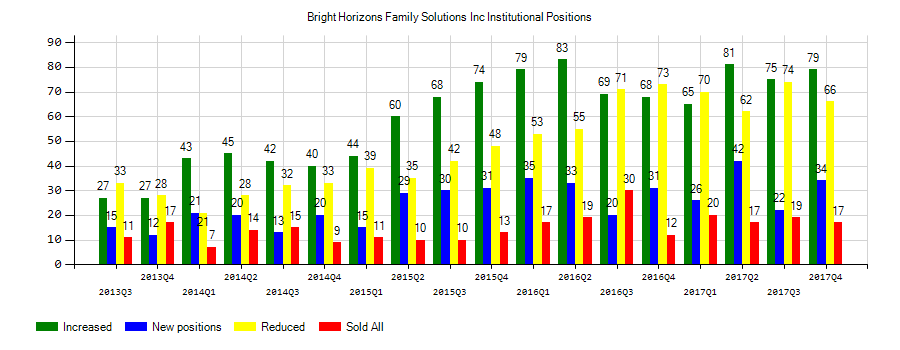

Bright Horizons Family Solutions Inc (BFAM) investors sentiment increased to 1.34 in 2018 Q4. It’s up 0.14, from 1.2 in 2018Q3. The ratio is more positive, as 131 investment professionals opened new and increased positions, while 98 sold and trimmed equity positions in Bright Horizons Family Solutions Inc. The investment professionals in our database now own: 54.55 million shares, down from 54.75 million shares in 2018Q3. Also, the number of investment professionals holding Bright Horizons Family Solutions Inc in top ten positions decreased from 2 to 1 for a decrease of 1. Sold All: 18 Reduced: 80 Increased: 93 New Position: 38.

British American Tobacco PLC (LON:BATS) stock had its “Buy” Rating kept by stock research analysts at Liberum Capital in a research note sent to investors and clients on Monday, 4 March.

Analysts await Bright Horizons Family Solutions Inc. (NYSE:BFAM) to report earnings on April, 29. They expect $0.74 earnings per share, up 8.82% or $0.06 from last year’s $0.68 per share. BFAM’s profit will be $42.97M for 42.23 P/E if the $0.74 EPS becomes a reality. After $0.85 actual earnings per share reported by Bright Horizons Family Solutions Inc. for the previous quarter, Wall Street now forecasts -12.94% negative EPS growth.

Bright Horizons Family Solutions Inc. provides child care, early education, and other services for employers and families. The company has market cap of $7.26 billion. It operates through Full Service Center-Based Child Care, Back-Up Dependent Care, and Other Educational Advisory Services divisions. It has a 46.94 P/E ratio. The Full Service Center-Based Child Care segment offers traditional center child care, preschool, and elementary education services.

The stock increased 0.28% or $0.35 during the last trading session, reaching $124.99. About 262,213 shares traded or 13.39% up from the average. Bright Horizons Family Solutions Inc. (BFAM) has risen 31.33% since March 5, 2018 and is uptrending. It has outperformed by 26.96% the S&P500. Some Historical BFAM News: 09/03/2018 Company Profile for Bright Horizons Family Solutions; 27/03/2018 – BRIGHT HORIZONS FAMILY SOLUTIONS REPORTS PRICING OF SECONDARY; 11/04/2018 – BRIGHT HORIZONS FAMILY SOLUTIONS INC BFAM.N : BMO RAISES TARGET PRICE TO $107 FROM $98; 03/04/2018 – BRIGHT HORIZONS FAMILY SOLUTIONS INC BFAM.N : RBC RAISES TARGET PRICE TO $98 FROM $95; 03/04/2018 – BRIGHT HORIZONS FAMILY SOLUTIONS INC BFAM.N : RBC CUTS TO SECTOR PERFORM FROM OUTPERFORM; 30/04/2018 – Bright Horizons Family 1Q EPS 62c; 30/04/2018 – BRIGHT HORIZONS SEES 2018 REVENUE UP 8%-10%; 30/04/2018 – BRIGHT HORIZONS 1Q ADJ EPS 72C, EST. 71C; 26/03/2018 – BRIGHT HORIZONS FAMILY SOLUTIONS INC – INTENDS TO FUND SHARE REPURCHASE WITH CASH ON HAND AND BORROWINGS UNDER ITS REVOLVING CREDIT FACILITY; 30/04/2018 – Bright Horizons Family 1Q Rev $463.7M

Kelly Lawrence W & Associates Inc Ca holds 3.1% of its portfolio in Bright Horizons Family Solutions Inc. for 128,805 shares. Welch Capital Partners Llc Ny owns 55,977 shares or 2.39% of their US portfolio. Moreover, Tokio Marine Asset Management Co Ltd has 2.06% invested in the company for 91,606 shares. The New York-based Bamco Inc Ny has invested 1.72% in the stock. Roosevelt Investment Group Inc, a New York-based fund reported 136,257 shares.

