Daiwa Sb Investments Ltd decreased its stake in Carnival Corp (CCL) by 52.25% based on its latest 2018Q4 regulatory filing with the SEC. Daiwa Sb Investments Ltd sold 79,800 shares as the company’s stock declined 8.69% while stock markets rallied. The institutional investor held 72,940 shares of the marine transportation company at the end of 2018Q4, valued at $3.60 million, down from 152,740 at the end of the previous reported quarter. Daiwa Sb Investments Ltd who had been investing in Carnival Corp for a number of months, seems to be less bullish one the $36.02 billion market cap company. The stock increased 0.39% or $0.2 during the last trading session, reaching $52.1. About 906,017 shares traded. Carnival Corporation (NYSE:CCL) has declined 14.28% since April 10, 2018 and is downtrending. It has underperformed by 18.65% the S&P500. Some Historical CCL News: 24/05/2018 – CARNIVAL CEO CONCLUDES REMARKS ON BLOOMBERG TV; 11/04/2018 – CARNIVAL AUTHORIZES ADDED $1B SHARE BUYBACK PROGRAM; 13/03/2018 – CARNIVAL GROUP INTERNATIONAL – EXPECTED RESULT DUE TO AN INCREASE IN REVENUE FROM PROPERTY DEVELOPMENT AND INVESTMENT BUSINESS BY NOT LESS THAN 40%; 24/04/2018 – Holland America Line Sponsors Guest Chef Night at Seattle’s FareStart Restaurant with President Orlando Ashford and Executive Team Serving Diners; 22/03/2018 – CARNIVAL CORP – IN CONSTANT CURRENCY, NET REVENUE YIELDS INCREASED 3.9 PERCENT FOR 1Q 2018; 16/04/2018 – Leonardo DiCaprio, Kourtney Kardashian Rave at Neon Carnival 2018; 15/05/2018 – Carnival Cruise Line To Offer Three Exciting Longer Length Carnival Journeys Sailings In 2019, Including 24-Day Trans-Pacific C; 28/03/2018 – CARNIVAL GROUP INTERNATIONAL HOLDINGS LTD – FY REVENUE HK$2.19 BLN VS HK$1.93 BLN; 28/03/2018 – CARNIVAL FY REVENUE HK$2.19B; 15/05/2018 – Carnival Cruise Line To Offer Three Exciting Longer Length Carnival Journeys Sailings In 2019, Including 24-Day Trans-Pacific Crossing, 13-Day Panama Canal Transit And 14-Day Hawaii Cruise

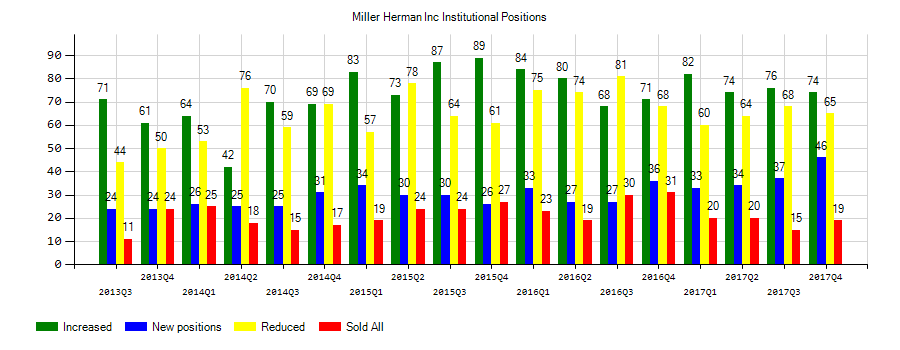

Jacobs Levy Equity Management Inc increased its stake in Miller Herman Inc (MLHR) by 20.16% based on its latest 2018Q4 regulatory filing with the SEC. Jacobs Levy Equity Management Inc bought 10,830 shares as the company’s stock rose 8.32% with the market. The institutional investor held 64,550 shares of the consumer durables company at the end of 2018Q4, valued at $1.95 million, up from 53,720 at the end of the previous reported quarter. Jacobs Levy Equity Management Inc who had been investing in Miller Herman Inc for a number of months, seems to be bullish on the $2.13B market cap company. The stock increased 0.84% or $0.3 during the last trading session, reaching $36.08. About 67,212 shares traded. Herman Miller, Inc. (NASDAQ:MLHR) has risen 1.32% since April 10, 2018 and is uptrending. It has underperformed by 3.05% the S&P500. Some Historical MLHR News: 21/03/2018 – Herman Miller 3Q Adj EPS 50c; 21/03/2018 – HERMAN MILLER 3Q ADJ EPS 50C, EST. 49C; 21/03/2018 – After-hours buzz: FIVE, MLHR & more; 07/03/2018 – Herman Miller: Lock’s Successor Will Be Named in Near Future; 07/03/2018 Herman Miller: Andrew Lock, President, Herman Miller International, Will Retire, Effective July 31; 16/05/2018 – MLHR May Face Pressure, Industry Posts 11th Consecutive Drop; 21/04/2018 – DJ Herman Miller Inc, Inst Holders, 1Q 2018 (MLHR); 21/03/2018 – Herman Miller Sees 4Q EPS 49c-EPS 53c; 21/03/2018 – HERMAN MILLER SEES 4Q EPS 56C TO 60C, EST. 70C; 21/03/2018 – Herman Miller 3Q EPS 49c

