California Public Employees Retirement System decreased its stake in Spirit Aerosystems Hold (SPR) by 5.32% based on its latest 2018Q3 regulatory filing with the SEC. California Public Employees Retirement System sold 18,029 shares as the company’s stock declined 12.63% with the market. The institutional investor held 320,695 shares of the capital goods company at the end of 2018Q3, valued at $29.40 million, down from 338,724 at the end of the previous reported quarter. California Public Employees Retirement System who had been investing in Spirit Aerosystems Hold for a number of months, seems to be less bullish one the $8.42B market cap company. The stock increased 1.85% or $1.44 during the last trading session, reaching $79.47. About 686,482 shares traded. Spirit AeroSystems Holdings, Inc. (NYSE:SPR) has declined 11.31% since January 19, 2018 and is downtrending. It has underperformed by 11.31% the S&P500. Some Historical SPR News: 02/05/2018 – SPR WAS AS MANY AS 15 SHIPMENTS FOR 737 BEHIND SCHEDULE: CEO; 02/05/2018 – Spirit Aerosystems Close to $650 Mln Deal for Asco Industries; 02/05/2018 – SPR `VERY CAPABLE’ OF SUPPORTING BOEING, AIRBUS RATE INCREASES; 02/05/2018 – SPIRIT AEROSYSTEMS CFO SANJAY KAPOOR COMMENTS ON WEBCAST; 27/04/2018 – Spirit AeroSystems Stockholders Vote in Favor of Shareholder Proposal to Lower Special Meeting Threshold to 10%; 02/05/2018 – SPIRIT AEROSYSTEMS BOOSTS DIV BY 20%; 05/04/2018 – Spirit Aerosystems, Wichita State to Work on Areas Such As Advanced Composites, Rapid Prototyping and Product Development; 14/03/2018 SPIRIT AEROSYSTEMS BEINGS PRESENTATION AT J.P. MORGAN EVENT; 02/05/2018 – Wells Fargo Bank NA Exits Position in Spirit Aero; 02/05/2018 – Spirit Aerosystems 1Q EPS $1.10

Dsm Capital Partners Llc decreased its stake in Royal Caribbean Cruises (RCL) by 0.79% based on its latest 2018Q3 regulatory filing with the SEC. Dsm Capital Partners Llc sold 18,559 shares as the company’s stock declined 15.38% with the market. The hedge fund held 2.32 million shares of the marine transportation company at the end of 2018Q3, valued at $301.03 million, down from 2.34M at the end of the previous reported quarter. Dsm Capital Partners Llc who had been investing in Royal Caribbean Cruises for a number of months, seems to be less bullish one the $22.85B market cap company. The stock increased 2.16% or $2.31 during the last trading session, reaching $109.35. About 1.88 million shares traded or 0.62% up from the average. Royal Caribbean Cruises Ltd. (NYSE:RCL) has declined 15.47% since January 19, 2018 and is downtrending. It has underperformed by 15.47% the S&P500. Some Historical RCL News: 26/04/2018 – ROYAL CARIBBEAN 1Q REV. $2.03B; 26/04/2018 – ROYAL CARIBBEAN SEES FY ADJ EPS $8.70 TO $8.90, EST. $8.76; 26/04/2018 – ROYAL CARIBBEAN CRUISES – NCC EXCLUDING FUEL ARE EXPECTED TO BE UP ABOUT 2.5% IN CONSTANT-CURRENCY AND UP 3.0% TO 3.5% AS-REPORTED FOR FY; 10/05/2018 – Royal Caribbean Honors Actors Carlos and Alexa PenaVega, With Baby Son Ocean, As First-Ever Godfamily For Global Cruise Line; 26/04/2018 – ROYAL CARIBBEAN CRUISES LTD QTRLY NET CRUISE COSTS EXCLUDING FUEL PER APCD WERE UP 11.2% IN CONSTANT-CURRENCY (UP 12.5% AS-REPORTED); 15/03/2018 – Royal Caribbean Eyes Next Generation of Cruisers with Multibillion-Dollar Investment In Ships, Experiences and Destinations; 26/04/2018 – ROYAL CARIBBEAN CRUISES LTD – FULL YEAR ADJUSTED EARNINGS GUIDANCE IS INCREASED BY $0.15 TO A RANGE OF $8.70 TO $8.90 PER SHARE; 26/04/2018 – ROYAL CARIBBEAN CRUISES LTD – QTRLY TOTAL REVENUE $2.03 BLN VS $2.01 BLN REPORTED LAST YEAR; 15/05/2018 – Azamara Club Cruises® Unveils 2020 Itineraries; 12/04/2018 – Talend Connect 2018: New Speakers Include AstraZeneca, Royal Caribbean & TD Bank