More notable recent Bright Horizons Family Solutions Inc. (NYSE:BFAM) news were published by: Seekingalpha.com which released: “Bright Horizons Family Solution Inc. (BFAM) CEO Stephen Kramer on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” on February 12, 2019, also Nasdaq.com with their article: “Market Trends Toward New Normal in MannKind, IDEX, Belden, Bright Horizons Family Solutions, Masonite International, and Veritiv — Emerging Consolidated Expectations, Analyst Ratings – Nasdaq” published on February 05, 2019, published: “Earnings Scheduled For February 12, 2019 – Benzinga” on February 12, 2019. More interesting news about Bright Horizons Family Solutions Inc. (NYSE:BFAM) were released by: Seekingalpha.com and their article: “EdTech: Smarter And Smarter – Seeking Alpha” published on March 21, 2018 as well as Seekingalpha.com‘s news article titled: “Bright Horizons Family Solutions (BFAM) Q2 2018 Results – Earnings Call Transcript – Seeking Alpha” with publication date: August 02, 2018.

More important recent British American Tobacco p.l.c. (LON:BATS) news were published by: Ft.com which released: “The London Report: BAT at seven-year low over dividend fears – Financial Times” on November 16, 2018, also published article titled: “How Cardinals’ O’Neill flexes more than his might, aims to be ‘a contact hitter with power’ – STLtoday.com”, published: “Tyler O’Neill flexes more than his might, aims to be ‘a contact hitter with power’ – STLtoday.com” on March 05, 2019. More interesting news about British American Tobacco p.l.c. (LON:BATS) was released by: and their article: “Hochman: Harper could put Cards over the top — but at what cost? – STLtoday.com” with publication date: February 14, 2019.

Among 8 analysts covering British American Tobacco PLC (LON:BATS), 5 have Buy rating, 0 Sell and 3 Hold. Therefore 63% are positive. British American Tobacco PLC has GBX 5150 highest and GBX 2700 lowest target. GBX 3931.25’s average target is 34.84% above currents GBX 2915.5 stock price. British American Tobacco PLC had 48 analyst reports since September 12, 2018 according to SRatingsIntel. On Tuesday, October 16 the stock rating was maintained by RBC Capital Markets with “Underperform”. The company was maintained on Tuesday, December 18 by Credit Suisse. On Thursday, December 13 the stock rating was maintained by Deutsche Bank with “Buy”. Credit Suisse maintained the stock with “Outperform” rating in Wednesday, November 14 report. The firm has “Overweight” rating by Barclays Capital given on Tuesday, October 23. The firm has “Buy” rating by Liberum Capital given on Wednesday, September 12. Credit Suisse maintained British American Tobacco p.l.c. (LON:BATS) on Wednesday, October 17 with “Outperform” rating. The rating was maintained by Deutsche Bank on Tuesday, October 16 with “Buy”. The firm has “Sector Performer” rating given on Thursday, November 29 by RBC Capital Markets. The rating was maintained by Liberum Capital with “Buy” on Friday, November 16.

British American Tobacco p.l.c. engages in the production and sale of tobacco products. The company has market cap of 61.95 billion GBP. It provides cigarettes and cigars; snus, a low-toxicant smokeless tobacco product; and e-cigarettes and other products, such as vapor and tobacco heating products, as well as nicotine inhalers. It has a 11.08 P/E ratio. The firm offers its products under the Dunhill, Kent, Lucky Strike, Pall Mall, Rothmans, Vogue, Viceroy, Kool, Peter Stuyvesant, Craven A, Benson & Hedges, John Player Gold Leaf, State Express 555, and Shuang Xi brands.

The stock increased 1.53% or GBX 44 during the last trading session, reaching GBX 2915.5. About 626,209 shares traded. British American Tobacco p.l.c. (LON:BATS) has 0.00% since March 5, 2018 and is . It has underperformed by 4.37% the S&P500.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.