Chou Associates Management Inc increased its stake in Resolute Fst Prods Inc (Call) (RFP) by 266.67% based on its latest 2018Q3 regulatory filing with the SEC. Chou Associates Management Inc bought 400,000 shares as the company’s stock declined 12.58% with the market. The hedge fund held 550,000 shares of the paper company at the end of 2018Q3, valued at $7.12 million, up from 150,000 at the end of the previous reported quarter. Chou Associates Management Inc who had been investing in Resolute Fst Prods Inc (Call) for a number of months, seems to be bullish on the $706.66 million market cap company. The stock decreased 15.81% or $1.46 during the last trading session, reaching $7.78. About 151,810 shares traded. Resolute Forest Products Inc. (NYSE:RFP) has risen 38.81% since January 31, 2018 and is uptrending. It has outperformed by 38.81% the S&P500. Some Historical RFP News: 03/05/2018 – RESOLUTE FOREST CEO YVES LAFLAMME SAYS ON 1Q EARNINGS CALL; 24/05/2018 – DirectRFP® Launches the World’s First RFP Automated Technology Platform; 25/04/2018 – St Louis County: Retirement Software RFP #2018-34-CL; 16/04/2018 – RESOLUTE FOREST PRODUCTS INC – A TENTATIVE FOUR-YEAR AGREEMENT HAS BEEN REACHED WITH UNIFOR, SUBJECT TO RATIFICATION BY THEIR MEMBERS; 14/05/2018 – Resolute Forest Products To Invest Over C$52M in Its Saint-Felicien Pulp Mill in Quebec; 13/03/2018 – U.S. COMMERCE DEPARTMENT MAKES PRELIMINARY FINDING IMPORTS OF CANADIAN UNCOATED GROUNDWOOD PAPER DUMPED, IMPOSES ANTIDUMPING DUTIES OF UP TO 22.16 PCT; 17/05/2018 – St. Croix Source: RFP-021-C-2018 (P); 03/05/2018 – RESOLUTE CEO SAYS TRANSPORT ISSUES CONTINUE TO IMPACT EARNINGS; 13/04/2018 – St Louis County: Revenue Cycle Management Services – RFP 2018-28-PR; 16/04/2018 – RESOLUTE FOREST PRODUCTS INC – THE MASTER AGREEMENT COVERS EIGHT OF RESOLUTE’S CANADIAN PULP AND PAPER MILLS

Lvw Advisors Llc increased its stake in Paccar Inc (PCAR) by 38.35% based on its latest 2018Q3 regulatory filing with the SEC. Lvw Advisors Llc bought 5,796 shares as the company’s stock declined 17.75% with the market. The institutional investor held 20,910 shares of the auto manufacturing company at the end of 2018Q3, valued at $1.43M, up from 15,114 at the end of the previous reported quarter. Lvw Advisors Llc who had been investing in Paccar Inc for a number of months, seems to be bullish on the $22.48 billion market cap company. The stock decreased 0.65% or $0.42 during the last trading session, reaching $64.33. About 66,332 shares traded. PACCAR Inc (NASDAQ:PCAR) has declined 16.37% since January 31, 2018 and is downtrending. It has underperformed by 16.37% the S&P500. Some Historical PCAR News: 24/04/2018 – Paccar 1Q U.S., Canada Class 8 Truck Industry Orders More Than Doubled; 24/04/2018 – PACCAR Achieves Record Quarterly Revenues and Excellent Profits; 07/05/2018 – NEW DEAL: PACCAR Financial $550m 3Y +60-65, 3Y L equiv; 19/04/2018 Paccar Closes Below 200-Day Moving Average: Technicals; 01/05/2018 – Paccar Raises Dividend to 28c Vs. 25c; 24/04/2018 – Paccar 1Q Net $512.1M; 24/04/2018 – Paccar 1Q Rev $5.65B; 19/04/2018 – Moody’s Affirms A1 Long-term Rating for Paccar Financial Corp., Paccar Financial Europe and Paccar Financial PLC; 24/04/2018 – Paccar 1Q EPS $1.45; 24/04/2018 – PACCAR INCREASED EST OF YR CLASS 8 TRUCK INDUSTRY RETAIL SALES

