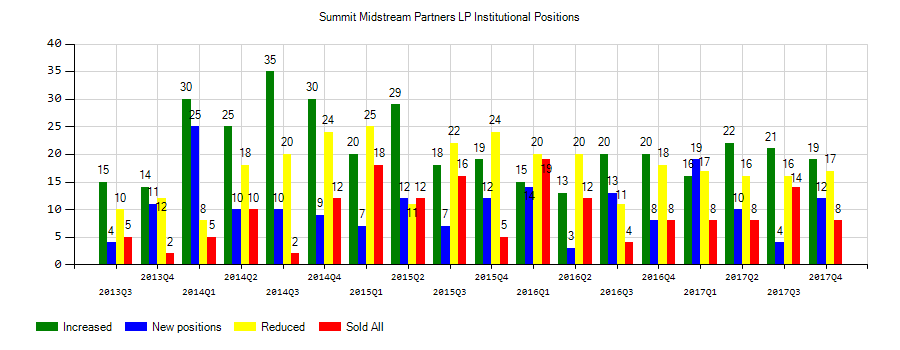

Kayne Anderson Capital Advisors Lp increased Summit Midstream Partners Lp (SMLP) stake by 2.28% reported in 2018Q3 SEC filing. Kayne Anderson Capital Advisors Lp acquired 70,680 shares as Summit Midstream Partners Lp (SMLP)’s stock declined 21.30%. The Kayne Anderson Capital Advisors Lp holds 3.17 million shares with $45.39 million value, up from 3.10M last quarter. Summit Midstream Partners Lp now has $1.01 billion valuation. The stock increased 1.88% or $0.25 during the last trading session, reaching $13.55. About 479,467 shares traded or 10.39% up from the average. Summit Midstream Partners, LP (NYSE:SMLP) has declined 33.94% since February 1, 2018 and is downtrending. It has underperformed by 33.94% the S&P500. Some Historical SMLP News: 16/03/2018 – SUMMIT MIDSTREAM PARTNERS LP – SMLP DOES NOT EXPECT TO BE ADVERSELY IMPACTED BY YESTERDAY’S ANNOUNCEMENT FROM FERC; 16/03/2018 Summit Midstream Partners, LP Responds to FERC Announcement; 25/05/2018 – Summit Midstream Partners, LP Announces Series A Preferred Distribution; 20/04/2018 – DJ Summit Midstream Partners LP, Inst Holders, 1Q 2018 (SMLP); 16/03/2018 – Summit Midstream Partners Doesn’t Expect to Be Adversely Impacted by FERC Income Tax Announcement; 03/05/2018 – Summit Midstream Partners 1Q Rev $117.3M; 03/05/2018 – SUMMIT MIDSTREAM PARTNERS LP – QTRLY TOTAL REVENUE $117.3 MLN VS $135.8 MLN; 16/03/2018 – SUMMIT MIDSTREAM PARTNERS DOESN’T SEE ADVERSE EFFECT ON FERC; 03/05/2018 – SUMMIT MIDSTREAM PARTNERS LP SMLP.N – QTRLY LOSS PER LIMITED PARTNER UNIT $0.18; 03/05/2018 – SUMMIT MIDSTREAM PARTNERS LP – ON TARGET TO DELIVER ON ITS 2018 FINANCIAL GUIDANCE

Among 7 analysts covering Intuitive Surgical (NASDAQ:ISRG), 6 have Buy rating, 0 Sell and 1 Hold. Therefore 86% are positive. Intuitive Surgical had 9 analyst reports since August 2, 2018 according to SRatingsIntel. On Thursday, August 2 the stock rating was maintained by Citigroup with “Buy”. Morgan Stanley maintained Intuitive Surgical, Inc. (NASDAQ:ISRG) on Thursday, October 11 with “Overweight” rating. The rating was maintained by Citigroup on Wednesday, January 2 with “Buy”. The firm has “Buy” rating by Citigroup given on Thursday, November 29. The rating was upgraded by Canaccord Genuity on Friday, October 19 to “Buy”. The company was upgraded on Tuesday, October 9 by PiperJaffray. Wells Fargo maintained Intuitive Surgical, Inc. (NASDAQ:ISRG) rating on Wednesday, September 12. Wells Fargo has “Outperform” rating and $635 target. The company was maintained on Friday, October 19 by Raymond James.

