Marshall Wace Llp increased its stake in Quanta Services (PWR) by 353.86% based on its latest 2018Q3 regulatory filing with the SEC. Marshall Wace Llp bought 205,438 shares as the company’s stock declined 10.73% with the market. The hedge fund held 263,495 shares of the capital goods company at the end of 2018Q3, valued at $8.80 million, up from 58,057 at the end of the previous reported quarter. Marshall Wace Llp who had been investing in Quanta Services for a number of months, seems to be bullish on the $5.15 billion market cap company. The stock increased 0.80% or $0.28 during the last trading session, reaching $35.18. About 984,932 shares traded. Quanta Services, Inc. (NYSE:PWR) has declined 20.13% since January 31, 2018 and is downtrending. It has underperformed by 20.13% the S&P500. Some Historical PWR News: 10/04/2018 – Quanta Computer Inc. Mar Rev NT$71.85B; 23/05/2018 – Quanta Services Presenting at KeyCorp Conference May 30; 30/03/2018 – Taiwan’s electronics makers face triple threat; 03/05/2018 – Quanta Services Sees 2018 Rev $9.95B-$10.55B; 30/03/2018 – TAIPEI — Earnings at Taiwan’s contract electronics manufacturers are sinking under the weight of surging costs, production problems with the iPhone, and trade tensions between the U.S. and mainland China; 03/05/2018 – Quanta Services 1Q Rev $2.42B; 09/03/2018 – Quanta Computer Inc. Feb Rev NT$64.29B; 22/05/2018 – Quanta Services Presenting at Conference May 30; 25/04/2018 – Quanta Successfully Completes Pilot Treatments in France; 03/05/2018 – Quanta Services 1Q Adj EPS 40c

Birchview Capital Lp decreased its stake in Veracyte Inc (VCYT) by 50.62% based on its latest 2018Q3 regulatory filing with the SEC. Birchview Capital Lp sold 50,000 shares as the company’s stock rose 11.02% while stock markets declined. The institutional investor held 48,767 shares of the health care company at the end of 2018Q3, valued at $466,000, down from 98,767 at the end of the previous reported quarter. Birchview Capital Lp who had been investing in Veracyte Inc for a number of months, seems to be less bullish one the $716.32 million market cap company. The stock decreased 0.34% or $0.06 during the last trading session, reaching $17.67. About 224,675 shares traded. Veracyte, Inc. (NASDAQ:VCYT) has risen 94.85% since January 31, 2018 and is uptrending. It has outperformed by 94.85% the S&P500. Some Historical VCYT News: 19/05/2018 – Veracyte: Afirma GSC Identified Significantly More Benign Thyroid Nodules Among Those Deemed Indeterminate; 11/04/2018 – VERACYTE REPORTS PRECISION MEDICINE PACT WITH LOXO ONCOLOGY; 22/04/2018 – DJ Veracyte Inc, Inst Holders, 1Q 2018 (VCYT); 23/05/2018 – Veracyte Announces New Study Published in JAMA Surgery Demonstrates Afirma GSC’s Ability to Significantly Reduce Unnecessary; 14/03/2018 Veracyte Announces New Data Demonstrating “Real-World” Performance of Afirma GSC To Be Presented at ENDO 2018; 11/04/2018 – VERACYTE INC – FINANCIAL AND OTHER TERMS OF AGREEMENT WERE NOT DISCLOSED; 19/05/2018 – Veracyte Announces That Data From Multiple Studies Demonstrate “Real-World” Value of Afirma Genomic Sequencing Classifier in Thyroid Cancer Diagnosis; 19/05/2018 – Veracyte Announces That Data From Multiple Studies Demonstrate “Real-World” Value of Afirma Genomic Sequencing Classifier in; 19/03/2018 – Veracyte Announces New Data Suggesting Afirma GSC’s Ability to Help Significantly More Patients Avoid Unnecessary Thyroid Surgery; 16/05/2018 – Veracyte Announces Launch of New Afirma Xpression Atlas at 2018 AACE Congress

Marshall Wace Llp, which manages about $11.75 billion US Long portfolio, decreased its stake in Realpage Inc (NASDAQ:RP) by 6,724 shares to 99,265 shares, valued at $6.54M in 2018Q3, according to the filing. It also reduced its holding in Kla (NASDAQ:KLAC) by 24,628 shares in the quarter, leaving it with 35,376 shares, and cut its stake in Sina Corp (NASDAQ:SINA).

