Glovista Investments Llc decreased its stake in Ambev Sa (ABEV) by 27.5% based on its latest 2018Q3 regulatory filing with the SEC. Glovista Investments Llc sold 143,940 shares as the company’s stock declined 9.87% with the market. The institutional investor held 379,456 shares of the beverages (production and distribution) company at the end of 2018Q3, valued at $1.73M, down from 523,396 at the end of the previous reported quarter. Glovista Investments Llc who had been investing in Ambev Sa for a number of months, seems to be less bullish one the $76.09 billion market cap company. The stock increased 0.82% or $0.04 during the last trading session, reaching $4.92. About 13.47M shares traded. Ambev S.A. (NYSE:ABEV) has declined 35.27% since February 7, 2018 and is downtrending. It has underperformed by 35.27% the S&P500. Some Historical ABEV News: 20/03/2018 – Treasurys Decline Against Backdrop of Fed meeting, AB InBev Bond Sale; 09/05/2018 – New York Post: Anheuser-Busch dragged down by flat domestic sales; 02/05/2018 – AMBEV SAYS QUILMES, CCU DEAL CONCLUDED TODAY; 09/05/2018 – Brazilian beverage company Ambev misses quarterly profit estimates; 20/03/2018 – AB InBev to Sell Dollar Bonds as Brewer Seeks to Refinance Debt; 27/03/2018 – AMBEV S.A. GRANTS FAVORABLE OPINION FOR AROSUCO DEAL HOLDER OK; 21/03/2018 – AB InBev sets out new goals for environmental shift; 17/04/2018 – S&PGR Affirms ‘BBB’ And ‘brAAA’ Ratings On Ambev S.A; 17/04/2018 – JGP Global Adds AB InBev, Exits Facebook, Cuts Kraft Heinz: 13F; 15/05/2018 – AMBEV NAMES FERNANDO MOMMENSOHN TENNENBAUM CFO

Voya Investment Management Llc decreased its stake in Omnicom Group Inc (OMC) by 3.13% based on its latest 2018Q3 regulatory filing with the SEC. Voya Investment Management Llc sold 7,178 shares as the company’s stock rose 8.95% while stock markets declined. The institutional investor held 222,128 shares of the advertising company at the end of 2018Q3, valued at $15.11 million, down from 229,306 at the end of the previous reported quarter. Voya Investment Management Llc who had been investing in Omnicom Group Inc for a number of months, seems to be less bullish one the $16.49 billion market cap company. The stock decreased 1.18% or $0.88 during the last trading session, reaching $73.58. About 1.67M shares traded. Omnicom Group Inc. (NYSE:OMC) has risen 3.76% since February 7, 2018 and is uptrending. It has outperformed by 3.76% the S&P500. Some Historical OMC News: 03/05/2018 – FleishmanHillard Appoints Janise Murphy Chief Practice Officer; 17/04/2018 – Omnicom 1Q EPS $1.14; 20/03/2018 – Publicis seeks to boost growth by going deeper into consulting; 07/03/2018 – FleishmanHillard Hires Research and Technology Strategist Matt Groch to Lead Development of Global Data Analytics Capability; 12/03/2018 – Omnicom Wins $741 Million U.S. Air Force Contract; 30/05/2018 – Publicité-Sorrell fait son “comeback” après son départ de WPP; 17/04/2018 – Omnicom 1Q Income Tax Expense Reduced by $13M; 23/05/2018 – Porter Novelli enlisted to support The Economist’s Pride and Prejudice Event; 17/04/2018 – Dunkin’ Donuts Names BBDO Worldwide as New Creative Agency of Record; 17/04/2018 – Omnicom Closes Above 200-Day Moving Average: Technicals

