Vigilant Capital Management Llc decreased its stake in Cimarex Energy Co. (XEC) by 99.62% based on its latest 2018Q3 regulatory filing with the SEC. Vigilant Capital Management Llc sold 116,343 shares as the company’s stock declined 14.40% with the market. The institutional investor held 440 shares of the oil & gas production company at the end of 2018Q3, valued at $41,000, down from 116,783 at the end of the previous reported quarter. Vigilant Capital Management Llc who had been investing in Cimarex Energy Co. for a number of months, seems to be less bullish one the $7.26 billion market cap company. The stock decreased 0.56% or $0.43 during the last trading session, reaching $75.94. About 45,069 shares traded. Cimarex Energy Co. (NYSE:XEC) has declined 34.73% since January 31, 2018 and is downtrending. It has underperformed by 34.73% the S&P500. Some Historical XEC News: 23/05/2018 – Cimarex Closes Below 50-Day Moving Average: Technicals; 24/05/2018 – CALLON PETROLEUM – CO INTENDS TO FUND CASH PURCHASE PRICE WITH PROCEEDS OF EQUITY OFFERING, CASH ON HAND AND/OR INCURRENCE OF LONG-TERM INDEBTEDNESS; 08/05/2018 – CIMAREX ENERGY CO XEC.N – QTRLY DAILY PRODUCTION AVERAGED 206.1 MBOE VS 177.2 MBOE; 08/05/2018 – Cimarex 1Q Adj EPS $1.82; 08/05/2018 – Cimarex 1Q EPS $1.96; 16/04/2018 Cimarex Closes Above 50-Day Moving Average: Technicals; 11/05/2018 – Cimarex Energy Declares Quarterly Cash Dividend; 30/04/2018 – Williston Basin Adds WPX Energy, Exits Cimarex; 24/05/2018 – CALLON UNIT TO BUY ACREAGE FOR $570M FROM CIMAREX ENERGY; 08/05/2018 – Cimarex Conference Set By Tudor Pickering & Co for May. 15-16

Benin Management Corp increased its stake in Exxon Mobil Corp (XOM) by 14.37% based on its latest 2018Q3 regulatory filing with the SEC. Benin Management Corp bought 8,699 shares as the company’s stock declined 6.33% with the market. The institutional investor held 69,221 shares of the integrated oil company at the end of 2018Q3, valued at $5.89M, up from 60,522 at the end of the previous reported quarter. Benin Management Corp who had been investing in Exxon Mobil Corp for a number of months, seems to be bullish on the $305.85B market cap company. The stock decreased 0.07% or $0.05 during the last trading session, reaching $72.24. About 761,448 shares traded. Exxon Mobil Corporation (NYSE:XOM) has declined 7.28% since January 31, 2018 and is downtrending. It has underperformed by 7.28% the S&P500. Some Historical XOM News: 30/05/2018 – Exxon Mobil investors voted down four shareholder proposals, including one that would require the oil giant to report on its political lobbying; 06/03/2018 – EXXONMOBIL – PROGRAM ADVANCES TO OUTDOOR TESTING IN CALIFORNIA OF NATURALLY OCCURRING ALGAE STRAINS; 27/04/2018 – EXXON MOBIL CORP XOM.N SAYS ‘VERY WELL POSITIONED’ TO MEET INTERNATIONAL MARITIME ORGANIZATION HIGH-SULPUR FUEL RULE CHANGE; 07/03/2018 – EXXONMOBIL – EXPECT 2025 EARNINGS FROM CHEMICAL BUSINESS TO ABOUT DOUBLE FROM 2017 LEVEL; 26/04/2018 – HESS CORP – TO ACQUIRE A 15 PERCENT PARTICIPATING INTEREST IN KAIETEUR BLOCK, OFFSHORE GUYANA; 30/05/2018 – Exxon CEO Sees Oil’s Economic Gain Balanced Against Environment; 17/04/2018 – ETHOSENERGY SAYS HAS BEEN AWARDED A MULTI-MLN DOLLAR CONTRACT BY EXXONMOBIL FOR WORK AT BAYTOWN REFINERY IN TEXAS; 23/05/2018 – EXXONMOBIL – EXPECTS TO ACHIEVE A 15 PERCENT REDUCTION OF METHANE EMISSIONS BY 2020 COMPARED WITH 2016; 07/03/2018 – Exxon Mobil To Grow Chemicals Manufacturing Capacity in North America, Asia Pacific by About 40%; 07/03/2018 – EXXON PLANS TO DRILL 15-20 THREE-MILE LATERALS IN BAKKEN IN ’18

