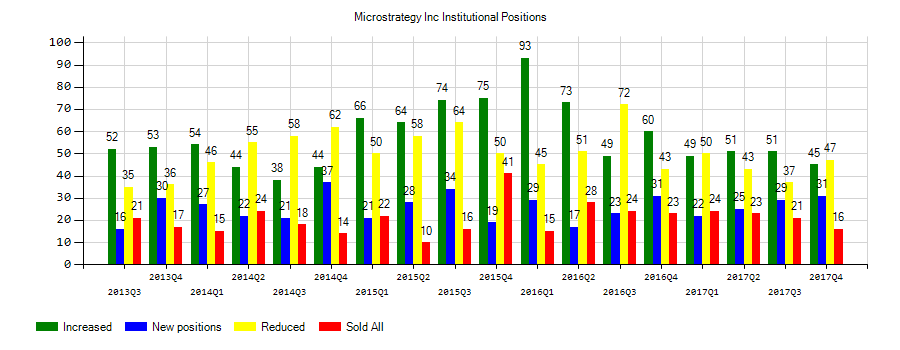

Horrell Capital Management Inc increased Microstrategy Inc (MSTR) stake by 26.29% reported in 2018Q4 SEC filing. Horrell Capital Management Inc acquired 9,200 shares as Microstrategy Inc (MSTR)’s stock rose 9.30%. The Horrell Capital Management Inc holds 44,200 shares with $5.65 million value, up from 35,000 last quarter. Microstrategy Inc now has $1.49B valuation. The stock increased 1.18% or $1.7 during the last trading session, reaching $145.32. About 22,794 shares traded. MicroStrategy Incorporated (NASDAQ:MSTR) has risen 12.46% since March 28, 2018 and is uptrending. It has outperformed by 8.09% the S&P500. Some Historical MSTR News: 25/04/2018 – Investor Expectations to Drive Momentum within MicroStrategy, Marcus & Millichap, Gentex, Ultragenyx Pharmaceutical, Dave & Bus; 26/04/2018 – MICROSTRATEGY 1Q REV. $123.0M, EST. $120.0M; 15/05/2018 – Mobile Engagement Provider Vibes Embeds MicroStrategy to Help Companies Increase Return on Marketing; 15/05/2018 – Glenhill Advisors LLC Exits Position in MicroStrategy; 18/05/2018 – MicroStrategy Closes Above 50-Day Moving Average: Technicals; 27/04/2018 – MicroStrategy Closes Below 50-Day Moving Average: Technicals; 26/04/2018 – MICROSTRATEGY 1Q EPS 15C, EST. 27C; 10/05/2018 – MicroStrategy Receives Highest Product Scores in 3 of 5 Use Cases in Gartner 2018 Critical Capabilities Report; 26/04/2018 – MicroStrategy 1Q EPS 15c; 21/04/2018 – DJ MicroStrategy Incorporated Class A, Inst Holders, 1Q 2018 (MSTR)

