Nichols & Pratt Advisers Llp decreased its stake in Procter & Gamble Co (PG) by 1.41% based on its latest 2018Q4 regulatory filing with the SEC. Nichols & Pratt Advisers Llp sold 8,152 shares as the company’s stock rose 6.30% with the market. The institutional investor held 571,683 shares of the package goods and cosmetics company at the end of 2018Q4, valued at $52.52M, down from 579,835 at the end of the previous reported quarter. Nichols & Pratt Advisers Llp who had been investing in Procter & Gamble Co for a number of months, seems to be less bullish one the $264.79 billion market cap company. The stock increased 0.17% or $0.18 during the last trading session, reaching $105.85. About 6.02M shares traded. The Procter & Gamble Company (NYSE:PG) has risen 25.63% since April 18, 2018 and is uptrending. It has outperformed by 21.26% the S&P500. Some Historical PG News: 06/03/2018 – P&G to ‘take back control’ of ads; 19/04/2018 – P&G QTRLY BABY, FEMININE AND FAMILY CARE SEGMENT ORGANIC SALES DECREASED THREE PERCENT; 19/04/2018 – P&G 3Q CORE EPS $1.00, EST. 98C; 03/04/2018 – PFIZER CONSIDERING OPTIONS WITH P&G INCLUDING JOINT VENTURE FOR CONSUMER BUSINESS – CNBC, CITING; 19/04/2018 – P&G Deal for Merck KGaA Business Valuation Is About EUR3.4B; 20/04/2018 – P&G’s vitamin boost could signal more to come; 13/03/2018 – P&G – RESOLVED ITS PATENT INFRINGEMENT DISPUTE WITH RANIR, LLC REGARDING RANIR’S TOOTH WHITENING STRIP PRODUCTS IN UNITED STATES AND CANADA; 29/03/2018 – Covata Named Gold Winner in 2018 Info Security PG’s Global Excellence Awards; 04/05/2018 – Cramer Remix: Why Apple is a better version of Procter & Gamble; 19/04/2018 – Teva and the Procter & Gamble Company Have Agreed to Terminate the PGT Healthcare Partnership

