Landscape Capital Management Llc decreased Royal Caribbean Cruises Ltd (RCL) stake by 75.98% reported in 2018Q3 SEC filing. Landscape Capital Management Llc sold 55,013 shares as Royal Caribbean Cruises Ltd (RCL)’s stock declined 15.38%. The Landscape Capital Management Llc holds 17,389 shares with $2.26 million value, down from 72,402 last quarter. Royal Caribbean Cruises Ltd now has $21.92B valuation. The stock increased 0.52% or $0.54 during the last trading session, reaching $104.9. About 1.67M shares traded. Royal Caribbean Cruises Ltd. (NYSE:RCL) has declined 15.47% since January 11, 2018 and is downtrending. It has underperformed by 15.47% the S&P500. Some Historical RCL News: 26/04/2018 – Royal Caribbean 1Q Net $218.7M; 26/04/2018 – ROYAL CARIBBEAN CRUISES LTD QTRLY NET CRUISE COSTS EXCLUDING FUEL PER APCD WERE UP 11.2% IN CONSTANT-CURRENCY (UP 12.5% AS-REPORTED); 26/04/2018 – RCL SEES 2018 NET YIELD UP 2.0%-3.75% IN CONSTANT FX; 26/04/2018 – ROYAL CARIBBEAN SEES 2Q ADJ. EPS $1.85 TO $1.90, EST. $1.96; 26/04/2018 – Royal Caribbean Expects Net Yield Increase of 2% to 3.75% on Constant Currency Basi; 26/04/2018 – ROYAL CARIBBEAN BOOSTS FULL YEAR ADJUSTED EARNINGS GUIDANCE; 06/03/2018 VALMET OYJ – VALMET TO UPGRADE AUTOMATION ON ROYAL CARIBBEAN’S MARINER OF THE SEAS CRUISE SHIP; 26/04/2018 – Royal Caribbean 1Q Gross Yields Were Up 3.1% in Constant Currency Basis; 12/04/2018 – Talend Connect 2018: New Speakers Include AstraZeneca, Royal Caribbean & TD Bank; 26/04/2018 – ROYAL CARIBBEAN CRUISES LTD – QTRLY TOTAL REVENUE $2.03 BLN VS $2.01 BLN REPORTED LAST YEAR

