Among 3 analysts covering Reinsurance Group (NYSE:RGA), 1 have Buy rating, 1 Sell and 1 Hold. Therefore 33% are positive. Reinsurance Group had 3 analyst reports since August 17, 2018 according to SRatingsIntel. The firm earned “Underweight” rating on Tuesday, November 13 by Morgan Stanley. RBC Capital Markets upgraded Reinsurance Group of America, Incorporated (NYSE:RGA) on Tuesday, December 11 to “Outperform” rating. Credit Suisse maintained Reinsurance Group of America, Incorporated (NYSE:RGA) on Friday, August 17 with “Neutral” rating. See Reinsurance Group of America, Incorporated (NYSE:RGA) latest ratings:

11/12/2018 Broker: RBC Capital Markets Old Rating: Sector Perform New Rating: Outperform New Target: $165 Upgrade

13/11/2018 Broker: Morgan Stanley Old Rating: Underweight New Rating: Underweight Old Target: $131 New Target: $134 Maintain

17/08/2018 Broker: Credit Suisse Old Rating: Neutral New Rating: Neutral Old Target: $155 New Target: $144 Maintain

Analysts expect Daseke, Inc. (NASDAQ:DSKE) to report $-0.10 EPS on March, 15.They anticipate $0.03 EPS change or 23.08% from last quarter’s $-0.13 EPS. After having $0.02 EPS previously, Daseke, Inc.’s analysts see -600.00% EPS growth. The stock increased 2.23% or $0.1 during the last trading session, reaching $4.59. About 216,311 shares traded. Daseke, Inc. (NASDAQ:DSKE) has declined 74.92% since February 14, 2018 and is downtrending. It has underperformed by 74.92% the S&P500. Some Historical DSKE News: 16/03/2018 – DASEKE INC – QTRLY SHR $0.82; 16/04/2018 – AVEDA TRANSPORTATION & ENERGY SERVICES TO MERGE WITH DASEKE,; 16/03/2018 – DASEKE INC – CAPITAL EXPENDITURES IN 2018 ARE EXPECTED TO RANGE BETWEEN $85-$105 MILLION; 16/03/2018 – Daseke Reports Record Revenue, Adjusted EBITDA and Net Income for the Fourth Quarter and Full Year 2017; 16/03/2018 – DASEKE INC – QTRLY DILUTED SHR $0.62; 08/05/2018 – DASEKE INC SEES 2018 ORGANIC REVENUE ABOUT $1.35 BILLION; 08/05/2018 – DASEKE INC SEES 2018 NET CAPITAL EXPENDITURES $85 MLN TO $105 MLN; 16/03/2018 – DASEKE – IN 2018, CO EXPECTS TO GROW ORGANIC ADJUSTED EBITDA TO ABOUT $150 MLN; 16/04/2018 – DASEKE TO PAY C$0.90 PER AVEDA SHARE, ASSUME AVEDA DEBT; 16/04/2018 – Daseke to Pay C$0.90 (US$0.71) Per Share Plus the Assumption of Aveda Debt

More notable recent Reinsurance Group of America, Incorporated (NYSE:RGA) news were published by: Seekingalpha.com which released: “Reinsurance Group of America Q4 EPS falls short; new $400M buyback – Seeking Alpha” on January 28, 2019, also Seekingalpha.com with their article: “Reinsurance Group of America, Incorporated (RGA) CEO Anna Manning on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” published on January 29, 2019, Businesswire.com published: “RGA Elects New Member to Board of Directors – Business Wire” on January 25, 2019. More interesting news about Reinsurance Group of America, Incorporated (NYSE:RGA) were released by: Globenewswire.com and their article: “Research Report Identifies Whirlpool, Adtalem Global Education, Reinsurance Group of America, WR Berkley, Veracyte, and 22nd Century Group with Renewed Outlook — Fundamental Analysis, Calculating Forward Movement – GlobeNewswire” published on February 01, 2019 as well as ‘s news article titled: “8 Stocks To Watch For January 28, 2019 – Benzinga” with publication date: January 28, 2019.

Reinsurance Group of America, Incorporated engages in reinsurance business. The company has market cap of $8.88 billion. It offers individual and group life and health insurance products, including term life, credit life, universal life, whole life, group life and health, joint and last survivor insurance, critical illness, disability, and longevity products, as well as asset-intensive and financial reinsurance products. It has a 12.85 P/E ratio. The firm also provides reinsurance for mortality, morbidity, and lapse risk associated with products; and reinsurance for investment-related risks, as well as develops and markets technology solutions for the insurance industry.

