Farmstead Capital Management Llc increased its stake in Intelsat S A (I) by 86.89% based on its latest 2018Q3 regulatory filing with the SEC. Farmstead Capital Management Llc bought 590,000 shares as the company’s stock declined 5.75% with the market. The institutional investor held 1.27M shares of the telecommunications equipment company at the end of 2018Q3, valued at $38.07 million, up from 679,000 at the end of the previous reported quarter. Farmstead Capital Management Llc who had been investing in Intelsat S A for a number of months, seems to be bullish on the $2.92B market cap company. The stock decreased 5.54% or $1.24 during the last trading session, reaching $21.14. About 3.01 million shares traded or 25.76% up from the average. Intelsat S.A. (NYSE:I) has risen 592.21% since January 20, 2018 and is uptrending. It has outperformed by 592.21% the S&P500. Some Historical I News: 03/05/2018 – MCINTYRE SAYS INTELSAT NEEDS IMMEDIATE CAPITAL RAISE; 01/05/2018 – Intelsat 1Q Contracted Backlog $8.6B; 16/04/2018 – Intelsat General Part of Team Selected to Build New Satellite Navigation Payload for the Federal Aviation Administration; 03/05/2018 – MCINTYRE SEES 50% DOWNSIDE FOR INTELSAT; 01/05/2018 – Intelsat Backs 2018 Rev $2.06B-$2.11B; 01/05/2018 – INTELSAT 1Q REV. $543.8M, EST. $521.8M; 15/03/2018 – Intelsat Announces Early Tender Results for Certain Notes of Intelsat (Luxembourg) S.A; 30/05/2018 – Intelsat Appoints Juan Pablo Cofino Regional Vice Pres, Latin Amer and the Caribbean; 15/03/2018 – INTELSAT: EARLY TENDER RESULTS BY UNIT INTELSAT CONNECT FINANCE; 06/04/2018 – INTELSAT SA – SATELLITE TELECOMMUNICATIONS NETWORK SIGNED A MULTI-YEAR EXTENSION WITH CO FOR SATELLITE SERVICES

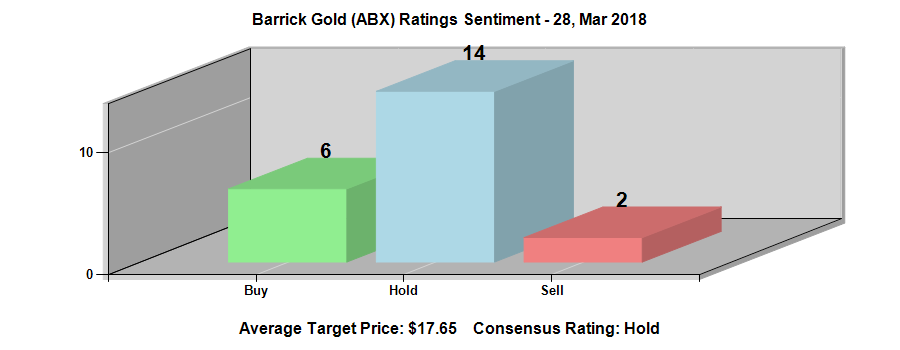

First Eagle Investment Management Llc increased its stake in Barrick Gold Corp (ABX) by 10.77% based on its latest 2018Q3 regulatory filing with the SEC. First Eagle Investment Management Llc bought 3.95 million shares as the company’s stock rose 41.80% while stock markets declined. The hedge fund held 40.59 million shares of the precious metals company at the end of 2018Q3, valued at $449.74 million, up from 36.64 million at the end of the previous reported quarter. First Eagle Investment Management Llc who had been investing in Barrick Gold Corp for a number of months, seems to be bullish on the $15.73 billion market cap company. The stock increased 3.20% or $0.42 during the last trading session, reaching $13.54. About 22.68M shares traded or 29.45% up from the average. Barrick Gold Corporation (NYSE:ABX) has risen 1.32% since January 20, 2018 and is uptrending. It has outperformed by 1.32% the S&P500. Some Historical ABX News: 23/03/2018 – Barrick Gold cuts 2017 compensation for top two executives; 13/05/2018 – GLENCORE, BARRICK HELD PRODUCTIVE TALKS ON KABANGA PROJECT; 09/05/2018 – Barrick buys 20% stake in group developing Idaho gold mine; 14/05/2018 – BARRICK GOLD CORP – PUEBLO VIEJO DOMINICANA CORPORATION SIGNED A 10-YEAR NATURAL GAS SUPPLY CONTRACT WITH AES ANDRES DR, S.A; 16/05/2018 – Hedge Funds Buy U.S. Steel, Sell Barrick Gold in Materials: 13F; 09/05/2018 – BARRICK REPORTS INVESTMENT IN MIDAS GOLD; 09/04/2018 – ROYAL GOLD – EVALUATING CARRYING VALUE OF 0.78% TO 5.45% SLIDING-SCALE NSR GOLD ROYALTY & 1.09% NSR COPPER ROYALTY ON BARRICK’S PASCUA-LAMA PROJECT; 16/05/2018 – BARRICK COMPLETES $38M INVESTMENT IN MIDAS GOLD; 23/04/2018 – BARRICK GOLD CORP – SEES 2018 TOTAL ATTRIBUTABLE CAPITAL EXPENDITURES $1,400 MLN- $1,600 MLN; 23/04/2018 – BARRICK GOLD – INCREASING FOCUS ON ORGANIC GROWTH IN NEVADA AND THE DOMINICAN REPUBLIC IN 2018