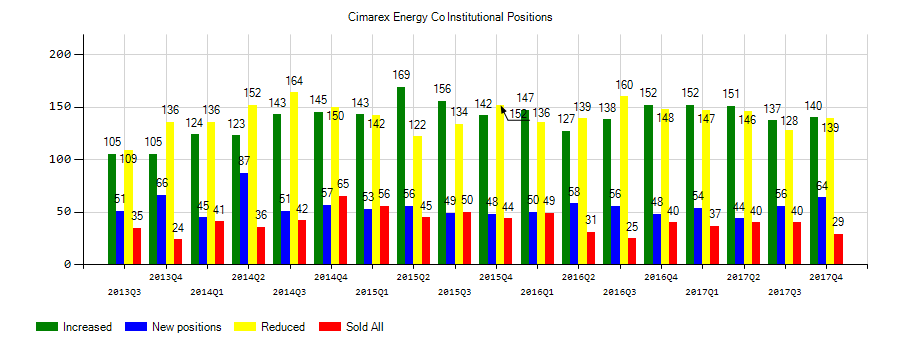

Investors sentiment decreased to 0.93 in Q3 2018. Its down 0.23, from 1.16 in 2018Q2. It is negative, as 44 investors sold XEC shares while 138 reduced holdings. 53 funds opened positions while 117 raised stakes. 91.38 million shares or 1.96% less from 93.21 million shares in 2018Q2 were reported. Korea Inv Corporation has invested 0.03% of its portfolio in Cimarex Energy Co. (NYSE:XEC). Guardian Life Ins Of America owns 270 shares or 0% of their US portfolio. Jnba Advsr invested 0.06% of its portfolio in Cimarex Energy Co. (NYSE:XEC). Telemus Cap Limited Liability Co holds 9,629 shares or 0.07% of its portfolio. Mitsubishi Ufj Secs Limited has 60 shares for 0.02% of their portfolio. Loring Wolcott And Coolidge Fiduciary Advsr Llp Ma holds 0% or 1,500 shares. First Quadrant LP Ca stated it has 5,068 shares or 0.01% of all its holdings. Of Toledo Na Oh stated it has 0.07% of its portfolio in Cimarex Energy Co. (NYSE:XEC). 2,260 were accumulated by Bragg Fincl Advsr. Numerixs Technology Inc has 700 shares for 0.01% of their portfolio. Schwab Charles Inv Mgmt Inc reported 617,562 shares or 0.04% of all its holdings. Parkside State Bank Tru invested 0.1% in Cimarex Energy Co. (NYSE:XEC). The Connecticut-based Point72 Asset Ltd Partnership has invested 0.13% in Cimarex Energy Co. (NYSE:XEC). Germany-based Dekabank Deutsche Girozentrale has invested 0.01% in Cimarex Energy Co. (NYSE:XEC). Suntrust Banks owns 2,989 shares.

Analysts await Cimarex Energy Co. (NYSE:XEC) to report earnings on February, 13. They expect $1.90 earnings per share, up 29.25% or $0.43 from last year’s $1.47 per share. XEC’s profit will be $181.67 million for 9.99 P/E if the $1.90 EPS becomes a reality. After $1.99 actual earnings per share reported by Cimarex Energy Co. for the previous quarter, Wall Street now forecasts -4.52% negative EPS growth.

Since August 30, 2018, it had 1 buy, and 1 insider sale for $77,871 activity. STEWART LISA A also bought $26,897 worth of Cimarex Energy Co. (NYSE:XEC) on Thursday, August 30.

Vigilant Capital Management Llc, which manages about $610.61M and $749.79M US Long portfolio, upped its stake in Diamondback Energy Inc. (NASDAQ:FANG) by 2,387 shares to 100,382 shares, valued at $13.57 million in 2018Q3, according to the filing. It also increased its holding in Allegion Plc (NYSE:ALLE) by 3,595 shares in the quarter, for a total of 161,655 shares, and has risen its stake in Alexion Pharmaceutical Inc. (NASDAQ:ALXN).

Among 35 analysts covering Cimarex Energy (NYSE:XEC), 21 have Buy rating, 0 Sell and 14 Hold. Therefore 60% are positive. Cimarex Energy had 164 analyst reports since July 21, 2015 according to SRatingsIntel. The stock of Cimarex Energy Co. (NYSE:XEC) earned “Hold” rating by Jefferies on Friday, February 16. As per Tuesday, December 22, the company rating was initiated by CapitalOne. The firm earned “Hold” rating on Tuesday, January 17 by Suntrust Robinson. The rating was upgraded by Jefferies on Tuesday, January 17 to “Hold”. Deutsche Bank maintained the stock with “Hold” rating in Wednesday, August 10 report. The stock of Cimarex Energy Co. (NYSE:XEC) earned “Hold” rating by Piper Jaffray on Thursday, October 5. The stock of Cimarex Energy Co. (NYSE:XEC) earned “Hold” rating by Piper Jaffray on Wednesday, April 18. The firm earned “Buy” rating on Thursday, July 13 by Citigroup. Citigroup maintained the stock with “Neutral” rating in Monday, September 14 report. The stock of Cimarex Energy Co. (NYSE:XEC) earned “Accumulate” rating by KLR Group on Monday, November 7.

