First Merchants Corp increased Omnicom Group Inc Com (OMC) stake by 25.05% reported in 2018Q4 SEC filing. First Merchants Corp acquired 7,776 shares as Omnicom Group Inc Com (OMC)’s stock declined 1.37%. The First Merchants Corp holds 38,814 shares with $2.84M value, up from 31,038 last quarter. Omnicom Group Inc Com now has $16.21B valuation. The stock decreased 0.18% or $0.13 during the last trading session, reaching $72.47. About 371,895 shares traded. Omnicom Group Inc. (NYSE:OMC) has risen 2.14% since March 27, 2018 and is uptrending. It has underperformed by 2.23% the S&P500. Some Historical OMC News: 18/04/2018 – Omnicom Names Mark O’Brien as Oper Chief of Brand Consulting Group; 22/05/2018 – Adweek: HSBC Awards Global Media Business to Omnicom’s PHD; 12/04/2018 – OMNICOM TO NAME JOHN WREN CHAIRMAN; 17/04/2018 – OMNICOM 1Q REV. $3.63B, EST. $3.62B; 15/05/2018 – Omnicom Presenting at JPMorgan Conference Tomorrow; 30/05/2018 – Sorrell plots comeback with new listed company after WPP exit; 08/03/2018 – BBDO New York Launches “It’s Time To Redefine” Public Awareness Campaign; 26/04/2018 – Jenny Glover Joins Juniper Park\TBWA as Executive Creative Director; 27/03/2018 – OMNICOM GROUP: OMNICOM HEALTH GROUP BUYS ELSEVIER’S PHARMA; 16/05/2018 – The lnteger Group Announces Partnership with Argentina’s AVC Marketing

Pangaea Logistics Solutions LTD. (NASDAQ:PANL) had a decrease of 93.99% in short interest. PANL’s SI was 1,100 shares in March as released by FINRA. Its down 93.99% from 18,300 shares previously. With 5,000 avg volume, 0 days are for Pangaea Logistics Solutions LTD. (NASDAQ:PANL)’s short sellers to cover PANL’s short positions. The SI to Pangaea Logistics Solutions LTD.’s float is 0.01%. The stock increased 1.71% or $0.055 during the last trading session, reaching $3.275. About 9,191 shares traded. Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL) has risen 19.30% since March 27, 2018 and is uptrending. It has outperformed by 14.93% the S&P500. Some Historical PANL News: 10/05/2018 – PANGAEA LOGISTICS SOLUTIONS LTD PANL.O QUARTERLY REVENUE FELL 6 PCT TO $79 MLN; 09/04/2018 – PANGAEA ONCOLOGY SA PANGO.MC – AS FIRST STEP CO TO PERFORM QIAGEN TECHNOLOGY VALIDATION TASKS FOR DIAGNOSIS OF VARIOUS TUMOR TYPES; 10/05/2018 – Pangaea Logistics Solns 1Q EPS 10c; 21/03/2018 – Pangaea Logistics Solns 4Q EPS 9c; 22/03/2018 – NBG PANGAEA PANGr.AT SAYS ADJUSTED EBITDA INCREASED FROM EUR 99.4 MLN IN 2016 TO EUR 100.5 MLN IN 2017 (AN INCREASE OF 1.1 PCT); 07/03/2018 NBG PANGAEA PANGr.AT SAYS SIGNING OF FINAL AGREEMENT IS EXPECTED TO TAKE PLACE AT THE END OF 2018; 21/03/2018 – Pangaea Logistics Solutions Ltd. Reports Financial Results for the Three Months and Year Ended December 31, 2017; 21/03/2018 – Pangaea Logistics Solns 4Q Rev $102.2M; 10/05/2018 – Pangaea Logistics Solns 1Q Rev $79M; 13/04/2018 – PANGAEA LOGISTICS SOLUTIONS BUYS NEW VESSEL FOR $14.2M

