Andra Ap-Fonden decreased its stake in Boston Properties Inc (BXP) by 16.7% based on its latest 2018Q3 regulatory filing with the SEC. Andra Ap-Fonden sold 9,000 shares as the company’s stock declined 1.21% with the market. The institutional investor held 44,900 shares of the consumer services company at the end of 2018Q3, valued at $5.53M, down from 53,900 at the end of the previous reported quarter. Andra Ap-Fonden who had been investing in Boston Properties Inc for a number of months, seems to be less bullish one the $22.84 billion market cap company. The stock increased 0.77% or $1.01 during the last trading session, reaching $132.61. About 823,191 shares traded or 6.71% up from the average. Boston Properties, Inc. (NYSE:BXP) has risen 2.44% since February 8, 2018 and is uptrending. It has outperformed by 2.44% the S&P500. Some Historical BXP News: 24/04/2018 – Boston Properties Profit Rises, Reaches Deal for Santa Monica Business Park — Earnings Review; 24/04/2018 – BOSTON PROPERTIES SAW FY FFO/SHARE OF $6.23 – $6.36; 24/04/2018 – BOSTON PROPERTIES 1Q REV. $661.2M, EST. $648.0M; 04/04/2018 – MFS Global Real Estate Fund Adds Boston Properties; 25/04/2018 – Tony Wilbert: CoStar News Scoop: Boston Properties Bests Rivals With $616 Million Winning Bid for Santa Monica Business; 25/04/2018 – BXP CEO SAYS INITIAL YIELD ON SANTA MONICA BUY `MID-HIGH 3%’; 24/04/2018 – BOSTON PROPERTIES INC BXP.N – COMPANY UPDATED ITS GUIDANCE FOR FULL YEAR 2018 EPS AND FFO PER SHARE; 25/04/2018 – BXP CEO SAYS IN MIDST OF NEGOTIATING COMMITMENT ON 3 HUDSON BVD; 25/04/2018 – BXP: SANTA MONICA BUSINESS PARK YIELD MAY RISE TO 6% BY YR 5; 24/04/2018 – Boston Properties 1Q FFO $1.49/Shr

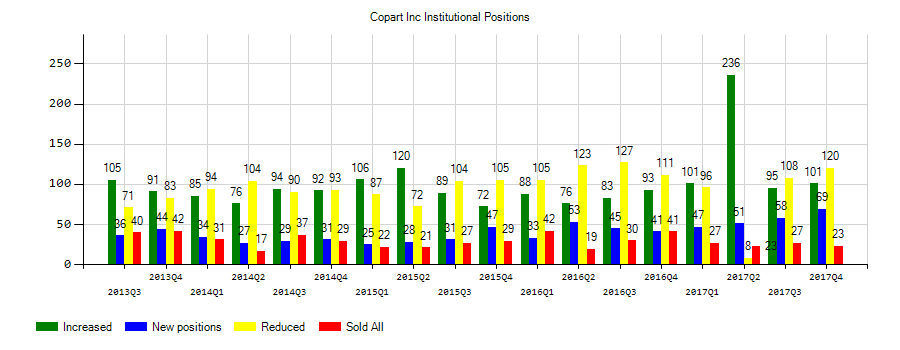

Origin Asset Management Llp decreased its stake in Copart Inc (CPRT) by 5.28% based on its latest 2018Q3 regulatory filing with the SEC. Origin Asset Management Llp sold 26,300 shares as the company’s stock declined 26.66% with the market. The institutional investor held 471,644 shares of the consumer durables company at the end of 2018Q3, valued at $24.30 million, down from 497,944 at the end of the previous reported quarter. Origin Asset Management Llp who had been investing in Copart Inc for a number of months, seems to be less bullish one the $12.00B market cap company. The stock decreased 1.23% or $0.64 during the last trading session, reaching $51.29. About 598,787 shares traded. Copart, Inc. (NASDAQ:CPRT) has risen 10.16% since February 8, 2018 and is uptrending. It has outperformed by 10.16% the S&P500. Some Historical CPRT News: 04/04/2018 – Copart at Site Visit Hosted By Wedbush Today; 30/03/2018 – Copart Site Visit Scheduled By Wedbush for Apr. 4; 17/05/2018 – Copart Fulfills New Owner Promise to Clear Hazardous Tires; 23/05/2018 – COPART INC CPRT.O – QTRLY NON-GAAP DILUTED NET INCOME PER COMMON SHARE $0.52; 23/05/2018 – Copart 3Q Rev $478.2M; 17/05/2018 – CPRT CLEARS SCRAP TIRES AT EX-SAFE TIRE FACILITY IN SAN ANTONIO; 09/03/2018 – COPART BUYS NORDIC SALVAGE AUTO AUCTION CO; 17/05/2018 – COPART SAYS IT CAN NOW EXPAND OPERATIONS IN BEXAR COUNTY; 23/05/2018 – COPART INC CPRT.O – QTRLY TOTAL SERVICE REVENUES AND VEHICLE SALES $478.2 MLN VS $373.9 MLN; 24/04/2018 – Copart Announces Expansion of Location Near Minneapolis, Minnesota

