Regal Investment Advisors Llc increased its stake in Avx Corp New (AVX) by 17.93% based on its latest 2018Q3 regulatory filing with the SEC. Regal Investment Advisors Llc bought 18,054 shares as the company’s stock declined 20.33% with the market. The institutional investor held 118,728 shares of the electrical products company at the end of 2018Q3, valued at $2.14 million, up from 100,674 at the end of the previous reported quarter. Regal Investment Advisors Llc who had been investing in Avx Corp New for a number of months, seems to be bullish on the $3.10 billion market cap company. The stock increased 0.66% or $0.12 during the last trading session, reaching $18.36. About 309,684 shares traded or 6.31% up from the average. AVX Corporation (NYSE:AVX) has declined 10.86% since February 14, 2018 and is downtrending. It has underperformed by 10.86% the S&P500. Some Historical AVX News: 04/04/2018 – AVX CORP – AVX INTERCONNECT EUROPE GMBH SIGNED AGREEMENT TO ACQUIRE KUMATEC SONDERMASCHINENBAU & KUNSTSTOFFVERARBEITUNG GMBH; 03/05/2018 – AVX Releases New High-Performance MLO Band-Pass Filters for RF/Microwave Applications; 04/04/2018 – AVX REPORTS A PACT TO BUY KUMATEC; 04/04/2018 – AVX CORP – INCLUDED IN PURCHASE IS KUMATEC’S 50% INTEREST IN KUMATEC HYDROGEN GMBH CO. KG; 09/04/2018 – AVX Releases the First Industrial Poke-Home Connector Without a Wire Stop; 30/04/2018 – AVX Completes Its Purchase of Kumatec; 30/04/2018 – AVX Earns 2017 TTI Supplier Excellence Award; 04/04/2018 – AVX Corporation Announces A Definitive Agreement To Acquire KUMATEC; 23/04/2018 – DJ AVX Corporation, Inst Holders, 1Q 2018 (AVX); 16/04/2018 – AVX to Present & Exhibit at the 2018 Components for Military & Space Electronics Conference & Exhibition

Westwood Global Investments Llc decreased its stake in America Movil Sa De Cv (AMX) by 1.13% based on its latest 2018Q3 regulatory filing with the SEC. Westwood Global Investments Llc sold 220,223 shares as the company’s stock declined 15.38% with the market. The institutional investor held 19.35M shares of the public utilities company at the end of 2018Q3, valued at $310.81M, down from 19.57 million at the end of the previous reported quarter. Westwood Global Investments Llc who had been investing in America Movil Sa De Cv for a number of months, seems to be less bullish one the $48.50 billion market cap company. The stock increased 0.48% or $0.07 during the last trading session, reaching $14.69. About 6.77M shares traded or 139.80% up from the average. América Móvil, S.A.B. de C.V. (NYSE:AMX) has declined 18.68% since February 14, 2018 and is downtrending. It has underperformed by 18.68% the S&P500. Some Historical AMX News: 19/04/2018 – IGNORE: AMERICA MOVIL POSTED 4Q EARNINGS FEB. 13; 25/04/2018 – AMERICA MOVIL ON TRACK TO ACCOMPLISH $8B BUDGET FOR CAPEX: HAJJ; 20/03/2018 – America Movil plans up to 3 bln pesos in share buybacks; 14/03/2018 – America Movil to roll out 4.5G in 76 cities by end-2018; 14/03/2018 – MEXICO’S AMERICA MOVIL’S SLIM DOMIT SAYS REGULATORY BURDEN HAS PUSHED IT TO CUT INVESTMENTS; 24/04/2018 – America Movil Sees Payments From Rivals Boost Mexico Sales; 27/03/2018 – Uruguay Mobile Market Report 2018 Forecast to 2022 – Companies Ancel, Claro, America Movil, Movistar and Telefonica are Covered – ResearchAndMarkets.com; 09/03/2018 – AMERICA MOVIL SAB DE CV AMX.N : DEUTSCHE BANK RAISES TARGET PRICE TO $22 FROM $21; 24/04/2018 – AMERICA MOVIL 1Q EBITDA MXN71.2B; EST. MXN72B; 23/04/2018 – POLL-America Movil profit seen down 35 pct on less FX gains

Among 14 analysts covering America Movil S.A.B. (NYSE:AMX), 7 have Buy rating, 2 Sell and 5 Hold. Therefore 50% are positive. America Movil S.A.B. had 36 analyst reports since July 21, 2015 according to SRatingsIntel. The firm has “Overweight” rating by Barclays Capital given on Monday, April 10. The firm has “Neutral” rating given on Friday, October 28 by Citigroup. As per Thursday, April 28, the company rating was downgraded by Citigroup. JP Morgan upgraded América Móvil, S.A.B. de C.V. (NYSE:AMX) on Thursday, December 17 to “Neutral” rating. On Friday, July 21 the stock rating was maintained by RBC Capital Markets with “Sell”. The firm has “Underweight” rating given on Thursday, April 28 by JP Morgan. Credit Suisse initiated América Móvil, S.A.B. de C.V. (NYSE:AMX) rating on Monday, December 7. Credit Suisse has “Neutral” rating and $19 target. Barclays Capital maintained the shares of AMX in report on Monday, July 18 with “Equalweight” rating. The firm has “Buy” rating by Scotia Capital given on Tuesday, February 13. The firm has “Neutral” rating by Macquarie Research given on Tuesday, November 17.