More notable recent Omnicom Group Inc. (NYSE:OMC) news were published by: Streetinsider.com which released: “Omnicom Group (OMC) Announces Divestiture of MarketStar – StreetInsider.com” on March 05, 2019, also Globenewswire.com with their article: “sparks & honey Welcomes Esteemed Business Leader Indra Nooyi to Advisory Board – GlobeNewswire” published on March 26, 2019, published: “Report: Exploring Fundamental Drivers Behind Facebook, Kellogg, Omnicom Group, Universal Health Services, Shutterstock, and Antero Midstream Partners LP — New Horizons, Emerging Trends, and Upcoming Developments – GlobeNewswire” on March 04, 2019. More interesting news about Omnicom Group Inc. (NYSE:OMC) were released by: Gurufocus.com and their article: “Ketchum Named PRWeek’s Agency of the Past 20 Years – GuruFocus.com” published on March 22, 2019 as well as Gurufocus.com‘s news article titled: “Caio Bamberg Named CEO of Ketchum Brazil – GuruFocus.com” with publication date: March 14, 2019.

First Merchants Corp decreased Russell 2000 Index Etf Ishares (IWM) stake by 2,587 shares to 25,191 valued at $3.37 million in 2018Q4. It also reduced Vanguard Info Tech Etf (VGT) stake by 3,445 shares and now owns 76,000 shares. Vectren Corp Com (NYSE:VVC) was reduced too.

Since October 18, 2018, it had 0 insider buys, and 4 selling transactions for $1.10 million activity. 500 shares were sold by Hewitt Dennis E., worth $37,924 on Tuesday, October 23. 13,000 shares valued at $1.01 million were sold by Nelson Jonathan B. on Friday, October 19. $40,657 worth of Omnicom Group Inc. (NYSE:OMC) was sold by RICE LINDA JOHNSON.

Among 2 analysts covering Omnicom Group (NYSE:OMC), 1 have Buy rating, 0 Sell and 1 Hold. Therefore 50% are positive. Omnicom Group had 3 analyst reports since October 24, 2018 according to SRatingsIntel. As per Wednesday, October 24, the company rating was maintained by Citigroup. Citigroup maintained the stock with “Neutral” rating in Thursday, February 14 report. BMO Capital Markets maintained it with “Outperform” rating and $83 target in Wednesday, February 13 report.

