Herald Investment Management Ltd decreased its stake in Amazon.Com Inc (AMZN) by 50% based on its latest 2018Q4 regulatory filing with the SEC. Herald Investment Management Ltd sold 1,000 shares as the company’s stock rose 1.10% with the market. The institutional investor held 1,000 shares of the consumer services company at the end of 2018Q4, valued at $1.50 million, down from 2,000 at the end of the previous reported quarter. Herald Investment Management Ltd who had been investing in Amazon.Com Inc for a number of months, seems to be less bullish one the $893.43B market cap company. The stock decreased 0.10% or $1.84 during the last trading session, reaching $1818.86. About 3.54M shares traded. Amazon.com, Inc. (NASDAQ:AMZN) has risen 13.57% since April 5, 2018 and is uptrending. It has outperformed by 9.20% the S&P500. Some Historical AMZN News: 07/03/2018 – Amazon Is Working on a Fix for Randomly Laughing Alexa Speakers; 30/05/2018 – STITCH FIX INC SFIX.O HAS NOT HAD ‘ANY SERIOUS DISCUSSIONS’ ABOUT COMBINING WITH AMAZON.COM INC AMZN.O -CEO KATRINA LAKE; 08/03/2018 – Amazon Isn’t the Only Retail Giant Trying to Remake Health Care; 18/05/2018 – Variety: `Stuber’ Scribe Tripper Clancy to Rewrite `High Five’ for Amazon Studios; 03/04/2018 – Amazon’s nascent advertising business could be worth around $20 billion in 2020, according to Alex DeGroote, a media analyst at Cenkos Securities; 08/05/2018 – Tony Romm: SCOOP: Trump admin will meet with Amazon, FB, Google and dozens of other companies’ top AI bosses on Thursday at WH; 06/03/2018 – Airbnb Hires Amazon Prime Head Greeley to Run Homes Business; 29/03/2018 – Former Walmart US CEO Bill Simon says Congress should consider splitting up Amazon; 16/05/2018 – Amazon cuts Whole Foods prices for Prime members in new grocery showdown; 01/05/2018 – AMAZON REPORTS PLANS TO EXPAND BOSTON TECH HUB & CREATE AN

Garnet Equity Capital Holdings Inc decreased its stake in Cott Corporation (COT) by 37.5% based on its latest 2018Q4 regulatory filing with the SEC. Garnet Equity Capital Holdings Inc sold 90,000 shares as the company’s stock rose 2.24% with the market. The hedge fund held 150,000 shares of the beverages (production and distribution) company at the end of 2018Q4, valued at $2.09 million, down from 240,000 at the end of the previous reported quarter. Garnet Equity Capital Holdings Inc who had been investing in Cott Corporation for a number of months, seems to be less bullish one the $2.02B market cap company. The stock increased 0.41% or $0.06 during the last trading session, reaching $14.83. About 452,657 shares traded. Cott Corporation (NYSE:COT) has declined 3.33% since April 5, 2018 and is downtrending. It has underperformed by 7.70% the S&P500. Some Historical COT News: 04/05/2018 – Cott Closes Above 200-Day Moving Average: Technicals; 03/05/2018 – Cott 1Q EBITDA $65M; 21/03/2018 – Cott Corp Successfully Completes Cash Tender Offer of Crystal Rock Holdings, Inc; 03/05/2018 – Cott Sees Full-Year 2018 Consolidated Rev at Over $2.35B; 25/04/2018 – Cott Announces Participation in Upcoming Conferences; 29/03/2018 – UK’S CMA – MERGER BETWEEN REFRESCO AND COTT WILL THEREFORE NOT BE REFERRED TO PHASE 2; 03/05/2018 – Cott 1Q EPS 3c; 29/03/2018 – CMA Won’t Refer Refresco, Cott Merger for Further Probe; 02/05/2018 – Nine Cott Directors Elected by Shareholders at Annual Meeting; 29/03/2018 – REG-Refresco receives CMA approval for integration of Cott’s UK bottling activities

Investors sentiment increased to 1.55 in Q4 2018. Its up 0.37, from 1.18 in 2018Q3. It improved, as 93 investors sold AMZN shares while 536 reduced holdings. 184 funds opened positions while 793 raised stakes. 371.97 million shares or 42.70% more from 260.67 million shares in 2018Q3 were reported. Foster Dykema Cabot & Communications Ma owns 258 shares for 0.07% of their portfolio. Gruss holds 14.58% or 7,550 shares. 134,981 are owned by Harding Loevner L P. Leonard Green And LP stated it has 0.77% in Amazon.com, Inc. (NASDAQ:AMZN). Portland Advsrs Ltd Liability holds 0.3% in Amazon.com, Inc. (NASDAQ:AMZN) or 491 shares. David R Rahn & Assoc stated it has 3.94% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN). Ubs Oconnor Limited Liability has invested 0% in Amazon.com, Inc. (NASDAQ:AMZN). Natl Bank Hapoalim Bm has 5,084 shares. Camelot Portfolios Lc has invested 0.49% in Amazon.com, Inc. (NASDAQ:AMZN). Alleghany De holds 1.87% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN) for 35,000 shares. Rathbone Brothers Public Limited invested in 4.95% or 86,053 shares. Weiss Multi holds 0.25% or 4,000 shares. Nomura Holdg holds 0.5% or 90,270 shares. Eagle Asset Mgmt invested in 0.08% or 8,098 shares. Suvretta reported 0.07% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN).

