Kellner Capital Llc decreased its stake in Nxp Semiconductors (NXPI) by 7.66% based on its latest 2018Q3 regulatory filing with the SEC. Kellner Capital Llc sold 26,400 shares as the company’s stock declined 18.87% with the market. The institutional investor held 318,101 shares of the semiconductors company at the end of 2018Q3, valued at $27.20 million, down from 344,501 at the end of the previous reported quarter. Kellner Capital Llc who had been investing in Nxp Semiconductors for a number of months, seems to be less bullish one the $27.43B market cap company. The stock increased 1.04% or $0.96 during the last trading session, reaching $92.84. About 251,060 shares traded. NXP Semiconductors N.V. (NASDAQ:NXPI) has declined 33.99% since February 14, 2018 and is downtrending. It has underperformed by 33.99% the S&P500. Some Historical NXPI News: 28/03/2018 – NXP Semiconductors, Alibaba’s AliOS Enter Partnership for New In-Vehicle Experiences; 13/04/2018 – Qualcomm: NXP Tender Offer Is Now Scheduled to Expire at 5:00 P.M., NYC Time, on April 20; 09/03/2018 – QCOM, NXPI/@danprimack: Qualcomm: Paul Jacobs out as executive chairman. Will remain on the board. Also extending cash tender for NXP. – ! $QCOM $NXPI; 03/05/2018 – WeBuildWebsites.ca: Qualcomm to refile China antitrust application for $44 billion NXP takeover; 19/04/2018 – LATEST: Qualcomm very concerned with the fate of NXP deal as the firms extend merger agreement, refile with MOFCOM; 27/04/2018 – Qualcomm Extends Cash Tender Offer for All Outstanding Shrs of NXP to May 11; 02/05/2018 – NXP SEMI 1Q EPS 17C, EST. $1.67; 25/05/2018 – NXP/Qualcomm cleared to talk with China, source says [20:15 BST25 May 2018] [Proprietary] []; 16/04/2018 – BTVI: Qualcomm to refile China antitrust for $44 bn NXP takeover; 23/03/2018 – QUALCOMM INC – CO AND NXP ARE PREPARING TO SEEK ADDITIONAL TIME TO COMPLETE TRANSACTION FROM FTC, SHOULD IT BECOME NECESSARY

