Washington Trust Company increased its stake in Marsh & Mclennan Cos Inc (MMC) by 4859.64% based on its latest 2018Q3 regulatory filing with the SEC. Washington Trust Company bought 57,441 shares as the company’s stock declined 1.83% with the market. The institutional investor held 58,623 shares of the finance company at the end of 2018Q3, valued at $4.85M, up from 1,182 at the end of the previous reported quarter. Washington Trust Company who had been investing in Marsh & Mclennan Cos Inc for a number of months, seems to be bullish on the $40.26B market cap company. The stock increased 2.45% or $1.91 during the last trading session, reaching $79.92. About 1.85M shares traded. Marsh & McLennan Companies, Inc. (NYSE:MMC) has risen 1.00% since January 6, 2018 and is uptrending. It has outperformed by 1.00% the S&P500. Some Historical MMC News: 14/05/2018 – Marsh & McLennan Companies to Webcast 2018 Annual Meeting of Stockholders on May 17; 07/03/2018 – PLUG POWER CEO ANDREW MARSH SPEAKS ON CONFERENCE CALL; 09/03/2018 – HYARD – MANY NEW ORDERS FOR MMC FP; 14/05/2018 – REG-Marsh & McLennan Marsh & McLennan Companies to Webcast 2018 Annual Meeting of Stockholders on May 17; 26/04/2018 – Marsh & McLennan 1Q Risk & Insurance Services Revenue $2.3B; 26/04/2018 – Marsh & McLennan 1Q Adj EPS $1.38; 09/03/2018 – MANY NEW ORDERS FOR MMC FP; 10/04/2018 – Sunit Patel Joins Mercer as Chief Actuary, US Health; 06/03/2018 – Oliver Wyman Acquires Design Thinking Consultancy 8works; 16/04/2018 – MARSH – MARSH’S NEW BLOCKCHAIN NETWORK IS EXPECTED TO GO INTO PRODUCTION LATER IN 2018

Selkirk Management Llc decreased its stake in Grubhub Inc. (GRUB) by 16.41% based on its latest 2018Q3 regulatory filing with the SEC. Selkirk Management Llc sold 21,500 shares as the company’s stock declined 42.69% with the market. The hedge fund held 109,500 shares of the business services company at the end of 2018Q3, valued at $15.18M, down from 131,000 at the end of the previous reported quarter. Selkirk Management Llc who had been investing in Grubhub Inc. for a number of months, seems to be less bullish one the $6.88 billion market cap company. The stock increased 6.30% or $4.49 during the last trading session, reaching $75.8. About 3.09M shares traded or 24.03% up from the average. GrubHub Inc. (NYSE:GRUB) has risen 17.22% since January 6, 2018 and is uptrending. It has outperformed by 17.22% the S&P500. Some Historical GRUB News: 01/05/2018 – GRUBHUB 1Q ADJ EPS 52C; 08/05/2018 – Chicagoans Can Now Order from Grubhub Through Groupon; 18/04/2018 – GRUBHUB INC GRUB.N : MORGAN STANLEY CUTS TO EQUAL-WEIGHT FROM OVERWEIGHT; 10/05/2018 – Grubhub Partners with Jack in the Box® to Bring Food Directly to Diners’ Homes; 01/05/2018 – Correct: GrubHub Sees 2Q Rev $228M-$236M; 09/04/2018 – GRUB: Postmates, DoorDash have talked merger to fend of GrubHub,; 23/04/2018 – SOHN CONFERENCE: HALF SKY CAPITAL CHIEF INVESTMENT OFFICER Ll RAN SAYS GRUBHUB IS ATTRACTIVE INVESTMENT IDEA; 15/03/2018 – Gig Economy Transforming Restaurant Industry by Managing Rising Delivery Demand Craze; 01/05/2018 – Grubhub: 5 Interesting Details About the Yum Brands Deal — Barrons.com; 01/05/2018 – GrubHub 1Q Net $30.8M

More important recent GrubHub Inc. (NYSE:GRUB) news were published by: Fool.com which released: “Why Grubhub Stock Fell 15.6% in November – Motley Fool” on December 11, 2018, also Seekingalpha.com published article titled: “Amazon Go seen generating huge sales – Seeking Alpha”, Seekingalpha.com published: “GrubHub slips 12% despite record Q3 – Seeking Alpha” on October 25, 2018. More interesting news about GrubHub Inc. (NYSE:GRUB) was released by: Seekingalpha.com and their article: “UberEats May Very Well Eat Grubhub – Seeking Alpha” with publication date: January 03, 2019.