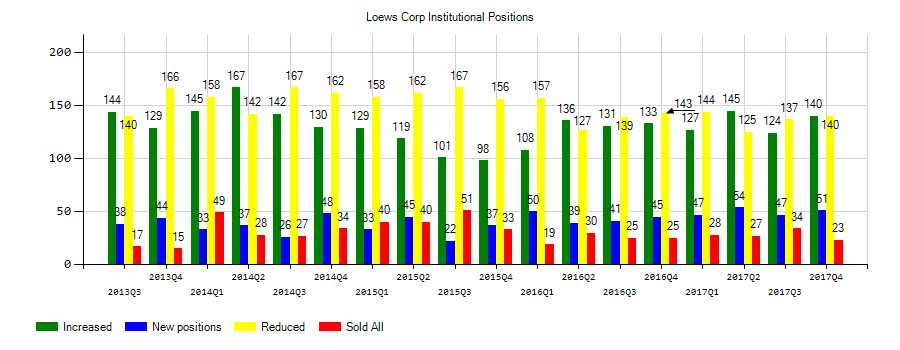

St James Investment Company Llc increased Loews Corp (L) stake by 71.1% reported in 2018Q3 SEC filing. St James Investment Company Llc acquired 442,857 shares as Loews Corp (L)’s stock declined 9.65%. The St James Investment Company Llc holds 1.07M shares with $53.53 million value, up from 622,894 last quarter. Loews Corp now has $14.55 billion valuation. The stock increased 0.74% or $0.34 during the last trading session, reaching $46.39. About 1.52 million shares traded or 17.82% up from the average. Loews Corporation (NYSE:L) has declined 9.70% since January 11, 2018 and is downtrending. It has underperformed by 9.70% the S&P500. Some Historical L News: 30/04/2018 – Loews Corporation Reports Net Income Of $293 Million For The First Quarter Of 2018; 13/03/2018 – JAMES S. TISCH REPORTS 5.1 PCT STAKE IN LOEWS CORP AS OF MARCH 8, 2018 – SEC FILING; 15/03/2018 – James S. Tisch Reports 5.1% Stake In Loews; 14/05/2018 – Loews Quadrupled Barrick Gold Stake Ahead of Earnings Beat; 09/04/2018 – CONSOLIDATED CONTAINER COMPANY SAYS HAS ACQUIRED ASSETS OF POLYCYCLE SOLUTIONS FROM DS SERVICES; 21/05/2018 – Bandera Partners Issues Public Letter to Bd of Loews Corp Regarding Boardwalk Pipeline Partners; 08/05/2018 – TAM CAPITAL SENDS OPEN LETTER TO LOEWS, BOARDWALK PARTNERS LP; 21/04/2018 – DJ Loews Corporation, Inst Holders, 1Q 2018 (L); 06/03/2018 – Loews Closes Above 50-Day Moving Average: Technicals; 11/05/2018 – BOARDWALK PIPELINE HLDR TAM AGAIN CALLS FOR LOEWS COMMITMENT

Investors sentiment increased to 0.95 in 2018 Q3. Its up 0.06, from 0.89 in 2018Q2. It increased, as 33 investors sold L shares while 141 reduced holdings. 45 funds opened positions while 121 raised stakes. 192.82 million shares or 0.29% less from 193.37 million shares in 2018Q2 were reported. Schwerin Boyle Mngmt Inc holds 431,425 shares. Mason Street Advisors Limited Liability accumulated 39,090 shares or 0.04% of the stock. Nordea Inv Mngmt Ab invested in 0.02% or 197,700 shares. Signaturefd Limited Liability Corporation reported 3,582 shares. Vident Inv Advisory Ltd Liability holds 7,606 shares. Engineers Gate Manager LP invested 0.05% in Loews Corporation (NYSE:L). Employees Retirement Association Of Colorado holds 0.01% or 46,973 shares. Psagot Inv House Ltd holds 0% in Loews Corporation (NYSE:L) or 5 shares. Korea Investment Corp owns 234,790 shares for 0.05% of their portfolio. Eubel Brady & Suttman Asset Mngmt holds 3.71% or 249,495 shares in its portfolio. 1,900 were accumulated by Focused Wealth Management. Foster Dykema Cabot Company Ma reported 6,000 shares stake. Moreover, Lpl Finance Ltd Com has 0% invested in Loews Corporation (NYSE:L). Amalgamated National Bank has invested 0.04% in Loews Corporation (NYSE:L). Northwestern Mutual Wealth Management stated it has 0% of its portfolio in Loews Corporation (NYSE:L).

St James Investment Company Llc decreased Anheuser (NYSE:BUD) stake by 5,651 shares to 666,387 valued at $58.36 million in 2018Q3. It also reduced Expeditors International Inc (NASDAQ:EXPD) stake by 7,357 shares and now owns 313,010 shares. The Tjx Companies Inc (NYSE:TJX) was reduced too.

Since September 4, 2018, it had 0 buys, and 8 sales for $1.07 million activity. EDELSON DAVID B also sold $825,936 worth of Loews Corporation (NYSE:L) shares. FRIBOURG PAUL J sold $32,191 worth of stock or 664 shares. LASKAWY PHILIP A also sold $32,191 worth of Loews Corporation (NYSE:L) shares. $17,861 worth of stock was sold by HARRIS WALTER L on Tuesday, September 4. On Tuesday, November 6 the insider BERMAN ANN E sold $109,182. DIKER CHARLES M sold 357 shares worth $17,857.

Since September 13, 2018, it had 1 insider buy, and 2 selling transactions for $998,977 activity. Fain Richard D also bought $2.00 million worth of Royal Caribbean Cruises Ltd. (NYSE:RCL) on Thursday, December 13. REITAN BERNT sold $168,179 worth of Royal Caribbean Cruises Ltd. (NYSE:RCL) on Monday, November 19. 6,600 shares were sold by Kulovaara Harri U, worth $828,652.

