Comerica Bank decreased its stake in Micron Technology Inc (MU) by 22.45% based on its latest 2018Q3 regulatory filing with the SEC. Comerica Bank sold 67,078 shares as the company’s stock declined 22.49% with the market. The institutional investor held 231,724 shares of the technology company at the end of 2018Q3, valued at $8.96M, down from 298,802 at the end of the previous reported quarter. Comerica Bank who had been investing in Micron Technology Inc for a number of months, seems to be less bullish one the $43.68 billion market cap company. The stock increased 6.48% or $2.37 during the last trading session, reaching $38.96. About 61.04M shares traded or 81.59% up from the average. Micron Technology, Inc. (NASDAQ:MU) has declined 19.44% since January 26, 2018 and is downtrending. It has underperformed by 19.44% the S&P500. Some Historical MU News: 22/03/2018 – MICRON 2Q ADJ EPS $2.82; 08/03/2018 – Tech Today: Apple for Snap? Hiking Micron Numbers, Splunk M&A Bait? — Barron’s Blog; 21/05/2018 – MICRON REPORTS $10B SHARE BUYBACK AUTHORIZATION; 22/03/2018 – Micron: Memory Production Will Be Affected By Issue At Production Facility — MarketWatch; 11/05/2018 – HOSOKAWA MICRON 6277.T 6-MTH GROUP NET PROFIT 1.93 BLN YEN (+18.1 %), 2017/18 FORECAST PROFIT 3.60 BLN YEN (+0.8 %); 21/05/2018 – MICRON & INTEL EXTEND THEIR LEADERSHIP IN 3D NAND FLASH MEMORY; 21/05/2018 – Micron increases its financial guidance for its fiscal third quarter; 21/05/2018 – Micron Ships lndustry’s First Quad-Level Cell NAND SSD; 25/05/2018 – MU: $MU – China to investigate DRAM manufacturers – ! $MU; 22/03/2018 – MICRON SEES 3Q ADJ. EPS $2.83 +/- $0.07, EST. $2.65

Cardinal Capital Management Llc decreased its stake in Mb Financial Inc New (MBFI) by 58.21% based on its latest 2018Q3 regulatory filing with the SEC. Cardinal Capital Management Llc sold 1.34 million shares as the company’s stock declined 15.28% with the market. The institutional investor held 961,615 shares of the major banks company at the end of 2018Q3, valued at $44.34M, down from 2.30M at the end of the previous reported quarter. Cardinal Capital Management Llc who had been investing in Mb Financial Inc New for a number of months, seems to be less bullish one the $3.82B market cap company. The stock increased 0.42% or $0.19 during the last trading session, reaching $45.67. About 687,364 shares traded or 19.40% up from the average. MB Financial, Inc. (NASDAQ:MBFI) has declined 9.16% since January 26, 2018 and is downtrending. It has underperformed by 9.16% the S&P500. Some Historical MBFI News: 24/04/2018 – MB FINANCIAL 1Q OPER EPS 64C, EST. 64C; 19/04/2018 – DJ MB Financial Inc, Inst Holders, 1Q 2018 (MBFI); 24/04/2018 – MB FINANCIAL 1Q NET INTEREST INCOME $132.9M; 12/04/2018 – MB FINANCIAL SEES ONE-TIME COSTS ABOUT $37M-$41M DURING 2018; 21/05/2018 – Fifth Third to Buy MB Financial; 24/04/2018 – MB Financial, Inc.’s First Quarter 2018 Earnings Release and Investor Presentation Available on its Investor Relations Website; 24/04/2018 – MB Financial 1Q Net $56.8M; 21/05/2018 – MB Financial/Fifth Third in spring deal talks; 22/05/2018 – WeissLaw LLP Investigates MB Financial, Inc. Acquisition; 22/05/2018 – Fifth Third Bancorp’s Deal to Buy MB Financial Announced Monday Includes $151M Termination Fee Payable by MB Under Certain Circumstances