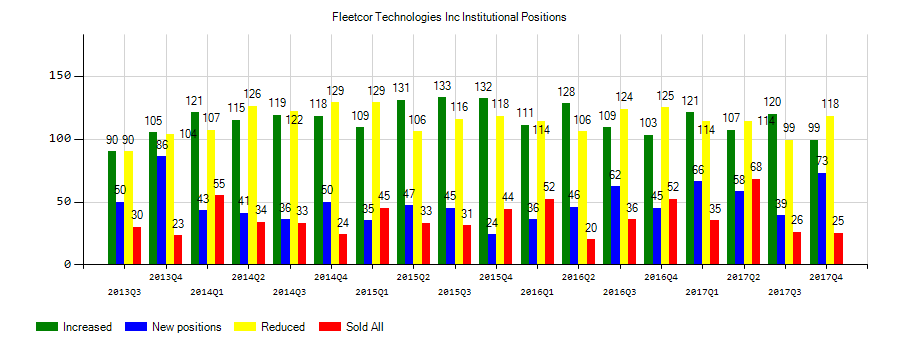

Bainco International Investors decreased its stake in Fleetcor Technologies Inc Com (FLT) by 60.32% based on its latest 2018Q3 regulatory filing with the SEC. Bainco International Investors sold 30,095 shares as the company’s stock declined 14.59% with the market. The institutional investor held 19,798 shares of the miscellaneous company at the end of 2018Q3, valued at $4.51 million, down from 49,893 at the end of the previous reported quarter. Bainco International Investors who had been investing in Fleetcor Technologies Inc Com for a number of months, seems to be less bullish one the $18.74B market cap company. The stock decreased 0.51% or $1.11 during the last trading session, reaching $218.28. About 23,357 shares traded. FleetCor Technologies, Inc. (NYSE:FLT) has risen 0.08% since February 14, 2018 and is uptrending. It has outperformed by 0.08% the S&P500. Some Historical FLT News: 03/05/2018 – FLEETCOR EXTENDS EUROPEAN FUEL CARD PACT W/SHELL THROUGH 2025; 25/05/2018 – FLEETCOR INVESTIGATION INITIATED by Former Louisiana Attorney General: Kahn Swick & Foti, LLC Investigates the Officers and Directors of FleetCor Technologies, Inc. – FLT; 14/03/2018 – FLEETCOR TECHNOLOGIES INC FLT.N : MORGAN STANLEY RAISES TARGET PRICE TO $235 FROM $232; 19/03/2018 – FLEETCOR Recognized for Innovation, Growth, & Success; 06/03/2018 Noventis And Comdata Partner To Expand Use Of Virtual Credit Cards In B2B Payments; 08/05/2018 – Comdata Announces Partnership Renewal with lnfintech to Support ePayables Vendor Enrollment; 03/05/2018 – FLEETCOR TECHNOLOGIES INC – ENTERED NEW AGREEMENT WITH PETROBRAS DISTRIBUIDORA S.A. TO ENABLE CARD-LESS FUEL PAYMENTS AT BR GAS STATIONS IN BRAZIL; 05/04/2018 – Motus Partners with FLEETCOR to Simplify Expense Reimbursement for Mobile Workforces; 21/03/2018 – UBER FREIGHT PARTNERS WITH FLEETCOR; 16/03/2018 – Morgan Stanley Likes FleetCor’s Future — Barrons.com

Kellner Capital Llc, which manages about $281.32M US Long portfolio, upped its stake in Gramercy Ppty Tr by 143,300 shares to 603,600 shares, valued at $16.56 million in 2018Q3, according to the filing. It also increased its holding in Cobiz Financial Inc (NASDAQ:COBZ) by 98,500 shares in the quarter, for a total of 190,400 shares, and has risen its stake in Kapstone Paper & Packaging C (NYSE:KS).

Among 32 analysts covering NXP Semiconductors NV (NASDAQ:NXPI), 17 have Buy rating, 2 Sell and 13 Hold. Therefore 53% are positive. NXP Semiconductors NV had 95 analyst reports since August 3, 2015 according to SRatingsIntel. SunTrust upgraded the stock to “Buy” rating in Friday, July 27 report. The stock of NXP Semiconductors N.V. (NASDAQ:NXPI) earned “Hold” rating by Robert W. Baird on Thursday, October 26. The firm earned “Hold” rating on Thursday, October 26 by Oppenheimer. The firm earned “Hold” rating on Monday, June 19 by Deutsche Bank. The stock of NXP Semiconductors N.V. (NASDAQ:NXPI) earned “Buy” rating by Jefferies on Friday, April 29. Canaccord Genuity maintained the shares of NXPI in report on Friday, August 25 with “Hold” rating. Drexel Hamilton upgraded the shares of NXPI in report on Thursday, May 3 to “Buy” rating. The firm has “Hold” rating given on Wednesday, October 11 by SunTrust. As per Wednesday, February 7, the company rating was maintained by Oppenheimer. As per Thursday, May 3, the company rating was maintained by Bernstein.

More notable recent NXP Semiconductors N.V. (NASDAQ:NXPI) news were published by: Globenewswire.com which released: “NXP Semiconductors Announces US$1 Billion Bridge Financing – GlobeNewswire” on September 20, 2018, also Nasdaq.com with their article: “NXPI September 28th Options Begin Trading – Nasdaq” published on August 09, 2018, Nasdaq.com published: “Earnings Preview: NXP Semiconductors (NXPI) Q4 Earnings Expected to Decline – Nasdaq” on January 30, 2019. More interesting news about NXP Semiconductors N.V. (NASDAQ:NXPI) were released by: and their article: “NXP Semiconductors’ Standalone Value Is $119, SunTrust Says In Downgrade (NASDAQ:NXPI) – Benzinga” published on June 11, 2018 as well as Nasdaq.com‘s news article titled: “Noteworthy Wednesday Option Activity: IRTC, DENN, NXPI – Nasdaq” with publication date: October 31, 2018.

