Tsp Capital Management Group Llc increased its stake in Sibanye Stillwater (SBGL) by 20.41% based on its latest 2018Q4 regulatory filing with the SEC. Tsp Capital Management Group Llc bought 305,540 shares as the company’s stock rose 62.60% with the market. The institutional investor held 1.80 million shares of the precious metals company at the end of 2018Q4, valued at $5.10 million, up from 1.50 million at the end of the previous reported quarter. Tsp Capital Management Group Llc who had been investing in Sibanye Stillwater for a number of months, seems to be bullish on the $2.16 billion market cap company. The stock decreased 0.13% or $0.005 during the last trading session, reaching $3.855. About 616,062 shares traded. Sibanye Gold Limited (NYSE:SBGL) has risen 11.60% since April 15, 2018 and is uptrending. It has outperformed by 7.23% the S&P500. Some Historical SBGL News: 31/05/2018 – Sibanye Gold: Still Confident in Rationale for Deal; 06/04/2018 – Sibanye Gold: New Facility Increased From $350M to US$600M; 14/05/2018 – BlueCrest Capital Management Takes Short Positions in Lonmin, Sibanye Gold; 31/05/2018 – SIBANYE-STILLWATER SGLJ.J – FINAL DECISION REGARDING FINANCIAL OPTIONS WILL BE ANNOUNCED SHORTLY; 31/05/2018 – SIBANYE PURSUING DELEVERAGING STRATEGY; 31/05/2018 – SIBANYE SAYS GROUP LIQUIDITY REMAINS SOUND; 06/04/2018 – SIBANYE-STILLWATER – FACILITY AGREEMENT WITH SYNDICATE OF INTERNATIONAL BANKS, LED BY BANK OF AMERICA MERRILL LYNCH INTERNATIONAL LIMITED AND HSBC BANK; 04/05/2018 – Three Workers Still Missing at Sibanye Gold Mine After Four Die; 06/04/2018 – SIBANYE-STILLWATER SGLJ.J – NEW US$600 MLN RCF REPLACES US$350 MLN RCF THAT WAS DUE TO MATURE ON 23 AUGUST 2018; 31/05/2018 – SIBANYE-STILLWATER SGLJ.J – HAS NO INTENTION TO ISSUE EQUITY IN ORDER TO REDUCE DEBT

Whetstone Capital Advisors Llc increased its stake in Amazon.Com Inc (AMZN) by 84.17% based on its latest 2018Q4 regulatory filing with the SEC. Whetstone Capital Advisors Llc bought 6,356 shares as the company’s stock rose 1.10% with the market. The hedge fund held 13,907 shares of the consumer services company at the end of 2018Q4, valued at $20.89M, up from 7,551 at the end of the previous reported quarter. Whetstone Capital Advisors Llc who had been investing in Amazon.Com Inc for a number of months, seems to be bullish on the $900.96 billion market cap company. The stock decreased 0.65% or $12.03 during the last trading session, reaching $1831.03. About 719,188 shares traded. Amazon.com, Inc. (NASDAQ:AMZN) has risen 13.57% since April 15, 2018 and is uptrending. It has outperformed by 9.20% the S&P500. Some Historical AMZN News: 16/04/2018 – BREAKING NEWS FROM CNBC’S EUGENE KIM & CHRISTINA FARR: AMAZON HAS SHELVED A PLAN TO SELL DRUGS TO HOSPITALS & INSIDERS SAY THERE ARE TWO REASONS WHY; 04/04/2018 – Variety: Canneseries: Rai’s `The Hunter’ Falls Prey to Amazon Prime Video; 04/04/2018 – Amazon Japan raises delivery fees by up to 50%: Rising costs and labor shortage may prompt other online retailers to follow suit; 26/04/2018 – Munster on $AMZN: AWS acceleration to 49% y/y revenue growth from 45% in Dec-17 and 43% in Sep-17 is testimony to a winning offering in a fast growth market. More good times for AWS ahead; 13/04/2018 – At Post Office, Amazon Isn’t the Only Big Shipper Getting Discounts; 23/03/2018 – OWNZONES Announces API Integration With Amazon Web Services (AWS) For Asset Conversion; 02/05/2018 – Sangam Iyer: AMAZON MAKES FORMAL OFFER TO BUY 60% STAKE IN FLIPKART – CNBC-TV18, CITING SOURCES– RTRS $AMZN #Flipkart; 19/05/2018 – AMZN: According to sources close to convo, USPS will likely not charge Amazon more, they have a binding contract – ! $AMZN; 20/03/2018 – Apple is now the only company more valuable than Amazon; 16/05/2018 – Parks Associates: Approximately 40% of Consumers Planning to Purchase a Smart Home Device Find Interoperability With Either Amazon Echo or Google Home Important

More notable recent Sibanye Gold Limited (NYSE:SBGL) news were published by: Seekingalpha.com which released: “Sibanye-Stillwater Bond: High-Yield In The Metals Industry Given Balanced Risks – Seeking Alpha” on March 11, 2019, also Seekingalpha.com with their article: “Despite Favorable Long-Term Outlook, I Wouldn’t Bet On Sibanye In 2018 – Seeking Alpha” published on June 18, 2018, Seekingalpha.com published: “SDRL, SBGL and CRBP among premarket gainers – Seeking Alpha” on March 19, 2019. More interesting news about Sibanye Gold Limited (NYSE:SBGL) were released by: Seekingalpha.com and their article: “Strike against Sibanye-Stillwater expanded to platinum operations – Seeking Alpha” published on January 14, 2019 as well as Seekingalpha.com‘s news article titled: “South African miners pop; Sibanye-Stillwater +7% premarket – Seeking Alpha” with publication date: October 15, 2018.