More news for Quanta Services, Inc. (NYSE:PWR) were recently published by: , which released: “21 Stocks Moving In Monday’s Pre-Market Session – Benzinga” on January 07, 2019. Bizjournals.com‘s article titled: “Duke Energy mulls bid to operate Puerto Rico’s troubled electric grid – Charlotte Business Journal” and published on January 22, 2019 is yet another important article.

Among 15 analysts covering Quanta Services Inc. (NYSE:PWR), 12 have Buy rating, 0 Sell and 3 Hold. Therefore 80% are positive. Quanta Services Inc. had 54 analyst reports since August 6, 2015 according to SRatingsIntel. Maxim Group maintained it with “Buy” rating and $32 target in Thursday, August 6 report. The firm has “Buy” rating given on Wednesday, January 31 by Stephens. Citigroup upgraded Quanta Services, Inc. (NYSE:PWR) on Friday, August 18 to “Buy” rating. The stock of Quanta Services, Inc. (NYSE:PWR) earned “Neutral” rating by Robert W. Baird on Friday, November 3. The company was downgraded on Monday, October 19 by FBR Capital. FBR Capital maintained Quanta Services, Inc. (NYSE:PWR) on Friday, May 6 with “Mkt Perform” rating. The rating was initiated by Citigroup on Friday, November 13 with “Neutral”. The stock of Quanta Services, Inc. (NYSE:PWR) has “Buy” rating given on Monday, November 6 by FBR Capital. Robert W. Baird downgraded Quanta Services, Inc. (NYSE:PWR) on Wednesday, July 26 to “Hold” rating. Stifel Nicolaus maintained it with “Buy” rating and $45.0 target in Friday, October 6 report.

Analysts await Veracyte, Inc. (NASDAQ:VCYT) to report earnings on February, 26. They expect $-0.13 EPS, up 45.83% or $0.11 from last year’s $-0.24 per share. After $-0.12 actual EPS reported by Veracyte, Inc. for the previous quarter, Wall Street now forecasts 8.33% negative EPS growth.

Among 6 analysts covering Veracyte (NASDAQ:VCYT), 4 have Buy rating, 0 Sell and 2 Hold. Therefore 67% are positive. Veracyte had 13 analyst reports since August 14, 2015 according to SRatingsIntel. The stock has “Neutral” rating by Janney Capital on Thursday, November 29. The firm has “Hold” rating given on Tuesday, November 7 by Piper Jaffray. As per Tuesday, November 7, the company rating was maintained by Leerink Swann. The stock of Veracyte, Inc. (NASDAQ:VCYT) has “Buy” rating given on Friday, December 18 by Cantor Fitzgerald. The stock of Veracyte, Inc. (NASDAQ:VCYT) has “Buy” rating given on Friday, August 14 by BTIG Research. The stock has “Hold” rating by Piper Jaffray on Wednesday, April 18. As per Tuesday, November 7, the company rating was downgraded by Janney Capital. As per Tuesday, November 29, the company rating was upgraded by Janney Capital. Piper Jaffray maintained Veracyte, Inc. (NASDAQ:VCYT) rating on Friday, August 14. Piper Jaffray has “Overweight” rating and $12 target.

Since July 31, 2018, it had 0 buys, and 6 selling transactions for $1.65 million activity. Hall Christopher M also sold $240,000 worth of Veracyte, Inc. (NASDAQ:VCYT) on Thursday, August 9. Shares for $5.41M were sold by TREU JESSE I on Tuesday, July 31.

