Ascena Retail Group Inc (ASNA) investors sentiment increased to 2 in Q3 2018. It’s up 0.51, from 1.49 in 2018Q2. The ratio improved, as 100 active investment managers increased and opened new holdings, while 50 cut down and sold positions in Ascena Retail Group Inc. The active investment managers in our database now hold: 188.66 million shares, up from 178.07 million shares in 2018Q2. Also, the number of active investment managers holding Ascena Retail Group Inc in top ten holdings was flat from 3 to 3 for the same number . Sold All: 11 Reduced: 39 Increased: 58 New Position: 42.

The stock of The Meet Group, Inc. (NASDAQ:MEET) is a huge mover today! The stock increased 4.55% or $0.26 during the last trading session, reaching $5.98. About 1.06M shares traded. The Meet Group, Inc. (NASDAQ:MEET) has risen 65.68% since February 4, 2018 and is uptrending. It has outperformed by 65.68% the S&P500. Some Historical MEET News: 02/05/2018 – Meet Group Sees 2018 Rev $152M-$155M; 31/05/2018 – LOVOO Launches Live Video in France and Switzerland; 07/03/2018 – Meet Group 4Q Loss/Shr 94c; 22/04/2018 – DJ Meet Group Inc, Inst Holders, 1Q 2018 (MEET); 09/04/2018 – MEET GROUP – AHEAD OF SCHEDULE WITH PLANS TO BRING LIVE VIDEO TO LOVOO, AND NOW EXPECT TO BEGIN ROLLING OUT FEATURE IN PHASED APPROACH STARTING IN MAY; 31/05/2018 – The Meet Group Brings Live Video to France and Switzerland; 07/03/2018 – Meet Group 4Q Loss $67.7M; 02/05/2018 – Meet Group 1Q Loss/Shr 6c; 28/05/2018 – Meet Group Non-Deal Roadshow Scheduled By Northland for Jun. 4; 09/04/2018 – THE MEET GROUP PROVIDES UPDATE ON LIVESTREAMING VIDEO PROGRESSThe move comes after 8 months positive chart setup for the $442.17 million company. It was reported on Feb, 4 by . We have $6.40 PT which if reached, will make NASDAQ:MEET worth $30.95M more.

Analysts await Ascena Retail Group, Inc. (NASDAQ:ASNA) to report earnings on March, 4. They expect $-0.19 EPS, down 58.33% or $0.07 from last year’s $-0.12 per share. After $0.06 actual EPS reported by Ascena Retail Group, Inc. for the previous quarter, Wall Street now forecasts -416.67% negative EPS growth.

Stadium Capital Management Llc holds 33.77% of its portfolio in Ascena Retail Group, Inc. for 19.23 million shares. Golden Gate Private Equity Inc. owns 17.47 million shares or 26.14% of their US portfolio. Moreover, Icm Asset Management Inc Wa has 5.47% invested in the company for 1.71 million shares. The Michigan-based Csat Investment Advisory L.P. has invested 0.32% in the stock. Nomura Holdings Inc, a Japan-based fund reported 17.01 million shares.

The stock increased 11.11% or $0.26 during the last trading session, reaching $2.6. About 1.45M shares traded. Ascena Retail Group, Inc. (ASNA) has risen 37.19% since February 4, 2018 and is uptrending. It has outperformed by 37.19% the S&P500. Some Historical ASNA News: 05/03/2018 – ASCENA RETAIL GROUP – REVOLVING CREDIT FACILITY ALSO MAY BE USED FOR ISSUANCE OF LETTERS OF CREDIT AND INCLUDES $200 MLN LETTER OF CREDIT SUBLIMIT; 05/03/2018 ASCENA RETAIL 2Q ADJ LOSS/SHR 12C, EST. LOSS/SHR 9.0C; 20/03/2018 – Ascena Retail General Counsel Duane D. Holloway Resigning to Join Another Public Company; 08/03/2018 – ascena retail group Celebrates International Women’s Day; 07/03/2018 – Norges Bank Exits Position in Ascena Retail; 05/03/2018 – Ascena Retail Quarterly Loss Wider Than Expected — MarketWatch; 08/03/2018 – CORRECTING and REPLACING ascena retail group, inc. Celebrates International Women’s Day; 11/05/2018 – St. Jude Children’s Research Hospital® Unveils St. Jude Garden Grown by LOFT in Celebration of More Than a Decade of Partnership; 17/05/2018 – ASCENA RETAIL GROUP INC – ON MAY 15, 2018, BOARD OF CO INCREASED SIZE OF BOARD TO ELEVEN DIRECTORS – SEC FILING; 05/03/2018 – ASCENA RETAIL GROUP-2018 AGREEMENT PROVIDES SENIOR SECURED ASSET BASED REVOLVING CREDIT FACILITY OF $500 MLN WITH OPTIONAL INCREASE OF UP TO $200 MLN