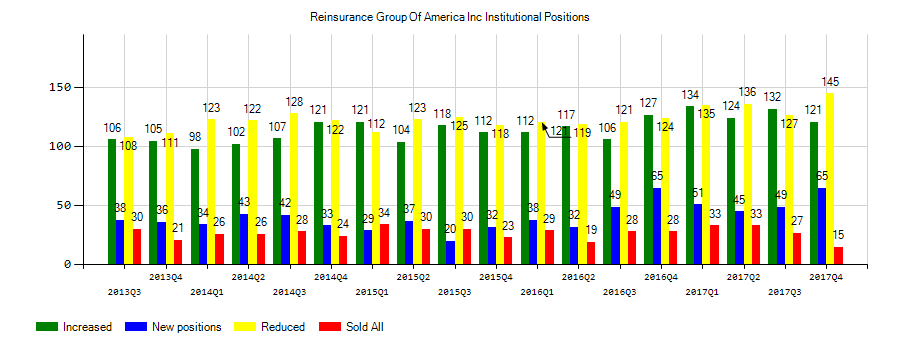

Investors sentiment decreased to 0.76 in Q3 2018. Its down 0.29, from 1.05 in 2018Q2. It dived, as 32 investors sold Reinsurance Group of America, Incorporated shares while 157 reduced holdings. 50 funds opened positions while 93 raised stakes. 56.00 million shares or 0.84% less from 56.48 million shares in 2018Q2 were reported. Legacy Private Co reported 0.14% stake. Peoples Fincl owns 43 shares or 0% of their US portfolio. Skyline Asset Management Limited Partnership accumulated 133,947 shares. Cwm Ltd, Nebraska-based fund reported 41 shares. Royal Fincl Bank Of Canada invested in 203,953 shares or 0.01% of the stock. National Bank & Trust Of America Corp De reported 776,100 shares. Parallax Volatility Advisers L P stated it has 0% in Reinsurance Group of America, Incorporated (NYSE:RGA). Bowling Portfolio Mgmt Ltd Co owns 8,988 shares or 0.18% of their US portfolio. Daiwa Securities stated it has 0% of its portfolio in Reinsurance Group of America, Incorporated (NYSE:RGA). Nelson Van Denburg And Campbell Wealth Mgmt Limited Liability Com invested in 1,182 shares. Cibc Asset Mngmt Inc holds 0% in Reinsurance Group of America, Incorporated (NYSE:RGA) or 2,279 shares. Archford Cap Strategies Lc has 0% invested in Reinsurance Group of America, Incorporated (NYSE:RGA) for 31 shares. Dnb Asset Mngmt As invested in 31,400 shares. Principal Fincl Group holds 305,602 shares or 0.04% of its portfolio. Manufacturers Life Ins Communication The has 0.02% invested in Reinsurance Group of America, Incorporated (NYSE:RGA).

The stock decreased 0.76% or $1.09 during the last trading session, reaching $141.4. About 240,209 shares traded. Reinsurance Group of America, Incorporated (NYSE:RGA) has declined 14.40% since February 14, 2018 and is downtrending. It has underperformed by 14.40% the S&P500. Some Historical RGA News: 23/04/2018 – REINSURANCE GROUP AMENDS BYLAWS TO IMPLEMENT PROXY ACCESS; 28/03/2018 – ADVISORY-Ignore stray alert on China Reinsurance Group’s FY results chain; 23/04/2018 – RGA Appoints New Members to Board of Directors; 17/05/2018 – Fitch Affirms RGA Reinsurance Co.’s IFS Rating at ‘A’; Outlook Stable; 28/03/2018 – CHINA REINSURANCE GROUP CORP 1508.HK – REGISTERED CAPITAL OF CHINA CONTINENT INSURANCE WILL BE CHANGED TO RMB15.12 BLN; 23/04/2018 – REINSURANCE GROUP OF AMERICA INC – ADDITION OF JOHN GAUTHIER AND HAZEL MCNEILAGE TO ITS BOARD INCREASES NUMBER OF RGA DIRECTORS TO 11; 28/03/2018 – CHINA REINSURANCE GROUP CORP – FY NET PREMIUM EARNED RMB 98.28 BLN VS RMB82.62 BLN; 28/03/2018 – CHINA REINSURANCE GROUP CORP – FY NET PREMIUM EARNED RMB98.28 BLN VS RMB82.62 BLN; 14/03/2018 Reinsurance Group of America to Host Investor Day; 26/04/2018 – Reinsurance Group 1Q EPS $1.52

Since November 6, 2018, it had 2 buys, and 5 insider sales for $2.01 million activity. Shares for $597,975 were sold by Manning Anna on Friday, November 30. On Friday, December 28 MATSON – TIMOTHY T bought $13,053 worth of Reinsurance Group of America, Incorporated (NYSE:RGA) or 100 shares. $296,265 worth of stock was sold by Laughlin John P Jr on Tuesday, November 27. Boot Arnoud W.A. sold 620 shares worth $90,520. LARSON TODD C sold $672,199 worth of stock.

More notable recent Daseke, Inc. (NASDAQ:DSKE) news were published by: Seekingalpha.com which released: “Daseke rides Dane Capital call higher – Seeking Alpha” on January 18, 2019, also Seekingalpha.com with their article: “Daseke: Down, But Not Out – Seeking Alpha” published on January 18, 2019, Nasdaq.com published: “Daseke Reports Preliminary Fourth Quarter and Full Year 2018 Results Exceeding Outlook, Introduces Strong 2019 Outlook – Nasdaq” on February 07, 2019. More interesting news about Daseke, Inc. (NASDAQ:DSKE) were released by: and their article: “(DSKE), J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT) – Knight Swift Delivers A Surprise Message To Wall Street: We Had A Better Quarter Than You Thought – Benzinga” published on January 17, 2019 as well as Streetinsider.com‘s news article titled: “Daseke, Inc. (DSKE) Appoints Chris Easter as COO – StreetInsider.com” with publication date: January 17, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.