Prescott Group Capital Management Llc decreased its stake in Gp Strategies Corp (GPX) by 59.44% based on its latest 2018Q3 regulatory filing with the SEC. Prescott Group Capital Management Llc sold 95,108 shares as the company’s stock declined 30.24% with the market. The hedge fund held 64,910 shares of the other consumer services company at the end of 2018Q3, valued at $1.09M, down from 160,018 at the end of the previous reported quarter. Prescott Group Capital Management Llc who had been investing in Gp Strategies Corp for a number of months, seems to be less bullish one the $275.81M market cap company. The stock decreased 0.54% or $0.09 during the last trading session, reaching $16.65. About 11,884 shares traded. GP Strategies Corporation (NYSE:GPX) has declined 42.34% since March 1, 2018 and is downtrending. It has underperformed by 42.34% the S&P500. Some Historical GPX News: 03/05/2018 – GP STRATEGIES BUYS IC AXON; 03/05/2018 – GP Strategies 1Q Rev $125M; 27/03/2018 GP Strategies and Nexus Global Partner to Drive Productivity for Manufacturers; 23/04/2018 – Pembroke Management Exits Position in GP Strategies; 03/05/2018 – GP Strategies 1Q EPS 16c; 03/05/2018 – GP Strategies Acquires IC Axon Expanding Pharmaceutical And Life Sciences Capabilities; 16/05/2018 – Stonegate Digital Capital Group Strategies Generated Gross Performance of Over 439% and 1144% Since lnception with Partner Capital; 03/05/2018 – GP Strategies 1Q Net $2.63M; 05/04/2018 – GP STRATEGIES REPORTS PACT WITH MANCHESTERCF; 30/04/2018 – GM Recognizes GP Strategies for Performance, Quality, and Innovation

Kahn Brothers Group Inc increased its stake in New York Community (NYCB) by 29.29% based on its latest 2018Q3 regulatory filing with the SEC. Kahn Brothers Group Inc bought 895,314 shares as the company’s stock declined 10.88% with the market. The hedge fund held 3.95 million shares of the finance company at the end of 2018Q3, valued at $40.98 billion, up from 3.06M at the end of the previous reported quarter. Kahn Brothers Group Inc who had been investing in New York Community for a number of months, seems to be bullish on the $5.96B market cap company. The stock increased 0.56% or $0.07 during the last trading session, reaching $12.58. About 549,314 shares traded. New York Community Bancorp, Inc. (NYSE:NYCB) has declined 27.02% since March 1, 2018 and is downtrending. It has underperformed by 27.02% the S&P500. Some Historical NYCB News: 25/04/2018 – NEW YORK COMMUNITY 1Q EPS 20C, EST. 20C; 23/04/2018 – S&P REVISES NEW YORK COMMUNITY BANCORP INC. OUTLOOK TO ‘NEGATIVE’ FROM ‘STABLE’; RATING ‘BBB-‘; 25/04/2018 – NY Community Bancorp 1Q Net $106.6M; 18/04/2018 – AHRC Nassau And New York Community Bank Team Up To Increase Financial Literacy For Adults With Intellectual Disabilities; 09/05/2018 – New York Community Presenting at Barclays Conference May 16; 22/03/2018 New York Community Closes Below 50-Day Average: Technicals; 25/04/2018 – NEW YORK COMMUNITY 1Q NET INTEREST MARGIN 2.42%; 22/05/2018 – New York Community Presenting at Conference May 29; 23/04/2018 – S&PGR Revs New York Community Bancorp Outlk To Neg; Afrms Rtgs; 23/03/2018 – FITCH AFFIRMS NEW YORK COMMUNITY AT ‘BBB+’/’F2’; OUTLOOK TO NEG

Kahn Brothers Group Inc, which manages about $651.15 billion US Long portfolio, decreased its stake in Ny Times Cl A (NYSE:NYT) by 352,436 shares to 1.44M shares, valued at $33.44 billion in 2018Q3, according to the filing. It also reduced its holding in Sterling Bancorp (NYSE:STL) by 165,991 shares in the quarter, leaving it with 683,635 shares, and cut its stake in Citigroup.

Investors sentiment decreased to 0.91 in Q3 2018. Its down 0.13, from 1.04 in 2018Q2. It fall, as 40 investors sold NYCB shares while 113 reduced holdings. 53 funds opened positions while 86 raised stakes. 320.67 million shares or 4.14% more from 307.94 million shares in 2018Q2 were reported. Amp Cap Invsts reported 0.01% in New York Community Bancorp, Inc. (NYSE:NYCB). Mackay Shields Limited Company has 0% invested in New York Community Bancorp, Inc. (NYSE:NYCB). Mondrian Investment Prtn Limited stated it has 1.95% in New York Community Bancorp, Inc. (NYSE:NYCB). Tci Wealth Advsr Inc has 0.01% invested in New York Community Bancorp, Inc. (NYSE:NYCB). Macquarie Group Ltd owns 11,000 shares. Us Bancorporation De reported 42,772 shares stake. California Pub Employees Retirement Sys holds 0.02% or 1.58M shares. Stratos Wealth Prtnrs Limited reported 17,942 shares. First Allied Advisory Services Incorporated reported 32,390 shares or 0.02% of all its holdings. 2.29 million were reported by Bessemer Gp. Prentiss Smith & Com invested in 0.01% or 1,250 shares. 2.20 million were accumulated by Amf Pensionsforsakring Ab. State Street invested in 0.02% or 21.87 million shares. Caisse De Depot Et Placement Du Quebec reported 0% of its portfolio in New York Community Bancorp, Inc. (NYSE:NYCB). 638,290 are owned by Tiaa Cref Inv Llc.

