Pacifica Capital Investments Llc decreased its stake in Five Below Inc (FIVE) by 13.75% based on its latest 2018Q3 regulatory filing with the SEC. Pacifica Capital Investments Llc sold 37,882 shares as the company’s stock declined 23.62% with the market. The hedge fund held 237,641 shares of the consumer services company at the end of 2018Q3, valued at $30.91M, down from 275,523 at the end of the previous reported quarter. Pacifica Capital Investments Llc who had been investing in Five Below Inc for a number of months, seems to be less bullish one the $6.72B market cap company. The stock increased 0.56% or $0.67 during the last trading session, reaching $120.46. About 808,255 shares traded. Five Below, Inc. (NASDAQ:FIVE) has risen 51.81% since February 28, 2018 and is uptrending. It has outperformed by 51.81% the S&P500. Some Historical FIVE News: 21/03/2018 – FIVE BELOW 4Q EPS $1.21, EST. $1.17; 21/03/2018 – FIVE BELOW INC – VELLIOS WILL STAND FOR RE-ELECTION AT SHAREHOLDERS MEETING FOR A NEW THREE-YEAR TERM ON BOARD; 21/03/2018 – Five Below Sees 1Q EPS 31c-EPS 34c; 21/03/2018 – After-hours buzz: FIVE, MLHR & more; 21/03/2018 – Five Below 4Q EPS $1.21; 06/03/2018 – Five Below Increases Board Size to 1; 23/04/2018 – DJ Five Below Inc, Inst Holders, 1Q 2018 (FIVE); 21/03/2018 – FIVE BELOW INC FIVE.O FY SHR VIEW $2.36, REV VIEW $1.51 BLN — THOMSON REUTERS l/B/E/S; 18/05/2018 – Five Below Partners With Philadelphia Eagles for 2018 Eagles Autism Challenge 5K Run/Walk; 22/05/2018 – Five Below’s Above A Reasonable Price

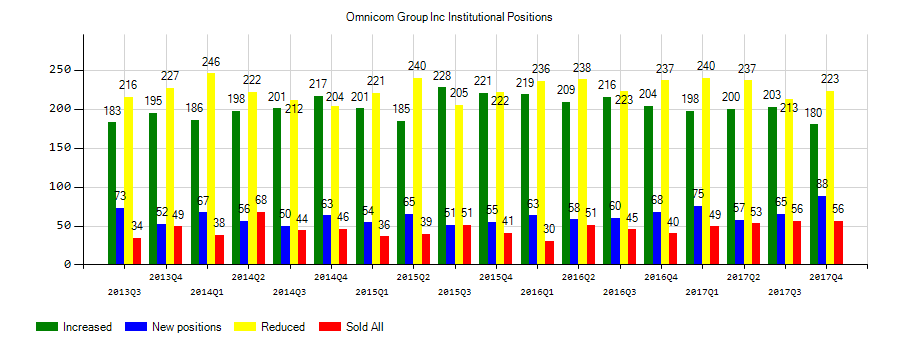

Agf Investments Inc increased its stake in Omnicom Group Inc. (OMC) by 23.31% based on its latest 2018Q3 regulatory filing with the SEC. Agf Investments Inc bought 290,807 shares as the company’s stock rose 8.95% while stock markets declined. The institutional investor held 1.54 million shares of the advertising company at the end of 2018Q3, valued at $104.63 million, up from 1.25 million at the end of the previous reported quarter. Agf Investments Inc who had been investing in Omnicom Group Inc. for a number of months, seems to be bullish on the $16.85 billion market cap company. The stock decreased 0.24% or $0.18 during the last trading session, reaching $75.34. About 1.25M shares traded. Omnicom Group Inc. (NYSE:OMC) has risen 3.76% since February 28, 2018 and is uptrending. It has outperformed by 3.76% the S&P500. Some Historical OMC News: 08/03/2018 – BBDO New York Launches “It’s Time To Redefine” Public Awareness Campaign; 17/04/2018 – Omnicom 1Q Net $264.1M; 30/05/2018 – Publicité-Sorrell fait son “comeback” après son départ de WPP; 18/04/2018 – Omnicom Names Mark O’Brien as Oper Chief of Brand Consulting Group; 18/04/2018 – Omnicom Forms Brand Consulting Group; 17/04/2018 – Omnicom 1Q EPS $1.14; 22/03/2018 – Omnicom Hosts Its Own Upfront, Turning Table on Media Sellers; 23/05/2018 – London Exchange: PRESS: WPP Loses USD400 Million HSBC Account To Omnicom – FT; 12/03/2018 – Omnicom Wins $741 Million U.S. Air Force Contract; 12/03/2018 – Omnicom’s GSD&M ldea City wins $741 mln U.S. defense contract -Pentagon

Analysts await Five Below, Inc. (NASDAQ:FIVE) to report earnings on March, 20. They expect $1.57 EPS, up 33.05% or $0.39 from last year’s $1.18 per share. FIVE’s profit will be $87.55M for 19.18 P/E if the $1.57 EPS becomes a reality. After $0.22 actual EPS reported by Five Below, Inc. for the previous quarter, Wall Street now forecasts 613.64% EPS growth.

