Bridgecreek Investment Management Llc decreased its stake in Paycom Software Inc (PAYC) by 6.34% based on its latest 2018Q4 regulatory filing with the SEC. Bridgecreek Investment Management Llc sold 9,275 shares as the company’s stock rose 36.42% with the market. The institutional investor held 137,025 shares of the technology company at the end of 2018Q4, valued at $16.78M, down from 146,300 at the end of the previous reported quarter. Bridgecreek Investment Management Llc who had been investing in Paycom Software Inc for a number of months, seems to be less bullish one the $11.05 billion market cap company. The stock decreased 0.67% or $1.27 during the last trading session, reaching $188.89. About 373,252 shares traded. Paycom Software, Inc. (NYSE:PAYC) has risen 79.65% since April 17, 2018 and is uptrending. It has outperformed by 75.28% the S&P500. Some Historical PAYC News: 01/05/2018 – Paycom Software 1Q EPS 70c; 01/05/2018 – PAYCOM SOFTWARE 1Q REV. $153.9M, EST. $151.5M; 29/05/2018 – Paycom Announces Latest Expansion in Columbus; 16/05/2018 – Sylebra HK Co Exits Position in Paycom Software; 10/05/2018 – Paycom Software Presenting at Conference Jun 5; 01/05/2018 – PAYCOM SOFTWARE SEES 2Q REV. $123.0M TO $125.0M; 05/04/2018 – Rochester Becomes Paycom’s Latest Sales Office Opening; 14/05/2018 – Paycom Software Presenting at JPMorgan Conference Tomorrow; 25/04/2018 – Paycom to Participate in Upcoming Investor Conferences; 01/05/2018 – Paycom Software 1Q Adj EPS 95c

Mackay Shields Llc increased its stake in Smucker J M Co (SJM) by 21.74% based on its latest 2018Q4 regulatory filing with the SEC. Mackay Shields Llc bought 3,944 shares as the company’s stock rose 1.24% with the market. The institutional investor held 22,084 shares of the packaged foods company at the end of 2018Q4, valued at $2.07 million, up from 18,140 at the end of the previous reported quarter. Mackay Shields Llc who had been investing in Smucker J M Co for a number of months, seems to be bullish on the $13.53 billion market cap company. The stock decreased 0.21% or $0.25 during the last trading session, reaching $118.93. About 485,823 shares traded. The J. M. Smucker Company (NYSE:SJM) has declined 19.20% since April 17, 2018 and is downtrending. It has underperformed by 23.57% the S&P500. Some Historical SJM News: 06/03/2018 – J. M. SMUCKER TERMINATES PACT AFTER CHALLENGE FROM FTC; 04/04/2018 – JM SMucker to buy Ainsworth Pet Nutrition for $1.7 bln; 04/04/2018 – J M SMUCKER CO – WILL EXPLORE STRATEGIC OPTIONS FOR ITS U.S. BAKING BUSINESS, INCLUDING A POTENTIAL SALE; 06/03/2018 – J. M. SMUCKER CO.: TERMINATION OF PACT TO BUY WESSON® OIL; 24/05/2018 – FOSSIL GROUP INC – BELGYA CURRENTLY SERVES AS VICE CHAIR AND CHIEF FINANCIAL OFFICER OF J.M. SMUCKER COMPANY; 04/04/2018 – JM Smucker snaps up pet food co, weighs options for baking brands; 04/04/2018 – J.M. Smucker Pays Up For Nutrish Pet-food Brand, May Sell Pillsbury Division — MarketWatch; 06/03/2018 – Smucker, Conagra Call Off Wesson Oil Deal After FTC Challenge; 04/04/2018 – L Catterton and Lang Family to Sell Ainsworth Pet Nutrition to J.M. Smucker for $1.9 Billion; 14/05/2018 – The J. M. Smucker Company Completes Acquisition of Ainsworth Pet Nutrition, LLC, Maker of Rachael Ray™ Nutrish® Pet Food

Mackay Shields Llc, which manages about $81.03 billion and $12.32B US Long portfolio, decreased its stake in Immersion Corp (NASDAQ:IMMR) by 140,018 shares to 130,782 shares, valued at $1.17M in 2018Q4, according to the filing. It also reduced its holding in Terex Corp New (NYSE:TEX) by 129,499 shares in the quarter, leaving it with 141,061 shares, and cut its stake in Abbvie Inc (NYSE:ABBV).

More notable recent The J. M. Smucker Company (NYSE:SJM) news were published by: Seekingalpha.com which released: “How Safe Is J.M. Smucker’s Dividend? – Seeking Alpha” on April 09, 2019, also Seekingalpha.com with their article: “J. M. Smucker: Back In A Jif – Seeking Alpha” published on March 18, 2019, Investorplace.com published: “Can General Mills Beat the Odds Again With Wednesday’s Earnings Report? – Investorplace.com” on March 19, 2019. More interesting news about The J. M. Smucker Company (NYSE:SJM) were released by: Seekingalpha.com and their article: “J.M. Smucker lowers profit guidance – Seeking Alpha” published on November 28, 2018 as well as Seekingalpha.com‘s news article titled: “J.M. Smucker Co.: These Catalysts Could Send The Stock Higher – Seeking Alpha” with publication date: March 25, 2019.