Among 23 analysts covering Spirit Aerosystems (NYSE:SPR), 16 have Buy rating, 1 Sell and 6 Hold. Therefore 70% are positive. Spirit Aerosystems had 84 analyst reports since July 30, 2015 according to SRatingsIntel. Barclays Capital maintained the shares of SPR in report on Thursday, June 9 with “Overweight” rating. The stock of Spirit AeroSystems Holdings, Inc. (NYSE:SPR) earned “Underperform” rating by RBC Capital Markets on Thursday, January 12. Cowen & Co maintained it with “Buy” rating and $6900 target in Wednesday, August 2 report. Bernstein maintained the stock with “Buy” rating in Thursday, November 2 report. The firm earned “Neutral” rating on Friday, December 9 by JP Morgan. The firm earned “Sell” rating on Friday, January 29 by Goldman Sachs. The stock of Spirit AeroSystems Holdings, Inc. (NYSE:SPR) has “Sector Perform” rating given on Thursday, February 4 by RBC Capital Markets. The stock of Spirit AeroSystems Holdings, Inc. (NYSE:SPR) has “Buy” rating given on Tuesday, September 5 by Jefferies. The rating was upgraded by Buckingham Research on Thursday, June 9 to “Neutral”. Robert W. Baird initiated Spirit AeroSystems Holdings, Inc. (NYSE:SPR) rating on Thursday, October 6. Robert W. Baird has “Outperform” rating and $54 target.

More notable recent Spirit AeroSystems Holdings, Inc. (NYSE:SPR) news were published by: Bizjournals.com which released: “Airbus sells 120 of its new A220 jets in year-end push – Wichita Business Journal” on January 03, 2019, also Bizjournals.com with their article: “Spirit AeroSystems stock jumps on reported plans for increased 737 output – Wichita Business Journal” published on September 19, 2018, Bizjournals.com published: “Boeing halts South Carolina plant as Hurricane Florence bears down – Wichita Business Journal” on September 13, 2018. More interesting news about Spirit AeroSystems Holdings, Inc. (NYSE:SPR) were released by: Bizjournals.com and their article: “Spirit AeroSystems unveils ‘breakthrough’ fabrication process – Wichita Business Journal” published on July 18, 2018 as well as Bizjournals.com‘s news article titled: “Report: Boeing to deliver first KC-46 tanker by the end of the year – Wichita Business Journal” with publication date: December 21, 2018.

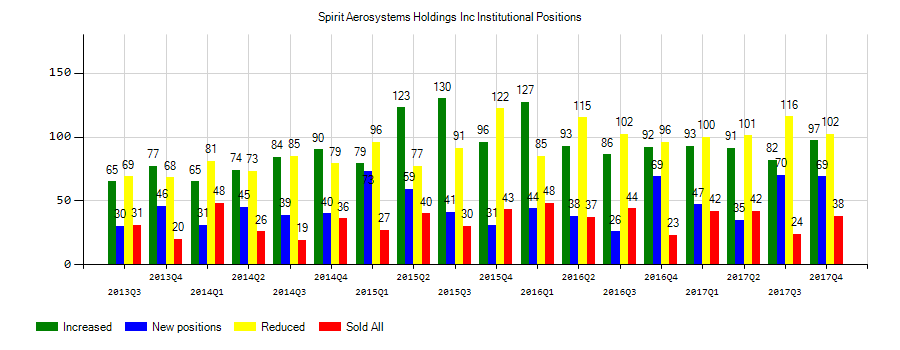

Investors sentiment increased to 0.93 in Q3 2018. Its up 0.13, from 0.8 in 2018Q2. It increased, as 38 investors sold SPR shares while 117 reduced holdings. 59 funds opened positions while 85 raised stakes. 98.80 million shares or 4.52% less from 103.47 million shares in 2018Q2 were reported. Factory Mutual has 0.28% invested in Spirit AeroSystems Holdings, Inc. (NYSE:SPR). 24,088 were reported by Bokf Na. 241,604 are held by New York State Common Retirement Fund. Massmutual Fsb Adv has 5 shares for 0% of their portfolio. Voya Investment Mgmt Limited Liability Com reported 0.15% of its portfolio in Spirit AeroSystems Holdings, Inc. (NYSE:SPR). Nuveen Asset Mngmt Ltd Liability invested 0% in Spirit AeroSystems Holdings, Inc. (NYSE:SPR). Moreover, First Amer National Bank & Trust has 0.12% invested in Spirit AeroSystems Holdings, Inc. (NYSE:SPR) for 19,788 shares. Asset Mgmt One Ltd reported 0.03% in Spirit AeroSystems Holdings, Inc. (NYSE:SPR). 5,308 were reported by Nomura. Dupont Capital Mngmt Corporation reported 0.2% in Spirit AeroSystems Holdings, Inc. (NYSE:SPR). Bluecrest Management Limited stated it has 15,844 shares or 0.04% of all its holdings. Sumitomo Mitsui Asset holds 0.01% of its portfolio in Spirit AeroSystems Holdings, Inc. (NYSE:SPR) for 7,062 shares. Atwood Palmer Inc accumulated 0% or 350 shares. C M Bidwell And Associates Limited owns 47 shares or 0% of their US portfolio. Dimensional Fund Advisors LP stated it has 808,358 shares or 0.03% of all its holdings.