More notable recent Boston Properties, Inc. (NYSE:BXP) news were published by: Seekingalpha.com which released: “Boston Properties, Inc. (BXP) CEO Owen Thomas on Q3 2018 Results – Earnings Call Transcript – Seeking Alpha” on October 31, 2018, also Investorplace.com with their article: “5 REITs to Buy for Big-Time Gains This Year – Investorplace.com” published on January 18, 2019, Seekingalpha.com published: “BAML goes contrarian, upgrades Boston Properties – Seeking Alpha” on February 15, 2018. More interesting news about Boston Properties, Inc. (NYSE:BXP) were released by: Businesswire.com and their article: “Boston Properties Prices $1.0 Billion Offering of Green Bonds – Business Wire” published on November 13, 2018 as well as Marketwatch.com‘s news article titled: “Boston Properties boosts dividend by 19%, the biggest increase in its history – MarketWatch” with publication date: September 18, 2018.

Among 24 analysts covering Boston Properties Inc. (NYSE:BXP), 12 have Buy rating, 0 Sell and 12 Hold. Therefore 50% are positive. Boston Properties Inc. has $159 highest and $11900 lowest target. $135.79’s average target is 2.40% above currents $132.61 stock price. Boston Properties Inc. had 89 analyst reports since July 21, 2015 according to SRatingsIntel. SunTrust maintained the shares of BXP in report on Monday, October 9 with “Hold” rating. The stock of Boston Properties, Inc. (NYSE:BXP) earned “Top Pick” rating by RBC Capital Markets on Tuesday, January 3. The rating was maintained by Argus Research on Friday, September 4 with “Buy”. DA Davidson upgraded the stock to “Buy” rating in Monday, November 19 report. The rating was maintained by Jefferies with “Hold” on Monday, October 23. On Monday, September 21 the stock rating was downgraded by Mizuho to “Neutral”. The firm has “Hold” rating by Jefferies given on Tuesday, February 27. The rating was maintained by SunTrust on Wednesday, November 21 with “Hold”. The rating was upgraded by Bank of America to “Buy” on Thursday, February 15. BTIG Research upgraded the stock to “Buy” rating in Wednesday, January 9 report.

Andra Ap-Fonden, which manages about $3.88 billion US Long portfolio, upped its stake in Automatic Data Processing In (NASDAQ:ADP) by 7,000 shares to 79,000 shares, valued at $11.90M in 2018Q3, according to the filing. It also increased its holding in Kimco Rlty Corp (NYSE:KIM) by 24,100 shares in the quarter, for a total of 501,800 shares, and has risen its stake in Ingredion Inc (NYSE:INGR).

Investors sentiment increased to 1.07 in 2018 Q3. Its up 0.12, from 0.95 in 2018Q2. It is positive, as 31 investors sold BXP shares while 137 reduced holdings. 63 funds opened positions while 117 raised stakes. 141.78 million shares or 0.33% less from 142.26 million shares in 2018Q2 were reported. Guardian Life Of America, New York-based fund reported 437 shares. Moody National Bank & Trust Tru Division has invested 0.01% in Boston Properties, Inc. (NYSE:BXP). Td Asset Mngmt reported 0.01% of its portfolio in Boston Properties, Inc. (NYSE:BXP). Rafferty Asset Management Ltd Limited Liability Company holds 0.08% or 42,212 shares in its portfolio. Daiwa Secs Incorporated invested in 2.01M shares or 2.07% of the stock. Morgan Stanley invested in 3.09 million shares. Stratos Wealth Partners Limited accumulated 46 shares. Quantum Mngmt Limited Liability Corp Nj holds 0.31% or 9,135 shares. Lord Abbett Limited Liability Corp invested in 0.2% or 581,780 shares. Shelton Capital Mngmt invested in 0.01% or 1,721 shares. Tudor Et Al invested in 9,438 shares. Profund Advsr Llc holds 0.05% of its portfolio in Boston Properties, Inc. (NYSE:BXP) for 11,160 shares. Kayne Anderson Rudnick Limited Liability Co invested 0.01% in Boston Properties, Inc. (NYSE:BXP). Bnp Paribas Arbitrage Sa accumulated 147,348 shares. Financial Bank Of Ny Mellon accumulated 1.61 million shares.