Investors sentiment decreased to 0.82 in Q4 2018. Its down 0.42, from 1.24 in 2018Q3. It dropped, as 73 investors sold CCL shares while 242 reduced holdings. 68 funds opened positions while 191 raised stakes. 391.52 million shares or 1.04% more from 387.50 million shares in 2018Q3 were reported. First Hawaiian Retail Bank holds 30,288 shares. Thomas J Herzfeld Advsrs accumulated 19,518 shares or 0.38% of the stock. Endurance Wealth Management Incorporated invested in 0% or 100 shares. Toronto Dominion Savings Bank owns 255,834 shares for 0.02% of their portfolio. Numerixs Invest invested 0.26% of its portfolio in Carnival Corporation (NYSE:CCL). Horizon Kinetics Ltd Co stated it has 0.05% in Carnival Corporation (NYSE:CCL). 733,179 were reported by Credit Suisse Ag. Manufacturers Life Insur The holds 0.02% or 393,404 shares. 1.06M were accumulated by Marshall Wace Llp. Cibc Asset owns 43,489 shares or 0.02% of their US portfolio. Acadian Asset Management Limited Liability Com invested in 288,312 shares. London Of Virginia holds 3.16% or 6.72 million shares. Financial Bank Of The West owns 5,703 shares or 0.03% of their US portfolio. Brinker has invested 0.11% of its portfolio in Carnival Corporation (NYSE:CCL). Atria Investments Llc holds 0.01% of its portfolio in Carnival Corporation (NYSE:CCL) for 5,061 shares.

More notable recent Carnival Corporation (NYSE:CCL) news were published by: Investorplace.com which released: “5 Must-See Stock Charts: Oil, JNJ, BBBY, CCL, and NIO – Investorplace.com” on March 26, 2019, also with their article: “A Peek Into The Markets: US Stock Futures Edge Higher Ahead Of Economic Data – Benzinga” published on March 13, 2019, Prnewswire.com published: “Holland America Line to Call Next Pinnacle Class Ship Ryndam – PRNewswire” on April 08, 2019. More interesting news about Carnival Corporation (NYSE:CCL) were released by: and their article: “Benzinga’s Top Upgrades, Downgrades For March 13, 2019 – Benzinga” published on March 13, 2019 as well as ‘s news article titled: “Cunard Makes Headlines at Seatrade Cruise Global with News of Badgley Mischka Capsule Collection and Expanded 2020 Alaska Season – Benzinga” with publication date: April 09, 2019.

Daiwa Sb Investments Ltd, which manages about $47.22B and $433.28M US Long portfolio, upped its stake in Zoetis Inc (NYSE:ZTS) by 11,871 shares to 148,389 shares, valued at $12.69M in 2018Q4, according to the filing. It also increased its holding in First Solar Inc (NASDAQ:FSLR) by 125,163 shares in the quarter, for a total of 260,778 shares, and has risen its stake in Paypal Holdings Inc.

Since December 26, 2018, it had 1 insider purchase, and 2 sales for $518,842 activity. $1.00 million worth of Carnival Corporation (NYSE:CCL) was bought by DONALD ARNOLD W on Wednesday, December 26. KRUSE STEIN sold $364,082 worth of stock or 6,966 shares.

Investors sentiment decreased to 0.98 in Q4 2018. Its down 0.05, from 1.03 in 2018Q3. It fall, as 22 investors sold MLHR shares while 75 reduced holdings. 36 funds opened positions while 59 raised stakes. 45.19 million shares or 0.55% less from 45.44 million shares in 2018Q3 were reported. Livforsakringsbolaget Skandia Omsesidigt has invested 0.09% of its portfolio in Herman Miller, Inc. (NASDAQ:MLHR). Germany-based Deutsche Bank Ag has invested 0.01% in Herman Miller, Inc. (NASDAQ:MLHR). Ing Groep Nv holds 0.01% or 9,095 shares. Ls Investment Advsrs Ltd Llc holds 0.01% or 3,307 shares. Zebra Mngmt has invested 0.55% of its portfolio in Herman Miller, Inc. (NASDAQ:MLHR). Texas Permanent School Fund accumulated 38,829 shares or 0.02% of the stock. New York State Common Retirement Fund reported 58,400 shares or 0% of all its holdings. Dupont Cap Mgmt has 0% invested in Herman Miller, Inc. (NASDAQ:MLHR) for 5,456 shares. Aperio Group Ltd Liability Corp accumulated 69,712 shares. Ameriprise Financial owns 567,717 shares for 0.01% of their portfolio. Alpha Windward Ltd Liability invested in 0.32% or 14,460 shares. Shelton Capital Mgmt invested in 35,423 shares or 0.07% of the stock. Moreover, Parametric Portfolio Associates Lc has 0.01% invested in Herman Miller, Inc. (NASDAQ:MLHR) for 171,096 shares. Virginia Retirement Et Al holds 0.02% or 54,500 shares. Verition Fund Mngmt Ltd Liability Corporation stated it has 11,702 shares or 0.03% of all its holdings.

More notable recent Herman Miller, Inc. (NASDAQ:MLHR) news were published by: Nasdaq.com which released: “Top-Ranked Stocks to Fill in the Sweet 16 Bracket – Nasdaq” on March 28, 2019, also Seekingalpha.com with their article: “Herman Miller Solid Growth Threatened By Uncertainty – Seeking Alpha” published on June 11, 2018, published: “A Peek Into The Markets: US Stock Futures Mixed Ahead Of Economic Reports – Benzinga” on March 21, 2019. More interesting news about Herman Miller, Inc. (NASDAQ:MLHR) were released by: Fool.com and their article: “Perspectives From Herman Miller’s Management – The Motley Fool” published on December 27, 2018 as well as Nasdaq.com‘s news article titled: “After-Hours Earnings Report for March 20, 2019 : MU, WPM, WEX, WSM, MLHR, GES, UNIT, RAVN, QADA, PANL, RYB, NTN – Nasdaq” with publication date: March 20, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.