Beach Investment Counsel Inc increased its stake in Royal Caribbean Cruise Ltd. (RCL) by 186.91% based on its latest 2018Q3 regulatory filing with the SEC. Beach Investment Counsel Inc bought 78,570 shares as the company’s stock declined 15.38% with the market. The hedge fund held 120,607 shares of the marine transportation company at the end of 2018Q3, valued at $15.67M, up from 42,037 at the end of the previous reported quarter. Beach Investment Counsel Inc who had been investing in Royal Caribbean Cruise Ltd. for a number of months, seems to be bullish on the $20.44B market cap company. It closed at $97.79 lastly. It is down 15.47% since January 3, 2018 and is downtrending. It has underperformed by 15.47% the S&P500. Some Historical RCL News: 26/04/2018 – ROYAL CARIBBEAN CRUISES LTD – FULL YEAR ADJUSTED EARNINGS GUIDANCE IS INCREASED BY $0.15 TO A RANGE OF $8.70 TO $8.90 PER SHARE; 26/04/2018 – Royal Caribbean 1Q EPS $1.02; 19/03/2018 – Royal Caribbean Names Adam Goldstein as Vice Chairman; 19/03/2018 – ROYAL CARIBBEAN CRUISES LTD RCL.N – AFTER SALE OF GOLDEN ERA, IT IS EXPECTED THAT SKYSEA WILL WIND DOWN ITS BUSINESS OPERATIONS BEFORE END OF 2018; 15/05/2018 – Azamara Club Cruises® Unveils 2020 Itineraries; 19/03/2018 – ROYAL CARIBBEAN CRUISES LTD RCL.N – ROYAL CARIBBEAN EXPECTS IMPACT OF TRANSACTIONS TO FALL IN A RANGE OF $0.12 TO $0.15 A SHARE IN FY2018; 07/05/2018 – This $1 billion cruise ship with a race track hopes to dethrone Carnival and Royal Caribbean; 19/03/2018 – RCL NAMES ADAM GOLDSTEIN AS VICE CHAIRMAN, RECOGNIZING DECADES; 26/04/2018 – ROYAL CARIBBEAN CRUISES LTD QTRLY NET CRUISE COSTS EXCLUDING FUEL PER APCD WERE UP 11.2% IN CONSTANT-CURRENCY (UP 12.5% AS-REPORTED); 15/05/2018 – Azamara Club Cruises® Unveils 2020 ltineraries

Personal Capital Advisors Corp increased its stake in Duke Energy Corp New (DUK) by 4.76% based on its latest 2018Q3 regulatory filing with the SEC. Personal Capital Advisors Corp bought 22,622 shares as the company’s stock rose 9.96% while stock markets declined. The institutional investor held 498,134 shares of the power generation company at the end of 2018Q3, valued at $39.86M, up from 475,512 at the end of the previous reported quarter. Personal Capital Advisors Corp who had been investing in Duke Energy Corp New for a number of months, seems to be bullish on the $60.38 billion market cap company. The stock decreased 1.85% or $1.6 during the last trading session, reaching $84.7. About 2.86 million shares traded. Duke Energy Corporation (NYSE:DUK) has risen 2.97% since January 3, 2018 and is uptrending. It has outperformed by 2.97% the S&P500. Some Historical DUK News: 10/05/2018 – DUKE ENERGY 1Q EARNINGS CALL CONCLUDES; 16/05/2018 – Duke Energy: Hydroelectric Plant Sale to Close in 1Q of 2019; 16/05/2018 – Duke Energy at American Gas Association Financial Forum May 20; 16/05/2018 – DUKE ENERGY TO SELL 5 SMALL HYDROELECTRIC PLANTS TO NORTHBROOK; 15/05/2018 – DUKE ENERGY: NEW EXEC APPOINTMENTS FOR CUSTOMER SERVICES; 19/03/2018 – Piedmont Natural Gas seeks approval to reduce customer billing rates in North Carolina; 19/04/2018 – RTO Insider: @DukeEnergy said last week that it will pass $38 million in savings it will realize from the Tax Cuts and Jobs Act; 08/03/2018 – Duke Becoming Cautious About Building Generation — CERAWeek Market Talk; 21/05/2018 – DUKE RAISES OCONEE 3 REACTOR TO 100% POWER FROM 0% FRIDAY: NRC; 08/03/2018 – Piedmont Natural Gas reminds its customers and communities to be vigilant about avoiding utility scams