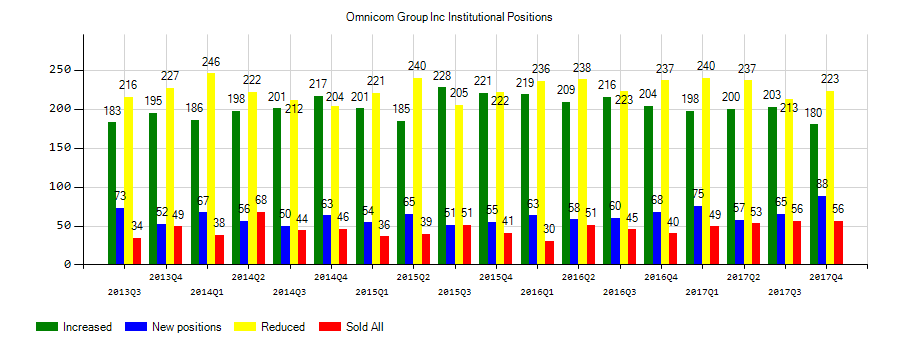

Investors sentiment decreased to 0.83 in Q3 2018. Its down 0.17, from 1 in 2018Q2. It dived, as 49 investors sold OMC shares while 234 reduced holdings. 69 funds opened positions while 165 raised stakes. 226.63 million shares or 1.94% less from 231.12 million shares in 2018Q2 were reported. Tci Wealth Advsr Inc stated it has 0% in Omnicom Group Inc. (NYSE:OMC). Parallax Volatility Advisers Ltd Partnership reported 0% of its portfolio in Omnicom Group Inc. (NYSE:OMC). Moreover, Aperio Gru Ltd Co has 0.04% invested in Omnicom Group Inc. (NYSE:OMC) for 138,825 shares. Raymond James Tru Na stated it has 0.19% in Omnicom Group Inc. (NYSE:OMC). Kentucky Retirement System Insurance Tru Fund reported 0.06% in Omnicom Group Inc. (NYSE:OMC). Capital Research Glob, California-based fund reported 1.50M shares. First Personal Svcs accumulated 518 shares. Teachers Retirement Sys Of The State Of Kentucky reported 22,600 shares. Asset Management One Limited has 0.05% invested in Omnicom Group Inc. (NYSE:OMC) for 373,141 shares. Amica Retiree Med reported 0.06% stake. River Road Asset Mgmt Limited Liability Com reported 1.02% of its portfolio in Omnicom Group Inc. (NYSE:OMC). 283,100 are owned by Her Majesty The Queen In Right Of The Province Of Alberta As Represented By Alberta Investment Management. Stratos Wealth Prtn Ltd accumulated 1,580 shares. Meiji Yasuda Life stated it has 0.08% in Omnicom Group Inc. (NYSE:OMC). Meeder Asset Mgmt, Ohio-based fund reported 295 shares.

Since October 18, 2018, it had 0 insider buys, and 4 selling transactions for $1.10 million activity. Nelson Jonathan B. sold $1.01 million worth of stock or 13,000 shares. RICE LINDA JOHNSON also sold $40,657 worth of Omnicom Group Inc. (NYSE:OMC) on Thursday, October 18.

Analysts await Omnicom Group Inc. (NYSE:OMC) to report earnings on February, 21. They expect $1.65 earnings per share, up 6.45% or $0.10 from last year’s $1.55 per share. OMC’s profit will be $369.78M for 11.15 P/E if the $1.65 EPS becomes a reality. After $1.24 actual earnings per share reported by Omnicom Group Inc. for the previous quarter, Wall Street now forecasts 33.06% EPS growth.

More important recent Omnicom Group Inc. (NYSE:OMC) news were published by: Seekingalpha.com which released: “Omnicom Group Inc. Is A Good Buy – Seeking Alpha” on February 26, 2018, also Seekingalpha.com published article titled: “Turning Challenge Into Opportunity – Seeking Alpha”, Seekingalpha.com published: “Ad giants slip after Publicis revenue disappointment – Seeking Alpha” on February 06, 2019. More interesting news about Omnicom Group Inc. (NYSE:OMC) was released by: Seekingalpha.com and their article: “Why Omnicom Is More Attractive Than WPP – Seeking Alpha” with publication date: September 26, 2018.