Since July 30, 2018, it had 0 insider buys, and 14 insider sales for $41.32 million activity. Shares for $121,509 were sold by SMITH LONNIE M. On Monday, December 3 the insider Samath Jamie sold $123,002. $16.28M worth of Intuitive Surgical, Inc. (NASDAQ:ISRG) was sold by Rosa David J.. $4.20M worth of stock was sold by MOHR MARSHALL on Monday, July 30. The insider Myriam Curet sold 1,100 shares worth $548,103. The insider Brogna Salvatore sold $1.48 million. The insider GUTHART GARY S sold 28,085 shares worth $15.24M.

Investors sentiment decreased to 1.18 in Q3 2018. Its down 0.11, from 1.29 in 2018Q2. It dived, as 26 investors sold ISRG shares while 235 reduced holdings. 94 funds opened positions while 213 raised stakes. 92.91 million shares or 1.44% less from 94.27 million shares in 2018Q2 were reported. Moreover, Virginia Retirement Et Al has 0.37% invested in Intuitive Surgical, Inc. (NASDAQ:ISRG) for 56,200 shares. Highlander Capital Mgmt Ltd Limited Liability Company stated it has 0.96% in Intuitive Surgical, Inc. (NASDAQ:ISRG). Wells Fargo & Com Mn invested in 0.06% or 384,830 shares. 33,000 are owned by Bedrijfstakpensioenfonds Voor De Media Pno. Factory Mutual Ins reported 37,000 shares stake. The Oregon-based M Inc has invested 0.12% in Intuitive Surgical, Inc. (NASDAQ:ISRG). Cim Llc holds 4.33% or 20,663 shares in its portfolio. Aqr Capital Mgmt Ltd Liability Corporation, a Connecticut-based fund reported 416,645 shares. Savant Ltd Co accumulated 534 shares. Moreover, Spears Abacus Advisors Ltd Liability Corporation has 0.05% invested in Intuitive Surgical, Inc. (NASDAQ:ISRG) for 675 shares. Wealthtrust invested in 0.04% or 143 shares. Bender Robert holds 35,053 shares. 850 were reported by Joel Isaacson & Ltd Liability Company. The Tennessee-based B Riley Wealth Mngmt has invested 0.08% in Intuitive Surgical, Inc. (NASDAQ:ISRG). Gagnon Limited Com stated it has 3.07% of its portfolio in Intuitive Surgical, Inc. (NASDAQ:ISRG).

More notable recent Intuitive Surgical, Inc. (NASDAQ:ISRG) news were published by: Nasdaq.com which released: “Intuitive Surgical (ISRG) Dips More Than Broader Markets: What You Should Know – Nasdaq” on January 29, 2019, also Nasdaq.com with their article: “Intuitive Surgical: ISRG Stock Dips on Q4 Profit Miss, Revenue Beat – Nasdaq” published on January 24, 2019, Nasdaq.com published: “Why Earnings Season Could Be Great for Intuitive Surgical (ISRG) – Nasdaq” on January 23, 2019. More interesting news about Intuitive Surgical, Inc. (NASDAQ:ISRG) were released by: Nasdaq.com and their article: “Intuitive Surgical (ISRG) Up on Solid Preliminary Q4 Results – Nasdaq” published on January 10, 2019 as well as Nasdaq.com‘s news article titled: “ISRG, RMD Earnings on Jan 24: Here Are the Key Predictions – Nasdaq” with publication date: January 23, 2019.

Pictet Asset Management Ltd increased Restaurant Brands Intl Inc stake by 60,655 shares to 80,771 valued at $4.78 million in 2018Q3. It also upped Weibo Corp (NASDAQ:WB) stake by 17,053 shares and now owns 105,776 shares. Grifols S A (NASDAQ:GRFS) was raised too.

