Analysts expect Choice Hotels International, Inc. (NYSE:CHH) to report $0.83 EPS on February, 19.They anticipate $0.20 EPS change or 31.75% from last quarter’s $0.63 EPS. CHH’s profit would be $46.47 million giving it 23.69 P/E if the $0.83 EPS is correct. After having $1.24 EPS previously, Choice Hotels International, Inc.’s analysts see -33.06% EPS growth. The stock decreased 0.64% or $0.51 during the last trading session, reaching $78.65. About 104,795 shares traded. Choice Hotels International, Inc. (NYSE:CHH) has declined 5.91% since February 1, 2018 and is downtrending. It has underperformed by 5.91% the S&P500. Some Historical CHH News: 10/05/2018 – Choice Hotels International 1Q Profit Up 3.3%; 10/05/2018 – CHOICE HOTELS INTERNATIONAL INC CHH.N FY2018 SHR VIEW $3.62 — THOMSON REUTERS l/B/E/S; 06/03/2018 – Ingenico Group Partners with Choice Hotels to Enhance Payment Security at Hotels Across the U.S; 10/05/2018 – CHOICE HOTELS INTERNATIONAL INC CHH.N – ADJUSTED EBITDA FOR FULL-YEAR 2018 IS EXPECTED TO RANGE BETWEEN $330 MILLION AND $337 MILLION; 03/04/2018 – Sleep Inn Hotel Opens In Houston; 21/03/2018 – Ascend Hotel Collection Robust Growth Focuses On Major Markets; 11/04/2018 – CHOICE HOTELS INTERNATIONAL – STRATEGIC ALLIANCE ALSO CONTEMPLATES CHOICE EXPANDING PRESENCE IN SPAIN AND LATIN AMERICA; 10/05/2018 – CHOICE HOTELS INTERNATIONAL INC CHH.N SEES FY 2018 SHR $3.37 TO $3.47; 11/04/2018 – CHOICE HOTELS INTERNATIONAL INC – CHOICE HOTELS’ BRANDS WILL LEVERAGE HOTEL MANAGEMENT ARM OF SERCOTEL HOTELS; 17/05/2018 – CHOICE HOTELS INTERNATIONAL INC CHH.N : BARCLAYS RAISES TARGET PRICE TO $77 FROM $75

Sun Life Financial Inc increased Principal Financial Group Inc (PFG) stake by 2947.37% reported in 2018Q3 SEC filing. Sun Life Financial Inc acquired 21,280 shares as Principal Financial Group Inc (PFG)’s stock declined 22.31%. The Sun Life Financial Inc holds 22,002 shares with $1.29 million value, up from 722 last quarter. Principal Financial Group Inc now has $14.14 billion valuation. The stock decreased 0.21% or $0.1 during the last trading session, reaching $49.97. About 628,515 shares traded. Principal Financial Group, Inc. (NYSE:PFG) has declined 39.53% since February 1, 2018 and is downtrending. It has underperformed by 39.53% the S&P500. Some Historical PFG News: 26/04/2018 – Principal Financial 1Q EPS $1.36; 10/04/2018 – GLADSTONE CAPITAL SAYS APPOINTED JULIA RYAN TO SERVE IN TEMPORARY CAPACITY AS ACTING PRINCIPAL FINANCIAL OFFICER – SEC FILING; 26/04/2018 – PRINCIPAL FINANCIAL AUM $673.8B; 26/04/2018 – PRINCIPAL 1Q ADJ. OPER EPS $1.40, EST. $1.35; 26/03/2018 – Principal Financial Non-Deal Roadshow Set By KBW for Apr. 3-6; 08/05/2018 – Momenta Pharmaceuticals Designates CEO Craig A. Wheeler as Principal Fincl Officer, Principal Accounting Officer; 06/04/2018 – REG-Principal Financial Group Funding LLC FRN Variable Rate Fix; 01/05/2018 – Principal Financial at Barclays Insurance Forum May 15; 26/04/2018 – Principal Financial 1Q Net $397.1M; 26/04/2018 – Principal Financial 1Q Adj EPS $1.40

Since September 18, 2018, it had 0 insider purchases, and 4 sales for $4.55 million activity. $430,199 worth of Choice Hotels International, Inc. (NYSE:CHH) was sold by Cimerola Patrick. $788,458 worth of Choice Hotels International, Inc. (NYSE:CHH) was sold by Pacious Patrick on Tuesday, September 18.