California Public Employees Retirement System, which manages about $77.58B US Long portfolio, upped its stake in Jm Smucker Co/The (NYSE:SJM) by 63,760 shares to 392,873 shares, valued at $40.31M in 2018Q3, according to the filing. It also increased its holding in Copart Inc (NASDAQ:CPRT) by 8,338 shares in the quarter, for a total of 501,337 shares, and has risen its stake in Syneos Health Inc.

Analysts await Spirit AeroSystems Holdings, Inc. (NYSE:SPR) to report earnings on February, 1. They expect $1.77 earnings per share, up 34.09% or $0.45 from last year’s $1.32 per share. SPR’s profit will be $187.62M for 11.22 P/E if the $1.77 EPS becomes a reality. After $1.70 actual earnings per share reported by Spirit AeroSystems Holdings, Inc. for the previous quarter, Wall Street now forecasts 4.12% EPS growth.

Since September 13, 2018, it had 1 insider buy, and 2 insider sales for $998,977 activity. Fain Richard D bought $2.00M worth of stock. The insider REITAN BERNT sold $168,179.

Analysts await Royal Caribbean Cruises Ltd. (NYSE:RCL) to report earnings on January, 23. They expect $1.51 earnings per share, up 12.69% or $0.17 from last year’s $1.34 per share. RCL’s profit will be $315.59 million for 18.10 P/E if the $1.51 EPS becomes a reality. After $3.98 actual earnings per share reported by Royal Caribbean Cruises Ltd. for the previous quarter, Wall Street now forecasts -62.06% negative EPS growth.

Investors sentiment is 0.99 in 2018 Q3. Its the same as in 2018Q2. It is flat, as 45 investors sold RCL shares while 196 reduced holdings. only 90 funds opened positions while 149 raised stakes. 143.34 million shares or 0.68% more from 142.37 million shares in 2018Q2 were reported. Kbc Grp Nv reported 125,989 shares. Liberty Mutual Asset Mgmt Inc, Massachusetts-based fund reported 6,771 shares. Barnett & Co has invested 1.87% in Royal Caribbean Cruises Ltd. (NYSE:RCL). The North Carolina-based First Citizens Bancorporation And Tru has invested 0.1% in Royal Caribbean Cruises Ltd. (NYSE:RCL). Fincl Bank Hapoalim Bm, a Israel-based fund reported 4,329 shares. Blair William And Il owns 82,811 shares or 0.07% of their US portfolio. State Of Wisconsin Inv Board reported 0.08% of its portfolio in Royal Caribbean Cruises Ltd. (NYSE:RCL). Archon Cap Management Llc owns 56,845 shares. 12,700 are held by Envestnet Asset Management Inc. Int Ca invested in 3,052 shares. Schroder Investment Mngmt Gp holds 4,175 shares. Bamco Incorporated New York reported 0.09% of its portfolio in Royal Caribbean Cruises Ltd. (NYSE:RCL). Regent Mngmt Limited Company has invested 0.7% in Royal Caribbean Cruises Ltd. (NYSE:RCL). Wolverine Asset Mngmt Ltd Liability Company holds 20,091 shares. Palladium Prns Ltd Com has 0.53% invested in Royal Caribbean Cruises Ltd. (NYSE:RCL).

Dsm Capital Partners Llc, which manages about $5.78B and $6.71B US Long portfolio, upped its stake in Hdfc Bank (NYSE:HDB) by 5,920 shares to 785,554 shares, valued at $73.92 million in 2018Q3, according to the filing. It also increased its holding in Msci (NYSE:MSCI) by 221,492 shares in the quarter, for a total of 1.00M shares, and has risen its stake in Autohome (NYSE:ATHM).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.