Tributary Capital Management Llc decreased its stake in Navigant Consulting (NCI) by 41.55% based on its latest 2018Q3 regulatory filing with the SEC. Tributary Capital Management Llc sold 337,285 shares as the company’s stock declined 3.33% with the market. The institutional investor held 474,445 shares of the consumer services company at the end of 2018Q3, valued at $10.94 million, down from 811,730 at the end of the previous reported quarter. Tributary Capital Management Llc who had been investing in Navigant Consulting for a number of months, seems to be less bullish one the $857.32 million market cap company. The stock increased 0.35% or $0.07 during the last trading session, reaching $20.13. About 141,733 shares traded. Navigant Consulting, Inc. (NYSE:NCI) has risen 24.48% since March 4, 2018 and is uptrending. It has outperformed by 24.48% the S&P500. Some Historical NCI News: 12/03/2018 – Navigant Expands into Australia; 16/04/2018 – Navigant Nominates Rudina Seseri for Election to Bd of Directors; 10/04/2018 – Navigant and Baptist Health South Florida Create Joint Venture to Deliver Revenue Cycle Management Improvements in the; 03/04/2018 – Navigant Research Report Shows Intelligent Building Solutions Make Hospital Facilities More Efficient, Productive, and; 22/03/2018 – As Healthcare Becomes a Value Proposition for the Smart Home, Navigant Research Expects a Range of Opportunities for; 30/05/2018 – Navigant Research Report Shows Global Spending on Customer Engagement Through Demand Side Management (DSM) is Expected to Reach $1.1 Billion by 2027; 10/05/2018 – Navigant Announces Agreement With Engine Cap; 27/03/2018 – Navigant Research Report Shows Vehicle Electrification Market Players Are Focused on the Traction Motor; 03/05/2018 – Navigant Appoints Kai Tsai to Lead Health Plan Consulting Solutions; 12/04/2018 – Navigant Research Report Shows the Global Market for Utility Customer Information and Relationship Management Systems Is

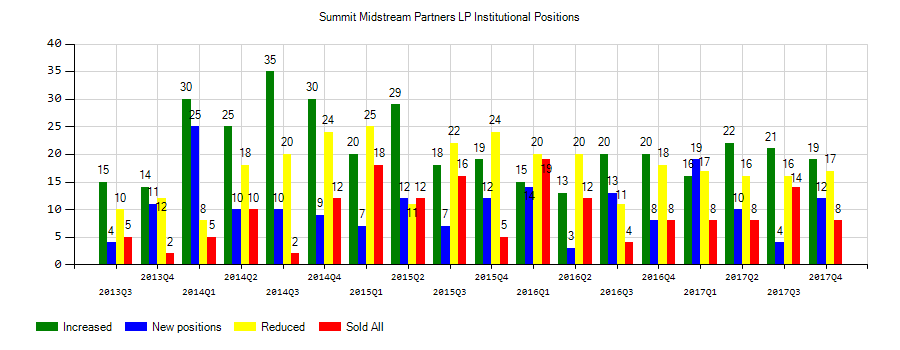

Evergreen Capital Management Llc decreased its stake in Summit Midstream Partners Lp (SMLP) by 5.62% based on its latest 2018Q3 regulatory filing with the SEC. Evergreen Capital Management Llc sold 25,946 shares as the company’s stock declined 21.30% with the market. The institutional investor held 436,114 shares of the public utilities company at the end of 2018Q3, valued at $6.24M, down from 462,060 at the end of the previous reported quarter. Evergreen Capital Management Llc who had been investing in Summit Midstream Partners Lp for a number of months, seems to be less bullish one the $756.71 million market cap company. The stock decreased 2.88% or $0.3 during the last trading session, reaching $10.11. About 294,093 shares traded. Summit Midstream Partners, LP (NYSE:SMLP) has declined 33.94% since March 4, 2018 and is downtrending. It has underperformed by 33.94% the S&P500. Some Historical SMLP News: 16/03/2018 Summit Midstream Partners, LP Responds to FERC Announcement; 03/05/2018 – SUMMIT MIDSTREAM PARTNERS LP – QTRLY TOTAL REVENUE $117.3 MLN VS $135.8 MLN; 03/05/2018 – SUMMIT MIDSTREAM PARTNERS LP SMLP.N – QTRLY LOSS PER LIMITED PARTNER UNIT $0.18; 25/05/2018 – Summit Midstream Partners, LP Announces Series A Preferred Distribution; 16/03/2018 – Summit Midstream Partners Doesn’t Expect to Be Adversely Impacted by FERC Income Tax Announcement; 16/03/2018 – SUMMIT MIDSTREAM PARTNERS LP – SMLP DOES NOT EXPECT TO BE ADVERSELY IMPACTED BY YESTERDAY’S ANNOUNCEMENT FROM FERC; 03/05/2018 – Summit Midstream Partners 1Q Rev $117.3M; 03/05/2018 – Summit Midstream Partners 1Q Loss/Shr 18c; 20/04/2018 – DJ Summit Midstream Partners LP, Inst Holders, 1Q 2018 (SMLP); 03/05/2018 – SUMMIT MIDSTREAM PARTNERS LP – ON TARGET TO DELIVER ON ITS 2018 FINANCIAL GUIDANCE

