Carret Asset Management Llc increased its stake in Amazon.Com Inc (AMZN) by 81.8% based on its latest 2018Q4 regulatory filing with the SEC. Carret Asset Management Llc bought 755 shares as the company’s stock rose 1.10% with the market. The institutional investor held 1,678 shares of the consumer services company at the end of 2018Q4, valued at $2.52 million, up from 923 at the end of the previous reported quarter. Carret Asset Management Llc who had been investing in Amazon.Com Inc for a number of months, seems to be bullish on the $874.71 billion market cap company. The stock increased 0.41% or $7.33 during the last trading session, reaching $1780.75. About 3.32 million shares traded. Amazon.com, Inc. (NASDAQ:AMZN) has risen 13.57% since March 31, 2018 and is uptrending. It has outperformed by 9.20% the S&P500. Some Historical AMZN News: 28/03/2018 – Amazon loses nearly $40 billion in value on report Trump wants to ‘go after’ company’s tax treatment; 11/04/2018 – Techmeme: Despite Trump’s repeated criticism of Amazon and Washington Post, Jeff Bezos has remained silent; sources say it; 17/05/2018 – Rediff: Amazon readies plan to take on Walmart in India’s retail space; 24/05/2018 – Here’s Amazon’s explanation for the Alexa eavesdropping scandal; 19/03/2018 – AMAZON.COM INC – ANNOUNCED AMAZON GAMEON, A CROSS-PLATFORM, COMPETITIVE GAMING SERVICE FOR DEVELOPERS; 22/05/2018 – Amazon is selling facial recognition technology to police, allowing them to analyze ‘millions of faces in real-time’; 30/05/2018 – Agylstor™, a High Density Computational Storage Leader, Announces Investment From Boeing HorizonX Ventures; 06/04/2018 – Don’t count on Amazon winning the $10 billion Defense Department deal — it’s still wide open; 08/05/2018 – lnnerScope Hearing Technologies, Inc. Launches eCommerce Store on Amazon.com for its Personal Sound Amplifier Products for the Millions of Amazon Shoppers; 09/05/2018 – Selling its products on Amazon is driving traffic to Chico’s boutiques, said CEO and President Shelley Broader

Westfield Capital Management Company Lp increased its stake in Essent Group Ltd (ESNT) by 16.04% based on its latest 2018Q4 regulatory filing with the SEC. Westfield Capital Management Company Lp bought 148,425 shares as the company’s stock rose 12.80% with the market. The institutional investor held 1.07 million shares of the property-casualty insurers company at the end of 2018Q4, valued at $36.71 million, up from 925,627 at the end of the previous reported quarter. Westfield Capital Management Company Lp who had been investing in Essent Group Ltd for a number of months, seems to be bullish on the $4.27B market cap company. The stock decreased 0.93% or $0.41 during the last trading session, reaching $43.45. About 616,004 shares traded or 1.18% up from the average. Essent Group Ltd. (NYSE:ESNT) has declined 2.06% since March 31, 2018 and is downtrending. It has underperformed by 6.43% the S&P500.

Investors sentiment decreased to 1.16 in Q4 2018. Its down 0.24, from 1.4 in 2018Q3. It turned negative, as 23 investors sold ESNT shares while 74 reduced holdings. 28 funds opened positions while 85 raised stakes. 84.19 million shares or 0.15% less from 84.31 million shares in 2018Q3 were reported. Polar Cap Llp has 1.83 million shares. Howe & Rusling has invested 0% in Essent Group Ltd. (NYSE:ESNT). Waterstone Cap Limited Partnership holds 9.18% or 133,000 shares. Stone Ridge Asset Llc has invested 0.05% in Essent Group Ltd. (NYSE:ESNT). Zurcher Kantonalbank (Zurich Cantonalbank) invested 0% of its portfolio in Essent Group Ltd. (NYSE:ESNT). Hillsdale Investment Mngmt holds 0.06% or 14,100 shares in its portfolio. Sei Invests invested in 98,310 shares. Sterling Capital Mngmt Ltd has invested 0.01% of its portfolio in Essent Group Ltd. (NYSE:ESNT). Goldman Sachs Group Inc accumulated 392,811 shares or 0% of the stock. Cqs Cayman Limited Partnership holds 0.2% or 85,000 shares in its portfolio. Robeco Institutional Asset Mngmt Bv invested 0.03% of its portfolio in Essent Group Ltd. (NYSE:ESNT). Parkside Fin Bankshares And Tru, a Missouri-based fund reported 1,339 shares. Morgan Stanley, New York-based fund reported 398,343 shares. Convergence Partners Limited Liability Company owns 0.12% invested in Essent Group Ltd. (NYSE:ESNT) for 15,586 shares. Fifth Third Bancorp accumulated 0.08% or 333,711 shares.

More notable recent Essent Group Ltd. (NYSE:ESNT) news were published by: which released: “Earnings Scheduled For February 8, 2019 – Benzinga” on February 08, 2019, also Seekingalpha.com with their article: “Essent plans more insurance-linked note deals – Seeking Alpha” published on February 08, 2019, Zacks.com published: “3 Reasons Growth Investors Will Love Essent Group (ESNT) – Zacks.com” on February 06, 2019. More interesting news about Essent Group Ltd. (NYSE:ESNT) were released by: Seekingalpha.com and their article: “Essent Group (ESNT) CEO Mark Casale on Q2 2018 Results – Earnings Call Transcript – Seeking Alpha” published on August 03, 2018 as well as Seekingalpha.com‘s news article titled: “Essent Group Ltd. 2018 Q4 – Results – Earnings Call Slides – Seeking Alpha” with publication date: February 08, 2019.