Among 34 analysts covering Grubhub Inc (NYSE:GRUB), 18 have Buy rating, 3 Sell and 13 Hold. Therefore 53% are positive. Grubhub Inc had 152 analyst reports since July 27, 2015 according to SRatingsIntel. The stock of GrubHub Inc. (NYSE:GRUB) has “Buy” rating given on Monday, August 31 by Brean Capital. The firm has “Buy” rating given on Tuesday, September 5 by Canaccord Genuity. The company was upgraded on Thursday, April 13 by IBC. As per Wednesday, January 11, the company rating was initiated by Credit Suisse. The firm has “Buy” rating by Monness Crespi & Hardt given on Monday, June 6. Wells Fargo maintained GrubHub Inc. (NYSE:GRUB) on Wednesday, May 30 with “Hold” rating. The stock has “Buy” rating by Canaccord Genuity on Friday, July 29. The firm earned “Neutral” rating on Wednesday, October 28 by Susquehanna. The company was maintained on Thursday, November 16 by KeyBanc Capital Markets. The company was upgraded on Friday, October 26 by DA Davidson.

Analysts await GrubHub Inc. (NYSE:GRUB) to report earnings on February, 14. They expect $0.16 EPS, down 48.39% or $0.15 from last year’s $0.31 per share. GRUB’s profit will be $14.51M for 118.44 P/E if the $0.16 EPS becomes a reality. After $0.33 actual EPS reported by GrubHub Inc. for the previous quarter, Wall Street now forecasts -51.52% negative EPS growth.

More important recent Marsh & McLennan Companies, Inc. (NYSE:MMC) news were published by: Seekingalpha.com which released: “Marsh & McLennan Companies: A Not So Obvious Buy – Seeking Alpha” on August 14, 2018, also Businesswire.com published article titled: “Mercer and HLTH Collaborate to Engage Employers in Reshaping the Future of Health – Business Wire”, Businesswire.com published: “Marsh Announces Future Leadership Appointments for Regional, Specialty and Placement Teams – Business Wire” on December 18, 2018. More interesting news about Marsh & McLennan Companies, Inc. (NYSE:MMC) was released by: Businesswire.com and their article: “Marsh & McLennan. UK Regulatory Announcement: Marsh & McLennan To Acquire Jardine Lloyd Thompson Group Plc – Business Wire” with publication date: September 18, 2018.

Since August 29, 2018, it had 0 buys, and 1 insider sale for $6.83 million activity.

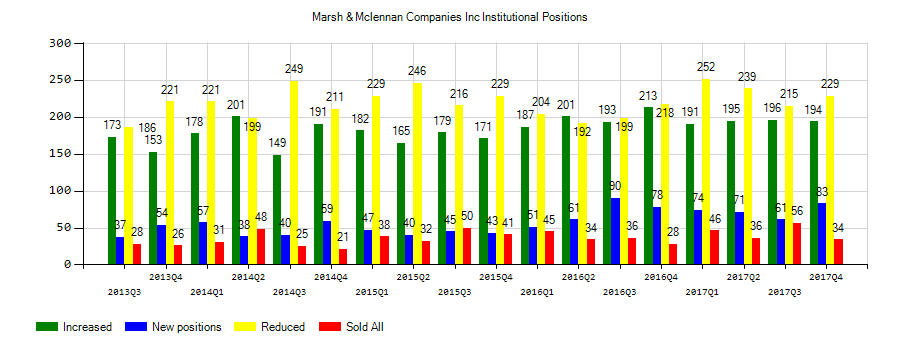

Investors sentiment increased to 1.16 in Q3 2018. Its up 0.16, from 1 in 2018Q2. It is positive, as 21 investors sold MMC shares while 213 reduced holdings. 71 funds opened positions while 200 raised stakes. 416.43 million shares or 0.13% less from 416.99 million shares in 2018Q2 were reported. Guggenheim Cap Ltd Co has invested 0.07% of its portfolio in Marsh & McLennan Companies, Inc. (NYSE:MMC). Qci Asset Mgmt Inc Ny holds 0% or 556 shares in its portfolio. Northern Trust Corp holds 0.13% or 6.54 million shares in its portfolio. 1.81M were reported by Sound Shore Management Ct. Shine Inv Advisory Svcs owns 804 shares for 0.04% of their portfolio. Connecticut-based Cubist Systematic Strategies Ltd Company has invested 0.13% in Marsh & McLennan Companies, Inc. (NYSE:MMC). Fil Limited owns 1.50 million shares. National Bank & Trust Of Montreal Can has invested 0.04% in Marsh & McLennan Companies, Inc. (NYSE:MMC). Moreover, Johnson Group Inc has 0% invested in Marsh & McLennan Companies, Inc. (NYSE:MMC) for 495 shares. Huntington Natl Bank invested in 74,106 shares or 0.1% of the stock. Dodge & Cox has 0% invested in Marsh & McLennan Companies, Inc. (NYSE:MMC). Bb&T reported 214,068 shares stake. Kbc Grp Incorporated Nv invested in 0.29% or 466,645 shares. Teacher Retirement Sys Of Texas has 66,884 shares for 0.04% of their portfolio. Buckingham Asset Mngmt Limited Co invested 0.04% in Marsh & McLennan Companies, Inc. (NYSE:MMC).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.