Buckhead Capital Management Llc increased Hanesbrands Inc (HBI) stake by 59.29% reported in 2018Q3 SEC filing. Buckhead Capital Management Llc acquired 61,255 shares as Hanesbrands Inc (HBI)’s stock declined 15.87%. The Buckhead Capital Management Llc holds 164,570 shares with $3.03 million value, up from 103,315 last quarter. Hanesbrands Inc now has $5.62 billion valuation. The stock increased 1.27% or $0.19 during the last trading session, reaching $15.56. About 2.20M shares traded. Hanesbrands Inc. (NYSE:HBI) has declined 27.36% since February 5, 2018 and is downtrending. It has underperformed by 27.36% the S&P500. Some Historical HBI News: 01/05/2018 – Hanesbrands Sees 2Q EPS 38c-EPS 40c; 01/05/2018 – Hanesbrands Backs 2018 Sales $6.72B-$6.82B; 12/03/2018 – HANESBRANDS INC HBI.N : CREDIT SUISSE STARTS WITH NEUTRAL RATING; $21 TARGET PRICE; 20/03/2018 – U.S. apparel, footwear industry opposes likely Trump tariffs on China; 02/04/2018 – HanesBrands Earns Ninth Consecutive U.S. EPA Energy Star Partner of the Year Award for Environmental Excellence; 05/04/2018 – HanesBrands Earns EPA’s Energy Star Environmental Excellence Award; 12/04/2018 – Hanes Invites Men Everywhere to #VouchForThePouch with New Comfort Flex Fit Men’s Boxer Briefs; 01/05/2018 – Hanesbrands Sees 2Q Adj EPS 44c-Adj EPS 46c; 12/04/2018 – Hanes Invites Men Everywhere to #VouchForThePouch with New Comfort Flex Fit Men’s Boxer Briefs; 25/04/2018 – Hanesbrands Partners With National Park Service for Five-Year Deal

Luminus Management Llc increased Canadian Solar Inc (CSIQ) stake by 396.65% reported in 2018Q3 SEC filing. Luminus Management Llc acquired 2.13 million shares as Canadian Solar Inc (CSIQ)’s stock rose 11.78%. The Luminus Management Llc holds 2.67M shares with $38.72M value, up from 537,700 last quarter. Canadian Solar Inc now has $1.15 billion valuation. The stock decreased 1.60% or $0.32 during the last trading session, reaching $19.65. About 312,989 shares traded. Canadian Solar Inc. (NASDAQ:CSIQ) has declined 4.09% since February 5, 2018 and is downtrending. It has underperformed by 4.09% the S&P500. Some Historical CSIQ News: 14/03/2018 – CANADIAN SOLAR – SUCCESSFULLY COMPLETED CONSTRUCTION & STARTED COMMERCIAL OPERATION OF 6 MWP SOLAR PV POWER PROJECT IN KEETMANSHOOP, NAMIBIA; 16/03/2018 – CANADIAN SOLAR INC CSIQ.O : UBS STARTS WITH SELL ; TARGET PRICE $15; 15/05/2018 – CANADIAN SOLAR INC – 35 MWP COMMERCIAL AND INDUSTRIAL SOLAR PORTFOLIO IN KARNATAKA REACHED COMMERCIAL OPERATION IN MARCH 2018; 26/04/2018 – Canadian Solar Files Annual Report on Form 20-F for Year Ended December 31, 2017; 16/04/2018 – Canadian Solar Sells 80.6-Megawatt Brazil Project to Gas Natural; 10/04/2018 – Canadian Solar to Build 364 Megawatts of Projects in Brazil; 10/04/2018 – Canadian Solar Awarded 364 MWp Solar Projects in Brazil; 27/04/2018 – CANADIAN SOLAR – AGREES WITH GLOBAL INVESTMENT HOLDINGS TO DEVELOP & OPERATE A SOLAR POWER PROJECTS PIPELINE WITH TOTAL CAPACITY OF UP TO 300 MWP; 27/04/2018 – Canadian Solar Partners with Global Investment Holdings to Develop and Provide Services for up to 300 MWp Solar Projects in EMEA; 29/03/2018 – Canadian Solar Acquires a 97.6 MWp Solar Power Project in Argentina

Luminus Management Llc decreased Duke Energy Corp (NYSE:DUK) stake by 430,770 shares to 1.72 million valued at $137.27 million in 2018Q3. It also reduced Ecolab Inc (NYSE:ECL) stake by 7,424 shares and now owns 64,100 shares. C.H. Robinson Worldwide Inc (NASDAQ:CHRW) was reduced too.

Among 3 analysts covering Canadian Solar (NASDAQ:CSIQ), 1 have Buy rating, 1 Sell and 1 Hold. Therefore 33% are positive. Canadian Solar had 3 analyst reports since August 23, 2018 according to SRatingsIntel. The rating was downgraded by JP Morgan to “Underweight” on Monday, October 22. The stock of Canadian Solar Inc. (NASDAQ:CSIQ) has “Neutral” rating given on Thursday, August 23 by FBR Capital. The stock of Canadian Solar Inc. (NASDAQ:CSIQ) earned “Buy” rating by Goldman Sachs on Thursday, January 3.

