Cornerstone Advisors Inc increased its stake in Bemis Inc (BMS) by 91.83% based on its latest 2018Q3 regulatory filing with the SEC. Cornerstone Advisors Inc bought 107,058 shares as the company’s stock declined 4.79% with the market. The institutional investor held 223,639 shares of the consumer durables company at the end of 2018Q3, valued at $10.87M, up from 116,581 at the end of the previous reported quarter. Cornerstone Advisors Inc who had been investing in Bemis Inc for a number of months, seems to be bullish on the $4.17 billion market cap company. The stock increased 0.95% or $0.43 during the last trading session, reaching $45.8. About 564,354 shares traded. Bemis Company, Inc. (NYSE:BMS) has risen 0.13% since January 6, 2018 and is uptrending. It has outperformed by 0.13% the S&P500. Some Historical BMS News: 16/03/2018 – BEMIS CO. REPORTS PACT WITH STARBOARD; 16/03/2018 – Packaging firm Bemis adds four directors in deal with Starboard; 21/04/2018 – DJ Bemis Company Inc, Inst Holders, 1Q 2018 (BMS); 07/05/2018 – Bemis Presenting at Wells Fargo Industrials Conference Tomorrow; 23/04/2018 – S&PGR Lowers Ratings On Bemis Co. Inc.; Outlook Stable; 26/04/2018 – BEMIS COMPANY INC – MANAGEMENT CONTINUES TO EXPECT CAPITAL EXPENDITURES FOR 2018 BETWEEN $150 AND $160 MLN; 16/03/2018 – Bemis Names Guillermo Novo, Marran H. Ogilvie to Board; 26/04/2018 – BEMIS COMPANY INC – QTRLY SHR $0.52; 16/03/2018 – Bemis: Board to Be Comprised of 13 Directors After Annual Meeting; 16/03/2018 – Bemis Company Announces Agreement with Starboard

Jpmorgan Chase & Company decreased its stake in Barrick Gold Corp (ABX) by 39.54% based on its latest 2018Q3 regulatory filing with the SEC. Jpmorgan Chase & Company sold 1.14M shares as the company’s stock rose 41.80% while stock markets declined. The institutional investor held 1.75 million shares of the precious metals company at the end of 2018Q3, valued at $19.35M, down from 2.89 million at the end of the previous reported quarter. Jpmorgan Chase & Company who had been investing in Barrick Gold Corp for a number of months, seems to be less bullish one the $15.73 billion market cap company. The stock increased 3.20% or $0.42 during the last trading session, reaching $13.54. About 22.73M shares traded or 18.64% up from the average. Barrick Gold Corporation (NYSE:ABX) has risen 1.32% since January 6, 2018 and is uptrending. It has outperformed by 1.32% the S&P500. Some Historical ABX News: 16/05/2018 – Hedge Funds Buy U.S. Steel, Sell Barrick Gold in Materials: 13F; 23/04/2018 – BARRICK GOLD CORP – COMPANY’S CONSOLIDATED 2018 GOLD PRODUCTION GUIDANCE REMAINS UNCHANGED; 19/03/2018 – Barrick Announces Nomination of María Ignacia Benítez as Independent Director; 23/04/2018 – BARRICK GOLD CORP – CONTINUE TO TARGET THE FIRST HALF OF 2018 FOR THE COMPLETION OF A DETAILED PROPOSAL FOR REVIEW BY ACACIA; 23/04/2018 – BARRICK GOLD-WORK TO DATE ON PREFEASIBILITY STUDY FOR POTENTIAL UNDERGROUND PROJECT AT PASCUA-LAMA INDICATES IT DOES NOT MEET CO’S INVESTMENT CRITERIA; 09/05/2018 – Blackrock Group Adds Aptiv, Exits Barrick Gold, Cuts Exxon: 13F; 09/05/2018 – Blackrock Japan Adds Aptiv, Exits Barrick Gold: 13F; 23/03/2018 – Barrick Gold cuts 2017 compensation for top two executives; 23/04/2018 – Barrick Gold’s Earnings Beat Projections, Affirms Production Outlook — Earnings Review; 22/03/2018 – S&PGR Upgrades Barrick Gold To ‘BBB’ From ‘BBB-‘; Otlk Stable

Jpmorgan Chase & Company, which manages about $522.20 billion US Long portfolio, upped its stake in Vaneck Vectors Etf Tr by 31,675 shares to 40,864 shares, valued at $1.27M in 2018Q3, according to the filing. It also increased its holding in Royal Caribbean Cruises Ltd (NYSE:RCL) by 1.15 million shares in the quarter, for a total of 2.31 million shares, and has risen its stake in Mgm Resorts International (NYSE:MGM).

Analysts await Barrick Gold Corporation (NYSE:ABX) to report earnings on February, 13. They expect $0.12 earnings per share, down 45.45% or $0.10 from last year’s $0.22 per share. ABX’s profit will be $139.42M for 28.21 P/E if the $0.12 EPS becomes a reality. After $0.08 actual earnings per share reported by Barrick Gold Corporation for the previous quarter, Wall Street now forecasts 50.00% EPS growth.