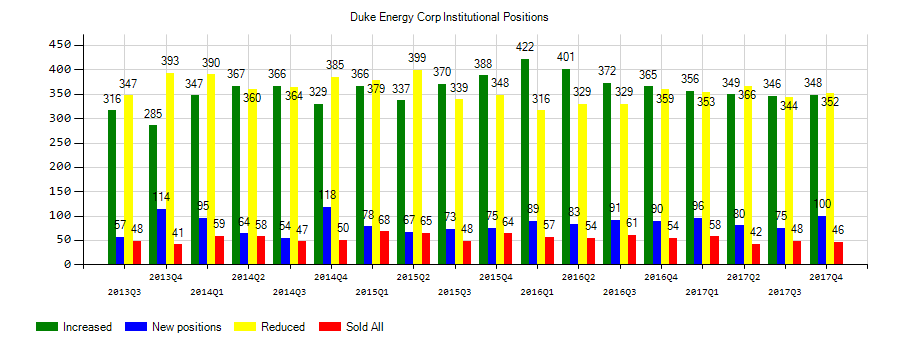

Investors sentiment decreased to 0.91 in Q3 2018. Its down 0.04, from 0.95 in 2018Q2. It is negative, as 46 investors sold DUK shares while 386 reduced holdings. 79 funds opened positions while 312 raised stakes. 408.54 million shares or 94.96% less from 8.11 billion shares in 2018Q2 were reported. 2,824 were reported by Pacific Inv. Cordasco holds 0.34% of its portfolio in Duke Energy Corporation (NYSE:DUK) for 4,415 shares. Commonwealth Of Pennsylvania Pub School Empls Retrmt stated it has 0.07% of its portfolio in Duke Energy Corporation (NYSE:DUK). Smith Asset Management LP reported 38 shares. Axa invested in 360,043 shares. Envestnet Asset Mngmt reported 14,094 shares stake. Us Bank & Trust De has 0.09% invested in Duke Energy Corporation (NYSE:DUK) for 389,279 shares. Bb&T Secs Ltd stated it has 0.29% in Duke Energy Corporation (NYSE:DUK). Amer Century Cos Incorporated, a Missouri-based fund reported 155,264 shares. Wells Fargo Mn stated it has 0.09% of its portfolio in Duke Energy Corporation (NYSE:DUK). Parametric Associates Ltd Llc reported 0.15% stake. Checchi Advisers Ltd Com invested in 0.08% or 8,404 shares. Zurcher Kantonalbank (Zurich Cantonalbank) holds 160,060 shares or 0.11% of its portfolio. Hourglass Cap Limited Liability Corp invested in 3,022 shares. Bnp Paribas Arbitrage has invested 0% in Duke Energy Corporation (NYSE:DUK).

More notable recent Duke Energy Corporation (NYSE:DUK) news were published by: Bizjournals.com which released: “More than 700,000 customers lost power in Winter Storm Diego as Duke Energy calculates repair costs – Charlotte Business Journal” on December 11, 2018, also Bizjournals.com with their article: “Duke Energy, Childress Klein to build uptown tower – Charlotte Business Journal” published on December 07, 2018, Investorplace.com published: “7 Stocks to Buy to Survive a Bear Market – Investorplace.com” on December 07, 2018. More interesting news about Duke Energy Corporation (NYSE:DUK) were released by: Bizjournals.com and their article: “Memorial for former Duke Energy CEO Jim Rogers planned in Charlotte – Charlotte Business Journal” published on December 21, 2018 as well as Fool.com‘s news article titled: “Forget Duke Energy Corporation — Brookfield Infrastructure Partners Is a Better Dividend Growth Stock – The Motley Fool” with publication date: December 30, 2018.

Personal Capital Advisors Corp, which manages about $1.01 billion and $7.80 billion US Long portfolio, decreased its stake in First Solar Inc (NASDAQ:FSLR) by 340,840 shares to 12,588 shares, valued at $610,000 in 2018Q3, according to the filing. It also reduced its holding in Bandwidth Inc by 12,000 shares in the quarter, leaving it with 5,935 shares, and cut its stake in Oracle Corp (NYSE:ORCL).

Among 20 analysts covering Duke Energy (NYSE:DUK), 7 have Buy rating, 2 Sell and 11 Hold. Therefore 35% are positive. Duke Energy has $96 highest and $71 lowest target. $82.45’s average target is -2.66% below currents $84.7 stock price. Duke Energy had 102 analyst reports since August 7, 2015 according to SRatingsIntel. Barclays Capital maintained the stock with “Equal-Weight” rating in Friday, March 18 report. As per Thursday, February 1, the company rating was maintained by RBC Capital Markets. The stock of Duke Energy Corporation (NYSE:DUK) has “Hold” rating given on Monday, March 5 by SunTrust. The rating was maintained by RBC Capital Markets with “Buy” on Sunday, October 1. As per Friday, January 8, the company rating was maintained by Argus Research. JP Morgan upgraded the shares of DUK in report on Monday, July 23 to “Neutral” rating. The firm has “Neutral” rating given on Monday, February 22 by Mizuho. The stock of Duke Energy Corporation (NYSE:DUK) earned “Equal-Weight” rating by Morgan Stanley on Wednesday, June 13. The company was maintained on Monday, October 19 by Suntrust Robinson. As per Wednesday, June 20, the company rating was upgraded by Bank of America.