More notable recent América Móvil, S.A.B. de C.V. (NYSE:AMX) news were published by: Seekingalpha.com which released: “America Movil SA de CV (AMX) CEO Daniel Aboumrad on Q3 2018 Results – Earnings Call Transcript – Seeking Alpha” on October 17, 2018, also Investorplace.com with their article: “5 Mexican Stocks That Should Benefit From the Recent Trade Agreement – Investorplace.com” published on August 30, 2018, Prnewswire.com published: “SparkCognition and Global HITSS offer artificial intelligence solutions to advance digital transformation in various industries – PRNewswire” on January 23, 2019. More interesting news about América Móvil, S.A.B. de C.V. (NYSE:AMX) were released by: Seekingalpha.com and their article: “America Movil’s (AMX) CEO Daniel Hajj on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” published on February 13, 2019 as well as Seekingalpha.com‘s news article titled: “Telefonica confirms sale talks around Central American operations – Seeking Alpha” with publication date: January 22, 2019.

Since August 23, 2018, it had 0 insider buys, and 4 insider sales for $448,961 activity. VENUTO PETER sold $116,281 worth of AVX Corporation (NYSE:AVX) on Thursday, January 24. 10,000 shares were sold by King Willing, worth $209,390 on Friday, August 31.

Regal Investment Advisors Llc, which manages about $657.66M and $475.01M US Long portfolio, decreased its stake in First Tr Exchange Traded Fd (FXO) by 10,275 shares to 12,318 shares, valued at $394,000 in 2018Q3, according to the filing. It also reduced its holding in Ishares Tr (USMV) by 15,915 shares in the quarter, leaving it with 19,666 shares, and cut its stake in First Tr Exchange Traded Fd (FDN).

More notable recent AVX Corporation (NYSE:AVX) news were published by: Businesswire.com which released: “AVX Corporation Announces Preliminary Third Quarter Results – Business Wire” on January 24, 2019, also Zacks.com with their article: “AVX (AVX) Reports Next Week: Wall Street Expects Earnings Growth – Zacks.com” published on January 17, 2019, Zacks.com published: “AVX (AVX) Tops Q3 Earnings Estimates – Zacks.com” on January 24, 2019. More interesting news about AVX Corporation (NYSE:AVX) were released by: Zacks.com and their article: “Is AVX (AVX) Stock Outpacing Its Computer and Technology Peers This Year? – Zacks.com” published on February 05, 2019 as well as Zacks.com‘s news article titled: “Is AVX (AVX) Stock Undervalued Right Now? – Zacks.com” with publication date: January 31, 2019.

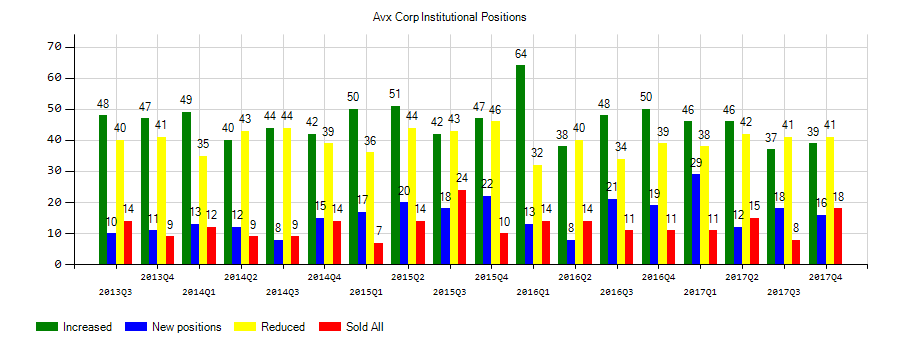

Investors sentiment increased to 1.47 in Q3 2018. Its up 0.32, from 1.15 in 2018Q2. It improved, as 15 investors sold AVX shares while 38 reduced holdings. 41 funds opened positions while 37 raised stakes. 41.22 million shares or 1.16% more from 40.75 million shares in 2018Q2 were reported. Renaissance Techs Llc holds 387,200 shares or 0.01% of its portfolio. Ameritas Investment Partners invested in 3,566 shares or 0% of the stock. Blackrock stated it has 4.31M shares. Commonwealth National Bank Of Australia has invested 0% in AVX Corporation (NYSE:AVX). Hsbc Holding Plc holds 0% in AVX Corporation (NYSE:AVX) or 33,906 shares. Verition Fund Management Ltd Llc has 0.02% invested in AVX Corporation (NYSE:AVX). Moreover, Macquarie Grp Inc Ltd has 0% invested in AVX Corporation (NYSE:AVX). James, a Ohio-based fund reported 118,715 shares. Oppenheimer Incorporated holds 0.01% or 23,883 shares. Millennium Management Limited Liability Company reported 265,143 shares. Northern Corporation accumulated 800,269 shares. Bridgeway Mngmt Inc holds 118,800 shares or 0.02% of its portfolio. Royal Retail Bank Of Canada, a Ontario – Canada-based fund reported 1,212 shares. Sterling Cap Mngmt Ltd Liability Co has invested 0.01% of its portfolio in AVX Corporation (NYSE:AVX). The Illinois-based Ubs Asset Americas has invested 0% in AVX Corporation (NYSE:AVX).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.