Lincluden Management Ltd increased Enbridge Inc. (ENB) stake by 52.84% reported in 2018Q4 SEC filing. Lincluden Management Ltd acquired 802,096 shares as Enbridge Inc. (ENB)’s stock rose 8.38%. The Lincluden Management Ltd holds 2.32 million shares with $72.07M value, up from 1.52 million last quarter. Enbridge Inc. now has $74.28B valuation. The stock decreased 0.52% or $0.19 during the last trading session, reaching $36.47. About 884,673 shares traded. Enbridge Inc. (NYSE:ENB) has risen 10.22% since March 28, 2018 and is uptrending. It has outperformed by 5.85% the S&P500. Some Historical ENB News: 09/05/2018 – ENBRIDGE – UNDER TERMS , CPPIB WILL FUND ITS 49 PERCENT PRO-RATA SHARE OF REMAINING CONSTRUCTION CAPITAL REQUIRED TO COMPLETE HOHE SEE PROJECTS; 05/04/2018 – ENBRIDGE IS SAID TO SEEK PARTIAL SALE OF GERMAN WIND FARM STAKE; 03/04/2018 – Stephen Wicary: Enbridge hires RBC to sell western Canadian gas assets, sources tell @scottdeveau; 18/05/2018 – ENBRIDGE’S STINGRAY: CONTINUED ONSHORE COMPRESSION OUTAGE; 09/05/2018 – ENBRIDGE INCOME FUND HOLDINGS INC – POST TRANSACTION, FUND WILL MAINTAIN A 51 PERCENT INTEREST IN CANADIAN RENEWABLE POWER ASSETS; 27/04/2018 – Enbridge says expects Superior Terminal to resume normal ops by end of day; 09/05/2018 – ENBRIDGE INC – ENBRIDGE ANTICIPATES A MINIMAL AMOUNT OF CASH TAXES ARISING FROM SALE OF RENEWABLE ASSETS; 24/04/2018 – Enbridge Slumps as Minnesota Ruling Casts Doubt on Key Pipeline; 10/05/2018 – ENBRIDGE STARTS FIRST-QUARTER EARNINGS CONFERENCE CALL; 09/05/2018 – ENBRIDGE TO SELL 49% OF STAKE IN SOME POWER ASSETS FOR $1.75B

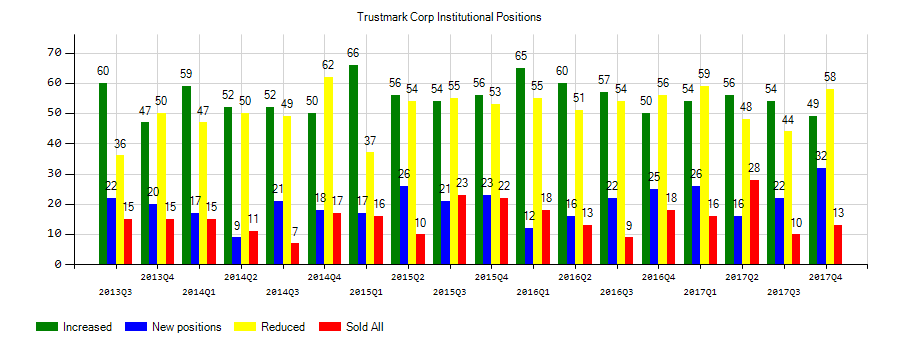

Trustmark Corp (TRMK) investors sentiment decreased to 0.97 in Q4 2018. It’s down -0.36, from 1.33 in 2018Q3. The ratio has worsened, as 70 active investment managers increased or started new stock positions, while 72 reduced and sold positions in Trustmark Corp. The active investment managers in our database now hold: 43.97 million shares, down from 47.56 million shares in 2018Q3. Also, the number of active investment managers holding Trustmark Corp in top ten stock positions decreased from 1 to 0 for a decrease of 1. Sold All: 16 Reduced: 56 Increased: 47 New Position: 23.