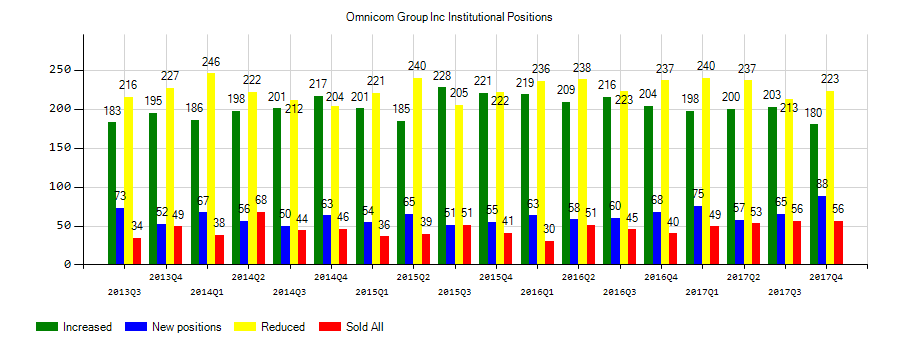

Investors sentiment increased to 0.97 in 2018 Q4. Its up 0.14, from 0.83 in 2018Q3. It improved, as 47 investors sold OMC shares while 211 reduced holdings. 77 funds opened positions while 174 raised stakes. 225.06 million shares or 0.69% less from 226.63 million shares in 2018Q3 were reported. Kbc Nv invested in 0.02% or 20,532 shares. Jpmorgan Chase Co, New York-based fund reported 459,919 shares. Tocqueville Asset Lp reported 0% of its portfolio in Omnicom Group Inc. (NYSE:OMC). Zacks Investment Mgmt invested in 0.06% or 31,942 shares. Burke Herbert Retail Bank Tru Com has invested 0.31% in Omnicom Group Inc. (NYSE:OMC). Capital Fincl Advisers invested in 0.01% or 9,484 shares. Barclays Public Ltd Company holds 693,133 shares or 0.04% of its portfolio. Commonwealth Of Pennsylvania School Empls Retrmt invested in 12,226 shares or 0.02% of the stock. Dynamic Advisor Solutions reported 0.06% of its portfolio in Omnicom Group Inc. (NYSE:OMC). 54,551 were accumulated by Gulf Bankshares (Uk). Fdx Inc has invested 0.06% in Omnicom Group Inc. (NYSE:OMC). Howe Rusling accumulated 12 shares. The France-based Axa has invested 0.07% in Omnicom Group Inc. (NYSE:OMC). Savant Capital Ltd Liability Corp invested in 0.07% or 4,468 shares. Ontario – Canada-based Tdam Usa has invested 0.09% in Omnicom Group Inc. (NYSE:OMC).

Since November 6, 2018, it had 0 buys, and 2 selling transactions for $1.31 million activity. Another trade for 10,000 shares valued at $970,235 was sold by LACERTE LAWRENCE. GRECO ROSEMARIE B sold $342,721 worth of stock or 3,750 shares.

More notable recent Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL) news were published by: Nasdaq.com which released: “Earnings Preview: Pangaea Logistics (PANL) Q4 Earnings Expected to Decline – Nasdaq” on March 13, 2019, also Seekingalpha.com with their article: “Pangaea Logistics Solutions Ltd (PANL) CEO Edward Coll on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” published on March 21, 2019, published: “Earnings Scheduled For March 20, 2019 – Benzinga” on March 20, 2019. More interesting news about Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL) were released by: Prnewswire.com and their article: “Pangaea Logistics Solutions to Report Fourth Quarter 2018 Results – PRNewswire” published on March 15, 2019 as well as Nasdaq.com‘s news article titled: “After-Hours Earnings Report for March 20, 2019 : MU, WPM, WEX, WSM, MLHR, GES, UNIT, RAVN, QADA, PANL, RYB, NTN – Nasdaq” with publication date: March 20, 2019.

Pangaea Logistics Solutions, Ltd., together with its subsidiaries, provides seaborne dry bulk transportation services to industrial clients worldwide. The company has market cap of $145.75 million. The Company’s dry bulk cargoes include grains, coal, iron ore, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite, and limestone. It has a 7.8 P/E ratio. The firm also provides cargo loading, cargo discharge, vessel chartering, voyage planning, and technical vessel management services.

Investors sentiment decreased to 1.01 in 2018 Q4. Its down 0.37, from 1.38 in 2018Q3. It dropped, as 53 investors sold Pangaea Logistics Solutions, Ltd. shares while 78 reduced holdings. 52 funds opened positions while 80 raised stakes. 51.86 million shares or 11.25% more from 46.62 million shares in 2018Q3 were reported. Deutsche National Bank Ag invested 0.02% in Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL). Kelly Lawrence W & Associates Ca invested 0.01% in Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL). Canada Pension Plan Investment Board accumulated 10 shares or 0% of the stock. Duncker Streett And Inc has invested 0.04% in Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL). 121 are owned by Clearbridge Lc. Raymond James Associates holds 34,712 shares or 0.01% of its portfolio. Eaton Vance Management stated it has 0% in Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL). Proshare Advsrs Limited Liability Co holds 0% or 6,228 shares in its portfolio. Amundi Pioneer Asset Inc holds 0.02% or 239,745 shares in its portfolio. Cambridge Invest Advsrs accumulated 3,539 shares. Utd Fin Advisers Ltd Liability Corporation reported 3,049 shares or 0% of all its holdings. Markston Ltd Liability Com holds 0% in Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL) or 35 shares. Freestone Cap Holdings Ltd Com, Washington-based fund reported 2,260 shares. Commonwealth Of Pennsylvania Public School Empls Retrmt System reported 0.01% in Pangaea Logistics Solutions, Ltd. (NASDAQ:PANL). 2,175 are owned by Koshinski Asset Management Inc.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.