Westfield Capital Management Company Lp, which manages about $17.38 billion and $11.72 billion US Long portfolio, decreased its stake in Univar Inc by 747,588 shares to 1.15M shares, valued at $20.42M in 2018Q4, according to the filing. It also reduced its holding in Raymond James Financial Inc (NYSE:RJF) by 227,306 shares in the quarter, leaving it with 595,810 shares, and cut its stake in Flowserve Corp (NYSE:FLS).

Since October 17, 2018, it had 1 buying transaction, and 3 sales for $2.23 million activity. Shares for $72,240 were bought by GLANVILLE ROBERT. $369,030 worth of Essent Group Ltd. (NYSE:ESNT) was sold by Gibbons Mary Lourdes on Tuesday, February 5.

Since October 29, 2018, it had 0 insider purchases, and 10 insider sales for $50.29 million activity. Another trade for 181 shares valued at $285,960 was made by Huttenlocher Daniel P on Thursday, November 15. Blackburn Jeffrey M sold 2,055 shares worth $3.22M. BEZOS JEFFREY P sold $5.31 million worth of stock or 3,200 shares. $3.02M worth of Amazon.com, Inc. (NASDAQ:AMZN) shares were sold by Zapolsky David. $1.85 million worth of Amazon.com, Inc. (NASDAQ:AMZN) shares were sold by WILKE JEFFREY A. $3.21 million worth of stock was sold by Olsavsky Brian T on Thursday, November 15.

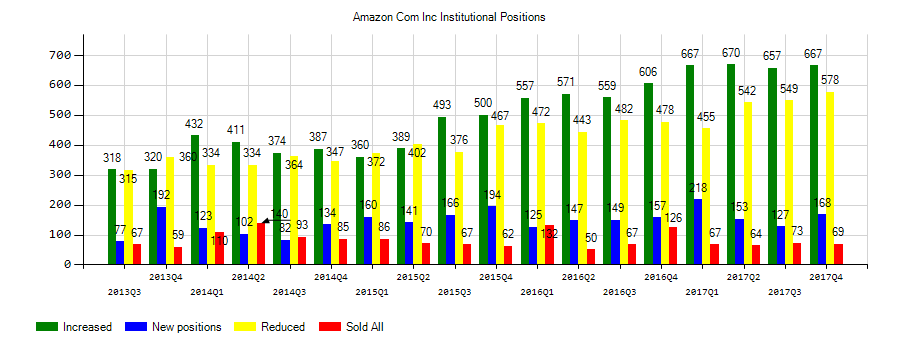

Investors sentiment increased to 1.55 in 2018 Q4. Its up 0.37, from 1.18 in 2018Q3. It increased, as 93 investors sold AMZN shares while 536 reduced holdings. 184 funds opened positions while 793 raised stakes. 371.97 million shares or 42.70% more from 260.67 million shares in 2018Q3 were reported. Live Your Vision Limited Liability Corp invested in 0% or 3 shares. Berkshire Asset Mgmt Ltd Llc Pa accumulated 1,546 shares or 0.22% of the stock. Pinnacle Wealth Mngmt Advisory Limited Liability Corp reported 0.57% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN). 3.17 million were accumulated by Natl Bank Of America Corporation De. 651 are owned by Delta Asset Mngmt Limited Liability Tn. Connor Clark Lunn Investment Mgmt Ltd invested in 0.68% or 65,985 shares. Ajo Ltd Partnership has 0.24% invested in Amazon.com, Inc. (NASDAQ:AMZN). Ny State Common Retirement Fund stated it has 2.27% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN). Tradewinds Capital Management Limited Liability Corp invested in 2,172 shares or 1.6% of the stock. Atlas Browninc stated it has 0.92% of its portfolio in Amazon.com, Inc. (NASDAQ:AMZN). 12,546 were accumulated by Fairfield Bush &. Roof Eidam Maycock Adv holds 0.13% or 186 shares in its portfolio. Brown Advisory Securities Ltd reported 4.31% in Amazon.com, Inc. (NASDAQ:AMZN). Beddow Cap Inc holds 0.22% in Amazon.com, Inc. (NASDAQ:AMZN) or 273 shares. Moreover, Klingenstein Fields & Company has 1.76% invested in Amazon.com, Inc. (NASDAQ:AMZN).

More notable recent Amazon.com, Inc. (NASDAQ:AMZN) news were published by: Nasdaq.com which released: “Buy Amazon (AMZN) Stock on Earnings Growth & E-commerce Dominance? – Nasdaq” on March 13, 2019, also Fool.com with their article: “Why Amazon Is Celebrating the Box Office Success of Jordan Peele’s “Us” – Motley Fool” published on March 27, 2019, Fool.com published: “Amazon Looks to Lose Unprofitable Items – The Motley Fool” on March 29, 2019. More interesting news about Amazon.com, Inc. (NASDAQ:AMZN) were released by: Investorplace.com and their article: “Why Amazon Stock Will Break Out of Its Trading Range – Investorplace.com” published on March 03, 2019 as well as ‘s news article titled: “Amazon (NASDAQ:AMZN), Costco (NASDAQ:COST) Make Cramer’s Shopping List — And Kroger’s Crossed Off (NYSE:KR) – Benzinga” with publication date: March 12, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.