Trustmark Corporation operates as the bank holding firm for Trustmark National Bank that provides banking and other financial solutions to individuals and corporate institutions in the United States. The company has market cap of $2.17 billion. The firm offers checking, savings, and money market accounts; individual retirement accounts; certificates of deposits; financing for commercial and industrial projects, income producing commercial real estate, owner-occupied real estate, and construction and land development; and installment and real estate loans, and lines of credit. It has a 15.12 P/E ratio. It also provides mortgage banking services, including construction financing, production of conventional and government insured mortgages, and secondary marketing and mortgage servicing; overdraft facilities; safe deposit boxes; and treasury management services.

Analysts await Trustmark Corporation (NASDAQ:TRMK) to report earnings on April, 23. They expect $0.51 earnings per share, down 5.56% or $0.03 from last year’s $0.54 per share. TRMK’s profit will be $33.10 million for 16.39 P/E if the $0.51 EPS becomes a reality. After $0.55 actual earnings per share reported by Trustmark Corporation for the previous quarter, Wall Street now forecasts -7.27% negative EPS growth.

Since January 1, 0001, it had 0 insider buys, and 4 selling transactions for $242,436 activity.

Trustmark National Bank Trust Department holds 0.72% of its portfolio in Trustmark Corporation for 221,472 shares. Earnest Partners Llc owns 2.29 million shares or 0.71% of their US portfolio. Moreover, Parametrica Management Ltd has 0.57% invested in the company for 16,285 shares. The Pennsylvania-based Somerset Trust Co has invested 0.24% in the stock. Diligent Investors Llc, a California-based fund reported 11,264 shares.

The stock increased 0.09% or $0.03 during the last trading session, reaching $33.43. About 60,478 shares traded. Trustmark Corporation (TRMK) has risen 13.48% since March 28, 2018 and is uptrending. It has outperformed by 9.11% the S&P500. Some Historical TRMK News: 29/05/2018 – Trustmark Closes Below 200-Day Moving Average: Technicals; 13/03/2018 – A.M. Best Affirms Credit Ratings of Trustmark Group, Inc. and Its Subsidiaries; 24/04/2018 – TRUSTMARK CORP QTRLY REVENUE, EXCLUDING INTEREST AND FEES ON ACQUIRED LOANS, INCREASED 4.0% YEAR-OVER-YEAR TO TOTAL $144.0 MLN; 24/04/2018 – TRUSTMARK 1Q NET INTEREST MARGIN 3.37%, EST. 3.41%; 15/03/2018 – S&PGR Lowers Trustmark Corp. L-T Rtg To ‘BBB’; Outlook Stable; 22/04/2018 – DJ Trustmark Corporation, Inst Holders, 1Q 2018 (TRMK); 12/03/2018 Judy Greffin Joins Trustmark Board of Directors; 15/03/2018 – S&P REVISES TRUSTMARK NATIONAL BANK TO RATING ‘BBB+’ FROM ‘A-‘; 21/05/2018 – Bradley Bodell Joins Trustmark as Chief Information Officer; 05/04/2018 – S&PGR Affirms 2 Trustmark National Bank-Related LOC Bonds Rtgs

More notable recent Trustmark Corporation (NASDAQ:TRMK) news were published by: Nasdaq.com which released: “Trustmark Corporation (TRMK) Ex-Dividend Date Scheduled for February 28, 2019 – Nasdaq” on February 27, 2019, also with their article: “Benzinga’s Top Upgrades, Downgrades For March 20, 2019 – Benzinga” published on March 20, 2019, Zacks.com published: “Trustmark (TRMK) Earnings Expected to Grow: Should You Buy? – Zacks.com” on January 16, 2019. More interesting news about Trustmark Corporation (NASDAQ:TRMK) were released by: Nasdaq.com and their article: “Trustmark Corporation (TRMK) Ex-Dividend Date Scheduled for May 31, 2018 – Nasdaq” published on May 30, 2018 as well as Bizjournals.com‘s news article titled: “Mississippi bank expands presence in metro Birmingham with Homewood office – Birmingham Business Journal” with publication date: February 25, 2019.

Lincluden Management Ltd decreased Wal Mart Stores Inc (NYSE:WMT) stake by 4,615 shares to 40,593 valued at $3.78 million in 2018Q4. It also reduced Royal Dutch Shell stake by 78,239 shares and now owns 91,326 shares. Wells Fargo & Co New (NYSE:WFC) was reduced too.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.