Streamline Health Solutions Inc (NASDAQ:STRM) had a decrease of 7.23% in short interest. STRM’s SI was 7,700 shares in March as released by FINRA. Its down 7.23% from 8,300 shares previously. With 10,200 avg volume, 1 days are for Streamline Health Solutions Inc (NASDAQ:STRM)’s short sellers to cover STRM’s short positions. The SI to Streamline Health Solutions Inc’s float is 0.09%. The stock increased 9.99% or $0.0999 during the last trading session, reaching $1.0999. About 1,854 shares traded. Streamline Health Solutions, Inc. (NASDAQ:STRM) has declined 37.36% since March 28, 2018 and is downtrending. It has underperformed by 41.73% the S&P500. Some Historical STRM News: 22/03/2018 – FCC: FCC Proposes to Streamline TV Satellite Reauthorizations – News Release – Mar 22, 2018; 10/05/2018 – FCC Proposes Rules to Streamline FM Translator Interference Complaint; 04/04/2018 – SnapGene and VectorBuilder Partner to Streamline DNA Cloning; 27/03/2018 – Lubbock Christian University Selects Campus Management’s Full Enterprise Suite to Transform Student Experience and Streamline Business Processes; 23/03/2018 – FCC: FCC Moves to Streamline Satellite TV Reauthorizations – Notice of Proposed Rulemaking – Mar 23, 2018; 23/03/2018 – FCC: FCC Moves to Streamline Satellite TV Reauthorizations – Clyburn Statement – Mar 23, 2018; 10/05/2018 – FCC Proposes Rules to Streamline FM Translator Interference Complaints; 03/05/2018 – GMP CEO SEES FURTHER OPPORTUNITIES TO STREAMLINE BUSINESS; 03/04/2018 – CORRECTING and REPLACING ? Vecna Robotics Partners with RightHand Robotics to Streamline Intralogistics and Material Handling; 15/03/2018 – THE CO-OPERATORS AND CENTRAL 1 TO STREAMLINE PARTNERSHIP

Streamline Health Solutions, Inc. provides health information technology solutions and services for hospitals and health systems in the United States and Canada. The company has market cap of $21.24 million. It offers computer software solutions through its Looking Glass platform, which captures, aggregates, and translates structured and unstructured data to deliver predictive insights to its clients. It currently has negative earnings. The firm also provides patient care solutions that enable healthcare providers to enhance their patient care through individual workflows comprising clinical analytics, operating room management, physician portal, and care coordination; and health information management, coding, and clinical documentation improvement solutions, which include Web software solutions, such as content management, release of information, computer-assisted coding, CDI, abstracting, and physician query.

Investors sentiment decreased to 0.6 in 2018 Q4. Its down 2.15, from 2.75 in 2018Q3. It worsened, as 4 investors sold Streamline Health Solutions, Inc. shares while 6 reduced holdings. 3 funds opened positions while 3 raised stakes. 6.70 million shares or 29.00% more from 5.19 million shares in 2018Q3 were reported. Acadian Asset Limited Liability Co holds 0% of its portfolio in Streamline Health Solutions, Inc. (NASDAQ:STRM) for 10,142 shares. Deutsche Bancorp Ag accumulated 54 shares or 0% of the stock. Northern Corporation has 31,053 shares. Renaissance Technology Ltd Company owns 338,550 shares for 0% of their portfolio. Comm Retail Bank holds 0% or 33,000 shares in its portfolio. Raymond James Financial Serv Advsrs Inc holds 0% of its portfolio in Streamline Health Solutions, Inc. (NASDAQ:STRM) for 46,430 shares. Susquehanna Intll Gp Limited Liability Partnership owns 316,486 shares. First Manhattan reported 529 shares. Kennedy Mngmt accumulated 598,512 shares. Panagora Asset Mgmt reported 0% of its portfolio in Streamline Health Solutions, Inc. (NASDAQ:STRM). Geode Cap Llc owns 0% invested in Streamline Health Solutions, Inc. (NASDAQ:STRM) for 79,728 shares. California Employees Retirement holds 0% or 28,600 shares. Morgan Stanley holds 0% in Streamline Health Solutions, Inc. (NASDAQ:STRM) or 399 shares. Johnson Counsel invested in 0% or 135,000 shares. Harbert Fund Advisors has 1.84M shares for 1.52% of their portfolio.

Since January 8, 2019, it had 5 buys, and 0 selling transactions for $87,300 activity. $19,200 worth of Streamline Health Solutions, Inc. (NASDAQ:STRM) shares were bought by PHILLIPS JONATHAN R. Salisbury Randolph had bought 5,000 shares worth $5,000. $24,500 worth of stock was bought by Green Wyche T III on Wednesday, January 9. Sides David William bought 20,000 shares worth $19,200. Shares for $19,400 were bought by Starkey Judith.