More notable recent Veracyte, Inc. (NASDAQ:VCYT) news were published by: Businesswire.com which released: “Veracyte to Present at the 37th Annual J.P. Morgan Healthcare Conference – Business Wire” on January 02, 2019, also Streetinsider.com with their article: “Veracyte (VCYT) Reports Strategic Collaboration with Johnson & Johnson (JNJ) Innovation in Battle Against Lung Cancer – StreetInsider.com” published on January 03, 2019, Seekingalpha.com published: “Evaluating Veracyte’s Medium And Long-Term Prospects – Seeking Alpha” on December 06, 2018. More interesting news about Veracyte, Inc. (NASDAQ:VCYT) were released by: and their article: “44 Stocks Moving In Thursday’s Mid-Day Session – Benzinga” published on January 03, 2019 as well as Seekingalpha.com‘s news article titled: “Veracyte announces pricing of common stock – Veracyte, Inc. (NASDAQ:VCYT) – Seeking Alpha” with publication date: July 26, 2018.

Birchview Capital Lp, which manages about $161.00 million and $154.93 million US Long portfolio, upped its stake in Clementia Pharmaceuticals Inc by 54,000 shares to 122,000 shares, valued at $1.36 million in 2018Q3, according to the filing.

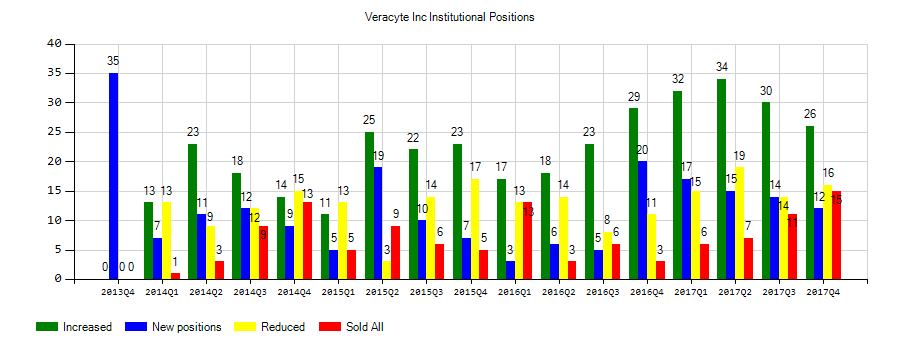

Investors sentiment increased to 4.11 in Q3 2018. Its up 2.57, from 1.54 in 2018Q2. It increased, as 3 investors sold VCYT shares while 15 reduced holdings. 38 funds opened positions while 36 raised stakes. 54.00 million shares or 158.33% more from 20.90 million shares in 2018Q2 were reported. Royal Comml Bank Of Canada holds 4,567 shares. Moreover, Next Century Growth Investors Limited Com has 0.41% invested in Veracyte, Inc. (NASDAQ:VCYT) for 366,946 shares. First Hawaiian Natl Bank has 0.02% invested in Veracyte, Inc. (NASDAQ:VCYT). Birchview Capital Ltd Partnership holds 0.3% of its portfolio in Veracyte, Inc. (NASDAQ:VCYT) for 48,767 shares. Essex Invest Mngmt Commerce Lc reported 315,286 shares. Panagora Asset Mngmt holds 184,532 shares. Morgan Stanley holds 0% or 70,289 shares. 1,000 are owned by Fin Management. Nikko Asset Mgmt Americas owns 2,602 shares. Highland Management Limited Partnership holds 40,400 shares or 0.02% of its portfolio. Eventide Asset Mngmt Lc, a Massachusetts-based fund reported 2.13M shares. Perkins Cap Management invested 1.21% in Veracyte, Inc. (NASDAQ:VCYT). Vanguard Grp Inc stated it has 1.43 million shares. Proshare Advsr Ltd reported 0% stake. Trexquant Invest LP reported 15,621 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.