Lenox Wealth Management Inc decreased its stake in America Movil Sab De Cv (AMX) by 97.66% based on its latest 2018Q3 regulatory filing with the SEC. Lenox Wealth Management Inc sold 73,507 shares as the company’s stock declined 15.38% with the market. The institutional investor held 1,760 shares of the public utilities company at the end of 2018Q3, valued at $28,000, down from 75,267 at the end of the previous reported quarter. Lenox Wealth Management Inc who had been investing in America Movil Sab De Cv for a number of months, seems to be less bullish one the $53.68B market cap company. The stock increased 0.83% or $0.13 during the last trading session, reaching $16.18. About 551,328 shares traded. América Móvil, S.A.B. de C.V. (NYSE:AMX) has declined 18.68% since February 1, 2018 and is downtrending. It has underperformed by 18.68% the S&P500. Some Historical AMX News: 14/03/2018 – AMERICA MOVIL CHAIRMAN CARLOS SLIM DOMIT SPEAKS IN MEXICO CITY; 24/04/2018 – America Movil Sees Payments From Rivals Boost Mexico Sales; 17/04/2018 – AMERICA MOVIL APPROVES DIVIDEND OF MXN0.32/SHARE; 24/04/2018 – America Movil 1Q Net Profit Down 51% on Year to MXN17.7 Billion; 18/04/2018 – Mexico’s top court sides with America Movil, says Telmex can charge rivals; 24/04/2018 – America Movil 1Q Ebitda Down 0.8% on Year to MXN71.2 Billion; 25/04/2018 – AMERICA MOVIL ON TRACK TO ACCOMPLISH $8B BUDGET FOR CAPEX: HAJJ; 16/04/2018 – America Movil shareholders approve 3 bln pesos in share buybacks; 20/03/2018 – CORRECT: AMERICA MOVIL TO PROPOSE MXN0.32/SHARE DIVIDEND; 24/04/2018 – America Movil 1Q Revenue Down 3.7% on Year to MXN254.4 Billion

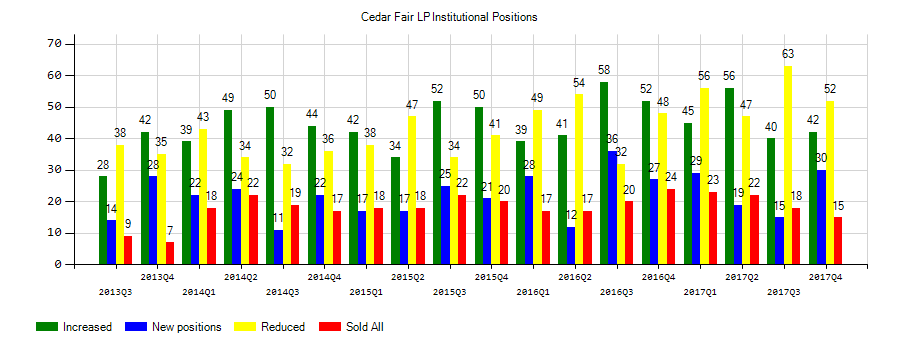

Ci Investments Inc decreased its stake in Cedar Fair LP (FUN) by 56.04% based on its latest 2018Q3 regulatory filing with the SEC. Ci Investments Inc sold 10,200 shares as the company’s stock declined 5.56% with the market. The institutional investor held 8,000 shares of the consumer services company at the end of 2018Q3, valued at $417,000, down from 18,200 at the end of the previous reported quarter. Ci Investments Inc who had been investing in Cedar Fair LP for a number of months, seems to be less bullish one the $3.12B market cap company. The stock decreased 0.09% or $0.05 during the last trading session, reaching $55.25. About 63,872 shares traded. Cedar Fair, L.P. (NYSE:FUN) has declined 22.29% since February 1, 2018 and is downtrending. It has underperformed by 22.29% the S&P500. Some Historical FUN News: 22/04/2018 – DJ Cedar Fair LP, Inst Holders, 1Q 2018 (FUN); 20/03/2018 – Carowinds Introduces Camp Snoopy and Non-Stop Family Fun; 02/05/2018 – Cedar Fair 1Q Rev $55M; 02/05/2018 – Cedar Fair Declares Cash Distribution of $0.89/LP Unit; 03/04/2018 – Factors of Influence in 2018, Key Indicators and Opportunity within Cedar Fair, American Public Education, Cadiz, National Rese; 23/03/2018 – Kings Dominion Debuts New “Hybrid” Roller Coaster Twisted Timbers; 02/05/2018 – Cedar Fair 1Q Loss $83.4M; 02/05/2018 – Cedar Fair Declares Dividend of $0.89; 14/03/2018 Cedar Fair Completes Credit Agreement Amendment; Reduces Borrowing Costs; 02/05/2018 – /C O R R E C T I O N — Cedar Fair Entertainment Company/