Investors sentiment decreased to 1.05 in Q3 2018. Its down 0.35, from 1.4 in 2018Q2. It dropped, as 93 investors sold MU shares while 253 reduced holdings. 109 funds opened positions while 256 raised stakes. 767.36 million shares or 3.16% less from 792.40 million shares in 2018Q2 were reported. Numerixs Inv Techs Inc invested in 60,300 shares. The Bahamas-based Pictet Bank & Trust And Tru Limited has invested 0.43% in Micron Technology, Inc. (NASDAQ:MU). Malaga Cove Cap Limited Liability Corp owns 25,559 shares. Lenox Wealth Mgmt holds 0% of its portfolio in Micron Technology, Inc. (NASDAQ:MU) for 154 shares. Principal Gp holds 1.78M shares or 0.07% of its portfolio. Mackay Shields Ltd Llc invested in 989,600 shares or 0.34% of the stock. The New York-based Dalton Greiner Hartman Maher & has invested 0.43% in Micron Technology, Inc. (NASDAQ:MU). Loomis Sayles Com Limited Partnership reported 497 shares. Oakbrook Invests Ltd Liability Corp accumulated 76,850 shares or 0.19% of the stock. Parsons Cap Ri accumulated 12,215 shares or 0.06% of the stock. Ima Wealth stated it has 51,459 shares or 0.91% of all its holdings. Moreover, Braun Stacey Associate has 0.66% invested in Micron Technology, Inc. (NASDAQ:MU) for 229,485 shares. Dimensional Fund Advsr Lp invested in 0.23% or 13.45 million shares. Oakmont Corp stated it has 344,000 shares or 2.02% of all its holdings. Korea-based Natl Pension Ser has invested 0.22% in Micron Technology, Inc. (NASDAQ:MU).

Comerica Bank, which manages about $12.40 billion US Long portfolio, upped its stake in Amedisys Inc (NASDAQ:AMED) by 5,481 shares to 35,691 shares, valued at $3.89 million in 2018Q3, according to the filing. It also increased its holding in Regency Centers Corp (NYSE:REG) by 20,251 shares in the quarter, for a total of 62,151 shares, and has risen its stake in Burlington Stores Inc (NYSE:BURL).

Analysts await Micron Technology, Inc. (NASDAQ:MU) to report earnings on March, 28. They expect $1.77 EPS, down 36.79% or $1.03 from last year’s $2.8 per share. MU’s profit will be $1.98 billion for 5.50 P/E if the $1.77 EPS becomes a reality. After $2.93 actual EPS reported by Micron Technology, Inc. for the previous quarter, Wall Street now forecasts -39.59% negative EPS growth.

Among 45 analysts covering Micron Technology Inc. (NASDAQ:MU), 32 have Buy rating, 1 Sell and 12 Hold. Therefore 71% are positive. Micron Technology Inc. had 286 analyst reports since July 29, 2015 according to SRatingsIntel. The firm earned “Hold” rating on Thursday, October 26 by KeyBanc Capital Markets. Standpoint Research upgraded the stock to “Buy” rating in Wednesday, December 7 report. Wedbush maintained it with “Neutral” rating and $15.0 target in Friday, October 2 report. Wells Fargo maintained Micron Technology, Inc. (NASDAQ:MU) on Monday, July 31 with “Buy” rating. The firm has “Buy” rating given on Friday, September 9 by UBS. The stock of Micron Technology, Inc. (NASDAQ:MU) earned “Buy” rating by Mizuho on Tuesday, February 16. Stifel Nicolaus maintained Micron Technology, Inc. (NASDAQ:MU) on Tuesday, February 6 with “Buy” rating. The firm has “Outperform” rating given on Tuesday, September 29 by Wells Fargo. On Tuesday, September 29 the stock rating was maintained by Stifel Nicolaus with “Buy”. As per Thursday, September 7, the company rating was maintained by Mizuho.

More notable recent Micron Technology, Inc. (NASDAQ:MU) news were published by: Nasdaq.com which released: “Pre-Market Most Active for Jan 14, 2019 : PCG, GG, SQQQ, AMD, QQQ, ACB, SCHW, C, TQQQ, TAK, MU, TVIX – Nasdaq” on January 14, 2019, also Nasdaq.com with their article: “After Hours Most Active for Jan 15, 2019 : F, PCG, GE, QQQ, KO, BAC, FOXA, TAL, SIRI, AMD, VMBS, MU – Nasdaq” published on January 15, 2019, Nasdaq.com published: “Zacks Value Trader Highlights: Micron, Apple, Bank OZK, WW and Fossil – Nasdaq” on January 25, 2019. More interesting news about Micron Technology, Inc. (NASDAQ:MU) were released by: Nasdaq.com and their article: “Notable Friday Option Activity: RMD, BA, MU – Nasdaq” published on January 25, 2019 as well as Seekingalpha.com‘s news article titled: “Will Micron’s Buyback Have A Cyclicality Problem? – Micron Technology Inc. (NASDAQ:MU) – Seeking Alpha” with publication date: January 03, 2019.