Investors sentiment is 0.99 in 2018 Q3. Its the same as in 2018Q2. It is the same, as 45 investors sold RCL shares while 196 reduced holdings. only 90 funds opened positions while 149 raised stakes. 143.34 million shares or 0.68% more from 142.37 million shares in 2018Q2 were reported. United Ser Automobile Association accumulated 476,247 shares. Wright Investors Serv Inc stated it has 1,960 shares or 0.09% of all its holdings. Shine Inv Advisory Services has invested 0.02% in Royal Caribbean Cruises Ltd. (NYSE:RCL). Jupiter Asset Mngmt Ltd reported 129,518 shares stake. Cubist Systematic Strategies Ltd Liability Company holds 0.05% or 7,208 shares. Profund Advisors Limited Liability Co reported 0.04% stake. Massachusetts Svcs Ma owns 558,334 shares. Regent Invest Mngmt Ltd Liability Corporation accumulated 17,150 shares. Whittier Trust Commerce invested in 0.01% or 1,694 shares. Macroview Mngmt Limited Liability Corp invested in 0.04% or 100 shares. Baltimore holds 1.89% or 80,286 shares. Tiger Management Limited Liability Company holds 200,560 shares or 2.61% of its portfolio. Kbc Nv holds 0.12% or 125,989 shares in its portfolio. Pnc Serv Grp holds 0.08% or 608,609 shares in its portfolio. Tiaa Cref Investment Mgmt Ltd Liability holds 0.06% or 686,912 shares in its portfolio.

More notable recent Royal Caribbean Cruises Ltd. (NYSE:RCL) news were published by: Seekingalpha.com which released: “Royal Caribbean Cruises declares $0.70 dividend – Seeking Alpha” on December 04, 2018, also Seekingalpha.com with their article: “Royal Caribbean: Q4 ’17 Takeaways – Seeking Alpha” published on January 26, 2018, published: “Insider Buys Of The Week: Aramark, Royal Caribbean, Valero Energy – Yahoo Finance” on December 17, 2018. More interesting news about Royal Caribbean Cruises Ltd. (NYSE:RCL) were released by: Seekingalpha.com and their article: “Royal Caribbean seen as sleeper pick – Seeking Alpha” published on April 30, 2018 as well as Fool.com‘s news article titled: “Why Royal Caribbean Cruises Ltd. Stock Rose Today – Motley Fool” with publication date: June 14, 2018.

Beach Investment Counsel Inc, which manages about $1.43 billion and $1.02 billion US Long portfolio, decreased its stake in Royal Dutch Shell by 221,085 shares to 25,086 shares, valued at $1.71 million in 2018Q3, according to the filing. It also reduced its holding in Dowdupont by 131,112 shares in the quarter, leaving it with 6,903 shares, and cut its stake in Bank Of America (NYSE:BAC).

Since September 13, 2018, it had 1 insider purchase, and 2 selling transactions for $998,977 activity. Fain Richard D bought 18,900 shares worth $2.00M. 6,600 shares were sold by Kulovaara Harri U, worth $828,652.

Among 23 analysts covering Royal Caribbean Cruises Ltd. (NYSE:RCL), 17 have Buy rating, 1 Sell and 5 Hold. Therefore 74% are positive. Royal Caribbean Cruises Ltd. had 83 analyst reports since August 3, 2015 according to SRatingsIntel. The firm has “Sell” rating by Goldman Sachs given on Tuesday, August 15. The stock of Royal Caribbean Cruises Ltd. (NYSE:RCL) earned “Hold” rating by Deutsche Bank on Thursday, September 29. JP Morgan maintained Royal Caribbean Cruises Ltd. (NYSE:RCL) rating on Thursday, January 25. JP Morgan has “Overweight” rating and $150 target. The rating was maintained by Stifel Nicolaus with “Buy” on Tuesday, July 24. Citigroup maintained Royal Caribbean Cruises Ltd. (NYSE:RCL) rating on Tuesday, October 30. Citigroup has “Buy” rating and $125 target. Stifel Nicolaus maintained it with “Buy” rating and $116 target in Monday, December 21 report. Nomura maintained the shares of RCL in report on Friday, October 26 with “Buy” rating. As per Wednesday, October 11, the company rating was maintained by Stifel Nicolaus. Stifel Nicolaus maintained the stock with “Buy” rating in Monday, September 24 report. On Wednesday, January 24 the stock rating was maintained by Stifel Nicolaus with “Buy”.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.