The stock of Celestica Inc. (NYSE:CLS) hit a new 52-week low and has $7.45 target or 8.00% below today’s $8.10 share price. The 5 months bearish chart indicates high risk for the $1.10B company. The 1-year low was reported on Feb, 3 by . If the $7.45 price target is reached, the company will be worth $88.24 million less. The stock decreased 18.43% or $1.83 during the last trading session, reaching $8.1. About 2.77M shares traded or 567.79% up from the average. Celestica Inc. (NYSE:CLS) has declined 6.35% since February 3, 2018 and is downtrending. It has underperformed by 6.35% the S&P500. Some Historical CLS News: 04/04/2018 – Celestica Completes Acquisition Of Atrenne Integrated Solutions; 25/04/2018 – Celestica Closes Above 50-Day Moving Average: Technicals; 27/04/2018 – Celestica: Deepak Chopra Appointed to Board of Directors; 27/04/2018 – Celestica 1Q Adj EPS 24c; 27/04/2018 – Celestica Sees 2Q Adj EPS 25c-Adj EPS 31c; 27/04/2018 – Celestica Announces Election of Directors; 18/04/2018 – Lincoln International represents RFE Investments Partners in the sale of Atrenne Integrated Solutions, Inc. to Celestica, Inc; 14/05/2018 – Janus Henderson Group Buys New 2.5% Position in Celestica; 27/04/2018 – Celestica Sees 2Q Rev $1.575B-$1.675B; 17/05/2018 – Celestica Forms Golden Cross: Technicals

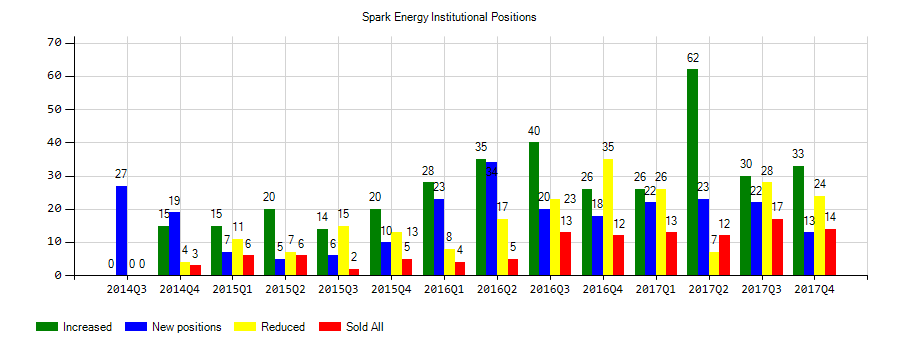

Spark Energy (SPKE) investors sentiment decreased to 0.89 in 2018 Q3. It’s down -0.08, from 0.97 in 2018Q2. The ratio has worsened, as 34 institutional investors increased or opened new holdings, while 38 cut down and sold their equity positions in Spark Energy. The institutional investors in our database now have: 9.63 million shares, down from 9.77 million shares in 2018Q2. Also, the number of institutional investors holding Spark Energy in top ten holdings was flat from 0 to 0 for the same number . Sold All: 11 Reduced: 27 Increased: 21 New Position: 13.

Celestica Inc. provides supply chain solutions in Canada and internationally. The company has market cap of $1.10 billion. The firm offers a range of services, including design and development, engineering, supply chain management, new product introduction, component sourcing, electronics manufacturing, assembly and test, complex mechanical assembly, systems integration, precision machining, order fulfillment, logistics, and after-market repair and return services. It has a 11.57 P/E ratio. The Company’s services and products are used in various applications, such as servers, networking and telecommunications equipment, storage systems, optical equipment, aerospace and defense electronics, healthcare products and applications, semiconductor equipment, and industrial and alternative energy products.

More notable recent Celestica Inc. (NYSE:CLS) news were published by: Seekingalpha.com which released: “Celestica Inc. (CLS) CEO Rob Mionis on Q4 2018 Results – Earnings Call Transcript – Seeking Alpha” on February 01, 2019, also Seekingalpha.com with their article: “Celestica Inc. 2018 Q4 – Results – Earnings Call Slides – Seeking Alpha” published on February 01, 2019, published: “Mid-Afternoon Market Update: Crude Oil Up Over 2%; Celestica Shares Fall On Earnings Miss – Benzinga” on February 01, 2019. More interesting news about Celestica Inc. (NYSE:CLS) were released by: and their article: “12 Stocks To Watch For February 1, 2019 – Benzinga” published on February 01, 2019 as well as Globenewswire.com‘s news article titled: “Celestica Announces 2019 Annual General Shareholders’ Meeting Toronto Stock Exchange:CLS – GlobeNewswire” with publication date: February 01, 2019.