More notable recent New York Community Bancorp, Inc. (NYSE:NYCB) news were published by: Fool.com which released: “Is New York Community Bancorp a Buy? – Motley Fool” on January 07, 2019, also Seekingalpha.com with their article: “New York Community Bancorp plans $300M stock buyback – Seeking Alpha” published on October 24, 2018, Seekingalpha.com published: “New York Community Bancorp rating cut to junk by S&P – Seeking Alpha” on October 26, 2018. More interesting news about New York Community Bancorp, Inc. (NYSE:NYCB) were released by: Seekingalpha.com and their article: “Updates: FCB Financial And New York Community Bancorp – Seeking Alpha” published on April 27, 2018 as well as Seekingalpha.com‘s news article titled: “Ignore The Rating Downgrade And Buy This Bank – Seeking Alpha” with publication date: October 29, 2018.

Analysts await GP Strategies Corporation (NYSE:GPX) to report earnings on March, 7. They expect $0.29 earnings per share, down 23.68% or $0.09 from last year’s $0.38 per share. GPX’s profit will be $4.80 million for 14.35 P/E if the $0.29 EPS becomes a reality. After $0.27 actual earnings per share reported by GP Strategies Corporation for the previous quarter, Wall Street now forecasts 7.41% EPS growth.

More notable recent GP Strategies Corporation (NYSE:GPX) news were published by: Prnewswire.com which released: “GP Strategies Acquires IC Axon Expanding Pharmaceutical and Life Sciences Capabilities – PR Newswire” on May 03, 2018, also Seekingalpha.com with their article: “GP Strategies Corporation 2018 Q2 – Results – Earnings Call Slides – Seeking Alpha” published on July 31, 2018, Seekingalpha.com published: “GP Strategies names new president, CFO – Seeking Alpha” on November 22, 2017. More interesting news about GP Strategies Corporation (NYSE:GPX) were released by: Gurufocus.com and their article: “GP Strategies: Buy or Beware? – GuruFocus.com” published on April 22, 2018 as well as Prnewswire.com‘s news article titled: “GP Strategies Acquires TTi Global – PRNewswire” with publication date: December 05, 2018.

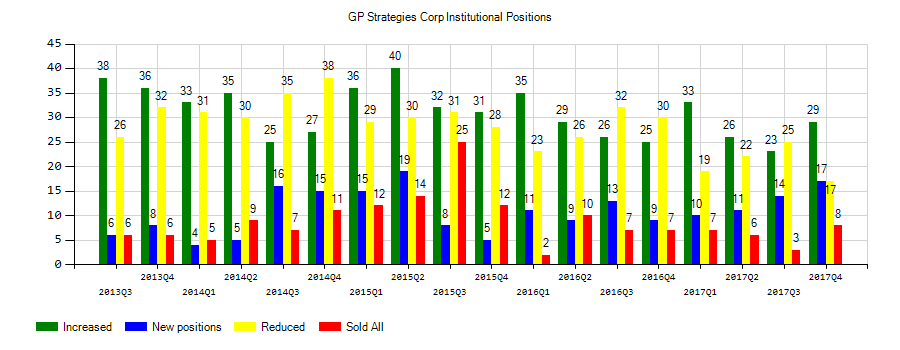

Investors sentiment decreased to 1.14 in 2018 Q3. Its down 0.07, from 1.21 in 2018Q2. It dived, as 10 investors sold GPX shares while 19 reduced holdings. 9 funds opened positions while 24 raised stakes. 14.27 million shares or 0.55% more from 14.19 million shares in 2018Q2 were reported. Neuberger Berman Group Limited Liability reported 461,753 shares. Panagora Asset Mngmt Incorporated accumulated 5,708 shares. Cubic Asset Mngmt Ltd Liability Corp has 0.06% invested in GP Strategies Corporation (NYSE:GPX) for 12,390 shares. Stratos Wealth Limited invested 0% in GP Strategies Corporation (NYSE:GPX). Zurcher Kantonalbank (Zurich Cantonalbank) stated it has 920 shares. Alphaone Inv Ser Ltd Limited Liability Company has invested 1.14% in GP Strategies Corporation (NYSE:GPX). Tiaa Cref Inv Mngmt holds 0% of its portfolio in GP Strategies Corporation (NYSE:GPX) for 52,659 shares. Moreover, Hotchkis And Wiley Management Lc has 0.01% invested in GP Strategies Corporation (NYSE:GPX). Bridgeway owns 23,000 shares for 0% of their portfolio. First Interstate Comml Bank holds 8,030 shares or 0.03% of its portfolio. Manatuck Hill Prtnrs Ltd Liability Corporation accumulated 61,400 shares or 0.39% of the stock. State Street Corporation stated it has 231,781 shares. Oppenheimer Asset Mgmt owns 0.02% invested in GP Strategies Corporation (NYSE:GPX) for 55,195 shares. Connors Investor Incorporated reported 10,000 shares. Dimensional Fund Advsrs Lp has invested 0.01% in GP Strategies Corporation (NYSE:GPX).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.