Investors sentiment is 0.99 in Q3 2018. Its the same as in 2018Q2. It is the same, as 45 investors sold RCL shares while 196 reduced holdings. only 90 funds opened positions while 149 raised stakes. 143.34 million shares or 0.68% more from 142.37 million shares in 2018Q2 were reported. 100 were reported by Tru Department Mb Finance Financial Bank N A. Norinchukin Comml Bank The accumulated 22,039 shares. Mufg Americas Hldgs Corporation invested 0.29% in Royal Caribbean Cruises Ltd. (NYSE:RCL). Scotia holds 54,738 shares or 0.09% of its portfolio. Moreover, World Investors has 0% invested in Royal Caribbean Cruises Ltd. (NYSE:RCL) for 93,000 shares. Cls Investments Ltd Liability stated it has 3,397 shares or 0.01% of all its holdings. Bluestein R H holds 0.01% or 2,000 shares in its portfolio. Amer Century reported 0.25% of its portfolio in Royal Caribbean Cruises Ltd. (NYSE:RCL). Victory Cap owns 55,297 shares or 0.01% of their US portfolio. Overbrook Mgmt, a New York-based fund reported 6,021 shares. North Star Mngmt owns 305 shares for 0% of their portfolio. 2,462 are held by Iberiabank Corp. Mariner Lc has invested 0.01% in Royal Caribbean Cruises Ltd. (NYSE:RCL). Swiss Bankshares has 0.08% invested in Royal Caribbean Cruises Ltd. (NYSE:RCL). Commonwealth Of Pennsylvania School Empls Retrmt invested in 0.03% or 14,062 shares.

Analysts await Royal Caribbean Cruises Ltd. (NYSE:RCL) to report earnings on January, 23. They expect $1.51 earnings per share, up 12.69% or $0.17 from last year’s $1.34 per share. RCL’s profit will be $315.59 million for 17.37 P/E if the $1.51 EPS becomes a reality. After $3.98 actual earnings per share reported by Royal Caribbean Cruises Ltd. for the previous quarter, Wall Street now forecasts -62.06% negative EPS growth.

More notable recent Royal Caribbean Cruises Ltd. (NYSE:RCL) news were published by: Streetinsider.com which released: “150 passengers on Royal Caribbean’s (RCL) ship hit with outbreak of Norovirus – Boston Globe – StreetInsider.com” on January 10, 2019, also Fool.com with their article: “3 Growth Stocks for In-the-Know Investors – The Motley Fool” published on January 09, 2019, Streetinsider.com published: “Bullish Options Positioning Continues in Royal Caribbean Cruises (RCL), Targeting Upside in Shares Through March -Susquehanna – StreetInsider.com” on January 07, 2019. More interesting news about Royal Caribbean Cruises Ltd. (NYSE:RCL) were released by: Gurufocus.com and their article: “2 Travel and Leisure Stocks to Buy – GuruFocus.com” published on December 13, 2018 as well as Seekingalpha.com‘s news article titled: “Royal Caribbean Cruises declares $0.70 dividend – Seeking Alpha” with publication date: December 04, 2018.

Among 8 analysts covering Royal Caribbean Cruises (NYSE:RCL), 5 have Buy rating, 0 Sell and 3 Hold. Therefore 63% are positive. Royal Caribbean Cruises had 11 analyst reports since July 24, 2018 according to SRatingsIntel. Macquarie Research maintained the stock with “Neutral” rating in Friday, October 26 report. Stifel Nicolaus maintained the shares of RCL in report on Tuesday, July 24 with “Buy” rating. The stock has “Buy” rating by Deutsche Bank on Wednesday, August 29. Nomura maintained the stock with “Buy” rating in Friday, October 26 report. The rating was maintained by Bank of America with “Neutral” on Wednesday, September 26. The stock of Royal Caribbean Cruises Ltd. (NYSE:RCL) earned “Equal-Weight” rating by Morgan Stanley on Thursday, September 6. The rating was maintained by Stifel Nicolaus on Monday, September 24 with “Buy”. The firm earned “Buy” rating on Thursday, October 18 by Nomura. The firm earned “Outperform” rating on Monday, October 29 by Wells Fargo. The firm has “Buy” rating by Citigroup given on Friday, August 17.

Landscape Capital Management Llc increased Ca Inc (NASDAQ:CA) stake by 18,648 shares to 27,054 valued at $1.19 million in 2018Q3. It also upped Nuveen New York Amt Qlt Muni (NRK) stake by 32,166 shares and now owns 286,873 shares. American Eagle Outfitters Ne (NYSE:AEO) was raised too.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.