International Value Advisers Llc increased Schlumberger Ltd. (SLB) stake by 15.8% reported in 2018Q3 SEC filing. International Value Advisers Llc acquired 375,055 shares as Schlumberger Ltd. (SLB)’s stock declined 30.03%. The International Value Advisers Llc holds 2.75 million shares with $167.44M value, up from 2.37M last quarter. Schlumberger Ltd. now has $61.54 billion valuation. The stock increased 0.42% or $0.19 during the last trading session, reaching $44.5. About 4.51 million shares traded. Schlumberger Limited (NYSE:SLB) has declined 32.38% since February 27, 2018 and is downtrending. It has underperformed by 32.38% the S&P500. Some Historical SLB News: 20/04/2018 – SCHLUMBERGER EARNINGS CONFERENCE CALL BEGINS; 14/05/2018 – Schlumberger at UBS Global Oil & Gas Conference May 22; 06/03/2018 – SCHLUMBERGER CEO CONCLUDES COMMENTS AT CERAWEEK CONFERENCE; 20/04/2018 – Schlumberger profit barely tops Street, says oil market balanced; 28/04/2018 – Russia gives tentative nod to Schlumberger’s acquisition of EDC – RIA; 06/03/2018 – CERAWEEK – SCHLUMBERGER’S KIBSGAARD SEES GROWTH IN INVESTMENTS GLOBALLY, WHICH IS RESTORING OPTIMISM; 25/04/2018 – SCHLUMBERGER NV – ON APRIL 25, 2018 HELGE LUND RESIGNED FROM BOARD OF DIRECTORS OF SCHLUMBERGER LIMITED; 20/04/2018 – SCHLUMBERGER – PRODUCTION CHALLENGES IN US SHALE ARE EMERGING THAT ARE LINKED TO INFILL DRILLING WELL-TO-WELL INTERFERENCE; 12/04/2018 – NATIONAL OIL KENYA PICKS SCHLUMBERGER TO DEVELOP LOKICHAR PLAN; 18/04/2018 – SEADRILL CEO SAYS EXPECTS JOHN FREDRIKSEN TO REMAIN LONG-TERM ‘ANCHOR SHAREHOLDER’

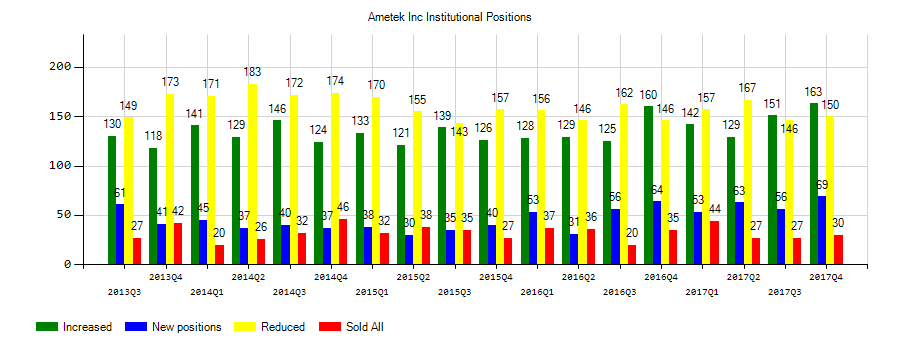

New York State Teachers Retirement System decreased Ametek Inc New (AME) stake by 2.38% reported in 2018Q3 SEC filing. New York State Teachers Retirement System sold 7,986 shares as Ametek Inc New (AME)’s stock declined 10.93%. The New York State Teachers Retirement System holds 327,351 shares with $25.90 million value, down from 335,337 last quarter. Ametek Inc New now has $18.42B valuation. The stock increased 0.26% or $0.21 during the last trading session, reaching $79.34. About 305,280 shares traded. AMETEK, Inc. (NYSE:AME) has declined 0.98% since February 27, 2018 and is downtrending. It has underperformed by 0.98% the S&P500. Some Historical AME News: 02/05/2018 – AMETEK 1Q EPS 78C, EST. 72C; 22/04/2018 – DJ AMETEK Inc, Inst Holders, 1Q 2018 (AME); 07/05/2018 – Ametek at Wells Fargo Industrials Conference Tomorrow; 02/05/2018 – Ametek Increases 2018 Guidance After First-Quarter Profit Rise; Buys SoundCom; 02/05/2018 – AMETEK BUYS SOUNDCOM SYSTEMS; 22/03/2018 – Ametek Closes Below 50-Day Moving Average: Technicals; 02/05/2018 – Ametek Sees 2Q EPS 76c-EPS 78c; 26/04/2018 – Ametek Presenting at Wells Fargo Industrials Conference May 8; 29/05/2018 – P&M Corporate Finance (PMCF) Announces the Sale of SoundCom Corporation to AMETEK, Inc. (NYSE: AME); 09/05/2018 – Matthew J. Conti Elected Vice President, Human Re