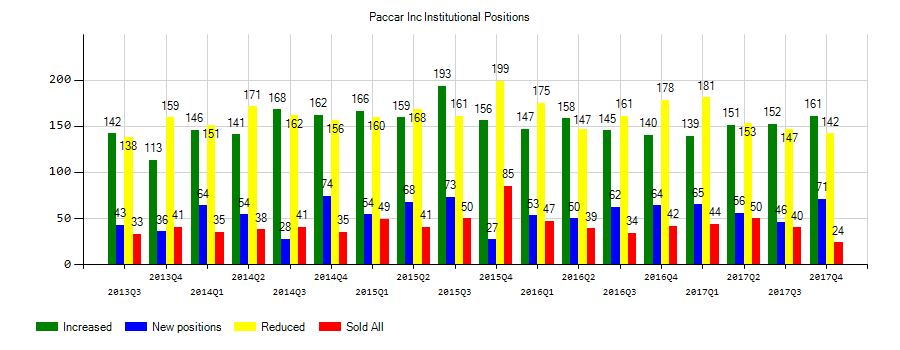

Investors sentiment increased to 1.16 in 2018 Q3. Its up 0.18, from 0.98 in 2018Q2. It is positive, as 39 investors sold PCAR shares while 162 reduced holdings. 81 funds opened positions while 152 raised stakes. 202.64 million shares or 1.95% less from 206.66 million shares in 2018Q2 were reported. Oppenheimer Incorporated, a New York-based fund reported 29,878 shares. Dimensional Fund Advsrs Limited Partnership holds 0.07% or 2.65 million shares. Wilbanks Smith Thomas Asset Mngmt Ltd Liability Com reported 0% of its portfolio in PACCAR Inc (NASDAQ:PCAR). Verity Asset Incorporated has 3,374 shares for 0.23% of their portfolio. Putnam Limited Liability Corporation has 0% invested in PACCAR Inc (NASDAQ:PCAR) for 4,627 shares. Northern Trust Corp owns 3.92M shares for 0.07% of their portfolio. Cleararc Capital Incorporated holds 0.08% or 9,076 shares. Alliancebernstein LP owns 833,286 shares for 0.04% of their portfolio. Heartland reported 0.03% of its portfolio in PACCAR Inc (NASDAQ:PCAR). Benjamin F Edwards And holds 0% or 576 shares. Us Bank De reported 2.67M shares. Eagle Global Ltd Limited Liability Company invested 0.02% in PACCAR Inc (NASDAQ:PCAR). Lord Abbett Limited Liability Corporation has 0.01% invested in PACCAR Inc (NASDAQ:PCAR) for 66,400 shares. State Of Tennessee Treasury Department stated it has 78,250 shares. First Washington Corporation reported 159,928 shares.

Among 29 analysts covering Paccar Inc (NASDAQ:PCAR), 6 have Buy rating, 5 Sell and 18 Hold. Therefore 21% are positive. Paccar Inc had 130 analyst reports since July 30, 2015 according to SRatingsIntel. BMO Capital Markets maintained the stock with “Buy” rating in Wednesday, April 25 report. As per Tuesday, September 5, the company rating was maintained by BMO Capital Markets. The stock of PACCAR Inc (NASDAQ:PCAR) has “Buy” rating given on Tuesday, June 6 by UBS. The stock of PACCAR Inc (NASDAQ:PCAR) has “Neutral” rating given on Wednesday, April 25 by Credit Suisse. The firm has “Buy” rating given on Friday, May 26 by Jefferies. On Wednesday, October 25 the stock rating was maintained by Robert W. Baird with “Neutral”. Robert W. Baird downgraded PACCAR Inc (NASDAQ:PCAR) on Tuesday, January 3 to “Neutral” rating. The firm has “Hold” rating given on Wednesday, May 30 by Goldman Sachs. The rating was downgraded by Bank of America to “Neutral” on Thursday, May 11. The stock of PACCAR Inc (NASDAQ:PCAR) has “Buy” rating given on Wednesday, October 25 by UBS.

