Kirkland Lake Gold LTD.HARES (NYSE:KL) had an increase of 10.93% in short interest. KL’s SI was 899,000 shares in April as released by FINRA. Its up 10.93% from 810,400 shares previously. With 1.02M avg volume, 1 days are for Kirkland Lake Gold LTD.HARES (NYSE:KL)’s short sellers to cover KL’s short positions. The SI to Kirkland Lake Gold LTD.HARES’s float is 0.47%. The stock increased 0.19% or $0.06 during the last trading session, reaching $31.62. About 862,053 shares traded. Kirkland Lake Gold Ltd. (NYSE:KL) has risen 115.15% since April 13, 2018 and is uptrending. It has outperformed by 110.78% the S&P500. Some Historical KL News: 30/05/2018 – Kirkland Lake Gold Completes Acquisition of Shrs of Novo Resources Corp; 27/04/2018 – Kirkland Lake Gold Intersects High-Grade Mineralization at Macassa, Results Support Continued Growth in Mineral Reserves and Mineral Re; 27/04/2018 – Kirkland Lake Gold Intersects High-Grade Mineralization at Macassa, Results Support Continued Growth in Mineral Reserves and Mi; 28/03/2018 – KIRKLAND LAKE GOLD LTD KL.TO : BMO RAISES TARGET PRICE TO C$25 FROM C$24.5; 17/05/2018 – Kirkland Lake Gold Renews Normal Course Issuer Bid; 02/05/2018 – Kirkland Lake Gold Reports Solid Earnings and Cash Flow in First Quarter 2018, Announces Dividend Increase; 25/04/2018 – Kirkland Lake Gold Expands New High-Grade Zone Below Taylor Mine, Reports Mineralized Extensions Along Strike and at Depth: Upd; 10/05/2018 – Kirkland Lake Gold Enters Into Agreement to Acquire Shrs of Novo Resources Corp; 11/05/2018 – NOVO RESOURCES CORP – CONDITIONALLY AGREED TO LIFT REMAINDER OF 12-MONTH CONTRACTUAL HOLD PERIOD IN ORDER TO PERMIT PURCHASE BY KIRKLAND LAKE GOLD; 21/05/2018 – Kirkland Lake Access Event Scheduled By National Bank Financial

Thornburg Investment Management Inc increased Amazon.Com Inc (AMZN) stake by 13.65% reported in 2018Q4 SEC filing. Thornburg Investment Management Inc acquired 2,235 shares as Amazon.Com Inc (AMZN)’s stock rose 1.10%. The Thornburg Investment Management Inc holds 18,609 shares with $27.95M value, up from 16,374 last quarter. Amazon.Com Inc now has $905.32B valuation. The stock decreased 0.05% or $1.01 during the last trading session, reaching $1843.06. About 2.83M shares traded. Amazon.com, Inc. (NASDAQ:AMZN) has risen 13.57% since April 13, 2018 and is uptrending. It has outperformed by 9.20% the S&P500. Some Historical AMZN News: 20/03/2018 – Amazon Prime Video Announces “All or Nothing” Banner for Upcoming Global Sports Docuseries; 08/03/2018 – Uber has hired a top Amazon voice exec as head of product as Daniel Graf departs Assaf Ronen has been running the e-commerce giant’s voice shopping efforts; 09/03/2018 – Amazon, which closed at $60.49 per share on March 9, 2009, has risen more than 2,000 percent since then; 07/03/2018 – AMAZON.COM INC AMZN.O – ANNOUNCED PLANS FOR FIRST MISSOURI FULFILLMENT CENTER TO BE LOCATED IN ST. PETERS; 21/05/2018 – MEDIA-Amazon in talks to buy stake in India’s Future Retail – FactorDaily; 29/04/2018 – Walmart in Advanced Discussions to Invest In India’s Flipkart; 26/03/2018 – British PM May says EU looking at interim taxes on digital firms; 05/04/2018 – Tech helped lead the move higher, with Facebook jumping 3.7 percent and Netflix, Amazon and Alphabet all rising more than 1 percent; 28/03/2018 – FB, AMZN: Trump hates Amazon, not Facebook; 25/04/2018 – The Financial Brand Forum Conference Presentation from StrategyCorps: The Amazon Prime Effect

Kirkland Lake Gold Ltd. engages in the exploration and development of gold properties. The company has market cap of $6.65 billion. The firm owns and operates five underground gold mines, including the Macassa mine, the Holt mine, and the Taylor mine in Ontario, Canada; and the Fosterville Mine in Victoria and the Cosmo Mine in Northern Territory, Australia, as well as four milling facilities in Canada and Australia. It has a 24.51 P/E ratio. The firm was formerly known as Kirkland Lake Gold Inc. and changed its name to Kirkland Lake Gold Ltd. in December 2016.