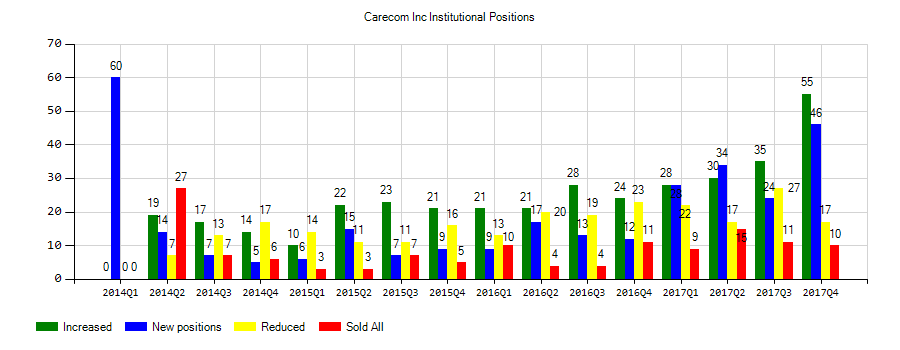

Diker Management Llc decreased its stake in Care Com Inc (CRCM) by 46% based on its latest 2018Q4 regulatory filing with the SEC. Diker Management Llc sold 100,237 shares as the company’s stock rose 43.40% with the market. The hedge fund held 117,663 shares of the consumer services company at the end of 2018Q4, valued at $2.27M, down from 217,900 at the end of the previous reported quarter. Diker Management Llc who had been investing in Care Com Inc for a number of months, seems to be less bullish one the $505.11M market cap company. The stock decreased 1.51% or $0.24 during the last trading session, reaching $15.69. About 636,600 shares traded or 64.66% up from the average. Care.com, Inc. (NYSE:CRCM) has risen 41.87% since April 18, 2018 and is uptrending. It has outperformed by 37.50% the S&P500. Some Historical CRCM News: 14/03/2018 – Care.com Closes Above 50-Day Moving Average: Technicals; 08/05/2018 – Care.com Closes Above 200-Day Moving Average: Technicals; 08/05/2018 – Care.com Sees 2018 Adj EPS 65c-Adj EPS 67c; 09/05/2018 – Care.com to Participate At Upcoming Investor Conferences; 08/05/2018 – Care.com 1Q Adj EPS 19c; 05/03/2018 Care.com to Participate At 30th Annual ROTH Conference; 08/05/2018 – CARE.COM SEES 2Q ADJ EPS ABOUT 10C, EST. 10C; 08/05/2018 – Care.com Sees 2018 Rev $191.0M-$193.0M; 08/05/2018 – Care.com 1Q Rev $47.3M; 08/05/2018 – Care.com Sees 2018 EBIT $31.0M-EBIT $32.0M

Since November 2, 2018, it had 0 buys, and 50 selling transactions for $350.20 million activity. On Thursday, November 29 Posada Juan Fernando sold $99,989 worth of The Procter & Gamble Company (NYSE:PG) or 1,074 shares. Magesvaran Suranjan sold $131,509 worth of The Procter & Gamble Company (NYSE:PG) on Friday, November 2. $131,509 worth of The Procter & Gamble Company (NYSE:PG) was sold by Keith R. Alexandra on Friday, November 2. Sheppard Valarie L had sold 1,075 shares worth $99,932 on Thursday, November 29. 10,000 shares valued at $927,424 were sold by Jejurikar Shailesh on Monday, November 12. 104,157 The Procter & Gamble Company (NYSE:PG) shares with value of $9.54 million were sold by Bishop Steven D.

Investors sentiment increased to 0.84 in 2018 Q4. Its up 0.05, from 0.79 in 2018Q3. It is positive, as 59 investors sold PG shares while 738 reduced holdings. 159 funds opened positions while 509 raised stakes. 1.54 billion shares or 9.68% more from 1.41 billion shares in 2018Q3 were reported. First Allied Advisory has 0.33% invested in The Procter & Gamble Company (NYSE:PG) for 90,445 shares. Optimum Invest Advisors stated it has 0.19% in The Procter & Gamble Company (NYSE:PG). Public Employees Retirement Association Of Colorado holds 445,893 shares or 0.29% of its portfolio. Mutual Of America Cap Mngmt Ltd Limited Liability Company holds 0.49% of its portfolio in The Procter & Gamble Company (NYSE:PG) for 325,973 shares. 12,020 were accumulated by Tci Wealth Advisors. Apg Asset Management Nv owns 4.38M shares for 0.72% of their portfolio. Massachusetts-based Factory Mutual Ins Comm has invested 1.32% in The Procter & Gamble Company (NYSE:PG). Hm Payson Co has invested 0.33% in The Procter & Gamble Company (NYSE:PG). Guinness Asset Mgmt Ltd invested 3.96% in The Procter & Gamble Company (NYSE:PG). 1832 Asset LP owns 0.01% invested in The Procter & Gamble Company (NYSE:PG) for 20,607 shares. Trust Company Of Oklahoma stated it has 6,335 shares or 0% of all its holdings. City Hldgs Co holds 64,726 shares or 1.94% of its portfolio. Banque Pictet Cie Sa owns 93,502 shares. 22,487 were reported by Moneta Group Inv Advisors Limited Co. Palladium Ptnrs Ltd Liability Co reported 162,128 shares.

More notable recent The Procter & Gamble Company (NYSE:PG) news were published by: Bizjournals.com which released: “Former P&G executive tapped to help guide Campbell Soup as another P&G veteran departs – Cincinnati Business Courier” on March 29, 2019, also Seekingalpha.com with their article: “Procter & Gamble: Dividend Remains Strong – Seeking Alpha” published on April 05, 2019, Bizjournals.com published: “P&G technology draws interest of Nestlé – Cincinnati Business Courier” on March 19, 2019. More interesting news about The Procter & Gamble Company (NYSE:PG) were released by: Seekingalpha.com and their article: “By How Much Will Procter & Gamble Raise Its Dividend Next Month? – Seeking Alpha” published on March 15, 2019 as well as Seekingalpha.com‘s news article titled: “Procter & Gamble declares $0.7459 dividend – Seeking Alpha” with publication date: April 09, 2019.