Among 24 analysts covering Barrick Gold Corp. (NYSE:ABX), 8 have Buy rating, 1 Sell and 15 Hold. Therefore 33% are positive. Barrick Gold Corp. had 98 analyst reports since August 6, 2015 according to SRatingsIntel. The company was maintained on Tuesday, June 20 by Jefferies. The firm earned “Buy” rating on Thursday, February 15 by Jefferies. The company was upgraded on Tuesday, September 25 by TD Securities. The stock has “Sector Perform” rating by RBC Capital Markets on Friday, September 18. On Thursday, November 30 the stock rating was downgraded by Citigroup to “Sell”. The firm has “Buy” rating by RBC Capital Markets given on Tuesday, July 18. JP Morgan maintained Barrick Gold Corporation (NYSE:ABX) rating on Monday, September 17. JP Morgan has “Neutral” rating and $13 target. RBC Capital Markets downgraded the stock to “Sector Perform” rating in Wednesday, November 1 report. Jefferies maintained it with “Buy” rating and $21 target in Friday, April 7 report. The firm earned “Neutral” rating on Wednesday, August 29 by Citigroup.

More notable recent Barrick Gold Corporation (NYSE:ABX) news were published by: Seekingalpha.com which released: “Barrick Gold little changed following mixed Q3 results – Seeking Alpha” on October 24, 2018, also Seekingalpha.com with their article: “Barrick Gold: Gold Is About To Shine Again – Seeking Alpha” published on December 31, 2018, Seekingalpha.com published: “Barrick Gold And Randgold Resources Tie The Knot – Seeking Alpha” on September 25, 2018. More interesting news about Barrick Gold Corporation (NYSE:ABX) were released by: 247Wallst.com and their article: “Is There Gold in the Merger of Barrick, Randgold? – 24/7 Wall St.” published on September 24, 2018 as well as ‘s news article titled: “Barrick Gold Corporation (NYSE:ABX), Randgold Resources Limited (NASDAQ:GOLD) – Is The Rally Over For Gold? – Benzinga” with publication date: November 09, 2018.

Among 17 analysts covering Bemis Company Inc. (NYSE:BMS), 3 have Buy rating, 0 Sell and 14 Hold. Therefore 18% are positive. Bemis Company Inc. had 62 analyst reports since September 14, 2015 according to SRatingsIntel. The company was downgraded on Friday, October 28 by Bank of America. The stock has “Buy” rating by UBS on Tuesday, July 25. The stock of Bemis Company, Inc. (NYSE:BMS) earned “Hold” rating by KeyBanc Capital Markets on Thursday, June 1. The firm has “Hold” rating given on Wednesday, January 31 by SunTrust. The firm earned “Underperform” rating on Friday, February 2 by Bank of America. The rating was downgraded by Bank of America on Wednesday, December 7 to “Underperform”. The firm has “Sell” rating given on Thursday, February 1 by RBC Capital Markets. The stock of Bemis Company, Inc. (NYSE:BMS) has “Sell” rating given on Monday, July 3 by RBC Capital Markets. The stock of Bemis Company, Inc. (NYSE:BMS) has “Underperform” rating given on Tuesday, January 2 by Bank of America. RBC Capital Markets maintained Bemis Company, Inc. (NYSE:BMS) rating on Tuesday, September 5. RBC Capital Markets has “Sell” rating and $39.0 target.

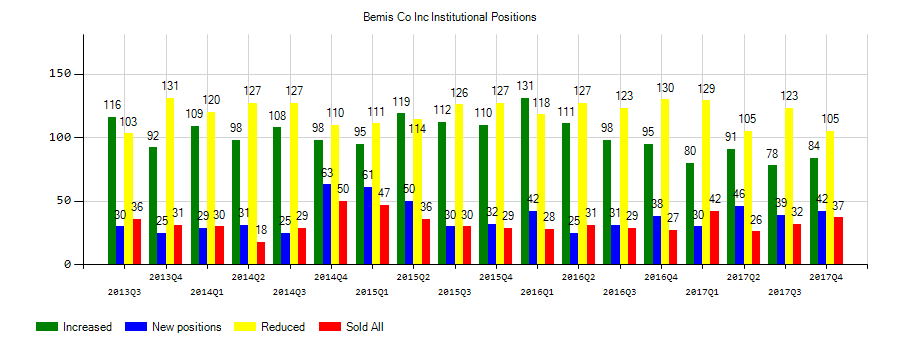

Investors sentiment decreased to 0.86 in Q3 2018. Its down 0.05, from 0.91 in 2018Q2. It is negative, as 32 investors sold BMS shares while 108 reduced holdings. 55 funds opened positions while 65 raised stakes. 61.64 million shares or 5.47% less from 65.20 million shares in 2018Q2 were reported. Moreover, North Star Management has 0% invested in Bemis Company, Inc. (NYSE:BMS) for 500 shares. Palisade Asset Limited Liability Company holds 0.25% of its portfolio in Bemis Company, Inc. (NYSE:BMS) for 38,253 shares. 600 were reported by Amer And Management. New Mexico Educational Retirement Board invested 0.04% in Bemis Company, Inc. (NYSE:BMS). Barclays Public Limited Liability Corp reported 116,629 shares or 0% of all its holdings. Schaper Benz Wise Counsel Inc Wi holds 95,353 shares. Northern Corporation owns 703,945 shares. Rhumbline Advisers accumulated 0.01% or 155,465 shares. Voya Invest Ltd Liability Corporation accumulated 69,948 shares. Stearns Fincl Services Group Inc reported 4,985 shares stake. Amalgamated Commercial Bank holds 0.02% of its portfolio in Bemis Company, Inc. (NYSE:BMS) for 17,974 shares. Zevin Asset Mgmt Limited Liability holds 0.33% or 23,567 shares in its portfolio. Oregon Public Employees Retirement Fund has invested 0.02% of its portfolio in Bemis Company, Inc. (NYSE:BMS). First Advisors Limited Partnership accumulated 497,880 shares. Shelton Capital Mgmt reported 6,419 shares stake.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.