More notable recent Kirkland Lake Gold Ltd. (NYSE:KL) news were published by: Seekingalpha.com which released: “Kirkland Lake Gold: What Now? – Seeking Alpha” on March 27, 2019, also Globenewswire.com with their article: “Kirkland Lake Gold Declares Quarterly Dividend Payment Toronto Stock Exchange:KL – GlobeNewswire” published on March 15, 2019, Investorplace.com published: “Investors Have Little Reason to Stick With Goldcorp Stock – Investorplace.com” on April 03, 2019. More interesting news about Kirkland Lake Gold Ltd. (NYSE:KL) were released by: Nasdaq.com and their article: “Mid-Morning Market Update: Markets Edge Lower; Walgreens Misses Q2 Views – Nasdaq” published on April 02, 2019 as well as ‘s news article titled: “Mid-Afternoon Market Update: ADMA Biologics Jumps On FDA Nod For Immunodeficiency Therapy; Evoke Pharma Shares Plummet – Benzinga” with publication date: April 02, 2019.

Thornburg Investment Management Inc decreased Expedia Group Inc (NASDAQ:EXPE) stake by 4,202 shares to 288,656 valued at $32.52 million in 2018Q4. It also reduced Hp Inc stake by 104,658 shares and now owns 1.48M shares. China Petroleum & Chem (NYSE:SNP) was reduced too.

Among 15 analysts covering Amazon.com (NASDAQ:AMZN), 15 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. Amazon.com had 22 analyst reports since October 23, 2018 according to SRatingsIntel. The rating was maintained by Bank of America on Friday, October 26 with “Buy”. The rating was maintained by Deutsche Bank on Wednesday, January 23 with “Buy”. As per Tuesday, October 23, the company rating was maintained by Jefferies. Evercore maintained Amazon.com, Inc. (NASDAQ:AMZN) rating on Monday, March 4. Evercore has “Buy” rating and $1965 target. As per Friday, February 1, the company rating was maintained by Deutsche Bank. The company was maintained on Thursday, March 21 by DA Davidson. Barclays Capital maintained it with “Overweight” rating and $1950 target in Friday, October 26 report. The stock has “Buy” rating by Morgan Stanley on Thursday, February 28. Wells Fargo maintained Amazon.com, Inc. (NASDAQ:AMZN) rating on Monday, March 18. Wells Fargo has “Buy” rating and $2100 target. The rating was maintained by Cowen & Co with “Buy” on Tuesday, March 26.

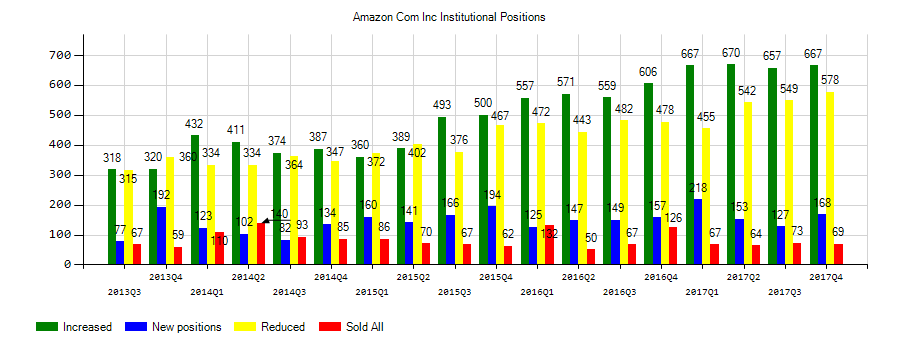

Investors sentiment increased to 1.55 in Q4 2018. Its up 0.37, from 1.18 in 2018Q3. It is positive, as 93 investors sold AMZN shares while 536 reduced holdings. 184 funds opened positions while 793 raised stakes. 371.97 million shares or 42.70% more from 260.67 million shares in 2018Q3 were reported. 118,863 were reported by Marsico Capital Mngmt. Ally Fin Inc has invested 2.16% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN). Heritage Wealth Advsrs invested 0.15% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN). Wetherby Asset Mngmt holds 8,190 shares or 1.74% of its portfolio. Bainco Int holds 3.22% or 12,403 shares. Utd American Securities Inc (D B A Uas Asset Management) accumulated 13,148 shares. Natl Insurance Tx invested in 29,070 shares or 2.55% of the stock. 2,354 are held by Convergence Invest Prns Ltd. Lynch & Associates In, Indiana-based fund reported 383 shares. Reliance Tru Of Delaware invested 0.45% in Amazon.com, Inc. (NASDAQ:AMZN). Silvercrest Asset Mngmt Limited Liability Corp holds 0.2% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 12,017 shares. Argi Investment Services Ltd Liability holds 0.07% or 754 shares in its portfolio. Fin Serv holds 0.39% or 415 shares. Ballentine Prtnrs Ltd has 0.2% invested in Amazon.com, Inc. (NASDAQ:AMZN). Ingalls Snyder Ltd Com owns 0.14% invested in Amazon.com, Inc. (NASDAQ:AMZN) for 1,726 shares.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.