Among 17 analysts covering Omnicom (NYSE:OMC), 3 have Buy rating, 2 Sell and 12 Hold. Therefore 18% are positive. Omnicom had 54 analyst reports since July 23, 2015 according to SRatingsIntel. Jefferies maintained the stock with “Hold” rating in Monday, September 18 report. Argus Research upgraded it to “Buy” rating and $82 target in Thursday, July 23 report. The rating was maintained by Morgan Stanley with “Underweight” on Wednesday, May 23. The stock of Omnicom Group Inc. (NYSE:OMC) earned “Neutral” rating by Credit Suisse on Thursday, September 15. The stock of Omnicom Group Inc. (NYSE:OMC) has “Hold” rating given on Monday, August 14 by Jefferies. The stock of Omnicom Group Inc. (NYSE:OMC) earned “Sector Perform” rating by RBC Capital Markets on Friday, October 7. The rating was upgraded by Atlantic Securities to “Neutral” on Friday, March 2. BMO Capital Markets maintained the shares of OMC in report on Wednesday, November 22 with “Hold” rating. The rating was maintained by Credit Suisse with “Neutral” on Wednesday, October 11. The firm has “Hold” rating given on Thursday, October 19 by Jefferies.

Voya Investment Management Llc, which manages about $84.40 billion and $48.57B US Long portfolio, upped its stake in Matthews Intl Corp (NASDAQ:MATW) by 17,360 shares to 599,800 shares, valued at $30.08 million in 2018Q3, according to the filing. It also increased its holding in Jones Lang Lasalle Inc (NYSE:JLL) by 18,277 shares in the quarter, for a total of 27,826 shares, and has risen its stake in Micron Technology Inc (NASDAQ:MU).

Among 8 analysts covering AmBev SA (NYSE:ABEV), 5 have Buy rating, 1 Sell and 2 Hold. Therefore 63% are positive. AmBev SA had 14 analyst reports since September 17, 2015 according to SRatingsIntel. As per Monday, June 18, the company rating was downgraded by J.P. Morgan. The rating was downgraded by Bank of America on Thursday, October 25 to “Underperform”. JP Morgan maintained Ambev S.A. (NYSE:ABEV) on Tuesday, May 22 with “Overweight” rating. Barclays Capital maintained the shares of ABEV in report on Friday, July 28 with “Hold” rating. As per Thursday, August 18, the company rating was downgraded by Morgan Stanley. As per Monday, October 10, the company rating was maintained by Goldman Sachs. Barclays Capital maintained it with “Equal-Weight” rating and $7 target in Friday, October 27 report. The firm earned “Outperform” rating on Tuesday, September 12 by Credit Suisse. The firm earned “Overweight” rating on Thursday, November 10 by JP Morgan. On Friday, July 27 the stock rating was upgraded by Barclays Capital to “Overweight”.

Analysts await Ambev S.A. (NYSE:ABEV) to report earnings on March, 7. They expect $0.07 EPS, down 12.50% or $0.01 from last year’s $0.08 per share. ABEV’s profit will be $1.08 billion for 17.57 P/E if the $0.07 EPS becomes a reality. After $0.05 actual EPS reported by Ambev S.A. for the previous quarter, Wall Street now forecasts 40.00% EPS growth.

More notable recent Ambev S.A. (NYSE:ABEV) news were published by: Seekingalpha.com which released: “Brazil stocks, currency rally as far-right presidential candidate extends lead – Seeking Alpha” on October 02, 2018, also Seekingalpha.com with their article: “Anheuser-Busch InBev: Investing In The Whole Company Or The Ambev Portion? – Seeking Alpha” published on March 13, 2018, Seekingalpha.com published: “Ambev Brewery: Excellent Business, Down 40% And Still Expensive – Seeking Alpha” on July 09, 2018. More interesting news about Ambev S.A. (NYSE:ABEV) were released by: and their article: “Barclays Turns Bullish On AmBev’s Story (NYSE:ABEV) – Benzinga” published on July 27, 2018 as well as Seekingalpha.com‘s news article titled: “Explosive growth seen for cannabis-infused beverage market – Seeking Alpha” with publication date: September 27, 2018.

Glovista Investments Llc, which manages about $940.85M and $384.56M US Long portfolio, upped its stake in Jp Morgan Exchange Traded Fd by 288,593 shares to 303,650 shares, valued at $15.22 million in 2018Q3, according to the filing. It also increased its holding in Ishares Tr (MCHI) by 105,233 shares in the quarter, for a total of 727,998 shares, and has risen its stake in Ishares Tr (ILF).

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.