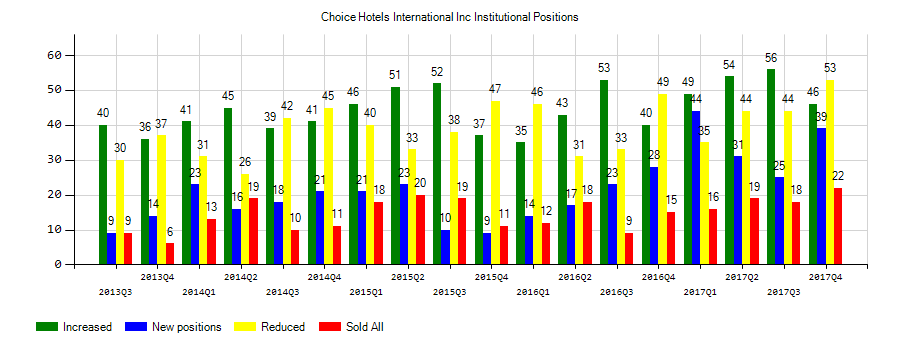

Investors sentiment decreased to 1.03 in Q3 2018. Its down 0.28, from 1.31 in 2018Q2. It dropped, as 25 investors sold Choice Hotels International, Inc. shares while 53 reduced holdings. 29 funds opened positions while 51 raised stakes. 31.01 million shares or 2.17% more from 30.35 million shares in 2018Q2 were reported. Teacher Retirement Systems Of Texas holds 0% of its portfolio in Choice Hotels International, Inc. (NYSE:CHH) for 4,339 shares. Fort L P stated it has 11,595 shares or 0.22% of all its holdings. Utah Retirement reported 0.01% stake. 39,400 were reported by Ubs Oconnor Lc. Morgan Stanley holds 0.01% or 307,370 shares. Goldman Sachs Inc holds 0.03% in Choice Hotels International, Inc. (NYSE:CHH) or 1.49 million shares. Gsa Capital Prtnrs Limited Liability Partnership reported 0.08% of its portfolio in Choice Hotels International, Inc. (NYSE:CHH). Earnest Partners Limited Liability Corp invested in 34 shares. Fenimore Asset owns 179,655 shares. 14,170 were reported by Schroder Management Group. Voya Inv Mngmt Limited Liability Company stated it has 0% of its portfolio in Choice Hotels International, Inc. (NYSE:CHH). Sg Americas Ltd Liability Corporation stated it has 0% in Choice Hotels International, Inc. (NYSE:CHH). Her Majesty The Queen In Right Of The Province Of Alberta As Represented By Alberta Management Corp reported 21,600 shares. Royal Bancshares Of Canada reported 0% stake. Tealwood Asset Mngmt owns 42,806 shares.

Among 2 analysts covering Choice Hotels (NYSE:CHH), 1 have Buy rating, 0 Sell and 1 Hold. Therefore 50% are positive. Choice Hotels had 2 analyst reports since September 7, 2018 according to SRatingsIntel. As per Thursday, November 15, the company rating was maintained by Wells Fargo.

Choice Hotels International, Inc., together with its subsidiaries, operates as a hotel franchisor worldwide. The company has market cap of $4.40 billion. It operates in two divisions, Hotel Franchising and SkyTouch Technology. It has a 26.8 P/E ratio. The firm franchises lodging properties under the proprietary brand names Comfort Inn, Comfort Suites, Quality, Clarion, Sleep Inn, Econo Lodge, Rodeway Inn, MainStay Suites, Suburban Extended Stay Hotel, Cambria hotels and suites, and Ascend Hotel Collection.

More notable recent Choice Hotels International, Inc. (NYSE:CHH) news were published by: Globenewswire.com which released: “Analysis: Positioning to Benefit within Motorola Solutions, FibroGen, UnitedHealth Group, Newell Brands, Vuzix, and Choice Hotels International — Research Highlights Growth, Revenue, and Consolidated Results – GlobeNewswire” on January 17, 2019, also Prnewswire.com with their article: “Cambria Hotels Begins Transformation of Downtown Los Angeles Building with “Sky Breaking” – PRNewswire” published on January 28, 2019, Bizjournals.com published: “Cambria Chicago Magnificent Mile hotel workers still on strike – Chicago Business Journal” on January 18, 2019. More interesting news about Choice Hotels International, Inc. (NYSE:CHH) were released by: Gurufocus.com and their article: “Coastal Sanctuary And Modern Amenities Await At Torrance, California’s First Boutique Hotel – GuruFocus.com” published on January 09, 2019 as well as Businesswire.com‘s news article titled: “Choice Hotels Goes All-In on AWS – Business Wire” with publication date: January 14, 2019.

Since September 4, 2018, it had 1 buy, and 4 selling transactions for $103,700 activity. GELATT DANIEL also bought $1.20 million worth of Principal Financial Group, Inc. (NASDAQ:PFG) on Monday, November 5. The insider Friedrich Amy Christine sold $103,700. $1.11M worth of Principal Financial Group, Inc. (NASDAQ:PFG) shares were sold by MCCAUGHAN JAMES P. $50,000 worth of Principal Financial Group, Inc. (NASDAQ:PFG) was sold by LAWLER JULIA M.

Sun Life Financial Inc decreased Pfizer Inc (NYSE:PFE) stake by 8,177 shares to 46,020 valued at $2.03M in 2018Q3. It also reduced Ishares Msci Eafe Index Fund (EFA) stake by 576,230 shares and now owns 41,362 shares. Technology Select Sector Spdr Fund (XLK) was reduced too.

Among 5 analysts covering Principal Financial Group (NYSE:PFG), 0 have Buy rating, 0 Sell and 5 Hold. Therefore 0 are positive. Principal Financial Group had 5 analyst reports since August 17, 2018 according to SRatingsIntel. The firm has “Neutral” rating by Credit Suisse given on Friday, August 17. The rating was maintained by UBS on Monday, October 8 with “Neutral”. On Tuesday, November 13 the stock rating was maintained by Morgan Stanley with “Equal-Weight”. The stock of Principal Financial Group, Inc. (NASDAQ:PFG) earned “Neutral” rating by Goldman Sachs on Tuesday, January 8. RBC Capital Markets downgraded Principal Financial Group, Inc. (NASDAQ:PFG) on Tuesday, December 11 to “Sector Perform” rating.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.