Herzfeld Caribbean Basin Fund Inc (CUBA) investors sentiment decreased to 1.29 in Q3 2018. It’s down -1.21, from 2.5 in 2018Q2. The ratio dived, as 9 hedge funds increased and opened new stock positions, while 7 reduced and sold stock positions in Herzfeld Caribbean Basin Fund Inc. The hedge funds in our database reported: 2.11 million shares, down from 2.21 million shares in 2018Q2. Also, the number of hedge funds holding Herzfeld Caribbean Basin Fund Inc in top ten stock positions was flat from 1 to 1 for the same number . Sold All: 2 Reduced: 5 Increased: 6 New Position: 3.

In a report issued to investors and clients on 4 January, stock research analysts at Stephens has begun coverage on shares of 8×8 (NASDAQ:EGHT). The financial firm issued Overweight rating on EGHT stock.

Since January 1, 0001, it had 2 insider purchases, and 0 selling transactions for $310,622 activity.

Thomas J. Herzfeld Advisors Inc. holds 2.85% of its portfolio in The Herzfeld Caribbean Basin Fund Inc. for 1.25 million shares. Shaker Financial Services Llc owns 117,835 shares or 0.36% of their US portfolio. Moreover, City Of London Investment Management Co Ltd has 0.21% invested in the company for 425,000 shares. The Pennsylvania-based Blue Bell Private Wealth Management Llc has invested 0.19% in the stock. Bennicas & Associates Inc., a California-based fund reported 12,050 shares.

The stock increased 7.15% or $0.34 during the last trading session, reaching $5.14. About 25,494 shares traded or 31.07% up from the average. The Herzfeld Caribbean Basin Fund Inc. (CUBA) has declined 18.98% since January 4, 2018 and is downtrending. It has underperformed by 18.98% the S&P500.

The Herzfeld Caribbean Basin Fund Inc. is a closed-ended equity mutual fund launched by Thomas J. The company has market cap of $31.55 million. Herzfeld Advisors, Inc. It currently has negative earnings. The fund is managed by Herzfeld/Cuba.

More notable recent The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA) news were published by: Nasdaq.com which released: “Cuba’s Castro blasts United States on 60th anniversary of revolution – Nasdaq” on January 01, 2019, also Nasdaq.com with their article: “‘Reality’ bites: Cuba plans more austerity as finances worsen – Nasdaq” published on December 28, 2018, Nasdaq.com published: “Cuba sees 1.5 percent growth next year after hard 2018 – Nasdaq” on December 21, 2018. More interesting news about The Herzfeld Caribbean Basin Fund Inc. (NASDAQ:CUBA) were released by: Nasdaq.com and their article: “U.S. Cuba lobby celebrates a farm bill win despite worsening ties – Nasdaq” published on December 18, 2018 as well as Nasdaq.com‘s news article titled: “Cuba panel closes door on gay marriage constitutional amendment – Nasdaq” with publication date: December 18, 2018.

Among 2 analysts covering 8×8 (NASDAQ:EGHT), 1 have Buy rating, 0 Sell and 1 Hold. Therefore 50% are positive. 8×8 has $25 highest and $22 lowest target. $23.50’s average target is 26.55% above currents $18.57 stock price. 8×8 had 2 analyst reports since July 12, 2018 according to SRatingsIntel. On Monday, July 30 the stock rating was maintained by FBR Capital with “Neutral”.

The stock increased 6.17% or $1.08 during the last trading session, reaching $18.57. About 535,045 shares traded. 8×8, Inc. (NASDAQ:EGHT) has risen 30.14% since January 4, 2018 and is uptrending. It has outperformed by 30.14% the S&P500. Some Historical EGHT News: 24/05/2018 – 8X8 4Q Rev $79.3M; 21/05/2018 – 8×8, Inc. to Participate in Upcoming Investor Conferences; 24/05/2018 – 8X8 4Q Adj Loss/Shr 3c; 16/03/2018 – 8X8 INC EGHT.N : DOUGHERTY RAISES TARGET PRICE TO $23 FROM $20; 19/04/2018 – DJ 8×8 Inc, Inst Holders, 1Q 2018 (EGHT); 24/05/2018 – 8X8 INC EGHT.N – EXCLUDING DXI REVENUE, SEES 2019 SERVICE REVENUE GROWTH IN THE RANGE OF 21% TO 22%; 13/03/2018 CFO Genovese Gifts 224 Of 8×8 Inc; 24/05/2018 – 8X8 INC – SEES FY 2019 SERVICE REVENUE IN THE RANGE OF $333 MILLION TO $338 MILLION, REPRESENTING APPROXIMATELY 19% TO 21% YEAR-OVER-YEAR INCREASE; 24/05/2018 – 8X8 INC – SEES 2019 TOTAL REVENUE IN THE RANGE OF $347 MILLION TO $352 MILLION, REPRESENTING APPROXIMATELY 17% TO 19% YEAR-OVER-YEAR INCREASE; 15/05/2018 – 8X8 INC – FINANCIAL TERMS OF ACQUISITION ARE NOT BEING DISCLOSED