Analysts await Amazon.com, Inc. (NASDAQ:AMZN) to report earnings on April, 25. They expect $4.67 EPS, up 42.81% or $1.40 from last year’s $3.27 per share. AMZN’s profit will be $2.29 billion for 97.37 P/E if the $4.67 EPS becomes a reality. After $6.04 actual EPS reported by Amazon.com, Inc. for the previous quarter, Wall Street now forecasts -22.68% negative EPS growth.

More notable recent Amazon.com, Inc. (NASDAQ:AMZN) news were published by: Nasdaq.com which released: “Music Streaming Space Peps Up: GOOGL, AMZN & Others to Watch – Nasdaq” on March 27, 2019, also with their article: “Amazon.com, Inc. (NASDAQ:AMZN) – Amazon Launches Day-Definite Delivery Service For Business Users – Benzinga” published on March 19, 2019, Nasdaq.com published: “Technology Sector Update for 04/04/2019: AMZN,QTT,ROKU,OKTA – Nasdaq” on April 04, 2019. More interesting news about Amazon.com, Inc. (NASDAQ:AMZN) were released by: Nasdaq.com and their article: “Amazon’s CRaP Could Be Target’s Treasure – Nasdaq” published on April 04, 2019 as well as Nasdaq.com‘s news article titled: “S&P, Nasdaq Make It 5 in a Row on Tech Strength – Nasdaq” with publication date: April 03, 2019.

Since October 29, 2018, it had 0 buys, and 10 sales for $50.29 million activity. Jassy Andrew R sold 1,726 shares worth $2.70M. BEZOS JEFFREY P sold 16,964 shares worth $27.69M. Olsavsky Brian T sold $3.21 million worth of stock. On Tuesday, November 20 WILKE JEFFREY A sold $1.85 million worth of Amazon.com, Inc. (NASDAQ:AMZN) or 1,230 shares. 181 shares valued at $285,960 were sold by Huttenlocher Daniel P on Thursday, November 15. Blackburn Jeffrey M sold 2,055 shares worth $3.22M.

Since December 4, 2018, it had 3 insider buys, and 2 selling transactions for $1.16 million activity. Shares for $764,701 were bought by Hinson Charles R.. Another trade for 33,560 shares valued at $499,004 was bought by Harrington Thomas. $199,395 worth of Cott Corporation (NYSE:COT) shares were bought by STANBROOK STEVEN P.

Analysts await Cott Corporation (NYSE:COT) to report earnings on May, 2. They expect $-0.04 EPS, down 100.00% or $0.02 from last year’s $-0.02 per share. After $0.03 actual EPS reported by Cott Corporation for the previous quarter, Wall Street now forecasts -233.33% negative EPS growth.

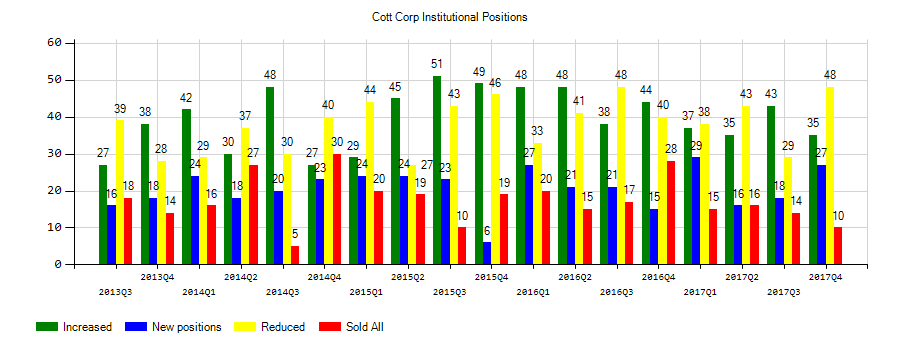

Investors sentiment decreased to 1.08 in Q4 2018. Its down 0.25, from 1.33 in 2018Q3. It fall, as 13 investors sold COT shares while 48 reduced holdings. 21 funds opened positions while 45 raised stakes. 99.22 million shares or 2.28% less from 101.53 million shares in 2018Q3 were reported. Canada Pension Plan Investment Board owns 751,410 shares. Pcj Inv Counsel accumulated 59,665 shares. Intact Inv Mngmt holds 601,200 shares. Davis has 0.09% invested in Cott Corporation (NYSE:COT). Marshall Wace Ltd Liability Partnership invested 0.14% in Cott Corporation (NYSE:COT). Td Asset Mngmt invested in 1.43M shares or 0.03% of the stock. Us Bankshares De, Minnesota-based fund reported 6,240 shares. Fil Ltd owns 41,717 shares. Dimensional Fund Limited Partnership, a Texas-based fund reported 902,874 shares. Engineers Gate Manager LP owns 0.11% invested in Cott Corporation (NYSE:COT) for 99,445 shares. First Mercantile Communication invested in 13,661 shares. Lodge Hill Capital Llc reported 373,008 shares stake. Goldman Sachs Inc has invested 0% in Cott Corporation (NYSE:COT). Dupont Capital Management Corp reported 52,955 shares or 0.02% of all its holdings. The New York-based Tiaa Cref Mgmt Ltd has invested 0% in Cott Corporation (NYSE:COT).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.