More notable recent FleetCor Technologies, Inc. (NYSE:FLT) news were published by: Seekingalpha.com which released: “Daily Graph: Exceptional Compounder FleetCor Technologies – Seeking Alpha” on November 29, 2018, also Streetinsider.com with their article: “Form 8-K FLEETCOR TECHNOLOGIES For: Feb 06 – StreetInsider.com” published on February 06, 2019, Gurufocus.com published: “10 Most Overvalued Stocks of the S&P 500 – GuruFocus.com” on February 08, 2019. More interesting news about FleetCor Technologies, Inc. (NYSE:FLT) were released by: and their article: “Earnings Scheduled For February 6, 2019 – Benzinga” published on February 06, 2019 as well as Zacks.com‘s news article titled: “FleetCor Technologies (FLT) Surpasses Q4 Earnings and Revenue Estimates – Zacks.com” with publication date: February 06, 2019.

Among 18 analysts covering Fleetcor Technologies (NYSE:FLT), 14 have Buy rating, 0 Sell and 4 Hold. Therefore 78% are positive. Fleetcor Technologies had 62 analyst reports since August 6, 2015 according to SRatingsIntel. The stock has “Buy” rating by Evercore on Friday, March 18. The stock of FleetCor Technologies, Inc. (NYSE:FLT) has “Buy” rating given on Thursday, November 2 by Citigroup. The stock has “Strong Buy” rating by Raymond James on Tuesday, May 2. The stock of FleetCor Technologies, Inc. (NYSE:FLT) earned “Buy” rating by Jefferies on Wednesday, October 11. The firm has “Buy” rating by Keefe Bruyette & Woods given on Thursday, February 8. Suntrust Robinson initiated FleetCor Technologies, Inc. (NYSE:FLT) on Friday, June 24 with “Buy” rating. The stock of FleetCor Technologies, Inc. (NYSE:FLT) earned “Overweight” rating by Morgan Stanley on Wednesday, March 14. Susquehanna upgraded the shares of FLT in report on Thursday, August 6 to “Positive” rating. Morgan Stanley maintained FleetCor Technologies, Inc. (NYSE:FLT) rating on Wednesday, October 18. Morgan Stanley has “Overweight” rating and $189 target. The rating was maintained by Barclays Capital with “Overweight” on Friday, August 5.

Investors sentiment decreased to 1.01 in 2018 Q3. Its down 0.60, from 1.61 in 2018Q2. It worsened, as 36 investors sold FLT shares while 141 reduced holdings. 61 funds opened positions while 117 raised stakes. 82.12 million shares or 3.27% less from 84.90 million shares in 2018Q2 were reported. Amundi Pioneer Asset Mgmt has 0.06% invested in FleetCor Technologies, Inc. (NYSE:FLT). Guggenheim Lc reported 0.04% of its portfolio in FleetCor Technologies, Inc. (NYSE:FLT). Baker Avenue Asset Management LP owns 5,119 shares. Huntington Savings Bank has invested 0% in FleetCor Technologies, Inc. (NYSE:FLT). 12 West Mngmt Ltd Partnership accumulated 9.14% or 546,284 shares. Old National Bank In holds 0.04% in FleetCor Technologies, Inc. (NYSE:FLT) or 3,351 shares. Utah Retirement accumulated 16,328 shares. D E Shaw Incorporated invested in 5,911 shares or 0% of the stock. Wellington Mngmt Group Llp stated it has 5.31M shares or 0.25% of all its holdings. Pnc Svcs Gp Inc Inc reported 2,744 shares. Toth Advisory reported 0.22% in FleetCor Technologies, Inc. (NYSE:FLT). Commonwealth Of Pennsylvania Public School Empls Retrmt stated it has 0.02% in FleetCor Technologies, Inc. (NYSE:FLT). Boothbay Fund has 2,591 shares for 0.06% of their portfolio. Wilbanks Smith And Thomas Asset Management Ltd Liability Com holds 0.02% or 1,517 shares in its portfolio. Violich Cap Mgmt owns 4,250 shares or 0.22% of their US portfolio.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.