Sustainable Growth Advisers Lp decreased its stake in Fleetcor Technologies Inc (FLT) by 5.35% based on its latest 2018Q2 regulatory filing with the SEC. Sustainable Growth Advisers Lp sold 102,014 shares as the company’s stock rose 6.43% with the market. The institutional investor held 1.81 million shares of the miscellaneous company at the end of 2018Q2, valued at $380.38M, down from 1.91M at the end of the previous reported quarter. Sustainable Growth Advisers Lp who had been investing in Fleetcor Technologies Inc for a number of months, seems to be less bullish one the $16.32B market cap company. The stock decreased 2.13% or $4 during the last trading session, reaching $184.11. About 373,383 shares traded. FleetCor Technologies, Inc. (NYSE:FLT) has risen 52.49% since November 25, 2017 and is uptrending. It has outperformed by 36.87% the S&P500. Some Historical FLT News: 22/04/2018 – DJ FleetCor Technologies Inc, Inst Holders, 1Q 2018 (FLT); 21/03/2018 – UBER FREIGHT PARTNERS WITH FLEETCOR; 03/05/2018 – FLEETCOR TECHNOLOGIES – CO WILL MANAGE, OPERATE & SELL SHELL FUEL CARD TO SMALL-TO-MEDIUM ENTERPRISES ACROSS 11 MARKETS IN EUROPE THROUGH 2025; 10/05/2018 – FLEETCOR-BELIEVES SIGNIFICANT NUMBER OF GIFT CARD,PIN NUMBERS ISSUED BY 6 STORED VALUE SOLUTIONS CUSTOMERS WERE ACCESSED IN APRIL 26 REPORTED INCIDENT; 03/05/2018 – FleetCor 1Q EPS $1.88; 23/05/2018 – ADVISORY-Please ignore alert on Fleetcor from law firm; 08/05/2018 – Comdata Announces Partnership Renewal with lnfintech to Support ePayables Vendor Enrollment; 16/04/2018 – FleetCor Closes Above 50-Day Moving Average: Technicals; 07/03/2018 – The Shuman Law Firm Investigates FleetCor Technologies, Inc; 03/05/2018 – FLEETCOR TECHNOLOGIES INC – TOOK IMMEDIATE ACTION TO STOP ACTIVITY ON SYSTEMS INVOLVING CO’S STORED VALUE SOLUTIONS GIFT CARD BUSINESS

Bamco Inc increased its stake in American Homes 4 Rent (AMH) by 28686.46% based on its latest 2018Q2 regulatory filing with the SEC. Bamco Inc bought 606,145 shares as the company’s stock rose 6.73% with the market. The institutional investor held 608,258 shares of the real estate investment trusts company at the end of 2018Q2, valued at $13.49 million, up from 2,113 at the end of the previous reported quarter. Bamco Inc who had been investing in American Homes 4 Rent for a number of months, seems to be bullish on the $6.98 billion market cap company. It closed at $19.84 lastly. It is down 1.77% since November 25, 2017 and is uptrending. It has underperformed by 13.85% the S&P500. Some Historical AMH News: 24/05/2018 – American Homes 4 Rent to Participate in NAREIT REITweek 2018 Conference; 03/05/2018 – AMERICAN HOMES 4 RENT SEES FULL YEAR 2018 CORE REVENUES GROWTH 3.5% – 4.5%; 14/05/2018 – LONG POND ADDED AMH, LQ, VICI, APLE, GPT IN 1Q: 13F; 24/05/2018 – American Homes 4 Rent CFO Diana Laing to Resign; 12/04/2018 – Moody’s upgrades $120.4 million of RMBS issued from American Home 4 Rent 2015-SFR1; 23/05/2018 – AMERICAN HOMES 4 RENT NAMES CHRISTOPHER LAU AS CFO; 24/05/2018 – American Homes 4 Rent to Participate in NAREIT RElTweek 2018 Conference; 03/05/2018 – AMERICAN HOMES 4 RENT SEES FULL YEAR 2018 CORE NOI AFTER CAPITAL EXPENDITURES GROWTH 3.0% – 4.0%; 03/05/2018 – American Homes 4 Rent Announces Distributions; 03/05/2018 – AMERICAN HOMES 1Q REV. $258.0M, EST. $251.3M

Another recent and important FleetCor Technologies, Inc. (NYSE:FLT) news was published by Seekingalpha.com which published an article titled: “FleetCor Technologies (FLT) Q3 2018 Results – Earnings Call Transcript” on October 31, 2018.