Lenox Wealth Management Inc, which manages about $693.17M and $336.29 million US Long portfolio, upped its stake in Relx Plc American Depositary Shares by 49,636 shares to 60,235 shares, valued at $1.26M in 2018Q3, according to the filing. It also increased its holding in Norwegian Cruise Line Holdings Ltd (NASDAQ:NCLH) by 75,766 shares in the quarter, for a total of 75,801 shares, and has risen its stake in Procter & Gamble Co (NYSE:PG).

Analysts await América Móvil, S.A.B. de C.V. (NYSE:AMX) to report earnings on February, 12. They expect $0.22 EPS, up 237.50% or $0.38 from last year’s $-0.16 per share. AMX’s profit will be $729.89 million for 18.39 P/E if the $0.22 EPS becomes a reality. After $0.30 actual EPS reported by América Móvil, S.A.B. de C.V. for the previous quarter, Wall Street now forecasts -26.67% negative EPS growth.

More notable recent América Móvil, S.A.B. de C.V. (NYSE:AMX) news were published by: Etfdailynews.com which released: “America Movil Offers A Rare Value Opportunity In The Telecom Space – ETF Daily News” on February 15, 2017, also Seekingalpha.com with their article: “KPN – Is A Dutch Telecom Provider The Next One To Be Acquired? – Seeking Alpha” published on November 08, 2016, Seekingalpha.com published: “Wall Street Breakfast: Senate Looks To Break Shutdown Deadlock – Seeking Alpha” on January 25, 2019. More interesting news about América Móvil, S.A.B. de C.V. (NYSE:AMX) were released by: Seekingalpha.com and their article: “America Movil On The Defensive But Still Capable – Seeking Alpha” published on November 25, 2016 as well as Seekingalpha.com‘s news article titled: “Report: AT&T planning to enter Brazil mobile market – Seeking Alpha” with publication date: February 17, 2018.

Among 14 analysts covering America Movil S.A.B. (NYSE:AMX), 7 have Buy rating, 2 Sell and 5 Hold. Therefore 50% are positive. America Movil S.A.B. had 36 analyst reports since July 21, 2015 according to SRatingsIntel. The firm has “Buy” rating given on Friday, October 20 by Credit Suisse. The stock of América Móvil, S.A.B. de C.V. (NYSE:AMX) has “Buy” rating given on Tuesday, April 3 by Goldman Sachs. The firm earned “Buy” rating on Wednesday, November 28 by UBS. The firm has “Neutral” rating given on Tuesday, November 17 by Macquarie Research. The stock has “Buy” rating by Bank of America on Tuesday, August 7. The firm earned “Neutral” rating on Monday, November 26 by Bradesco. RBC Capital Markets maintained América Móvil, S.A.B. de C.V. (NYSE:AMX) rating on Friday, July 21. RBC Capital Markets has “Sell” rating and $1400 target. The stock of América Móvil, S.A.B. de C.V. (NYSE:AMX) earned “Underweight” rating by JP Morgan on Thursday, April 28. RBC Capital Markets maintained América Móvil, S.A.B. de C.V. (NYSE:AMX) on Wednesday, October 21 with “Underperform” rating. Citigroup downgraded the stock to “Sell” rating in Thursday, April 28 report.