More notable recent Canadian Solar Inc. (NASDAQ:CSIQ) news were published by: Nasdaq.com which released: “Should Value Investors Buy Canadian Solar (CSIQ) Stock? – Nasdaq” on January 31, 2019, also Nasdaq.com with their article: “Canadian Solar (CSIQ) Gains As Market Dips: What You Should Know – Nasdaq” published on January 29, 2019, Nasdaq.com published: “CSIQ or RUN: Which Is the Better Value Stock Right Now? – Nasdaq” on January 23, 2019. More interesting news about Canadian Solar Inc. (NASDAQ:CSIQ) were released by: Nasdaq.com and their article: “Is Canadian Solar (CSIQ) Outperforming Other Oils-Energy Stocks This Year? – Nasdaq” published on January 21, 2019 as well as Nasdaq.com‘s news article titled: “Canadian Solar (CSIQ) Gains But Lags Market: What You Should Know – Nasdaq” with publication date: January 17, 2019.

Since November 2, 2018, it had 4 buys, and 4 sales for $231,549 activity. On Monday, November 19 the insider NELSON RONALD L bought $296,600. Mathews Jessica Tuchman also sold $203,594 worth of Hanesbrands Inc. (NYSE:HBI) on Friday, December 14. Hytinen Barry bought $147,340 worth of stock or 10,100 shares. Shares for $330,322 were sold by JOHNSON JOIA M on Monday, November 5. The insider Upchurch W Howard Jr sold $602,711. Another trade for 6,500 shares valued at $97,370 was made by Evans Gerald on Monday, November 19.

Among 9 analysts covering Hanesbrands (NYSE:HBI), 2 have Buy rating, 0 Sell and 7 Hold. Therefore 22% are positive. Hanesbrands had 10 analyst reports since August 16, 2018 according to SRatingsIntel. The firm has “Neutral” rating given on Monday, December 3 by Citigroup. The stock has “Neutral” rating by Macquarie Research on Thursday, August 23. On Friday, November 2 the stock rating was maintained by Nomura with “Neutral”. Wells Fargo maintained the shares of HBI in report on Wednesday, January 2 with “Market Perform” rating. The rating was downgraded by Deutsche Bank to “Hold” on Friday, January 11. The stock of Hanesbrands Inc. (NYSE:HBI) has “Equal-Weight” rating given on Friday, November 2 by Barclays Capital. Buckingham Research maintained Hanesbrands Inc. (NYSE:HBI) rating on Thursday, August 16. Buckingham Research has “Buy” rating and $26 target. As per Friday, November 2, the company rating was maintained by Bank of America. Buckingham Research maintained the shares of HBI in report on Wednesday, October 17 with “Buy” rating.

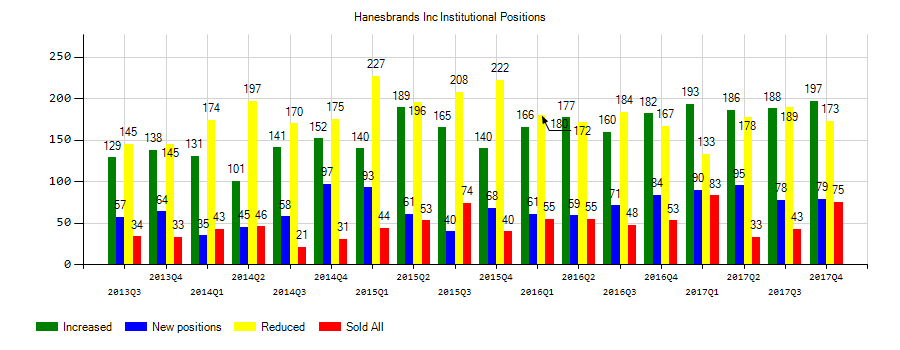

Investors sentiment increased to 0.86 in 2018 Q3. Its up 0.06, from 0.8 in 2018Q2. It improved, as 60 investors sold HBI shares while 180 reduced holdings. 60 funds opened positions while 146 raised stakes. 351.16 million shares or 1.42% less from 356.23 million shares in 2018Q2 were reported. Freestone Capital Holding Ltd Company stated it has 218,377 shares. Howe And Rusling owns 1.00 million shares for 3.08% of their portfolio. Brandywine Glob Inv Limited holds 0% or 37,488 shares. Trexquant Lp has invested 0.07% in Hanesbrands Inc. (NYSE:HBI). Fulton Retail Bank Na owns 26,369 shares or 0.03% of their US portfolio. New Mexico Educational Retirement Board has 32,100 shares. Moreover, Sun Life Fincl has 0% invested in Hanesbrands Inc. (NYSE:HBI). Wilbanks Smith Thomas Asset Mgmt Ltd Com owns 12,561 shares or 0.01% of their US portfolio. Boyd Watterson Asset Ltd Liability Corporation Oh owns 11,782 shares for 0.12% of their portfolio. Farmers And Merchants Invs reported 0.35% in Hanesbrands Inc. (NYSE:HBI). Salzhauer Michael has invested 0.07% in Hanesbrands Inc. (NYSE:HBI). Mason Street Advisors Limited Liability Com owns 50,680 shares for 0.02% of their portfolio. Carret Asset Mgmt Ltd Liability Corp invested 0.22% in Hanesbrands Inc. (NYSE:HBI). Mufg Americas holds 0% of its portfolio in Hanesbrands Inc. (NYSE:HBI) for 1,983 shares. Us Bank De reported 25,990 shares or 0% of all its holdings.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.