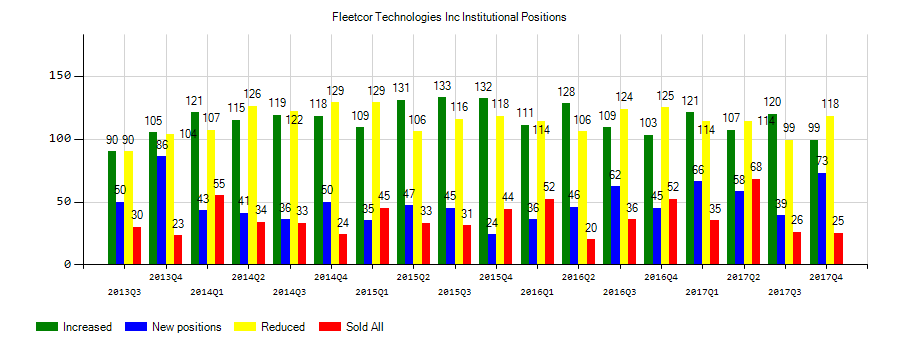

Investors sentiment increased to 1.61 in 2018 Q2. Its up 0.81, from 0.8 in 2018Q1. It is positive, as 38 investors sold FLT shares while 101 reduced holdings. 90 funds opened positions while 134 raised stakes. 84.90 million shares or 5.87% more from 80.19 million shares in 2018Q1 were reported. Highland Mngmt LP invested 0.02% in FleetCor Technologies, Inc. (NYSE:FLT). Florida-based State Board Of Administration Of Florida Retirement Systems has invested 0.07% in FleetCor Technologies, Inc. (NYSE:FLT). Victory Mngmt reported 198,031 shares. Pennsylvania-based Pitcairn has invested 0.24% in FleetCor Technologies, Inc. (NYSE:FLT). Old Bank In has invested 0.06% in FleetCor Technologies, Inc. (NYSE:FLT). 7,154 are owned by Riverhead Capital Mngmt Lc. Tourbillon Cap Partners Limited Partnership accumulated 171,543 shares. Mitsubishi Ufj Trust And Bk Corporation holds 0.07% of its portfolio in FleetCor Technologies, Inc. (NYSE:FLT) for 182,783 shares. Virginia Retirement Et Al stated it has 0.25% in FleetCor Technologies, Inc. (NYSE:FLT). Baker Avenue Asset Limited Partnership invested in 0.09% or 5,194 shares. Comerica Comml Bank reported 62,518 shares stake. Hartford Investment Mngmt Company, Connecticut-based fund reported 11,069 shares. Regions owns 10,283 shares. Bluecrest Management Limited invested in 2,626 shares. Moreover, M&T Savings Bank Corporation has 0.04% invested in FleetCor Technologies, Inc. (NYSE:FLT).

Sustainable Growth Advisers Lp, which manages about $6.01B and $8.43 billion US Long portfolio, upped its stake in Equinix Inc (NASDAQ:EQIX) by 192,219 shares to 920,012 shares, valued at $395.50M in 2018Q2, according to the filing. It also increased its holding in Alliance Data Systems Corp (NYSE:ADS) by 35,788 shares in the quarter, for a total of 711,553 shares, and has risen its stake in Schlumberger Ltd (NYSE:SLB).