Among 4 analysts covering AMETEK (NYSE:AME), 4 have Buy rating, 0 Sell and 0 Hold. Therefore 100% are positive. AMETEK had 5 analyst reports since November 2, 2018 according to SRatingsIntel. BMO Capital Markets maintained the shares of AME in report on Friday, November 2 with “Outperform” rating. The firm has “Outperform” rating by Robert W. Baird given on Friday, November 2. The firm has “Overweight” rating given on Tuesday, December 18 by Morgan Stanley. Morgan Stanley maintained AMETEK, Inc. (NYSE:AME) on Monday, November 5 with “Equal-Weight” rating.

Since August 29, 2018, it had 1 insider buy, and 7 selling transactions for $5.28 million activity. Another trade for 2,000 shares valued at $146,290 was bought by AMATO THOMAS A. $2.44M worth of AMETEK, Inc. (NYSE:AME) shares were sold by Hardin John Wesley. Marecic Thomas C had sold 17,097 shares worth $1.35M on Wednesday, February 13. McClain Gretchen W had sold 1,920 shares worth $150,816. VARET ELIZEBETH R also sold $632,874 worth of AMETEK, Inc. (NYSE:AME) shares.

Investors sentiment increased to 1.2 in 2018 Q3. Its up 0.04, from 1.16 in 2018Q2. It increased, as 24 investors sold AME shares while 161 reduced holdings. 60 funds opened positions while 162 raised stakes. 188.53 million shares or 1.17% less from 190.75 million shares in 2018Q2 were reported. Us Commercial Bank De has invested 0% in AMETEK, Inc. (NYSE:AME). Fil Limited invested in 47,740 shares or 0.01% of the stock. Creative Planning reported 0% of its portfolio in AMETEK, Inc. (NYSE:AME). Manufacturers Life Insurance Communications The reported 649,586 shares or 0.05% of all its holdings. California-based Wells Fargo & Mn has invested 0.03% in AMETEK, Inc. (NYSE:AME). Security reported 232 shares stake. Jabre Cap Ptnrs reported 0.11% of its portfolio in AMETEK, Inc. (NYSE:AME). Rhumbline Advisers reported 444,758 shares. Raymond James Services Advsr holds 0.02% of its portfolio in AMETEK, Inc. (NYSE:AME) for 56,258 shares. Wilbanks Smith And Thomas Asset Management Limited Liability Co reported 0.01% stake. British Columbia Inv Management reported 90,098 shares. Whittier Trust reported 458 shares. Moreover, Mackenzie Fin Corporation has 0% invested in AMETEK, Inc. (NYSE:AME). 500 were accumulated by M&R Capital. Swiss Bancshares stated it has 739,393 shares or 0.07% of all its holdings.

More recent AMETEK, Inc. (NYSE:AME) news were published by: Seekingalpha.com which released: “Ametek Q4 2018 Earnings Preview – Seeking Alpha” on February 04, 2019. Also Globenewswire.com published the news titled: “Analysis: Positioning to Benefit within AMETEK, Taylor Morrison Home, MBIA, Air Products and Chemicals, CBIZ, and Aqua Metals — Research Highlights Growth, Revenue, and Consolidated Results – GlobeNewswire” on January 31, 2019. Fool.com‘s news article titled: “Ametek (AME) Q4 2018 Earnings Conference Call Transcript – Motley Fool” with publication date: February 05, 2019 was also an interesting one.

New York State Teachers Retirement System increased Wellcare Group Inc (NYSE:WCG) stake by 4,298 shares to 90,095 valued at $28.88 million in 2018Q3. It also upped American Axle & Mfg Hldgs Inc (NYSE:AXL) stake by 24,960 shares and now owns 94,302 shares. Concho Res Inc (NYSE:CXO) was raised too.