More notable recent Navigant Consulting, Inc. (NYSE:NCI) news were published by: which released: “54 Stocks Moving In Tuesday’s Mid-Day Session – Benzinga” on February 26, 2019, also with their article: “71 Biggest Movers From Yesterday – Benzinga” published on February 20, 2019, Businesswire.com published: “Navigant Recognized as 2019 Best in KLAS for Revenue Cycle Outsourcing and 2019 Category Leader for Revenue Cycle Optimization – Business Wire” on February 04, 2019. More interesting news about Navigant Consulting, Inc. (NYSE:NCI) were released by: Businesswire.com and their article: “Analysis Shows One-in-Five U.S. Rural Hospitals at High Risk of Closing Unless Financial Situation Improves – Business Wire” published on February 20, 2019 as well as Businesswire.com‘s news article titled: “Navigant to Report Fourth Quarter and Full-Year 2018 Results on February 26, 2019 – Business Wire” with publication date: February 12, 2019.

Since September 4, 2018, it had 0 buys, and 2 sales for $1.20 million activity. $72,720 worth of stock was sold by Lieberman Stephen R on Thursday, September 6.

Tributary Capital Management Llc, which manages about $1.03 billion and $905.87 million US Long portfolio, upped its stake in Splunk Inc (NASDAQ:SPLK) by 2,700 shares to 15,700 shares, valued at $1.90M in 2018Q3, according to the filing. It also increased its holding in Xpo Logistics Inc (NYSE:XPO) by 6,700 shares in the quarter, for a total of 23,100 shares, and has risen its stake in Martin Marietta Materials (NYSE:MLM).

Investors sentiment decreased to 1.01 in 2018 Q3. Its down 0.66, from 1.67 in 2018Q2. It dropped, as 17 investors sold NCI shares while 55 reduced holdings. 25 funds opened positions while 48 raised stakes. 39.53 million shares or 2.42% less from 40.52 million shares in 2018Q2 were reported. Cwm Limited Liability Corp holds 0% or 13 shares. First Hawaiian Retail Bank holds 0.03% or 21,118 shares. Symphony Asset Ltd Company has invested 0.09% of its portfolio in Navigant Consulting, Inc. (NYSE:NCI). Bridgeway Mgmt holds 0.09% of its portfolio in Navigant Consulting, Inc. (NYSE:NCI) for 380,500 shares. Stone Ridge Asset Mgmt Lc holds 0.05% or 37,055 shares. Bnp Paribas Arbitrage owns 0% invested in Navigant Consulting, Inc. (NYSE:NCI) for 5,731 shares. State Of Tennessee Treasury Department reported 24,723 shares. Boston Prns holds 0.04% or 1.38M shares in its portfolio. Texas Permanent School Fund invested in 0.01% or 28,317 shares. Jane Street Grp Inc Ltd Company holds 0% or 22,081 shares in its portfolio. State Street owns 1.31 million shares for 0% of their portfolio. Mutual Of America Cap Ltd Liability Company invested in 0% or 856 shares. Capital Fund Mgmt holds 29,900 shares. 69,400 are owned by Nordea Investment Management. Park Oh invested 0.01% in Navigant Consulting, Inc. (NYSE:NCI).

Evergreen Capital Management Llc, which manages about $1.13B US Long portfolio, upped its stake in Nomura Hldgs Inc (NYSE:NMR) by 337,716 shares to 349,016 shares, valued at $1.67M in 2018Q3, according to the filing. It also increased its holding in Ishares Inc by 18,375 shares in the quarter, for a total of 178,475 shares, and has risen its stake in Plains Gp Hldgs L P.

More notable recent Summit Midstream Partners, LP (NYSE:SMLP) news were published by: Seekingalpha.com which released: “MLPs: A Quiet Place – Seeking Alpha” on January 27, 2019, also Prnewswire.com with their article: “Summit Midstream Partners, LP Reports Third Quarter 2018 Financial Results and Provides Update for Double E Pipeline – PR Newswire” published on November 08, 2018, Seekingalpha.com published: “A 13% Yield For Patient Income Investors – Seeking Alpha” on August 24, 2018. More interesting news about Summit Midstream Partners, LP (NYSE:SMLP) were released by: Prnewswire.com and their article: “Summit Midstream Partners, LP Announces Execution of Precedent Agreement with XTO Energy Inc. for Firm Transportation Capacity on Double E Pipeline – PR Newswire” published on July 27, 2018 as well as Seekingalpha.com‘s news article titled: “Mispriced Midstream MLP With 15% Yield Plus Upside – Seeking Alpha” with publication date: May 08, 2018.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.