Pinebridge Investments Lp increased its stake in Natus Medical Inc Del Com (BABY) by 342.3% based on its latest 2018Q3 regulatory filing with the SEC. Pinebridge Investments Lp bought 26,556 shares as the company’s stock declined 7.42% with the market. The hedge fund held 34,314 shares of the electromedical & electrotherapeutic apparatus company at the end of 2018Q3, valued at $1.22M, up from 7,758 at the end of the previous reported quarter. Pinebridge Investments Lp who had been investing in Natus Medical Inc Del Com for a number of months, seems to be bullish on the $1.15 billion market cap company. The stock increased 1.18% or $0.4 during the last trading session, reaching $34.38. About 279,666 shares traded. Natus Medical Incorporated (NASDAQ:BABY) has declined 12.80% since January 11, 2018 and is downtrending. It has underperformed by 12.80% the S&P500. Some Historical BABY News: 23/04/2018 – Natus Confirms Receipt of Notice of Voce Capital’s Intent to Nominate Director Candidates to Replace 50% of the Natus Bd; 19/03/2018 – natus medical incorporated dba excel-tec | natus neuroworks | K180421 | 03/14/2018 |; 23/04/2018 – Activist Voce Capital Seeks to Oust Natus Medical’s Chairman; 21/05/2018 – NOX MEDICAL SAYS JURY AWARDED CO DAMAGES FOR NATUS’ INFRINGEMENT, AND FINDING THAT NATUS’ INFRINGEMENT OF ‘532 PATENT WAS WILLFUL; 21/05/2018 – NOX MEDICAL SAYS CLAIMS FOR INFRINGEMENT BY NATUS NEUROLOGY; 23/04/2018 – NATUS MEDICAL INC – DATE OF COMPANY’S ANNUAL MEETING HAS NOT YET BEEN ANNOUNCED; 30/05/2018 – NATUS MEDICAL ISSUES INVESTOR PRESENTATION; 22/03/2018 – Natus Medical Incorporated vs Nox Medical EHF | FWD Entered | 03/21/2018; 20/03/2018 – Activist Voce Takes More Than 2% Stake in Natus Medical; 25/04/2018 – NATUS MEDICAL SEES 2Q ADJ EPS 25C TO 27C, EST. 36C

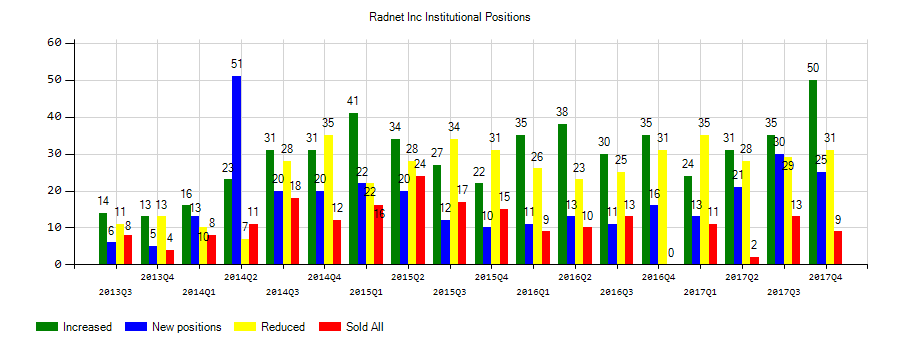

Cheyne Capital Management Uk Llp increased its stake in Radnet Inc (RDNT) by 119.69% based on its latest 2018Q3 regulatory filing with the SEC. Cheyne Capital Management Uk Llp bought 420,599 shares as the company’s stock declined 8.47% with the market. The hedge fund held 771,992 shares of the health care company at the end of 2018Q3, valued at $11.62 million, up from 351,393 at the end of the previous reported quarter. Cheyne Capital Management Uk Llp who had been investing in Radnet Inc for a number of months, seems to be bullish on the $550.73 million market cap company. The stock increased 1.62% or $0.18 during the last trading session, reaching $11.27. About 157,811 shares traded. RadNet, Inc. (NASDAQ:RDNT) has risen 28.62% since January 11, 2018 and is uptrending. It has outperformed by 28.62% the S&P500. Some Historical RDNT News: 22/03/2018 – Comvest Credit Partners Announces Investment in American Physician Partners, Inc; 09/05/2018 – RADNET INC SEES FY 2018 ADJUSTED EBITDA $140 MLN – $150 MLN; 08/03/2018 RadNet 4Q Loss/Shr 15c; 05/04/2018 – RadNet Becomes the Largest Outpatient Imaging Operator in the Greater Fresno, California Area with the Acquisition of Five Imag; 08/03/2018 – RadNet 4Q Adj EPS 13c; 09/05/2018 – RadNet Sees 2018 Adjusted EBITDA $140M-$150M; 08/03/2018 – RadNet Sees FY Rev $950M-$975M; 15/05/2018 – RadNet Presenting at Conference May 17; 20/04/2018 – S&P ASSIGNS RADNET INC. TO RATING ‘B’; 09/05/2018 – RADNET INC SEES FY 2018 TOTAL NET REVENUE $945 MLN – $970 MLN