Ascena Retail Group, Inc., through its subsidiaries, operates as a specialty retailer of apparel, shoes, and accessories for women and tween girls in the United States, Canada, and Puerto Rico. The company has market cap of $502.50 million. The firm operates through six divisions: ANN, Justice, Lane Bryant, maurices, dressbarn, and Catherines. It currently has negative earnings. It creates, designs, and develops a range of merchandise, including apparel, accessories, footwear, and intimates; lifestyle products comprising cosmetics and bedroom furnishings; and wear-to-work, sportswear, footwear, and social occasion apparel.

More notable recent Ascena Retail Group, Inc. (NASDAQ:ASNA) news were published by: Nasdaq.com which released: “URBN, ZUMZ & ASNA Score Decent Numbers in Holiday Season – Nasdaq” on January 18, 2019, also with their article: “Apple Inc. (NASDAQ:AAPL), Ascena Retail Group, Inc. (NASDAQ:ASNA) – Consumer Discretionary Q4 Earnings: U.S. Consumer Appears Strong Amid Heightened Global Uncertainty – Benzinga” published on January 18, 2019, published: “28 Stocks Moving In Monday’s Pre-Market Session – Benzinga” on January 14, 2019. More interesting news about Ascena Retail Group, Inc. (NASDAQ:ASNA) were released by: Streetinsider.com and their article: “Pre-Open Stock Movers 01/14: (MBOT) (GCI) (GG) Higher; (PCG) (ASNA) (TLRD) Lower (more…) – StreetInsider.com” published on January 14, 2019 as well as Nasdaq.com‘s news article titled: “Ascena Retail Earnings: ASNA Stock Soars on Q1 Revenue Beat – Nasdaq” with publication date: December 10, 2018.

The Meet Group, Inc. owns and operates a social network for meeting new people on the Web and on mobile platforms in the United States. The company has market cap of $442.17 million. The firm owns and operates MeetMe and Skout mobile applications; and meetme.com and skout.com Websites. It currently has negative earnings. It also offers online marketing capabilities, which enable marketers to display their advertisements in various formats and in various locations.

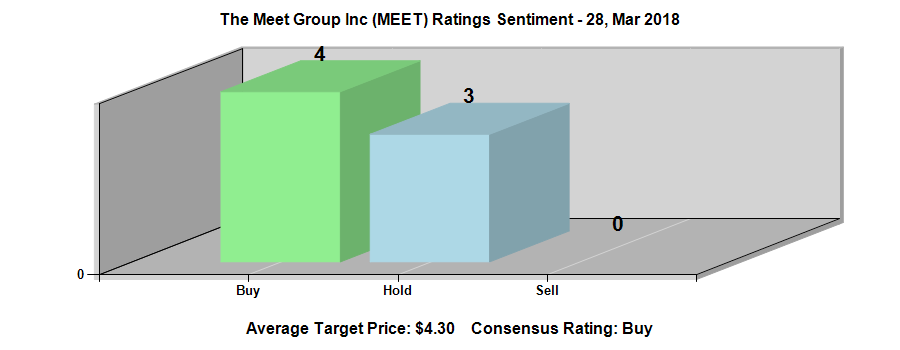

Analysts await The Meet Group, Inc. (NASDAQ:MEET) to report earnings on March, 6. They expect $0.06 EPS, down 40.00% or $0.04 from last year’s $0.1 per share. MEET’s profit will be $4.44 million for 24.92 P/E if the $0.06 EPS becomes a reality. After $0.07 actual EPS reported by The Meet Group, Inc. for the previous quarter, Wall Street now forecasts -14.29% negative EPS growth.

More notable recent The Meet Group, Inc. (NASDAQ:MEET) news were published by: Nasdaq.com which released: “Meet Group (MEET) Stock Sinks As Market Gains: What You Should Know – Nasdaq” on February 01, 2019, also Nasdaq.com with their article: “Here’s Why Momentum Investors Will Love Meet Group (MEET) – Nasdaq” published on January 30, 2019, Nasdaq.com published: “Yemen’s warring parties meet on ship to discuss stalled troop withdrawal – Nasdaq” on February 03, 2019. More interesting news about The Meet Group, Inc. (NASDAQ:MEET) were released by: Nasdaq.com and their article: “Cardiovascular Systems (CSII) Q2 Earnings Top, Revenues Meet – Nasdaq” published on February 01, 2019 as well as Nasdaq.com‘s news article titled: “Zimmer Biomet (ZBH) Q4 Earnings Meet Estimates, Revenues Top – Nasdaq” with publication date: February 01, 2019.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.