JMP Group Inc (JMP) investors sentiment increased to 1.29 in Q3 2018. It’s up 0.85, from 0.44 in 2018Q2. The ratio has increased, as 9 hedge funds increased or opened new stock positions, while 7 sold and decreased their holdings in JMP Group Inc. The hedge funds in our database reported: 2.99 million shares, up from 2.64 million shares in 2018Q2. Also, the number of hedge funds holding JMP Group Inc in top ten stock positions was flat from 0 to 0 for the same number . Sold All: 3 Reduced: 4 Increased: 2 New Position: 7.

Analysts expect Cardinal Resources Limited (TSE:CDV) to report $-0.02 EPS on February, 13.They anticipate $0.01 EPS change or 33.33% from last quarter’s $-0.03 EPS. After having $-1.43 EPS previously, Cardinal Resources Limited’s analysts see -98.60% EPS growth. The stock increased 7.69% or $0.03 during the last trading session, reaching $0.42. About 2,500 shares traded. Cardinal Resources Limited (TSE:CDV) has 0.00% since February 3, 2018 and is . It has by 0.00% the S&P500.

Analysts await JMP Group LLC (NYSE:JMP) to report earnings on February, 13. They expect $0.06 earnings per share, down 62.50% or $0.10 from last year’s $0.16 per share. JMP’s profit will be $1.28M for 18.75 P/E if the $0.06 EPS becomes a reality. After $0.08 actual earnings per share reported by JMP Group LLC for the previous quarter, Wall Street now forecasts -25.00% negative EPS growth.

JMP Group LLC, together with its subsidiaries, provides investment banking, sales and trading, equity research, and asset management services in the United States. The company has market cap of $95.84 million. It operates through three divisions: Broker-Dealer, Asset Management, and Corporate divisions. It currently has negative earnings. The Broker-Dealer segment offers services, such as underwriting and acting as a placement agent for public and private capital markets raising transactions; and financial advisory services in mergers and acquisitions, restructuring, and other strategic transactions.

More recent JMP Group LLC (NYSE:JMP) news were published by: Businesswire.com which released: “JMP Group Announces Change to Tax Status and Special Cash Distribution – Business Wire” on January 17, 2019. Also published the news titled: “Benzinga’s Top Upgrades, Downgrades For February 1, 2019 – Benzinga” on February 01, 2019. Streetinsider.com‘s news article titled: “JMP Securities Upgrades Kemper Corp (KMPR) to Market Outperform – StreetInsider.com” with publication date: January 08, 2019 was also an interesting one.

Continental Advisors Llc holds 0.2% of its portfolio in JMP Group LLC for 176,179 shares. Arbiter Partners Capital Management Llc owns 23,589 shares or 0.01% of their US portfolio. Moreover, Bridgeway Capital Management Inc has 0.01% invested in the company for 113,151 shares. The California-based Clenar Muke Llc has invested 0.01% in the stock. Acadian Asset Management Llc, a Massachusetts-based fund reported 4,753 shares.

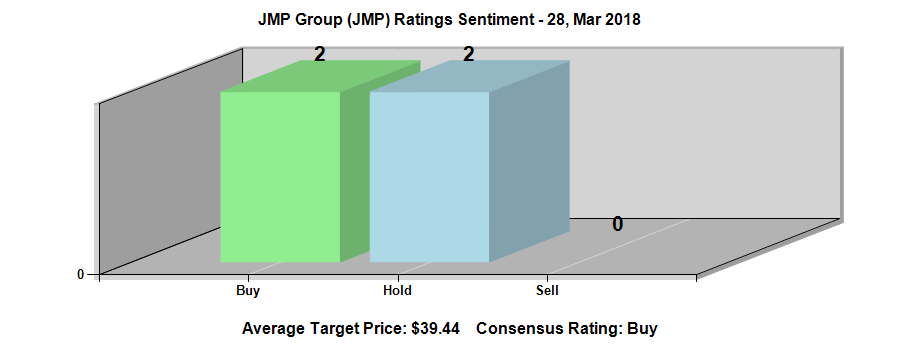

The stock decreased 1.32% or $0.06 during the last trading session, reaching $4.5. About 2,533 shares traded. JMP Group LLC (JMP) has declined 17.61% since February 3, 2018 and is downtrending. It has underperformed by 17.61% the S&P500. Some Historical JMP News: 03/05/2018 – JMP GROUP – FACILITY WAS ESTABLISHED TO FINANCE THE ACQUISITION OF A PORTFOLIO OF ASSETS, INCLUDING CERTAIN DEBT OBLIGATIONS; 22/05/2018 – JMP Group Announces Addition of Ezequiel (“Zeke”) Navar to Investment Banking Division; 02/05/2018 – JMP Group 1Q Rev $27.2M; 19/04/2018 – JMP Group Declares Second Quarter 2018 Monthly Distributions; 26/03/2018 Adobe: Some Serious Risks Lurk in JMP’s Sudden Downgrade — Barron’s Blog; 02/05/2018 – JMP Group 1Q Loss/Shr 1c; 22/05/2018 – JMP Group Announces Addition of Ezequiel (“Zeke”) Navar to Investment Banking Division; 20/04/2018 – DJ JMP Group LLC, Inst Holders, 1Q 2018 (JMP); 22/05/2018 – JMP Group Announces Addition of Ezequiel (“Zeke”) Navar to Investment Banking Division; 03/05/2018 – JMP GROUP – AMENDED REVOLVING CREDIT FACILITY WITH BNP PARIBAS TO INCREASE MAXIMUM AMOUNT TO BE BORROWED UNDER FACILITY BY $40 MLN TO $240 MLN

Cardinal Resources Limited, together with its subsidiaries, engages in the exploration and development of mineral properties in Ghana. The company has market cap of $147.51 million. It primarily explores for gold deposits. It currently has negative earnings. The company??s principal project is Namdini Gold project located in the Bolgatanga region.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.