Since January 15, 2019, it had 0 buys, and 1 insider sale for $3.96 million activity.

Analysts await Copart, Inc. (NASDAQ:CPRT) to report earnings on February, 25. They expect $0.52 earnings per share, up 10.64% or $0.05 from last year’s $0.47 per share. CPRT’s profit will be $121.69M for 24.66 P/E if the $0.52 EPS becomes a reality. After $0.47 actual earnings per share reported by Copart, Inc. for the previous quarter, Wall Street now forecasts 10.64% EPS growth.

Origin Asset Management Llp, which manages about $2.70B and $1.53 billion US Long portfolio, upped its stake in Momo Inc by 570,300 shares to 594,600 shares, valued at $26.04 million in 2018Q3, according to the filing. It also increased its holding in Cigna Corp (NYSE:CI) by 4,000 shares in the quarter, for a total of 118,400 shares, and has risen its stake in Visa Inc (NYSE:V).

More notable recent Copart, Inc. (NASDAQ:CPRT) news were published by: which released: “Earnings Preview: Copart (NASDAQ:CPRT) – Benzinga” on September 18, 2018, also Nasdaq.com with their article: “Caseys General Stores, Inc. (CASY) Ex-Dividend Date Scheduled for January 31, 2019 – Nasdaq” published on January 30, 2019, Seekingalpha.com published: “Copart: Buying The Post-Earnings Correction – Seeking Alpha” on September 20, 2018. More interesting news about Copart, Inc. (NASDAQ:CPRT) were released by: Nasdaq.com and their article: “Penske Automotive Group, Inc. (PAG) Ex-Dividend Date Scheduled for February 08, 2019 – Nasdaq” published on February 07, 2019 as well as Prnewswire.com‘s news article titled: “Copart Opens New North Charleston Location in South Carolina – PRNewswire” with publication date: February 01, 2019.

Investors sentiment decreased to 1.15 in Q3 2018. Its down 0.16, from 1.31 in 2018Q2. It dived, as 25 investors sold CPRT shares while 158 reduced holdings. 91 funds opened positions while 120 raised stakes. 172.64 million shares or 1.07% less from 174.51 million shares in 2018Q2 were reported. Arrowstreet Cap Limited Partnership has 0.11% invested in Copart, Inc. (NASDAQ:CPRT). D E Shaw And, New York-based fund reported 28,722 shares. Guardian Life Insurance Of America accumulated 581 shares or 0% of the stock. Massachusetts Services Company Ma reported 1.33 million shares or 0.03% of all its holdings. London Of Virginia holds 0.67% or 1.68 million shares. Gulf Int Comml Bank (Uk) Ltd invested in 0.04% or 69,088 shares. Trellus Co Limited has 1.08% invested in Copart, Inc. (NASDAQ:CPRT) for 14,500 shares. Fjarde Ap stated it has 63,386 shares or 0.05% of all its holdings. Moreover, Omers Administration has 0.05% invested in Copart, Inc. (NASDAQ:CPRT) for 97,400 shares. Intrust Commercial Bank Na holds 5,514 shares. Cambridge Inv Advisors owns 7,774 shares or 0% of their US portfolio. Salem Invest Counselors Inc reported 0.01% stake. Bollard Ltd Liability Corp owns 400 shares. Ledyard Retail Bank invested 0% in Copart, Inc. (NASDAQ:CPRT). Bnp Paribas Asset Sa reported 0.05% in Copart, Inc. (NASDAQ:CPRT).

Among 14 analysts covering Copart (NASDAQ:CPRT), 5 have Buy rating, 1 Sell and 8 Hold. Therefore 36% are positive. Copart has $63 highest and $33.0 lowest target. $52.33’s average target is 2.03% above currents $51.29 stock price. Copart had 34 analyst reports since January 15, 2016 according to SRatingsIntel. The rating was maintained by Robert W. Baird on Friday, December 22 with “Buy”. The company was maintained on Monday, February 26 by Jefferies. Barrington Research downgraded Copart, Inc. (NASDAQ:CPRT) on Friday, September 23 to “Mkt Perform” rating. The stock of Copart, Inc. (NASDAQ:CPRT) has “Buy” rating given on Wednesday, November 22 by Robert W. Baird. The firm has “Neutral” rating by Susquehanna given on Friday, August 26. The firm has “Hold” rating given on Thursday, July 6 by Jefferies. The rating was maintained by Jefferies on Thursday, September 22 with “Hold”. The company was maintained on Tuesday, October 31 by Robert W. Baird. The stock of Copart, Inc. (NASDAQ:CPRT) earned “Underweight” rating by JP Morgan on Friday, September 21. The firm earned “Buy” rating on Monday, February 26 by Robert W. Baird.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.