Tsp Capital Management Group Llc, which manages about $313.86 million and $178.19 million US Long portfolio, decreased its stake in Companhia Energetica De Mina (NYSE:CIG) by 152,000 shares to 1.59M shares, valued at $5.67 million in 2018Q4, according to the filing. It also reduced its holding in Merck & Co Inc (NYSE:MRK) by 4,882 shares in the quarter, leaving it with 37,386 shares, and cut its stake in Barings Global Short Duratio.

Since October 29, 2018, it had 0 insider purchases, and 10 selling transactions for $50.29 million activity. 1,230 Amazon.com, Inc. (NASDAQ:AMZN) shares with value of $1.85 million were sold by WILKE JEFFREY A. $3.21 million worth of Amazon.com, Inc. (NASDAQ:AMZN) shares were sold by Olsavsky Brian T. $2.70 million worth of Amazon.com, Inc. (NASDAQ:AMZN) was sold by Jassy Andrew R. BEZOS JEFFREY P sold 16,964 shares worth $27.69 million. $285,960 worth of stock was sold by Huttenlocher Daniel P on Thursday, November 15. Another trade for 1,375 shares valued at $2.31M was sold by STONESIFER PATRICIA Q.

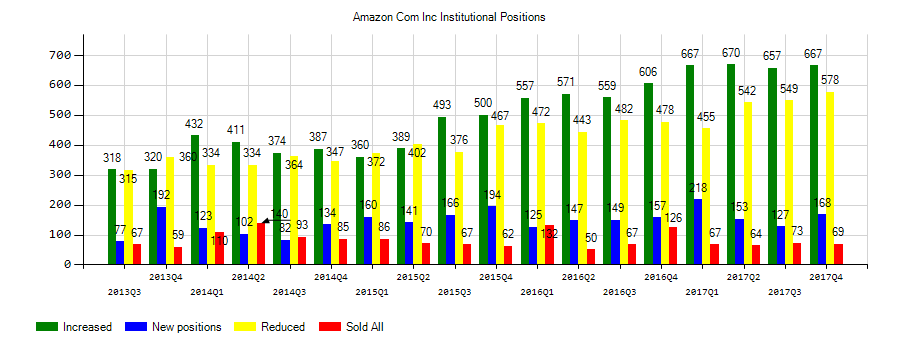

Investors sentiment increased to 1.55 in 2018 Q4. Its up 0.37, from 1.18 in 2018Q3. It is positive, as 93 investors sold AMZN shares while 536 reduced holdings. 184 funds opened positions while 793 raised stakes. 371.97 million shares or 42.70% more from 260.67 million shares in 2018Q3 were reported. Philadelphia Trust holds 0.12% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 761 shares. Aviance Cap Prtnrs Limited Liability Corp holds 0.74% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 1,405 shares. Boston Limited Co invested in 19,891 shares. Washington Tru Savings Bank holds 1,395 shares. Commerzbank Aktiengesellschaft Fi owns 670,083 shares or 10.96% of their US portfolio. Moreover, Tower Llc (Trc) has 1.55% invested in Amazon.com, Inc. (NASDAQ:AMZN). Robecosam Ag stated it has 0.08% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN). Connor Clark & Lunn Inv Ltd invested in 0.68% or 65,985 shares. Wolverine Asset Mgmt Ltd Liability Corp holds 5,275 shares or 0.1% of its portfolio. 4,743 are held by Campbell Newman Asset Management Inc. Seabridge Inv Advsr Ltd Company owns 272 shares for 0.15% of their portfolio. State Street Corp owns 15.77 million shares or 2.16% of their US portfolio. Cypress Funds Lc invested 11.61% in Amazon.com, Inc. (NASDAQ:AMZN). Cypress Mgmt Limited Liability Co (Wy) owns 1.66% invested in Amazon.com, Inc. (NASDAQ:AMZN) for 576 shares. Cobblestone Cap Ltd Ny reported 12,932 shares or 2% of all its holdings.

More notable recent Amazon.com, Inc. (NASDAQ:AMZN) news were published by: Fool.com which released: “A Few Things to Know About the (Potential) Yankees/YES Deal – The Motley Fool” on April 14, 2019, also Globenewswire.com with their article: “Report: Developing Opportunities within Amazon, Walmart, Extreme Networks, Ciena, Nova Measuring Instruments, and Maiden — Future Expectations, Projections Moving into 2019 – GlobeNewswire” published on April 15, 2019, Nasdaq.com published: “EBAY vs. AMZN: Which Stock Is the Better Value Option? – Nasdaq” on April 10, 2019. More interesting news about Amazon.com, Inc. (NASDAQ:AMZN) were released by: and their article: “Wal-Mart Stores, Inc. (NYSE:WMT), Amazon.com, Inc. (NASDAQ:AMZN) – Today’s Pickup: Isuzu Introduces Craft Beer Truck Complete With Taps – Benzinga” published on April 09, 2019 as well as Nasdaq.com‘s news article titled: “3 Top Breakout Stocks Brimming With Potential – Nasdaq” with publication date: March 18, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.