Since November 30, 2018, it had 3 buys, and 1 insider sale for $3.09 million activity. Another trade for 20,000 shares valued at $2.06 million was made by SMUCKER RICHARD K on Friday, November 30. 500 shares were bought by DINDO KATHRYN W, worth $46,100. Lemmon David J sold $94,571 worth of The J. M. Smucker Company (NYSE:SJM) on Monday, December 31.

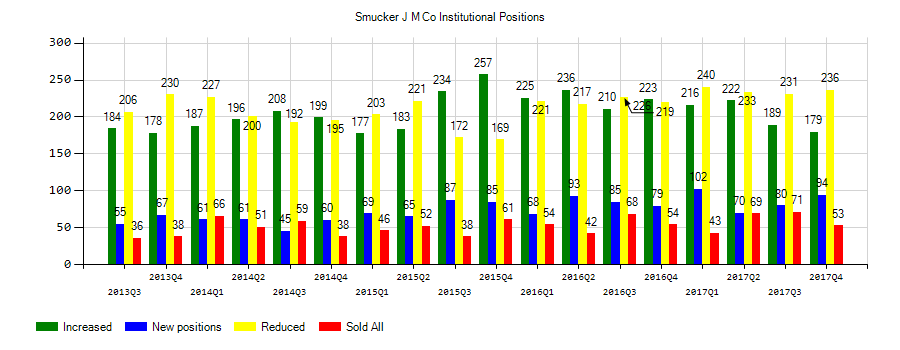

Investors sentiment decreased to 0.76 in Q4 2018. Its down 0.15, from 0.91 in 2018Q3. It fall, as 80 investors sold SJM shares while 222 reduced holdings. 63 funds opened positions while 168 raised stakes. 89.73 million shares or 3.62% more from 86.60 million shares in 2018Q3 were reported. Regions Financial reported 0.01% in The J. M. Smucker Company (NYSE:SJM). Vanguard Gru invested 0.06% in The J. M. Smucker Company (NYSE:SJM). Legg Mason Asset Mngmt (Japan) Ltd reported 0.34% of its portfolio in The J. M. Smucker Company (NYSE:SJM). Wesbanco Bankshares reported 0.03% in The J. M. Smucker Company (NYSE:SJM). 4,054 were reported by Johnson Fin Gp. 99,982 are owned by Hsbc Holdg Public Ltd Company. 16,842 were accumulated by Sigma Inv Mngmt. New York-based Neuberger Berman Grp Inc Limited Liability Com has invested 0% in The J. M. Smucker Company (NYSE:SJM). Scotia Capital has invested 0.05% in The J. M. Smucker Company (NYSE:SJM). Mastrapasqua Asset Mngmt holds 0.28% of its portfolio in The J. M. Smucker Company (NYSE:SJM) for 13,275 shares. Usca Ria Ltd Com reported 9,422 shares. Texas Permanent School Fund holds 0.04% or 22,881 shares in its portfolio. M&R Capital Mgmt accumulated 1 shares or 0% of the stock. Stratos Wealth Prtnrs Ltd reported 8,123 shares. Tarbox Family Office holds 0.18% or 4,623 shares in its portfolio.

Bridgecreek Investment Management Llc, which manages about $625.00 million and $374.54 million US Long portfolio, upped its stake in Svb Financial Group (NASDAQ:SIVB) by 16,275 shares to 17,940 shares, valued at $3.41 million in 2018Q4, according to the filing.

Analysts await Paycom Software, Inc. (NYSE:PAYC) to report earnings on May, 7. They expect $0.89 EPS, up 28.99% or $0.20 from last year’s $0.69 per share. PAYC’s profit will be $52.04 million for 53.06 P/E if the $0.89 EPS becomes a reality. After $0.55 actual EPS reported by Paycom Software, Inc. for the previous quarter, Wall Street now forecasts 61.82% EPS growth.

More notable recent Paycom Software, Inc. (NYSE:PAYC) news were published by: Globenewswire.com which released: “Paycom Places First at HR.com’s Leadership Excellence and Development Awards – GlobeNewswire” on March 18, 2019, also Businesswire.com with their article: “Paycom Software, Inc. Announces First Quarter 2019 Earnings Release Date and Conference Call – Business Wire” published on April 11, 2019, published: “Paycom Surges But These Analysts Remain Sidelined (NYSE:PAYC) – Benzinga” on February 06, 2019. More interesting news about Paycom Software, Inc. (NYSE:PAYC) were released by: Seekingalpha.com and their article: “Paycom: Standing Out In All The Metrics – Seeking Alpha” published on February 27, 2019 as well as Seekingalpha.com‘s news article titled: “Paycom +5% on Q4 beats, upside guide – Seeking Alpha” with publication date: February 05, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.