Among 17 analysts covering Fleetcor Technologies (NYSE:FLT), 15 have Buy rating, 0 Sell and 2 Hold. Therefore 88% are positive. Fleetcor Technologies had 59 analyst reports since August 6, 2015 according to SRatingsIntel. Monness Crespi & Hardt maintained it with “Buy” rating and $186 target in Monday, September 19 report. The firm has “Buy” rating given on Wednesday, April 5 by Jefferies. The rating was upgraded by Oppenheimer on Friday, August 5 to “Outperform”. The rating was maintained by Morgan Stanley on Friday, May 4 with “Overweight”. On Friday, August 5 the stock rating was maintained by Barclays Capital with “Overweight”. The firm has “Overweight” rating given on Friday, May 5 by JP Morgan. On Friday, April 15 the stock rating was initiated by Compass Point with “Neutral”. The stock has “Overweight” rating by Morgan Stanley on Thursday, November 2. The rating was maintained by Credit Suisse with “Hold” on Wednesday, January 17. The rating was maintained by Citigroup on Friday, July 20 with “Buy”.

Among 16 analysts covering American Homes 4 Rent (NYSE:AMH), 12 have Buy rating, 0 Sell and 4 Hold. Therefore 75% are positive. American Homes 4 Rent had 36 analyst reports since August 10, 2015 according to SRatingsIntel. BTIG Research initiated the stock with “Buy” rating in Tuesday, October 10 report. The company was downgraded on Friday, November 16 by Morgan Stanley. Evercore initiated the shares of AMH in report on Monday, June 5 with “In-Line” rating. Wood upgraded the shares of AMH in report on Friday, December 8 to “Outperform” rating. The stock has “Buy” rating by Keefe Bruyette & Woods on Thursday, December 7. Evercore upgraded the shares of AMH in report on Monday, December 4 to “Outperform” rating. Wells Fargo maintained the stock with “Market Perform” rating in Tuesday, August 28 report. BTIG Research maintained the stock with “Buy” rating in Monday, February 26 report. The stock of American Homes 4 Rent (NYSE:AMH) has “Buy” rating given on Tuesday, February 27 by Mizuho. Mizuho maintained American Homes 4 Rent (NYSE:AMH) rating on Friday, November 3. Mizuho has “Buy” rating and $26.5 target.

Investors sentiment increased to 1.5 in Q2 2018. Its up 0.66, from 0.84 in 2018Q1. It increased, as 26 investors sold AMH shares while 58 reduced holdings. 33 funds opened positions while 93 raised stakes. 248.84 million shares or 4.90% more from 237.22 million shares in 2018Q1 were reported. Long Pond Capital Ltd Partnership has 10.61M shares for 5.19% of their portfolio. Fifth Third Bank invested in 0% or 11,166 shares. Sei Invests Com owns 0.06% invested in American Homes 4 Rent (NYSE:AMH) for 802,613 shares. Westpac Banking invested in 0% or 310,052 shares. Us Natl Bank De invested 0% of its portfolio in American Homes 4 Rent (NYSE:AMH). Sumitomo Mitsui Asset Management Ltd has 0.01% invested in American Homes 4 Rent (NYSE:AMH) for 37,168 shares. Alliancebernstein LP stated it has 1.44 million shares. Voya Inv Mngmt Lc has invested 0% in American Homes 4 Rent (NYSE:AMH). Moreover, Metropolitan Life Insurance has 0% invested in American Homes 4 Rent (NYSE:AMH) for 20,905 shares. State Of Alaska Department Of Revenue reported 0.04% stake. Oppenheimer Asset Mgmt owns 14,142 shares. Amalgamated Fincl Bank owns 49,157 shares. Horizon Kinetics Ltd Liability Corp invested in 19,349 shares. Utd Services Automobile Association has 11,862 shares for 0% of their portfolio. Natixis Advsrs Limited Partnership invested in 0.05% or 223,404 shares.

Bamco Inc, which manages about $24.24 billion and $22.88B US Long portfolio, decreased its stake in Novanta Inc by 10,000 shares to 128,900 shares, valued at $8.03 million in 2018Q2, according to the filing. It also reduced its holding in Varonis Sys Inc (NASDAQ:VRNS) by 37,307 shares in the quarter, leaving it with 130,804 shares, and cut its stake in Willis Towers Watson Pub Ltd.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with our FREE daily email newsletter.