More notable recent Streamline Health Solutions, Inc. (NASDAQ:STRM) news were published by: Nasdaq.com which released: “Friday 1/11 Insider Buying Report: STRM, YRIV – Nasdaq” on January 11, 2019, also with their article: “Earnings Preview: Streamline Health (NASDAQ:STRM) – Benzinga” published on September 11, 2018, Seekingalpha.com published: “Streamline Health Solutions, Inc. (STRM) CEO David Sides on Q3 2018 Results – Earnings Call Transcript – Seeking Alpha” on December 11, 2018. More interesting news about Streamline Health Solutions, Inc. (NASDAQ:STRM) were released by: Seekingalpha.com and their article: “Streamline Health FQ2 results shy of consensus; shares down 1% after hours – Seeking Alpha” published on September 11, 2018 as well as Seekingalpha.com‘s news article titled: “Streamline Health up 17% ahead of FQ2 earnings report – Seeking Alpha” with publication date: September 11, 2018.

Investors sentiment increased to 1.48 in 2018 Q4. Its up 0.29, from 1.19 in 2018Q3. It improved, as 14 investors sold MSTR shares while 44 reduced holdings. 25 funds opened positions while 61 raised stakes. 7.58 million shares or 5.40% less from 8.01 million shares in 2018Q3 were reported. Zurcher Kantonalbank (Zurich Cantonalbank) reported 0% in MicroStrategy Incorporated (NASDAQ:MSTR). 807 were reported by Bnp Paribas Arbitrage Sa. Sei Investments invested in 0% or 1,855 shares. Moreover, Product Prtn Lc has 0.08% invested in MicroStrategy Incorporated (NASDAQ:MSTR). Deutsche Bancorp Ag has 0.01% invested in MicroStrategy Incorporated (NASDAQ:MSTR) for 88,433 shares. New York-based Etrade Cap Management Ltd Company has invested 0.01% in MicroStrategy Incorporated (NASDAQ:MSTR). Laurion Capital Mgmt LP has invested 0.04% in MicroStrategy Incorporated (NASDAQ:MSTR). Minnesota-based Thrivent Financial For Lutherans has invested 0.03% in MicroStrategy Incorporated (NASDAQ:MSTR). Art Advsr Limited Liability holds 0.04% or 4,303 shares. National Bank Of Ny Mellon owns 119,625 shares. Pinebridge Invests LP has invested 0.02% in MicroStrategy Incorporated (NASDAQ:MSTR). Fifth Third Retail Bank holds 0% of its portfolio in MicroStrategy Incorporated (NASDAQ:MSTR) for 160 shares. Fil Ltd reported 10,500 shares or 0% of all its holdings. 129,109 were accumulated by Invesco Ltd. Loomis Sayles And Communication Ltd Partnership has invested 0% in MicroStrategy Incorporated (NASDAQ:MSTR).

More notable recent MicroStrategy Incorporated (NASDAQ:MSTR) news were published by: Nasdaq.com which released: “Noteworthy Thursday Option Activity: MSTR, STAY, HD – Nasdaq” on March 21, 2019, also Globenewswire.com with their article: “Glancy Prongay & Murray LLP Announces Investigation on Behalf of MicroStrategy Incorporated Investors (MSTR) – GlobeNewswire” published on February 26, 2019, Globenewswire.com published: “INVESTOR ALERT: Law Offices of Howard G. Smith Announces Investigation on Behalf of MicroStrategy Incorporated Investors (MSTR) – GlobeNewswire” on March 07, 2019. More interesting news about MicroStrategy Incorporated (NASDAQ:MSTR) were released by: Globenewswire.com and their article: “Research Report Identifies Chico’s FAS, Canadian National Railway, Alaska Air Group, Avnet, Taubman Centers, and MicroStrategy with Renewed Outlook — Fundamental Analysis, Calculating Forward Movement – GlobeNewswire” published on February 28, 2019 as well as Nasdaq.com‘s news article titled: “MicroStrategy Aims to Grow in 2019 – Nasdaq” with publication date: January 31, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.