Cypress Capital Group decreased Altria Group Inc (MO) stake by 10.44% reported in 2018Q3 SEC filing. Cypress Capital Group sold 11,175 shares as Altria Group Inc (MO)’s stock declined 11.92%. The Cypress Capital Group holds 95,864 shares with $5.78 million value, down from 107,039 last quarter. Altria Group Inc now has $94.52B valuation. The stock increased 2.57% or $1.26 during the last trading session, reaching $50.3. About 10.46 million shares traded or 1.16% up from the average. Altria Group, Inc. (NYSE:MO) has declined 25.37% since January 5, 2018 and is downtrending. It has underperformed by 25.37% the S&P500. Some Historical MO News: 22/05/2018 – ALTRIA GROUP INC – NEW STRUCTURE INCLUDES ESTABLISHMENT OF TWO DIVISIONS – CORE TOBACCO AND INNOVATIVE TOBACCO PRODUCTS; 09/04/2018 – Fitch Sees Altria as Well-Positioned Through Its Licensing Agreement With Philip Morris; 09/04/2018 – Fitch: Altria’s Strong Profitability Benefits From Consistent Pricing Power, Reduced Variable Costs; 17/05/2018 – ALTRIA GROUP INC – ANNOUNCES EXPANSION OF ITS $1 BLN SHARE REPURCHASE PROGRAM TO $2 BLN,; 17/05/2018 – ALTRIA GROUP INC – DECLARES REGULAR QUARTERLY DIVIDEND OF $0.70 PER SHARE; 15/03/2018 – FDA seeks research, public input in fresh move to curb nicotine addiction; 04/05/2018 – Altria Group and Nikon Quietly Stay Away From the NRA’s Big Show; 22/05/2018 – ALTRIA GROUP ESTABLISHES CHIEF GROWTH OFFICER FUNCTION; 29/03/2018 – MFS Value Fund Cuts JPMorgan, Buys More Altria; 17/05/2018 – ALTRIA ANNUAL MEETING OF SHAREHOLDERS ENDS

More notable recent The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA) news were published by: Nasdaq.com which released: “‘Reality’ bites: Cuba plans more austerity as finances worsen – Nasdaq” on December 28, 2018, also Nasdaq.com with their article: “Cuba sees 1.5 percent growth next year after hard 2018 – Nasdaq” published on December 21, 2018, Nasdaq.com published: “U.S. Cuba lobby celebrates a farm bill win despite worsening ties – Nasdaq” on December 18, 2018. More interesting news about The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA) were released by: Nasdaq.com and their article: “Brazil’s Bolsonaro says he will target Venezuela, Cuba – Nasdaq” published on December 18, 2018 as well as Nasdaq.com‘s news article titled: “Cuba president says policy changes address people’s concerns, not a setback – Nasdaq” with publication date: December 07, 2018.

Since October 23, 2018, it had 2 insider buys, and 0 insider sales for $310,622 activity. The insider Herzfeld Erik Mervin bought 33,500 shares worth $193,832. 20,000 shares were bought by HERZFELD THOMAS J, worth $116,790 on Tuesday, October 23.

Herzfeld Caribbean Basin Fund Inc director and an insider Thomas Herzfeld a few days ago made a purchase of 16,000 company shares worth $79,730 at an average cost of $5.0. The dated 04/01/2019 transaction’s Form 4 that was filed with the SEC is available online here. Presently, Thomas Herzfeld holds 508,518 shares or roughly 8.29% of Herzfeld Caribbean Basin Fund Inc’s total market capitalization.

The stock increased 6.87% or $0.33 during the last trading session, reaching $5.13. About 33,839 shares traded or 69.83% up from the average. The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA) has declined 18.98% since January 5, 2018 and is downtrending. It has underperformed by 18.98% the S&P500.

The Herzfeld Caribbean Basin Fund Inc. is a closed-ended equity mutual fund launched by Thomas J. The company has market cap of $31.47 million. Herzfeld Advisors, Inc. It currently has negative earnings. The fund is managed by Herzfeld/Cuba.

Investors sentiment decreased to 1.29 in Q3 2018. Its down 1.21, from 2.5 in 2018Q2. It turned negative, as 2 investors sold The Herzfeld Caribbean Basin Fund Inc. shares while 5 reduced holdings. 3 funds opened positions while 6 raised stakes. 2.11 million shares or 4.57% less from 2.21 million shares in 2018Q2 were reported. Blue Bell Private Wealth Mngmt Llc owns 69,433 shares for 0.19% of their portfolio. Rmb Capital Mngmt Ltd Limited Liability Company stated it has 0% of its portfolio in The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA). Royal Bancorporation Of Canada stated it has 3,410 shares. Raymond James & Associate holds 10,160 shares. Tower Research Capital Lc (Trc) invested 0% of its portfolio in The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA). The California-based Bennicas And Associates Inc has invested 0.07% in The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA). Cornerstone Advsr Inc stated it has 57,558 shares. The Virginia-based Shaker Financial Service Llc has invested 0.36% in The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA). Moreover, Cwm Ltd Llc has 0% invested in The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA). Florida-based Thomas J Herzfeld Advisors has invested 2.85% in The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA). Guggenheim Capital Ltd Liability Company has 58,144 shares for 0% of their portfolio. 3,770 were reported by Morgan Stanley. Sandy Spring State Bank owns 2,667 shares. Susquehanna Ltd Liability Partnership invested 0% of its portfolio in The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA). Fincl Bank Of America Corporation De owns 1,395 shares or 0% of their US portfolio.