Since November 7, 2018, it had 0 buys, and 2 sales for $11.45 million activity. PIGOTT MARK C sold 194,004 shares worth $11.42M.

More notable recent PACCAR Inc (NASDAQ:PCAR) news were published by: Nasdaq.com which released: “Nasdaq 100 Movers: AMD, PCAR – Nasdaq” on January 29, 2019, also Nasdaq.com with their article: “PACCAR Inc. (PCAR) Ex-Dividend Date Scheduled for November 09, 2018 – Nasdaq” published on November 08, 2018, published: “Bank of America Corporation (NYSE:BAC), PACCAR Inc. (NASDAQ:PCAR) – PACCAR’s Forecast Sees A Slightly Growth In Class 8 Truck Market After A Strong Year – Benzinga” on January 30, 2019. More interesting news about PACCAR Inc (NASDAQ:PCAR) were released by: and their article: “Cummins Inc. (NYSE:CMI), (DMLRY) – New Coalition Seeks Repeal Of Federal Excise Tax On Heavy Trucks And Trailers – Benzinga” published on January 28, 2019 as well as ‘s news article titled: “Earnings Scheduled For January 29, 2019 – Benzinga” with publication date: January 29, 2019.

Lvw Advisors Llc, which manages about $2.12 billion and $356.22M US Long portfolio, decreased its stake in Target Corp (NYSE:TGT) by 8,649 shares to 9,236 shares, valued at $815,000 in 2018Q3, according to the filing.

More notable recent Resolute Forest Products Inc. (NYSE:RFP) news were published by: Seekingalpha.com which released: “Shaky start to 2019 for select paper/containboard stocks – Seeking Alpha” on January 02, 2019, also Fool.com with their article: “8X8 Inc (EGHT) Q3 2019 Earnings Conference Call Transcript – Motley Fool” published on January 30, 2019, Seekingalpha.com published: “Tracking Prem Watsa’s Fairfax Financial Holdings Portfolio – Q3 2018 Update – Seeking Alpha” on November 19, 2018. More interesting news about Resolute Forest Products Inc. (NYSE:RFP) were released by: Bizjournals.com and their article: “Game on: Navy releases RFP for part of NGEN-R contract – Washington Business Journal” published on September 18, 2018 as well as Streetinsider.com‘s news article titled: “Resolute Forest Products (RFP) Declares $1.50 Special Dividend; 11.5% Yield – StreetInsider.com” with publication date: November 01, 2018.

Among 4 analysts covering Resolute Forest Products (NYSE:RFP), 0 have Buy rating, 0 Sell and 4 Hold. Therefore 0 are positive. Resolute Forest Products had 22 analyst reports since October 21, 2015 according to SRatingsIntel. The stock of Resolute Forest Products Inc. (NYSE:RFP) earned “Hold” rating by RBC Capital Markets on Sunday, July 30. The stock of Resolute Forest Products Inc. (NYSE:RFP) has “Reduce” rating given on Friday, April 1 by TD Securities. TD Securities upgraded the stock to “Hold” rating in Friday, November 3 report. RBC Capital Markets maintained Resolute Forest Products Inc. (NYSE:RFP) on Thursday, February 1 with “Hold” rating. TD Securities maintained Resolute Forest Products Inc. (NYSE:RFP) on Friday, October 13 with “Sell” rating. The rating was maintained by RBC Capital Markets with “Hold” on Tuesday, April 17. The rating was upgraded by RBC Capital Markets on Friday, February 5 to “Outperform”. Dundee Securities downgraded the shares of RFP in report on Thursday, February 18 to “Neutral” rating. RBC Capital Markets maintained the shares of RFP in report on Thursday, January 11 with “Hold” rating. The rating was maintained by Scotia Capital with “Sell” on Tuesday, March 6.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.