Diker Management Llc, which manages about $674.54 million and $231.17 million US Long portfolio, upped its stake in Mimecast Ltd by 76,638 shares to 240,138 shares, valued at $8.08 million in 2018Q4, according to the filing. It also increased its holding in Vail Resorts Inc (NYSE:MTN) by 11,982 shares in the quarter, for a total of 23,087 shares, and has risen its stake in New York Times Co (NYSE:NYT).

Investors sentiment increased to 1.17 in 2018 Q4. Its up 0.06, from 1.11 in 2018Q3. It increased, as 14 investors sold CRCM shares while 40 reduced holdings. 25 funds opened positions while 38 raised stakes. 23.33 million shares or 8.61% more from 21.48 million shares in 2018Q3 were reported. Voya Invest Management Ltd Limited Liability Company holds 0% in Care.com, Inc. (NYSE:CRCM) or 29,323 shares. Portolan Cap Ltd Llc reported 1.90M shares stake. Stone Ridge Asset Management Limited Liability holds 0.03% or 29,609 shares. Ameriprise holds 0% in Care.com, Inc. (NYSE:CRCM) or 437,051 shares. Panagora Asset Management Inc has invested 0.02% in Care.com, Inc. (NYSE:CRCM). 44,200 were reported by Swiss Bancorp. Secor Cap Advsr Ltd Partnership has invested 0.05% in Care.com, Inc. (NYSE:CRCM). Invesco Ltd holds 0% of its portfolio in Care.com, Inc. (NYSE:CRCM) for 129,437 shares. Rice Hall James & Associates Limited Liability Company has invested 0.09% of its portfolio in Care.com, Inc. (NYSE:CRCM). Boston Advsr Ltd Limited Liability Company owns 79,179 shares for 0.09% of their portfolio. Barclays Public Ltd Com owns 35,900 shares. Oppenheimer Asset Management holds 1,616 shares. Gsa Prns Llp has 40,773 shares. Principal Financial Group has invested 0% in Care.com, Inc. (NYSE:CRCM). 35,151 are owned by Granite Invest Prns Ltd.

More notable recent Care.com, Inc. (NYSE:CRCM) news were published by: which released: “54 Biggest Movers From Yesterday – Benzinga” on April 03, 2019, also Globenewswire.com with their article: “Bragar Eagel & Squire, PC Announces That a Class Action Lawsuit Has Been Filed Against Care.com, Inc. (CRCM) and Encourages CRCM Investors to Contact the Firm – GlobeNewswire” published on April 03, 2019, Globenewswire.com published: “CRCM INVESTOR REMINDER: Hagens Berman Reminds Care.com (CRCM) Investors of Securities Class Action, Encourages Investors to Contact the Firm – GlobeNewswire” on April 15, 2019. More interesting news about Care.com, Inc. (NYSE:CRCM) were released by: Globenewswire.com and their article: “SHAREHOLDER ALERT: UXIN DPLO CNDT CRCM: The Law Offices of Vincent Wong Reminds Investors of Important Class Action Deadlines – GlobeNewswire” published on April 09, 2019 as well as Globenewswire.com‘s news article titled: “T, NTNX, CRCM – Bronstein, Gewirtz & Grossman, LLC Reminds Investors of Class Action – GlobeNewswire” with publication date: April 16, 2019.

Since November 5, 2018, it had 0 buys, and 12 sales for $3.72 million activity. The insider Musi Diane sold 29,900 shares worth $550,091. $636,711 worth of Care.com, Inc. (NYSE:CRCM) shares were sold by Marcelo Sheila Lirio. On Wednesday, January 2 Echenberg Michael sold $258,630 worth of Care.com, Inc. (NYSE:CRCM) or 13,633 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.