Analysts await Spark Energy, Inc. (NASDAQ:SPKE) to report earnings on March, 8. They expect $0.17 earnings per share, up 122.37% or $0.93 from last year’s $-0.76 per share. SPKE’s profit will be $5.93 million for 12.26 P/E if the $0.17 EPS becomes a reality. After $0.27 actual earnings per share reported by Spark Energy, Inc. for the previous quarter, Wall Street now forecasts -37.04% negative EPS growth.

Since January 1, 0001, it had 19 buys, and 0 insider sales for $3.51 million activity.

Crow Point Partners Llc holds 1.52% of its portfolio in Spark Energy, Inc. for 1.07 million shares. Bard Associates Inc owns 171,200 shares or 0.65% of their US portfolio. Moreover, Trellus Management Company Llc has 0.51% invested in the company for 43,000 shares. The Wisconsin-based Heartland Advisors Inc has invested 0.12% in the stock. Spark Investment Management Llc, a New York-based fund reported 221,300 shares.

Spark Energy, Inc., through its subsidiaries, operates as an independent retail energy services firm in the United States. The company has market cap of $290.89 million. It operates through two divisions, Retail Natural Gas and Retail Electricity. It has a 15.95 P/E ratio. The firm is involved in the retail distribution of natural gas and electricity to residential, commercial, and industrial customers.

More notable recent Spark Energy, Inc. (NASDAQ:SPKE) news were published by: Nasdaq.com which released: “The Zacks Analyst Blog Highlights: Archer Daniels Midland, Molina Healthcare, Eli Lilly, Spark Energy and Lamb Weston – Nasdaq” on January 24, 2019, also Nasdaq.com with their article: “Validea John Neff Strategy Daily Upgrade Report – 1/15/2019 – Nasdaq” published on January 15, 2019, Globenewswire.com published: “Spark Energy, Inc. Reports Third Quarter 2018 Financial Results – GlobeNewswire” on November 01, 2018. More interesting news about Spark Energy, Inc. (NASDAQ:SPKE) were released by: Globenewswire.com and their article: “Spark Energy, Inc. Announces Management Changes Nasdaq:SPKE – GlobeNewswire” published on December 14, 2018 as well as Globenewswire.com‘s news article titled: “Spark Energy, Inc. Reports First Quarter 2018 Financial Results – GlobeNewswire” with publication date: May 09, 2018.

The stock increased 0.48% or $0.04 during the last trading session, reaching $8.34. About 93,663 shares traded. Spark Energy, Inc. (SPKE) has declined 36.97% since February 3, 2018 and is downtrending. It has underperformed by 36.97% the S&P500. Some Historical SPKE News: 08/03/2018 Spark Energy, Inc. Announces Two Acquisitions, Engagement of Financial Advisor, and Reports Full Year and Fourth Quarter 2017 F; 09/05/2018 – Spark Energy 1Q Rev $284M; 08/03/2018 – SPARK ENERGY INC – CONTINUE TO SIMPLIFY, STREAMLINE, AND OPTIMIZE ORGANIZATION; 25/05/2018 – Report: Exploring Fundamental Drivers Behind Hyster-Yale Materials Handling, United Financial, Cadiz, Spark Energy, First Citiz; 10/05/2018 – Spark Energy Closes Below 50-Day Moving Average: Technicals; 09/05/2018 – Spark Energy 1Q Loss $41.8M; 09/05/2018 – SPARK ENERGY INC QTRLY TOTAL REVENUES $286.7 MLN VS $196.3 MLN; 15/03/2018 – Spark Energy re-energizes sale attempt, sources say [21:45 GMT15 Mar 2018] [Proprietary] []; 08/03/2018 – Spark Energy: Board of Directors Has Engaged Morgan Stanley as a Fincl Advisor to Explore Strategic Alternatives; 08/03/2018 – SPARK ENERGY SEES 2018 ADJ. EBITDA SIMILAR TO 2017

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.