Among 4 analysts covering RadNet (NASDAQ:RDNT), 3 have Buy rating, 0 Sell and 1 Hold. Therefore 75% are positive. RadNet had 8 analyst reports since March 15, 2016 according to SRatingsIntel. The stock of RadNet, Inc. (NASDAQ:RDNT) earned “Buy” rating by Jefferies on Thursday, November 9. Sterne Agee CRT initiated RadNet, Inc. (NASDAQ:RDNT) on Thursday, June 2 with “Neutral” rating. The firm has “Buy” rating given on Thursday, March 8 by Jefferies. Jefferies maintained the stock with “Hold” rating in Tuesday, March 15 report. The firm has “Hold” rating by Jefferies given on Thursday, July 13. Sidoti initiated the stock with “Buy” rating in Friday, April 15 report. Jefferies upgraded RadNet, Inc. (NASDAQ:RDNT) on Tuesday, August 22 to “Buy” rating.

More notable recent RadNet, Inc. (NASDAQ:RDNT) news were published by: Businesswire.com which released: “Turner Imaging Systems Announces Closing of Seed Investment Round – Business Wire” on February 27, 2018, also Globenewswire.com with their article: “RadNet Reports Third Quarter Financial Results and Reaffirms Previously Announced 2018 Guidance Levels – GlobeNewswire” published on November 09, 2018, Globenewswire.com published: “The Cancer Research Collaboration and Breastlink New York Partner With Diabetes Prevention Program Provider Blue Mesa Health – GlobeNewswire” on March 15, 2018. More interesting news about RadNet, Inc. (NASDAQ:RDNT) were released by: Globenewswire.com and their article: “RadNet, Inc. Announces Date of its Third Quarter 2017 Financial Results Conference Call – GlobeNewswire” published on October 27, 2017 as well as Globenewswire.com‘s news article titled: “RadNet and EmblemHealth Enter into New Partnership to Provide Diagnostic Imaging Services in the New York Metropolitan Area – GlobeNewswire” with publication date: August 02, 2018.

Pinebridge Investments Lp, which manages about $38.23B and $5.29 billion US Long portfolio, decreased its stake in Companhia Energetica De Mina Sp Adr N (NYSE:CIG) by 2.09M shares to 869,959 shares, valued at $1.49 million in 2018Q3, according to the filing. It also reduced its holding in Ishares Tr Core S&P500 Etf (IVV) by 1,900 shares in the quarter, leaving it with 44,730 shares, and cut its stake in Texas Capital Bancshares Inc Com (NASDAQ:TCBI).

Among 5 analysts covering Natus Medical (NASDAQ:BABY), 3 have Buy rating, 0 Sell and 2 Hold. Therefore 60% are positive. Natus Medical had 11 analyst reports since July 23, 2015 according to SRatingsIntel. The firm earned “Hold” rating on Monday, January 8 by William Blair. The rating was initiated by Benchmark on Tuesday, October 4 with “Buy”. The firm earned “Buy” rating on Thursday, July 23 by TH Capital. Roth Capital maintained Natus Medical Incorporated (NASDAQ:BABY) on Tuesday, February 27 with “Buy” rating. The stock has “Buy” rating by TH Capital on Tuesday, January 12. On Tuesday, April 5 the stock rating was maintained by Roth Capital with “Buy”. TH Capital maintained Natus Medical Incorporated (NASDAQ:BABY) rating on Thursday, October 22. TH Capital has “Buy” rating and $53 target. On Thursday, February 2 the stock rating was downgraded by Raymond James to “Mkt Perform”. The company was upgraded on Tuesday, September 13 by Raymond James. Roth Capital maintained the stock with “Buy” rating in Friday, June 23 report.

Investors sentiment increased to 1 in 2018 Q3. Its up 0.11, from 0.89 in 2018Q2. It is positive, as 13 investors sold BABY shares while 53 reduced holdings. 22 funds opened positions while 44 raised stakes. 28.55 million shares or 4.17% less from 29.79 million shares in 2018Q2 were reported. Federated Investors Pa invested in 0% or 143 shares. Cambiar Investors Ltd Company owns 0.1% invested in Natus Medical Incorporated (NASDAQ:BABY) for 148,243 shares. Voya Mgmt Ltd accumulated 12,501 shares or 0% of the stock. Pnc Services Grp Inc invested 0% in Natus Medical Incorporated (NASDAQ:BABY). Sei Invests invested in 0% or 1,130 shares. Hanson & Doremus Investment reported 0.01% stake. Penn Davis Mcfarland owns 6,500 shares or 0.07% of their US portfolio. Parametric Assocs Limited Co, a Washington-based fund reported 59,107 shares. Price T Rowe Associates Md has invested 0% in Natus Medical Incorporated (NASDAQ:BABY). Geode Capital Management Ltd Co reported 345,881 shares. Aperio Group Inc Limited Liability Com, a California-based fund reported 8,048 shares. Olstein Limited Partnership stated it has 24,750 shares. Dafna Capital Mngmt Limited Liability Company holds 37,900 shares or 0.55% of its portfolio. 600 were reported by Signaturefd Limited Liability Com. Bnp Paribas Arbitrage Sa has invested 0% in Natus Medical Incorporated (NASDAQ:BABY).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.