More notable recent Five Below, Inc. (NASDAQ:FIVE) news were published by: Nasdaq.com which released: “Walmart UK buyout would stretch even KKR – Nasdaq” on February 27, 2019, also Nasdaq.com with their article: “Buy These 4 Large-Cap Value Funds for Amazing Gains – Nasdaq” published on February 26, 2019, Nasdaq.com published: “Validea’s Top Five Healthcare Stocks Based On Martin Zweig – 2/17/2019 – Nasdaq” on February 17, 2019. More interesting news about Five Below, Inc. (NASDAQ:FIVE) were released by: Nasdaq.com and their article: “Five Vale staff and contractors arrested after Brazil dam disaster – Nasdaq” published on January 29, 2019 as well as Nasdaq.com‘s news article titled: “Validea’s Top Five Energy Stocks Based On Joel Greenblatt – 2/10/2019 – Nasdaq” with publication date: February 10, 2019.

Since September 11, 2018, it had 0 insider purchases, and 4 insider sales for $5.42 million activity. $416,808 worth of stock was sold by Romanko Michael on Monday, September 24. $3.07M worth of Five Below, Inc. (NASDAQ:FIVE) was sold by SARGENT RONALD. The insider Kaufman Daniel sold 3,995 shares worth $532,070.

Investors sentiment increased to 1.01 in 2018 Q3. Its up 0.17, from 0.84 in 2018Q2. It improved, as 29 investors sold FIVE shares while 134 reduced holdings. 81 funds opened positions while 84 raised stakes. 51.76 million shares or 6.73% less from 55.49 million shares in 2018Q2 were reported. Renaissance Technology Limited Liability holds 976,200 shares. Fdx Advsr holds 0.03% in Five Below, Inc. (NASDAQ:FIVE) or 5,301 shares. Teacher Retirement System Of Texas invested in 0.01% or 6,540 shares. Hengehold Cap Limited Liability Co reported 0.06% stake. Paloma Partners Mgmt owns 7,267 shares. Benjamin F Edwards And Inc invested in 0% or 392 shares. Keybank National Association Oh stated it has 0% in Five Below, Inc. (NASDAQ:FIVE). 1,568 were reported by Engineers Gate Manager L P. Royal National Bank & Trust Of Canada reported 120,921 shares. Asset Mngmt holds 0.02% in Five Below, Inc. (NASDAQ:FIVE) or 2,770 shares. Artemis Invest Mgmt Ltd Liability Partnership, a United Kingdom-based fund reported 60,254 shares. Neuberger Berman Grp Limited reported 244,396 shares. First Bankshares Of Omaha has invested 0.05% in Five Below, Inc. (NASDAQ:FIVE). Advisory Ser Networks Lc owns 0.01% invested in Five Below, Inc. (NASDAQ:FIVE) for 917 shares. Fmr Ltd Liability accumulated 2.12 million shares or 0.03% of the stock.

Since October 18, 2018, it had 0 insider purchases, and 4 insider sales for $1.10 million activity. Hewitt Dennis E. sold $37,924 worth of Omnicom Group Inc. (NYSE:OMC) on Tuesday, October 23. $1.01 million worth of Omnicom Group Inc. (NYSE:OMC) shares were sold by Nelson Jonathan B..

Agf Investments Inc, which manages about $9.93B US Long portfolio, decreased its stake in Sun Life Financial Inc. (NYSE:SLF) by 59,003 shares to 1.02M shares, valued at $40.41M in 2018Q3, according to the filing. It also reduced its holding in Visa Inc. (NYSE:V) by 10,305 shares in the quarter, leaving it with 312,362 shares, and cut its stake in The Procter & Gamble Co. (NYSE:PG).

More recent Omnicom Group Inc. (NYSE:OMC) news were published by: which released: “12 Stocks To Watch For February 12, 2019 – Benzinga” on February 12, 2019. Also Prnewswire.com published the news titled: “Porter Novelli Names Karen Ovseyevitz Head of San Francisco – PRNewswire” on February 27, 2019. Gurufocus.com‘s news article titled: “Omnicom Agencies Begin 2019 With Prestigious Industry Award Wins – GuruFocus.com” with publication date: February 25, 2019 was also an interesting one.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.