Among 4 analysts covering Summit Midstream Partners (NYSE:SMLP), 2 have Buy rating, 1 Sell and 1 Hold. Therefore 50% are positive. Summit Midstream Partners had 5 analyst reports since August 29, 2018 according to SRatingsIntel. Credit Suisse maintained it with “Outperform” rating and $15 target in Tuesday, November 20 report. The stock has “Buy” rating by Goldman Sachs on Tuesday, October 9. The firm has “Market Perform” rating given on Monday, September 24 by Wells Fargo. Barclays Capital maintained it with “Underweight” rating and $17 target in Wednesday, August 29 report.

Investors sentiment increased to 1.08 in Q3 2018. Its up 0.04, from 1.04 in 2018Q2. It increased, as 6 investors sold SMLP shares while 19 reduced holdings. 11 funds opened positions while 16 raised stakes. 31.09 million shares or 3.79% less from 32.31 million shares in 2018Q2 were reported. Harvest Fund Advisors Limited Com invested in 2.21M shares. Emory University holds 0.82% of its portfolio in Summit Midstream Partners, LP (NYSE:SMLP) for 87,560 shares. Kayne Anderson Advsrs Lp has invested 0.57% in Summit Midstream Partners, LP (NYSE:SMLP). Hightower Advsrs Limited Liability holds 37,701 shares. Deutsche National Bank & Trust Ag stated it has 154,445 shares or 0% of all its holdings. Massachusetts-based Twin Focus Capital Partners Ltd Liability Corporation has invested 0.99% in Summit Midstream Partners, LP (NYSE:SMLP). Raymond James Financial Serv Advsr Inc invested in 0% or 10,028 shares. The New York-based Rafferty Asset Mgmt Limited Liability Corp has invested 0.03% in Summit Midstream Partners, LP (NYSE:SMLP). Creative Planning has 0% invested in Summit Midstream Partners, LP (NYSE:SMLP) for 19,300 shares. Neuberger Berman Ltd Liability Com reported 19,267 shares. Hmi Cap Limited Liability Company invested in 7.45% or 4.08M shares. Susquehanna Group Inc Limited Liability Partnership has 19,121 shares for 0% of their portfolio. 492,394 were reported by Commonwealth Of Pennsylvania Public School Empls Retrmt. Savings Bank Of Montreal Can invested in 0% or 3,426 shares. Evergreen Management Ltd Llc holds 436,114 shares or 0.55% of its portfolio.

More notable recent Summit Midstream Partners, LP (NYSE:SMLP) news were published by: Seekingalpha.com which released: “A 13% Yield For Patient Income Investors – Seeking Alpha” on August 24, 2018, also Seekingalpha.com with their article: “A Nice 15.6% Yield For The Summit Midstream Of Your Life – Seeking Alpha” published on October 20, 2018, Seekingalpha.com published: “Summit Midstream: A Promising Future For This High-Yielding MLP – Seeking Alpha” on December 07, 2018. More interesting news about Summit Midstream Partners, LP (NYSE:SMLP) were released by: Seekingalpha.com and their article: “MLPs: A Quiet Place – Seeking Alpha” published on January 27, 2019 as well as Seekingalpha.com‘s news article titled: “A 15% Yield For Patient Income Investors – Seeking Alpha” with publication date: June 30, 2018.

Since August 17, 2018, it had 0 buys, and 6 sales for $342,929 activity. The insider Graves Brad N sold 5,000 shares worth $74,200. 3,000 shares valued at $48,012 were sold by Degeyter Brock M on Monday, September 17.

Kayne Anderson Capital Advisors Lp decreased Bp Midstream Partners Lp stake by 2.32M shares to 2.87 million valued at $54.01M in 2018Q3. It also reduced Energy Transfer Equity LP (NYSE:ETE) stake by 851,000 shares and now owns 4.03M shares. Plains All Amern Pipeline L (NYSE:PAA) was reduced too.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.