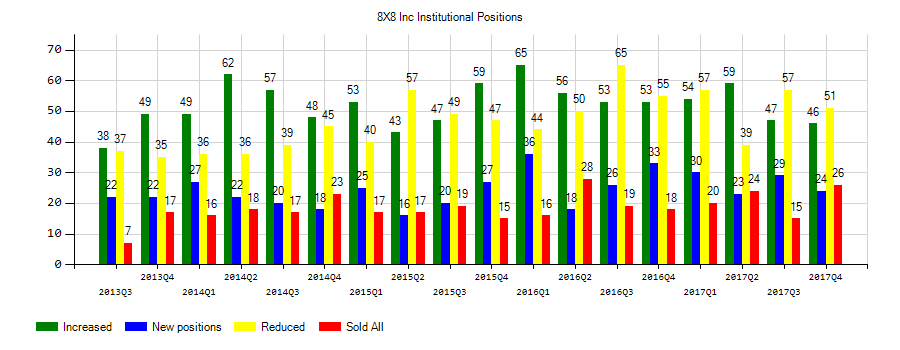

Investors sentiment decreased to 1.23 in 2018 Q3. Its down 0.19, from 1.42 in 2018Q2. It is negative, as 11 investors sold 8×8, Inc. shares while 51 reduced holdings. 24 funds opened positions while 52 raised stakes. 64.71 million shares or 0.42% more from 64.44 million shares in 2018Q2 were reported. Arizona State Retirement System accumulated 135,350 shares. State Of Wisconsin Investment Board accumulated 0.04% or 654,950 shares. Lpl Financial Ltd Limited Liability Company reported 24,325 shares or 0% of all its holdings. State Board Of Administration Of Florida Retirement Sys invested in 49,569 shares or 0% of the stock. Edge Wealth Mngmt Ltd Com reported 500 shares. Cubist Systematic Strategies Limited Liability Co reported 60,603 shares or 0.07% of all its holdings. Credit Suisse Ag holds 62,300 shares or 0% of its portfolio. Polar Asset Mngmt Incorporated holds 0.29% or 694,300 shares in its portfolio. Massachusetts Fincl Ma invested 0.01% in 8×8, Inc. (NYSE:EGHT). Commonwealth Of Pennsylvania School Empls Retrmt invested in 22,279 shares or 0.01% of the stock. Bogle Management Limited Partnership De has 276,507 shares for 0.42% of their portfolio. Comerica Bankshares, a Michigan-based fund reported 90,192 shares. State Teachers Retirement Systems owns 174,421 shares. Pinebridge L P holds 70,543 shares. Ubs Asset Management Americas Incorporated invested in 0% or 998,641 shares.

8×8, Inc. provides cloud-based, enterprise-class software solutions for small and medium businesses, mid-market, and distributed enterprises worldwide. The company has market cap of $1.77 billion. The firm operates in two divisions, Americas and Europe. It currently has negative earnings. The company's pure-cloud offering combines voice, conferencing, messaging, and video with integrated workflows and big data analytics on a single platform.

More notable recent 8×8, Inc. (NYSE:EGHT) news were published by: Streetinsider.com which released: “Stephens Starts 8×8 (EGHT) at Overweight – StreetInsider.com” on January 03, 2019, also Streetinsider.com with their article: “UPDATE: Rosenblatt Starts 8×8 (EGHT) at Buy – StreetInsider.com” published on December 20, 2018, Fool.com published: “Why 8×8, Inc. Stock Plunged 22% Today – Motley Fool” on May 25, 2018. More interesting news about 8×8, Inc. (NYSE:EGHT) were released by: Fool.com and their article: “Why Cloud Communications Stocks Soared in August – The Motley Fool” published on September 06, 2018 as well as Streetinsider.com‘s news article titled: “8×8, Inc. (EGHT) announces appointments of Steven Gatoff as CFO – StreetInsider.com” with publication date: October 08, 2018.

Since September 4, 2018, it had 1 insider buy, and 2 insider sales for $119,070 activity. Shares for $186,000 were sold by Hakeman Darren J.. Verma Vikram bought $97,945 worth of stock or 5,730 shares. Potter Ian sold $31,015 worth of 8×8, Inc. (NYSE:EGHT) on Sunday, October 21.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.