More notable recent Cimarex Energy Co. (NYSE:XEC) news were published by: Seekingalpha.com which released: “Cimarex Energy Co. 2018 Q3 – Results – Earnings Call Slides – Seeking Alpha” on November 07, 2018, also 247Wallst.com with their article: “Top Analyst Upgrades and Downgrades: Apache, Caesars, Dell, Devon Energy, HPE, NetApp, Nordstrom, MetLife, Snap and More – 24/7 Wall St.” published on January 16, 2019, 247Wallst.com published: “Top Analyst Upgrades and Downgrades: Allergan, Apple, Carnival, Ciena, Juniper, Lockheed Martin, Plug Power, Take-Two, United Continental, Zynga and More – 24/7 Wall St.” on January 30, 2019. More interesting news about Cimarex Energy Co. (NYSE:XEC) were released by: Seekingalpha.com and their article: “Resolute Energy’s largest shareholder dissatisfied with sale price to Cimarex – Seeking Alpha” published on November 19, 2018 as well as Seekingalpha.com‘s news article titled: “Cimarex Energy +9% after strong Q3 results – Seeking Alpha” with publication date: November 07, 2018.

More notable recent Exxon Mobil Corporation (NYSE:XOM) news were published by: Seekingalpha.com which released: “How Safe Is Exxon Mobil’s Dividend? – Seeking Alpha” on December 20, 2018, also Streetinsider.com with their article: “ExxonMobil (XOM) Says It Will Proceed with New Crude Unit as Part of Beaumont Refinery Expansion – StreetInsider.com” published on January 29, 2019, Seekingalpha.com published: “How To Boost Your Exxon Mobil Dividend Yield – Seeking Alpha” on January 10, 2019. More interesting news about Exxon Mobil Corporation (NYSE:XOM) were released by: 247Wallst.com and their article: “Exxon Deepens Commitment to Get Permian Oil to the Gulf Coast – 24/7 Wall St.” published on January 30, 2019 as well as 247Wallst.com‘s news article titled: “Apple, Boeing, Microsoft and More Dow Earnings Coming This Week – 24/7 Wall St.” with publication date: January 27, 2019.

Since September 19, 2018, it had 0 insider purchases, and 8 sales for $6.53 million activity. The insider Verity John R sold 15,850 shares worth $1.22 million. 9,522 Exxon Mobil Corporation (NYSE:XOM) shares with value of $746,620 were sold by Spellings James M Jr. 9,658 shares valued at $757,284 were sold by Wojnar Theodore J Jr on Wednesday, November 28. Another trade for 2,798 shares valued at $214,914 was sold by Hansen Neil A. On Wednesday, September 19 Corson Bradley W sold $1.26 million worth of Exxon Mobil Corporation (NYSE:XOM) or 15,000 shares. Another trade for 7,562 shares valued at $614,337 was made by Rosenthal David S on Tuesday, December 4.

Among 29 analysts covering Exxon Mobil (NYSE:XOM), 12 have Buy rating, 6 Sell and 11 Hold. Therefore 41% are positive. Exxon Mobil had 103 analyst reports since July 22, 2015 according to SRatingsIntel. The firm has “Buy” rating given on Wednesday, May 18 by Argus Research. As per Thursday, October 5, the company rating was maintained by Piper Jaffray. The firm has “Hold” rating given on Wednesday, December 20 by Jefferies. The stock of Exxon Mobil Corporation (NYSE:XOM) has “Long-Term Buy” rating given on Wednesday, June 7 by Hilliard Lyons. Deutsche Bank maintained it with “Hold” rating and $82 target in Tuesday, March 29 report. The rating was reinitiated by RBC Capital Markets with “Buy” on Thursday, July 6. UBS maintained Exxon Mobil Corporation (NYSE:XOM) rating on Monday, May 2. UBS has “Neutral” rating and $85 target. The firm has “Sell” rating given on Thursday, January 19 by UBS. The firm has “Buy” rating given on Thursday, May 11 by Bank of America. As per Friday, March 18, the company rating was initiated by Nomura.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.