Investors sentiment increased to 1.08 in 2018 Q3. Its up 0.36, from 0.72 in 2018Q2. It improved, as 31 investors sold FUN shares while 31 reduced holdings. 23 funds opened positions while 44 raised stakes. 27.42 million shares or 2.39% less from 28.09 million shares in 2018Q2 were reported. Financial Counselors reported 4,918 shares. Ancora Advsr Ltd Liability Corporation has 1,042 shares. Kings Point Capital Mngmt stated it has 0.01% in Cedar Fair, L.P. (NYSE:FUN). Old Natl Bancorporation In has invested 0.05% of its portfolio in Cedar Fair, L.P. (NYSE:FUN). Aurora Counsel owns 42,135 shares or 1.04% of their US portfolio. First Manhattan Com reported 0% stake. Hollow Brook Wealth Mngmt Limited Liability has invested 4.27% in Cedar Fair, L.P. (NYSE:FUN). Pecaut & stated it has 0.22% in Cedar Fair, L.P. (NYSE:FUN). Marshall Wace Llp owns 0.05% invested in Cedar Fair, L.P. (NYSE:FUN) for 122,403 shares. Private Trust Na stated it has 0.11% in Cedar Fair, L.P. (NYSE:FUN). Overbrook Mngmt holds 3.6% or 364,892 shares. Winfield Associate reported 0.45% stake. Ameriprise Fincl reported 0.01% in Cedar Fair, L.P. (NYSE:FUN). 4,200 are owned by Interocean. Live Your Vision Ltd Liability Corporation has invested 0% in Cedar Fair, L.P. (NYSE:FUN).

Ci Investments Inc, which manages about $13.35 billion US Long portfolio, upped its stake in Stanley Black & Decker Inc (NYSE:SWK) by 95,800 shares to 535,900 shares, valued at $78.48M in 2018Q3, according to the filing. It also increased its holding in Equinix Inc (NASDAQ:EQIX) by 4,512 shares in the quarter, for a total of 61,312 shares, and has risen its stake in Firstenergy Corp (NYSE:FE).

More notable recent Cedar Fair, L.P. (NYSE:FUN) news were published by: Seekingalpha.com which released: “Cedar Fair: An Undervalued, High-Yield Name – Seeking Alpha” on September 14, 2018, also Seekingalpha.com with their article: “GE: Let The Fun Begin – Seeking Alpha” published on October 01, 2018, Investorplace.com published: “7 S&P 500 Stocks to Buy That Tore Up Earnings – Investorplace.com” on January 31, 2019. More interesting news about Cedar Fair, L.P. (NYSE:FUN) were released by: Bloomberg.com and their article: “NYSE Needed Some Pretend Traders – Bloomberg” published on December 14, 2018 as well as Seekingalpha.com‘s news article titled: “Cedar Fair: 7% Payout, Improving Business Fundamentals – Cedar Fair, LP (NYSE:FUN) – Seeking Alpha” with publication date: November 06, 2018.

Among 11 analysts covering Cedar Fair (NYSE:FUN), 8 have Buy rating, 0 Sell and 3 Hold. Therefore 73% are positive. Cedar Fair had 30 analyst reports since August 24, 2015 according to SRatingsIntel. The firm has “Buy” rating given on Thursday, April 6 by Goldman Sachs. On Monday, August 24 the stock rating was upgraded by Hilliard Lyons to “Buy”. The firm has “Buy” rating by Goldman Sachs given on Monday, June 19. KeyBanc Capital Markets maintained it with “Buy” rating and $77.0 target in Wednesday, February 14 report. As per Thursday, February 16, the company rating was maintained by FBR Capital. KeyBanc Capital Markets maintained Cedar Fair, L.P. (NYSE:FUN) rating on Thursday, August 2. KeyBanc Capital Markets has “Overweight” rating and $70 target. Suntrust Robinson initiated it with “Hold” rating and $72 target in Thursday, April 13 report. Wedbush maintained Cedar Fair, L.P. (NYSE:FUN) rating on Thursday, August 2. Wedbush has “Outperform” rating and $58 target. Stifel Nicolaus maintained Cedar Fair, L.P. (NYSE:FUN) on Wednesday, August 2 with “Buy” rating. Macquarie Research initiated the stock with “Neutral” rating in Wednesday, December 9 report.

Since November 2, 2018, it had 3 buys, and 0 selling transactions for $1.42 million activity. $1.02 million worth of Cedar Fair, L.P. (NYSE:FUN) was bought by KLEIN THOMAS on Monday, November 5. Zimmerman Richard bought $293,520 worth of stock.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.