Cypress Capital Group increased Amazon.Com Inc (NASDAQ:AMZN) stake by 420 shares to 1,556 valued at $3.12M in 2018Q3. It also upped Schwab (SCHX) stake by 13,145 shares and now owns 16,240 shares. Zoetis Inc (NYSE:ZTS) was raised too.

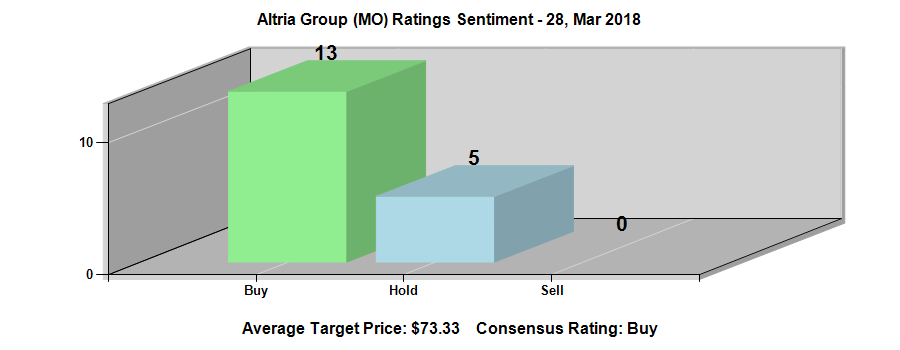

Among 6 analysts covering Altria Group (NYSE:MO), 3 have Buy rating, 1 Sell and 2 Hold. Therefore 50% are positive. Altria Group had 7 analyst reports since July 27, 2018 according to SRatingsIntel. Citigroup downgraded it to “Sell” rating and $45 target in Friday, December 21 report. The company was maintained on Monday, October 29 by Argus Research. The rating was maintained by Citigroup on Friday, September 21 with “Neutral”. The stock has “Buy” rating by Stifel Nicolaus on Friday, July 27. Jefferies downgraded it to “Hold” rating and $61 target in Friday, August 24 report.

Since August 29, 2018, it had 0 insider purchases, and 1 insider sale for $184,966 activity. DEVITRE DINYAR S sold $184,966 worth of stock.

Analysts await Altria Group, Inc. (NYSE:MO) to report earnings on February, 7. They expect $0.95 EPS, up 4.40% or $0.04 from last year’s $0.91 per share. MO’s profit will be $1.79B for 13.24 P/E if the $0.95 EPS becomes a reality. After $1.08 actual EPS reported by Altria Group, Inc. for the previous quarter, Wall Street now forecasts -12.04% negative EPS growth.

Investors sentiment increased to 0.93 in 2018 Q3. Its up 0.11, from 0.82 in 2018Q2. It improved, as 52 investors sold MO shares while 495 reduced holdings. 128 funds opened positions while 382 raised stakes. 1.17 billion shares or 1.41% more from 1.16 billion shares in 2018Q2 were reported. Hanson Doremus Invest Management holds 0.01% or 570 shares. Dynamic Advisor Solutions Ltd has invested 0.55% of its portfolio in Altria Group, Inc. (NYSE:MO). Bp Public Limited Liability Com invested 0.44% of its portfolio in Altria Group, Inc. (NYSE:MO). Profund Advsrs Ltd Company, a Maryland-based fund reported 40,510 shares. Leavell Mgmt invested in 44,028 shares. Estabrook Mngmt has 195 shares for 0% of their portfolio. Cognios Cap Limited Liability accumulated 29,227 shares. Duff And Phelps Investment has invested 0.02% of its portfolio in Altria Group, Inc. (NYSE:MO). Bnp Paribas Asset Mgmt Hldgs reported 0.02% stake. Prudential Public Ltd Liability Company, Illinois-based fund reported 2.50M shares. Philadelphia stated it has 0.09% in Altria Group, Inc. (NYSE:MO). Moreover, Tcw Grp has 0.01% invested in Altria Group, Inc. (NYSE:MO). First Merchants Corp invested 0.03% of its portfolio in Altria Group, Inc. (NYSE:MO). Viking Fund Mngmt Limited Liability holds 1.27% or 103,000 shares in its portfolio. Destination Wealth Mngmt, a California-based fund reported 3,211 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.