More notable recent Schlumberger Limited (NYSE:SLB) news were published by: Seekingalpha.com which released: “Trading The Slob: Schlumberger Under $40 Is Winning – Seeking Alpha” on January 29, 2019, also Seekingalpha.com with their article: “Rockwell Automation, Schlumberger form digital oilfield automation JV – Seeking Alpha” published on February 19, 2019, Seekingalpha.com published: “Schlumberger names company vet Le Peuch as new COO – Seeking Alpha” on February 08, 2019. More interesting news about Schlumberger Limited (NYSE:SLB) were released by: Globenewswire.com and their article: “Research Report Identifies Johnson & Johnson, Schlumberger, Karyopharm Therapeutics, WYNDHAM DESTINATIONS, INC, ASGN, and Suburban Propane Partners with Renewed Outlook — Fundamental Analysis, Calculating Forward Movement – GlobeNewswire” published on February 21, 2019 as well as Seekingalpha.com‘s news article titled: “Schlumberger Is Rallying On Negative News, Sign Of A Bottom? – Seeking Alpha” with publication date: January 30, 2019.

International Value Advisers Llc decreased United Technologies Corp (NYSE:UTX) stake by 17,942 shares to 638,836 valued at $89.32M in 2018Q3. It also reduced Oracle Corp (NYSE:ORCL) stake by 538,030 shares and now owns 5.70 million shares. Omnicom Group Inc. (NYSE:OMC) was reduced too.

Investors sentiment increased to 0.97 in 2018 Q3. Its up 0.01, from 0.96 in 2018Q2. It improved, as 62 investors sold SLB shares while 512 reduced holdings. 112 funds opened positions while 446 raised stakes. 1.02 billion shares or 1.46% less from 1.04 billion shares in 2018Q2 were reported. Ancora Ltd Liability reported 58,312 shares stake. Personal Advisors reported 3,382 shares stake. Harding Loevner Limited Partnership accumulated 10.89 million shares. Banced Corporation holds 0.46% of its portfolio in Schlumberger Limited (NYSE:SLB) for 4,446 shares. Cipher Ltd Partnership, a New York-based fund reported 67,662 shares. Lederer Investment Counsel Ca stated it has 0.64% in Schlumberger Limited (NYSE:SLB). Daiwa Securities Gru holds 0.03% or 52,714 shares. Stephens Incorporated Ar stated it has 0.14% of its portfolio in Schlumberger Limited (NYSE:SLB). Sirios Capital Mngmt Lp invested in 1.5% or 478,299 shares. Capital Intll Investors has 33.30 million shares. Sawgrass Asset Management Limited Liability Company holds 0.05% of its portfolio in Schlumberger Limited (NYSE:SLB) for 17,635 shares. Chesley Taft And Assocs Limited Liability Corp invested 0.19% in Schlumberger Limited (NYSE:SLB). Sun Life Fincl holds 11,481 shares or 0.13% of its portfolio. Moreover, Covington Management has 0.2% invested in Schlumberger Limited (NYSE:SLB). Stearns Financial Svcs Group Incorporated has invested 0.17% in Schlumberger Limited (NYSE:SLB).

Since September 6, 2018, it had 2 insider buys, and 2 sales for $3.20 million activity. Shares for $375,500 were bought by Schorn Patrick. 15,000 Schlumberger Limited (NYSE:SLB) shares with value of $660,000 were sold by Le Peuch Olivier. AYAT SIMON had sold 60,000 shares worth $3.40 million. MARKS MICHAEL E bought $482,480 worth of Schlumberger Limited (NYSE:SLB) on Thursday, September 6.

Among 8 analysts covering Schlumberger (NYSE:SLB), 4 have Buy rating, 0 Sell and 4 Hold. Therefore 50% are positive. Schlumberger had 10 analyst reports since September 11, 2018 according to SRatingsIntel. Jefferies maintained Schlumberger Limited (NYSE:SLB) on Wednesday, September 26 with “Buy” rating. UBS maintained it with “Buy” rating and $75 target in Monday, October 22 report. HSBC upgraded the shares of SLB in report on Monday, November 26 to “Buy” rating. Citigroup maintained the shares of SLB in report on Friday, January 4 with “Buy” rating. The stock of Schlumberger Limited (NYSE:SLB) earned “Overweight” rating by JP Morgan on Monday, September 17. Credit Suisse downgraded Schlumberger Limited (NYSE:SLB) on Wednesday, December 19 to “Neutral” rating. On Tuesday, December 11 the stock rating was downgraded by JP Morgan to “Neutral”. The stock of Schlumberger Limited (NYSE:SLB) has “Buy” rating given on Monday, October 22 by Citigroup.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.