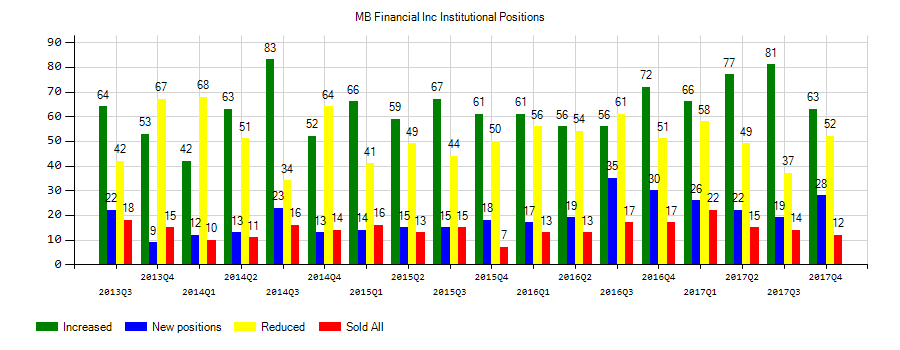

Investors sentiment decreased to 0.97 in 2018 Q3. Its down 0.10, from 1.07 in 2018Q2. It turned negative, as 26 investors sold MBFI shares while 52 reduced holdings. 24 funds opened positions while 52 raised stakes. 59.15 million shares or 3.77% more from 57.00 million shares in 2018Q2 were reported. Moreover, Ing Groep Nv has 0.01% invested in MB Financial, Inc. (NASDAQ:MBFI) for 12,872 shares. Goldman Sachs Gp has 0% invested in MB Financial, Inc. (NASDAQ:MBFI) for 351,004 shares. Public Employees Retirement Systems Of Ohio, Ohio-based fund reported 1,832 shares. Mutual Of America Capital Mgmt Ltd Liability Corporation has invested 0.13% in MB Financial, Inc. (NASDAQ:MBFI). Aperio Grp Inc Ltd Liability Corp holds 0.01% of its portfolio in MB Financial, Inc. (NASDAQ:MBFI) for 30,327 shares. Rmb Cap Mgmt Ltd Liability Com has invested 0.03% of its portfolio in MB Financial, Inc. (NASDAQ:MBFI). Ls Inv Ltd Liability Corporation reported 0.01% stake. Pinebridge Invs LP reported 0.01% of its portfolio in MB Financial, Inc. (NASDAQ:MBFI). Teacher Retirement Sys Of Texas stated it has 0% in MB Financial, Inc. (NASDAQ:MBFI). Zurcher Kantonalbank (Zurich Cantonalbank) holds 0% or 4,965 shares. Alliancebernstein LP holds 0% in MB Financial, Inc. (NASDAQ:MBFI) or 164,887 shares. California State Teachers Retirement reported 0.01% in MB Financial, Inc. (NASDAQ:MBFI). Nelson Van Denburg & Campbell Wealth Gru Limited Liability holds 0.02% or 1,940 shares in its portfolio. Deutsche Bancorp Ag accumulated 468,902 shares. Schwab Charles Investment Mngmt Inc holds 0.02% or 582,793 shares in its portfolio.

Cardinal Capital Management Llc, which manages about $1.96 billion and $3.18B US Long portfolio, upped its stake in Columbia Bkg Sys Inc (NASDAQ:COLB) by 135,739 shares to 2.77M shares, valued at $106.28M in 2018Q3, according to the filing. It also increased its holding in Syneos Health Inc by 147,116 shares in the quarter, for a total of 559,401 shares, and has risen its stake in Fb Finl Corp.

Among 13 analysts covering MB Financial (NASDAQ:MBFI), 1 have Buy rating, 0 Sell and 12 Hold. Therefore 8% are positive. MB Financial had 50 analyst reports since July 20, 2015 according to SRatingsIntel. The stock of MB Financial, Inc. (NASDAQ:MBFI) has “Hold” rating given on Friday, April 6 by Piper Jaffray. The rating was maintained by SunTrust with “Buy” on Thursday, November 16. The company was initiated on Friday, June 10 by Piper Jaffray. The firm earned “Hold” rating on Tuesday, May 22 by Macquarie Research. The stock of MB Financial, Inc. (NASDAQ:MBFI) has “Neutral” rating given on Friday, August 26 by DA Davidson. Piper Jaffray maintained the shares of MBFI in report on Tuesday, April 24 with “Hold” rating. The stock of MB Financial, Inc. (NASDAQ:MBFI) earned “Hold” rating by Jefferies on Thursday, January 25. As per Monday, September 21, the company rating was initiated by Hovde Group. As per Friday, January 26, the company rating was maintained by SunTrust. As per Friday, April 13, the company rating was maintained by Sandler O’Neill.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.