More notable recent Intelsat S.A. (NYSE:I) news were published by: Seekingalpha.com which released: “The Durability Of Innovation At 3M – Seeking Alpha” on January 17, 2019, also Seekingalpha.com with their article: “What A SWAN Looks Like: Prologis – Seeking Alpha” published on January 19, 2019, Seekingalpha.com published: “Snap CFO Resigns: Why I’m Not Interested – Seeking Alpha” on January 17, 2019. More interesting news about Intelsat S.A. (NYSE:I) were released by: Seekingalpha.com and their article: “Why I Sold GameStop – Seeking Alpha” published on January 14, 2019 as well as Marketwatch.com‘s news article titled: “Here’s what low NYSE trading volume is telling us about the stock market’s direction – MarketWatch” with publication date: January 18, 2019.

Among 10 analysts covering Intelsat S.A. (NYSE:I), 2 have Buy rating, 2 Sell and 6 Hold. Therefore 20% are positive. Intelsat S.A. had 21 analyst reports since August 4, 2015 according to SRatingsIntel. On Wednesday, November 1 the stock rating was downgraded by UBS to “Sell”. The firm has “Market Perform” rating given on Friday, February 26 by Wells Fargo. JP Morgan upgraded the stock to “Neutral” rating in Thursday, March 1 report. The company was upgraded on Wednesday, January 25 by RBC Capital Markets. The firm earned “Buy” rating on Friday, September 8 by Jefferies. RBC Capital Markets maintained Intelsat S.A. (NYSE:I) rating on Thursday, October 5. RBC Capital Markets has “Outperform” rating and $6 target. The firm has “Buy” rating by RBC Capital Markets given on Thursday, July 27. The stock has “Equal-Weight” rating by Morgan Stanley on Monday, November 12. Raymond James downgraded the shares of I in report on Monday, July 18 to “Underperform” rating. Goldman Sachs maintained Intelsat S.A. (NYSE:I) rating on Thursday, August 10. Goldman Sachs has “Neutral” rating and $3.5 target.

First Eagle Investment Management Llc, which manages about $39.80B US Long portfolio, decreased its stake in Microsoft Corp (NASDAQ:MSFT) by 3.22 million shares to 8.31M shares, valued at $950.21 million in 2018Q3, according to the filing. It also reduced its holding in Compania Cervecerias Unidas (NYSE:CCU) by 312,923 shares in the quarter, leaving it with 6.98 million shares, and cut its stake in American Express Co (NYSE:AXP).

More notable recent Barrick Gold Corporation (NYSE:ABX) news were published by: Investingnews.com which released: “Here’s What the Newmont-Goldcorp Deal Could Mean for the Gold Space – Investing News Network” on January 16, 2019, also Fool.ca with their article: “Top Stocks for January – The Motley Fool Canada” published on January 01, 2019, Nasdaq.com published: “Detailed Research: Economic Perspectives on General Electric, Intercontinental Exchange, Kennedy-Wilson, Barrick Gold, Newfield Exploration, and FTI Consulting — What Drives Growth in Today’s Competitive Landscape – Nasdaq” on December 28, 2018. More interesting news about Barrick Gold Corporation (NYSE:ABX) were released by: Globenewswire.com and their article: “Barrick-Randgold Merger Consummated as Trading Starts in New Company’s Shares – GlobeNewswire” published on January 02, 2019 as well as Investingnews.com‘s news article titled: “Canadian Miner Kidnapped, Killed in Burkina Faso – Investing News Network” with publication date: January 18, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.